The greatest financial risk for physicians is losing the ability to turn the knowledge and skills you spent a decade learning into a huge pile of money by working in your profession for decades. There are risks that could show up in your life that would prevent you from being able to accomplish this task. One of the most common of these risks is an extended or even permanent disability. Insurance companies estimate that as many as one in seven doctors will be disabled at some point during their career. While many imagine this will occur in a sudden traumatic accident, medical illness is actually a more common cause of disability that prevents a doctor from working.

Key Takeaways: What Doctors Need to Know About Disability Insurance

- The best Disability Insurance policy is an individual, portable, own-occupation, specialty-specific policy.

- Purchase disability insurance from an independent agent who can show you policies from all of the major companies. We have a list of recommended Disability Insurance agents used by thousands of white coat investors each year.

- Buy as much disability insurance as they are willing to sell you as a resident. Include a future purchase option (sometimes called a “benefit purchase rider” or “future increase option”) and a cost of living disability insurance rider.

- As an attending, increase your coverage to cover both your living expenses and retirement savings if you were to work to age 65.

- You may get sticker shock, but the reason disability insurance is expensive is that it actually gets used. Slightly more than 1 out of 4 adults will experience a disability before they retire. Physician disability insurance agents often use a figure of 1 out of 7 doctors actually using the disability insurance they purchase. Whatever the true statistic may be, it's certainly high enough to insure against.

Do not take the risk of not having disability insurance. Reach out to a WCI-vetted disability insurance agent if you need to get the right coverage in place.

Physician disability is a complicated type of insurance. This post will give you the “must-know” information to secure the best protection and help you avoid common disability insurance mistakes.

Table of Contents

Why Do Physicians Need Disability Insurance?

How Does Disability Insurance Work?

What Does Disability Insurance Cover?

Disability Insurance Riders for Physicians

Who Needs Disability Insurance?

How Much Physician Disability Insurance Do I Need?

Average Cost of Disability Insurance for Physicians

How Do I Buy Disability Insurance?

When to Buy Disability Insurance?

Who Do I Buy Disability Insurance From?

How to File a Disability Insurance Claim

When to Reduce or Cancel Your Disability Insurance?

Frequently Asked Questions (FAQ)

- How Much Does the Social Security Disability Insurance Benefit Provide?

- Can I Add or Remove Riders and Exclusions Later?

- What Are Some of the Differences Between Disability and Life Insurance?

- Is Disability Insurance Tax-Deductible?

- Do You Pay Taxes on Disability Insurance Benefits?

- Does Guardian Really Have the Best Policy for Doctors?

- Does the Military Provide Physicians with Disability Insurance?

- Should I Get Disability Insurance as a Resident?

- Do I Need the Student Loan Disability Insurance?

- What Is the Difference Between GSI, Individual, and Group Disability Coverage?

- What Is the Elimination Period in Disability Insurance?

- Can You Have Two Short-Term Disability Policies?

- What Mistakes Do Doctors Make When Buying Disability Insurance?

What Is Disability Insurance?

Disability insurance gives you an income to live on if you become so disabled that you can no longer work.

If you become disabled, a long-term disability insurance policy pays a predetermined amount each month until you either recover from your disability or reach age 65-67. (Note: Policies vary. It is possible to buy a policy that pays to age 70 or even, for a very high premium, until death).

Why Do Physicians Need Disability Insurance?

One out of seven doctors end up having to use their disability insurance. Losing the ability to turn the knowledge and skills you spent a decade learning into a pile of money by working in your profession for decades is one of the most expensive risks that physicians face. Your most valuable asset is your ability to work.

How Does Disability Insurance Work?

Disability insurance is a pretty straightforward proposition. You buy a policy and pay your premium monthly or annually. If you become disabled, you (and your doctor) fill out the paperwork to prove it to the satisfaction of the insurance company and then they pay you the promised monthly benefit until you either recover from your disability or the insurance company meets its contractual obligation to pay the benefit.

Short-Term vs. Long-Term Disability

Disability insurance is most commonly divided into short-term and long-term.

Short-Term Disability

A short-term disability policy generally begins paying just as soon as you get disabled and then pays for a maximum period of 3-24 months. These policies are often provided by an employer as an employee benefit. Short-term disability, while inconvenient financially, is not generally a financial catastrophe for a physician saving for retirement with an emergency fund. As a result, many doctors do not buy short-term disability policies at all.

Long-Term Disability

A long-term disability policy generally does not pay immediately, but only begins to pay after a waiting period ranging from 1-24 months (typically 3 months). Then, the policy will continue to pay you a benefit each month until age 65, 67, or 70, depending on the policy. Note that a 3 month waiting period typically means your first check won't come until the end of the first month after the 3 months, so it's really a 4 month waiting period. Since losing your ability to earn a living for the rest of your life is a financial catastrophe, any doctor who is not financially independent should buy a long-term disability insurance policy.

