Audiobooks are great. They let you listen to books on road trips and during your commute. Sometimes on Audible the book is even cheaper than the paperback version. However, one downside of an audiobook is that you can't see the images, graphs, tables, and diagrams that are in the print book. Another downside is that you can't click on the URL links like you can with the eBook or scan the URL QR codes like you can in the hard copy book.

Audiobooks are great. They let you listen to books on road trips and during your commute. Sometimes on Audible the book is even cheaper than the paperback version. However, one downside of an audiobook is that you can't see the images, graphs, tables, and diagrams that are in the print book. Another downside is that you can't click on the URL links like you can with the eBook or scan the URL QR codes like you can in the hard copy book.

In The White Coat Investor's Guide for Students book, the visual information is integral to the content. You will find below the tables, graphs, and diagrams referenced within the audiobook, the end-of-chapter “Additional Resources” URLs, and the text notes for all referenced outside sources. The Table of Contents links will help you easily navigate to the information you are looking for.

Before you dig in, don't forget to sign up here to subscribe to the:

- FREE monthly newsletter, including the free WCI Financial Bootcamp Email Course

- Real Estate Opportunities Group

- Weekly summary email

- Blog posts as soon as published, delivered to your inbox

Table of Contents

Tables, Graphs, and Diagrams

Chapter 2 – You Do Not Get a Pass on Math

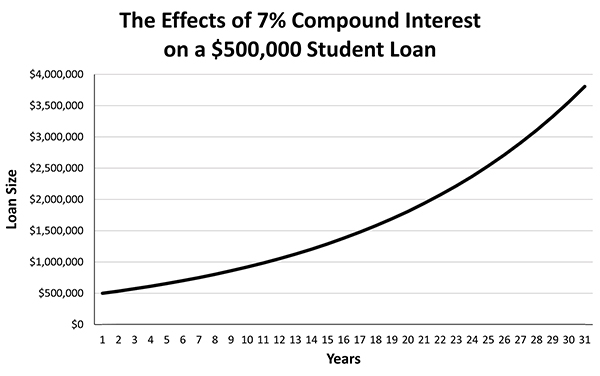

- Graph 1 – The Effects of 7% Compound Interest on a $500,000 Student Loan

Chapter 4 – How to Pay for Professional School

- Table 1 – Withdrawing IRA Money to Use for Education

Chapter 8 – How to Choose a Specialty (Physicians)

- Graph 2 – Average Income by Specialty

Chapter 9 – How to Choose a Specialty (Dentists)

- Table 2 – How Much Would Doctors Work If They Did Not Need the Money?

- Table 3 – The Reported Incomes of Generalist and Specialist Dentists

- Table 4 – Incomes of Dental Subspecialties

- Table 5 – Dental Specialist Match Rates

Chapter 10 – Avoiding Financial Catastrophes

- Table 6 – Medical Specialist Match Rates

Chapter 12 – How to Choose a Residency Program

- Table 7 – MD Match Application Costs

Chapter 13 – Why a Dentist Should Not Be Afraid to Open a Practice

- Table 3 – Dentist Practice Owners Make More Than Employees

Chapter 15 – Student Loan Management During Residency

- Table 8 – Federal vs. Private Loan Benefits

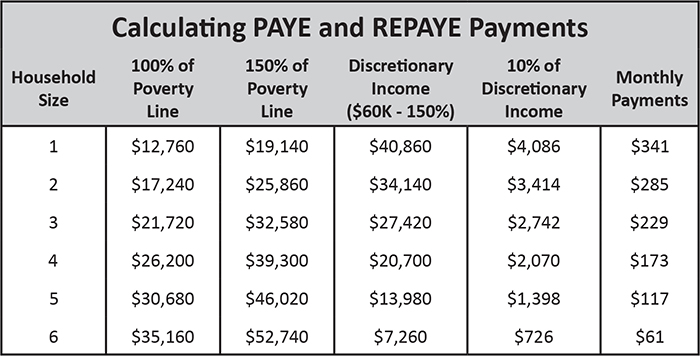

- Table 9 – Calculating PAYE and REPAYE Payments

- Table 10 – Comparison of IDR Programs

- Table 11 – PSLF Requirements

Chapter 17 – Protecting Your Most Valuable Asset

- Table 12 – Recommended Disability Insurance Riders

Chapter 19 – Stocks, Bonds, and Mutual Funds (Financial Literacy 101)

- Diagram 1 – The Investment Risk Spectrum

- Diagram 2 – Yield vs. Return

- Diagram 3 – Equity Style Box

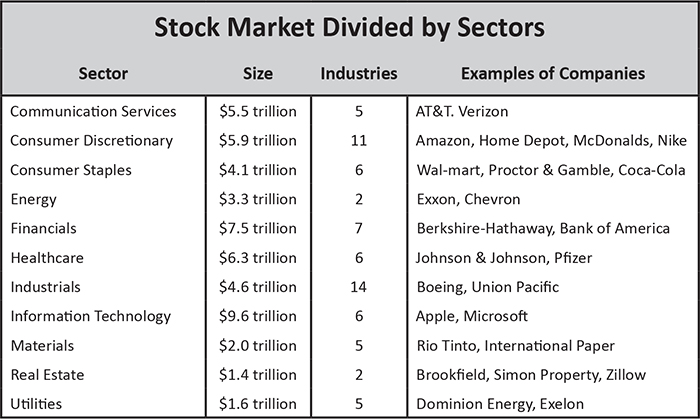

- Table 13 – Stock Market Divided by Sectors

- Diagram 4 – Debt Style Box

Chapter 20 – Taxes and Retirement Accounts (Financial Literacy 102)

- Table 14 – Federal Income Tax Brackets

- Graph 3 – Historical Tax Rates

Chapter 21 – Financial History (Financial Literacy 103)

- Graph 3 – Historical Tax Rates

Chapter 22 – Numbers You Need to Know (Financial Literacy 104)

- Table 15 – The Trinity Study

Additional Resources

Chapter 1 – Why Money Should Not Be Your Primary Motivation

Chapter 2 – You Do Not Get a Pass on Math

Chapter 3 – How to Choose a Medical or Dental School

Chapter 4 – How to Pay for Professional School

Chapter 5 – Why You Should Be a Thrifty Student

Chapter 6 – How to Live on Loans

Chapter 7 – The Advantages of Being a Non-Traditional Student

Chapter 8 – How to Choose a Specialty (Physicians)

Chapter 9 – How to Choose a Specialty (Dentists)

Chapter 10 – Avoiding Financial Catastrophes

Chapter 11 – Preventing and Combating Burnout

Chapter 12 – How to Choose a Residency Program

Chapter 13 – Why a Dentist Should Not Be Afraid to Open a Practice

Chapter 14 – Why Renting Could Actually Save You Money

Chapter 15 – Student Loan Management During Residency

Chapter 16 – Investing During Residency

Chapter 17 – Protecting Your Most Valuable Asset

Chapter 18 – Got Dependents? Get Life Insurance

Chapter 19 – Stocks, Bonds, and Mutual Funds (Financial Literacy 101)

Chapter 20 – Taxes and Retirement Accounts (Financial Literacy 102)

Chapter 21 – Financial History (Financial Literacy 103)

Chapter 22 – Numbers You Need to Know (Financial Literacy 104)

Notes

Introduction

Chapter 1 – Why Money Should Not Be Your Primary Motivation

Chapter 2 – You Do Not Get a Pass on Math

Chapter 3 – How to Choose a Medical or Dental School

Chapter 4 – How to Pay for Professional School

Chapter 6 – How to Live on Loans

Chapter 7 – The Advantages of Being a Non-Traditional Student

Chapter 8 – How to Choose a Specialty (Physicians)

Chapter 9 – How to Choose a Specialty (Dentists)

Chapter 10 – Avoiding Financial Catastrophes

Chapter 11 – Preventing and Combating Burnout

Chapter 12 – How to Choose a Residency Program

Chapter 13 – Why a Dentist Should Not Be Afraid to Open a Practice

Chapter 14 – Why Renting Could Actually Save You Money

Chapter 16 – Investing During Residency

Chapter 19 – Stocks, Bonds, and Mutual Funds (Financial Literacy 101)

Chapter 20 – Taxes and Retirement Accounts (Financial Literacy 102)

Chapter 21 – Financial History (Financial Literacy 103)

Chapter 22 – Numbers You Need to Know (Financial Literacy 104)