What Does Disability Insurance Cover?

Disability insurance covers all kinds of disabilities. The best (and unfortunately most expensive) policies cover the widest range of potential disabilities.

The Definition of Disability

The most important feature is the definition of disability. Disability insurance differs from life insurance in numerous ways, but none is more significant than in defining exactly when you become disabled (and when you become enabled again). The broader the definition of disability you get in your policy, the more the policy will cost.

Unlike life insurance, where life and death are pretty black and white, disability has 50 shades of gray. You want a policy with a strong, broad definition of disability that will cover any possible type of disability? That means “true own-occupation, specialty-specific” and no limitations on things such as psychiatric conditions or addictions. This is the main difference between the “Big 5” companies and others. Even among the “Big 5,” there are slight differences. It is OK not to purchase the policy with the very best definition of disability, but the weaker the definition, the bigger the discount you should expect.

Own-Occupation, Specialty-Specific

Probably the most important aspect of the definition for doctors is that it be specific to your occupation. For instance, if I lost my left thumb, there are a number of procedures in emergency medicine that I could no longer do. I would be completely disabled from managing a busy emergency department by myself. But I could probably still go do urgent care work. A specialty-specific definition of disability in my policy would provide me with my full disability payments in addition to the money I make at the urgent care. Sometimes, the “specialty-specific” clause is inherent to the policy, and at other times it is an additional rider (a piece of paper added to the policy for which you pay an additional premium). Either way, you almost surely want to get this in your policy. Here are the various definitions, starting with own occupation and progressing to any occupation.

Own-Occupation Definition

Under this definition, your policy will pay if you cannot work in your occupation/specialty, even if you can and do work in another field and make as much money as you want.

Own-occupation policies cover people based on the occupational duties they are performing at the time of claim. If your policy includes an own-occupation definition of total disability and you are exclusively performing the customary duties of your medical specialty or sub-specialty at the time of the claim, the policy will cover you when unable to perform your specialty or sub-specialty. If you have transitioned into a different role or expanded into a new career path that requires much less direct patient contact or procedural duties, you may no longer be considered totally disabled when unable to work in your specialty or sub-specialty. This is because your “occupation(s)” involves additional material and substantial duties, no longer limited to the performance of your medical specialty or sub-specialty. In these instances, you may be considered partially disabled or not disabled at all, depending on the exact circumstances.

Transitional Own-Occupation

Your policy will pay if you cannot work in your occupation/specialty, even if you can and do work in another field. But if you exceed your previous income while you now work in another field, your monthly benefit from the policy would likely be lowered.

Modified Own-Occupation

Your policy will only pay if you can't work in your occupation/specialty AND if you are not working in another field. This definition is also sometimes called “Own-Occupation, Not Engaged” or “Own-Occupation, Not Working.”

Any-Occupation

Your policy will only pay if you cannot work in any occupation based on education, training or experience. Note that some policies are own-occupation for a couple of years and then transition to any-occupation.

One company out there (Northwestern Mutual) sells a policy with a definition that they claim is BETTER than own-occupation. They call it Medical Own-Occupation, but in reality, it is just a form of modified own-occupation. Learn more about the NML Medical Own-Occupation Definition.

Do You Really Need an Own-Occupation, Specialty-Specific Policy?

Some non-procedural physicians argue that they might not need a true own-occupation policy. They reason that if they are so disabled that they cannot practice their specialty, they probably cannot do anything else. So, they accept a less broad definition of disability to save some dollars on the premium. If you choose to do this, make sure you understand the exact circumstances under which your policy will and will not pay out.

Mental Disorders/Substance Abuse

Many policies will only cover mental illness or substance abuse-related disabilities for a period of two years. I know an attorney who couldn't practice law after developing bipolar syndrome in his 30s. It took over a decade to get it under control. He had a policy that covered mental illness indefinitely, which prevented financial catastrophe from striking him and his family.

According to the April 2011 issue of Current Psychiatry Magazine, physicians are not immune to depression and have an increased risk of suicide. Additionally, the lack of distinction between a psychiatric diagnosis and impairment stigmatizes physicians and impedes treatment.

You'll need to decide whether this is a risk you're willing to run. If you want mental illness covered like every other illness, you'll be paying more.

Presumptive Total Disability

As you well know, disability can be defined in many shades of gray. In the event of your disability, you can expect a paperwork fight between you, your physician, the disability insurance company, and maybe even your attorney. However, most policies contain a section that defines “presumptive total disability” where you can be assured there won't be much arguing from the insurance company. Even better, the waiting period will be waived and you'll start getting payments right away. The policy I used to have read like this:

“Presumptive Total Disability – Your total and permanent loss, because of Your Injury of Sickness, of one of the following:

- Speech;

- Hearing in both ears, not restorable by hearing aids

- Sight in both eyes (see below);

- Use of both hands;

- Use of both feet; or

- Use of one hand and one foot.