Tables, Graphs, and Diagrams

Chapter 2 – You Do Not Get a Pass on Math

Graph 1

Chapter 4 – How to Pay for Professional School

Table 1

Chapter 8 – How to Choose a Specialty (Physicians)

Graph 2

Chapter 9 – How to Choose a Specialty (Dentists)

Table 2

Table 3: The Reported Incomes of Generalist and Specialist Dentists

Table 4: Incomes of Dental Subspecialties

Table 5

Chapter 10 – Avoiding Financial Catastrophes

Table 6

Chapter 12 – How to Choose a Residency Program

Table 7

Chapter 13 – Why a Dentist Should Not Be Afraid to Open a Practice

Table 3: Dentist Practice Owners Make More Than Employees

Chapter 15 – Student Loan Management During Residency

Table 8: Federal vs. Private Loan Benefits

Table 9

Table 10

Table 11

Chapter 17 – Protecting Your Most Valuable Asset

Table 12

Chapter 19 – Stocks, Bonds, and Mutual Funds (Financial Literacy 101)

Diagram 1

Diagram 2

Diagram 3

Diagram 4

Table 13

Chapter 20 – Taxes and Retirement Accounts (Financial Literacy 102)

Graph 3

Table 14

Chapter 21 – Financial History (Financial Literacy 103)

Graph 3

Chapter 22 – Numbers You Need to Know (Financial Literacy 104)

Table 15

Additional Resources

Chapter 1 – Why Money Should Not Be Your Primary Motivation

Blog Post:

Law School for the Rest of Us

Resource:

News Article: Pay in Banking vs. Consulting vs. Tech vs. Medicine vs. Law

Chapter 2 – You Do Not Get a Pass on Math

Blog Posts:

Maximum Student Loan to Debt Ratio

Average Medical School Debt

Surveys:

AAMC Graduation Questionnaire

AACOM Graduating Class Surveys

ADEA Senior Student Survey

Chapter 3 – How to Choose a Medical or Dental School

Blog Posts:

Public vs. Private Education Is the Wrong Question

Is Medical School Still Affordable?

Chapter 4 – How to Pay for Professional School

Blog Posts:

Don’t Give Up on PSLF Loan Forgiveness

Should I Join the Military to Pay for Medical School?

The Health Professions Scholarship Program

Army National Guard Physicians

NHSC—Loan Repayment or Scholarship?

How to Pay Off Medical School Loans in Less than 2 Years

How Fast Can You Get Out of Debt?

Resource:

Army Medicine: Health Professions Scholarship Program

Chapter 5 – Why You Should Be a Thrifty Student

Blog Posts:

The Frugal Physician: Self-Serving or Self-Denying?

The Frugal Physician: 5 Steps to Becoming Debt-Free

How to Get Rich by Driving a $5,000 Car

Chapter 6 – How to Live on Loans

Blog Posts:

The Right Way to Use Debt in Medical School

Hitting a Net Worth of $0 as an Intern

Live Like a Resident

Chapter 7 – The Advantages of Being a Non-Traditional Student

Blog Post:

10 Tips for Non-Traditional Medical School Applicants

Resource:

AAMC Article: Medical School Costs for Non-Traditional Students

Chapter 8 – How to Choose a Specialty (Physicians)

Blog Posts:

Picking a Specialty

Intra-Specialty Salary Differences

Podcast:

#158 Which Physician Specialty Is Best for Retiring Early?

Chapter 9 – How to Choose a Specialty (Dentists)

Blog Post:

Debt Dilemmas for Dental Specialists

Chapter 10 – Avoiding Financial Catastrophes

Blog Posts:

One House, One Spouse, One Job

Insure Only Against Financial Catastrophe

Big Debt Without an Income – A Med School Disaster

Physician Burnout: Factors and Cures

Book:

50 Nonclinical Careers for Physicians

Chapter 11 – Preventing and Combating Burnout

Blog Posts:

Avoiding Burnout

Using a Venn-Diagram to Decrease Burnout

Podcast:

#46 Physician Burnout with the Happy Philosopher

Resource:

Physician Life Coaching Services

Chapter 12 – How to Choose a Residency Program

Blog Posts:

Choosing a Residency: What Goes into a Rank List

10 Ways to Reduce Residency Interview Expenses

Spend Less and Interview More

Financial Survival as a Resident

How to Live Like a Resident as a Resident

Chapter 13 – Why a Dentist Should Not Be Afraid to Open a Practice

Blog Post:

Ownership Has Its Privileges

Resources:

Dental Entrepreneur Article: Ready to Own Your Own Dental Office? It Isn’t for Everyone

Website: Dentaltown

Chapter 14 – Why Renting Could Actually Save You Money

Blog Posts:

The Doctor Mortgage Loan

Physician Mortgage Loans for Other High-Income Professionals

Resources:

Physician Mortgage Lenders

New York Times Buy vs. Rent Calculator

Chapter 15 – Student Loan Management During Residency

Blog Posts:

Ultimate Guide to Student Loan Management for Doctors

Public Service Loan Forgiveness

REPAYE vs. Refinancing Student Loans as a Resident

REPAYE vs. PAYE/MFS for Married Residents

12 Reasons I Hate IDR Forgiveness Programs

10 Reasons You Should Pay Off Student Loans Quickly

PSLF Side Fund

Resources:

Cashback Deals on Student Loan Refinancing

Student Loan Specific Advisors

Government PSLF Site

PSLF Application

PSLF Employer Certification Form

Chapter 16 – Investing During Residency

Blog Posts:

Pay Off Debt or Invest

Financial Lessons for Residents by a Resident

Yes, Residents Can Save for Retirement

Why Everyone Should Love the Roth IRA

Roth vs. Traditional When Going for PSLF

Chapter 17 – Protecting Your Most Valuable Asset

Blog Posts:

What You Need to Know About Physician Disability Insurance

17 Physician Disability Insurance Mistakes

Disability Insurance for Military Physicians

Disability Insurance for Two Doctor Couples

Resource:

Recommended Independent Insurance Agents

Chapter 18 – Got Dependents? Get Life Insurance

Blog Posts:

How to Buy Life Insurance

Term Life Insurance Strategies for Physicians

Term Life Insurance: What You Need to Know Before You Buy

What You Need to Know About Whole Life Insurance

Resource:

Recommended Independent Insurance Agents

Chapter 19 – Stocks, Bonds, and Mutual Funds (Financial Literacy 101)

Course:

Fire Your Financial Advisor

Blog Posts:

Investing 101

You Need an Investing Plan

Why Talking About Individual Stocks (and Sectors) Makes You Look Dumb

7 Basic Principles of Bond Investing

7 Reasons Not to Use a 100% Stock Portfolio

150 Portfolios Better than Yours

10 Reasons I Invest in Index Funds

Why Does the Stock Market Go Up?

Chapter 20 – Taxes and Retirement Accounts (Financial Literacy 102)

Blog Posts:

Doctors Don’t Pay 50% of Their Income in Taxes

“I Want to Lower My Taxes” Is a Stupid Goal

Tax-Deferred Retirement Accounts: A Gift from the Government

Multiple 401(k) Rules

Backdoor Roth IRA Tutorial

The Stealth IRA

The 529 Account: A Tax Break for the Rich

ABLE: A Tax-Protected Investing Account for Your Special Child

3 Ways Your 401(k) Lowers Your Tax Bill

Resource:

Recommended Tax Strategists

Chapter 21 – Financial History (Financial Literacy 103)

Blog Posts:

Understanding Market History Provides Perspective

Cryptocurrencies like Bitcoin Are Not Investments

The Savings Rate

Resource:

Callan Table of Periodic Returns

Chapter 22 – Numbers You Need to Know (Financial Literacy 104)

Blog Posts:

Future Value Function Tutorial

How to Calculate Your Return – The XIRR Tutorial

The 4% Rule

The Rule of 72

Resources:

Google Sheets, a Free Spreadsheet

Moneychimp Calculators

Notes

Introduction

- “Historical Consumer Price Index (CPI-U) Data,” Inflation Data, Tim McMahon, accessed December 26, 2020.

- Erik Sherman, “College Tuition Is Rising at Twice the Inflation Rate—While Students Learn at Home,” Forbes, August 31, 2020.

- “Tuition and Student Fees Reports,” AAMC, accessed December 26, 2020.

- Leslie Kane, “Medscape Physician Debt and Net Worth Report 2020,” Medscape, June 24, 2020.

Chapter 1 – Why Money Should Not Be Your Primary Motivation

Chapter 2 – You Do Not Get a Pass on Math

- Dave Ramsey, “Don’t Be Stupid About How You Pay for Education,” The Dave Ramsey Show, September 26, 2016.

- “Graduation Questionnire (GQ),” AAMC, accessed December 26, 2020.

- “AACOM Reports: Entering and Graduating Class Surveys,” American Association of Colleges of Osteopathic Medicine (AACOM), accessed December 26, 2020.

- “ADEA Survey of Dental School Seniors, 2018 Graduating Class Tables Report,” ADEA: The Voice of Dental Education, November 2018.

- Josh Mitchell, “Mike Meru Has $1 Million in Student Loans. How Did That Happen?,” The Wall Street Journal, May 25, 2018.

Chapter 3 – How to Choose a Medical or Dental School

- “Results and Data: 2019 Main Residency Match,” The Match: National Resident Matching Program, May 2019.

- “2013–2021 Tuition and Student Fees Reports,” AAMC, accessed December 26, 2020.

- “Osteopathic College Tuition and Fees (1st Year) 2020–2021 and Historical,” American Association of Colleges of Osteopathic Medicine (AACOM), accessed December 26, 2020.

- “Dental School Rankings,” The Student Doctor Network (SDN), accessed December 26, 2020.

Chapter 4 – How to Pay for Professional School

Chapter 6 – How to Live on Loans

- Ecclesiastes 3:1, 2, 6 (KJV).

Chapter 7 – The Advantages of Being a Non-Traditional Student

Chapter 8 – How to Choose a Specialty (Physicians)

- Internal data from a White Coat Investor social media poll.

- Leslie Kane, “Medscape Physician Compensation Report 2020,” Medscape, May 14, 2020.

- American College of Emergency Physicians, and Daniel Stern and Associates, 2015 National Emergency Medicine Salary Survey: Clinical Results (Irving, TX: American College of Emergency Physicians, 2015).

Chapter 9 – How to Choose a Specialty (Dentists)

Chapter 10 – Avoiding Financial Catastrophes

Chapter 11 – Preventing and Combating Burnout

- Sara Berg, “WHO Adds Burnout to ICD-11. What It Means for Physicians,” AMA, July 23, 2019.

- Richard A. Friedman, “Is Burnout Real?,” The New York Times, June 3, 2019.

- Nadia Goodman, “How Google’s Marissa Mayer Prevents Burnout,” Entrepreneur, June 6, 2012.

- Leslie Kane, “Medscape National Physician Burnout and Suicide Report 2020: The Generational Divide,” Medscape, January 15, 2020.

- Internal data from a White Coat Investor social media poll. Similar “@WCInvestor” Twitter poll and data.

Chapter 13 – Why a Dentist Should Not Be Afraid to Open a Practice

Chapter 14 – Why Renting Could Actually Save You Money

- Summarized from Ecclesiastes 3:1 (KJV).

Chapter 16 – Investing During Residency

- Jonathan Clements, “How to Think About Money as a Physician” (speech), March 3, 2018, Physician Wellness and Financial Literacy Conference—Park City, video available in the conference course.

- Matt Krantz, “24 Bankruptcies Prove You Can Lose 90% of Your Money on Stocks,” Investor’s Business Daily, May 7, 2020.

- Berlinda Liu, “SPIVA US Year-End 2019 Scorecard: Active Funds Continued to Lag,” S&P Global, April 8, 2020.

Chapter 19 – Stocks, Bonds, and Mutual Funds (Financial Literacy 101)

- “Earnings Release FY19 Q4,” Microsoft, July 18, 2019.

- “List of Countries by GDP (Nominal),” Wikipedia, accessed December 28, 2020.

- “GDP by State,” Bureau of Economic Analysis (BEA): U.S. Department of Commerce, accessed December 28, 2020.

- Benjamin Graham, in discussion with Warren Buffet, quoted in Warren E. Buffet, “Letter to the Shareholders of Berkshire Hathaway Inc.,” Berkshire Hathaway Inc., March 1, 1994.

- “Sectors and Industries Overview,” Fidelity Investments, January 2020.

- Vanguard, Vanguard Total Stock Market Index Fund Summary Prospectus, April 28, 2020, 2–3.

Chapter 20 – Taxes and Retirement Accounts (Financial Literacy 102)

- “IRS Provides Tax Inflation Adjustments for Tax Year 2021,” IRS, October 26, 2020.

- “Historical Highest Marginal Income Tax Rates,” Tax Policy Center (TPC): Urban Institute and Brookings Institution, February 4, 2020.

- Robert McClelland, and Nikhita Airi, “Effective Income Tax Rates Have Fallen for the Top One Percent Since World War II,” Tax Policy Center (TPC): Urban Institute and Brookings Institution, January 6, 2020.

Chapter 21 – Financial History (Financial Literacy 103)

- Recommended resources to learn more about financial history:

William J. Bernstein, The Four Pillars of Investing: Lessons for Building a Winning Portfolio (McGraw-Hill Education, 2010).

Charles Mackay, Extraordinary Popular Delusions and the Madness of Crowds (CreateSpace Independent Publishing Platform, 2016).

Andrew H. Browning, The Panic of 1819: The First Great Depression (University of Missouri, 2019).

- Attributed to Mark Twain.

- G.R. Driver and John C. Miles, The Babylonian Laws (The Clarendon Press, 1955).

- Cyrus H. Gordon, Hammurabi’s Code (Holt, Reinhart and Winston, 1965), 8.

- Bava Metzia, fol. 42, col. 1.

- Isaac Newton, quoted in John O’Farrell, An Utterly Impartial History of Britain or 2000 Years of Upper-Class Idiots in Charge (Doubleday, 2007).

- John Rothchild, “When the Shoeshine Boys Talk Stocks It Was a Great Sell Signal in 1929. So What Are the Shoeshine Boys Talking About Now?,” Fortune Magazine, April 15, 1996.

- Evelyn Cheng, “Bitcoin Is Not a Classic Bubble, But Still Be ‘Suspicious,’ Says Investing Expert William Bernstein,” CNBC, October 24, 2017.

- James K. Glassman and Kevin A. Hassett, Dow 36,000: The New Strategy for Profiting from the Coming Rise in the Stock Market (Three Rivers Press, 2000).

- Dan Murphy, “Analyst Who Predicted Bitcoin’s Rise Now Sees It Hitting $300,000–$400,000,” CNBC, December 17, 2017.

- William J. Bernstein, Deep Risk: How History Informs Portfolio Design (Efficient Frontier Advisors, 2013).

- “List of Nationalizations by Country,” Wikipedia, accessed December 28, 2020.

- “The Callan Periodic Table of Investment Returns 2000–2019,” Callan Institute, 2020.

- John C. Bogle, Common Sense on Mutual Funds: Fully Updated 10th Anniversary Edition (J. Wiley & Sons, 2010).

- “Compound Annual Growth Rate (Annualized Return),” Moneychimp, accessed December 28, 2020.

- “Vanguard Portfolio Allocation Models,” Vanguard, accessed December 28, 2020.

- Jeremy Siegel, Stocks for the Long Run 5/E: The Definitive Guide to Financial Market Returns & Long-Term Investment Strategies (McGraw-Hill Education, 2014).

- “Federal Funds Rate—62 Year Historical Chart,” Macrotrends, accessed December 28, 2020.

- “Historical Highest Marginal Income Tax Rates,” Tax Policy Center (TPC): Urban Institute and Brookings Institution, February 4, 2020.

Chapter 22 – Numbers You Need to Know (Financial Literacy 104)

Audiobooks are great. They let you listen to books on road trips and during your commute. Sometimes on Audible the book is even cheaper than the paperback version. However, one downside of an audiobook is that you can't see the images, graphs, tables, and diagrams that are in the print book. Another downside is that you can't click on the URL links like you can with the eBook or scan the URL QR codes like you can in the hard copy book.

Audiobooks are great. They let you listen to books on road trips and during your commute. Sometimes on Audible the book is even cheaper than the paperback version. However, one downside of an audiobook is that you can't see the images, graphs, tables, and diagrams that are in the print book. Another downside is that you can't click on the URL links like you can with the eBook or scan the URL QR codes like you can in the hard copy book.