Total and permanent loss of sight in both eyes means: Both eyes must measure at or below 20/200, after reasonable efforts are made to correct their vision, using the most advanced medically acceptable procedures and devices available.”

Anything short of that, and you're going to have to get your doctor to certify your disability and get the insurance company to accept it. At times, this can involve visits to multiple specialists and even hiring an attorney. Note that with some companies, presumptive disability does not need to be permanent.

Cosmetic Surgery/Transplant Surgery

Some policies will cover you if your disability is the result of cosmetic surgery or the result of donating a kidney or other body part to someone else. Others will not. Best to read your policy carefully and know what it does and does not cover.

Disability Insurance Exclusions and Limitations

Disability insurance policies generally exclude any medical conditions you have at the time of applying for insurance. For example, if you already have chronic back pain, the policy will not provide a benefit if you are disabled due to a back condition. In addition, if you admit to participating in dangerous activities such as scuba diving, rock climbing, flying, and sky-diving, the policy will likely be issued with a rider that excludes those activities from coverage. Other exclusions may also apply, such as acts of war, normal pregnancy, and foreign travel. Here is a list of common exclusions:

- War or Act of War (this could probably be interpreted pretty broadly)

- Active Military Duty (having served, this is pretty stupid since 95%+ of our military folks are never in any kind of serious danger of being hurt by a combatant)

- Normal Pregnancy (don't want to work because you're eight months pregnant? Don't bother trying to get disability benefits for that)

- Foreign Travel (varies by policy, but many don't cover you during that European vacation, much less that humanitarian trip to Sudan—read the fine print)

- Mental/Nervous Disorder (many companies limit benefits to two years, where they might pay for “physical” disorders until you're 65 years old)

- Medical Exclusions (any medical conditions you have at the time the policy is issued will likely be excluded, meaning if you have heart disease at the time of issuance and it leads to you being disabled five years later, the policy isn't going to pay. Again, apply when you are young and healthy and/or when you haven't had medical problems for several years to minimize this.)

Residual Disability

Residual disability refers to being only partially disabled. This may occur from the initial injury or illness or be part of the process of recovery. You generally need to buy an additional rider to cover this. Read this rider carefully, it can be a bit complicated. The definition of residual disability that was in my policy is listed here:

“Residual Disability/Residually Disabled – Residual Disability means You are not Totally Disabled, but because of Your Injury or Sickness:

- Your Monthly Earnings are reduced by 20% or more of Your Indexed Prior Monthly Earnings; and

- You are under the regular care of a Physician appropriate for Your Injury or Sickness; and

- You are able:

- To do some, but not all, of the substantial and material duties of Your Regular Occupation; or

- To do all of the substantial and material duties of Your Regular Occupation, but not for as long a time or as effectively as You did immediately prior to Your Injury or Sickness.”

Imagine developing painful lumbar radiculopathy that keeps you from working more than 20 hours a week. This is the part of your policy that will cover that. This rider will also explain how much you get if you are partially disabled. My old policy says it pays the whole benefit (total disability) if I can't earn at least 20% of my “indexed prior monthly earnings,” which is basically the money I earn at my job. It doesn't count my investments, other disability income policies, rent from a rental property, or my nonvocational activities. It doesn't pay anything if my earnings aren't reduced at least 20%. If I am making between 20%-80% of what I made previously, I get the total disability benefit times the ratio of my loss of income for that month divided by my indexed prior monthly earnings. Note that with some companies, the partial disability rider will kick in at 15%.

Some contracts use “or” in the contract and others use “and” in the contracxt. For instance, a stronger policy would trigger the partial disability rider if you had a loss of income or a loss of time or a loss of duty whereas a weaker contract would require loss of income and loss of time and loss of duty where all of those triggers must be met.

Partial Disability vs. Residual Disability

Partial disability and residual disability are generally considered to be the same thing, but there is a technical difference at some companies. For example, at one company, a partial disability rider requires total disability during the elimination period and the residual disability rider does not. With another company, partial refers to the disability, such as one that only affects one part of the body (such as one arm), while residual refers to a decrease in earnings. Either way, the key is to understand how the residual/partial rider works in the policy you actually purchase.

Recovery Benefits

A physician should consider a contract that will continuing paying them a portion of their benefits upon recovery from a disability if their income continues to be down at least 15%-20%. Most carriers will pay a recovery benefit for the benefit period although one only pays for 12 months. This is especially important for practice owners. Think if a dentist were to be disabled for 6 months and then recovers and goes back to their practice. Many of their patients may have gone elsewhere because the dentist sees his patients twice a year. It could take several years to get back to where he/she was at before becoming disabled.

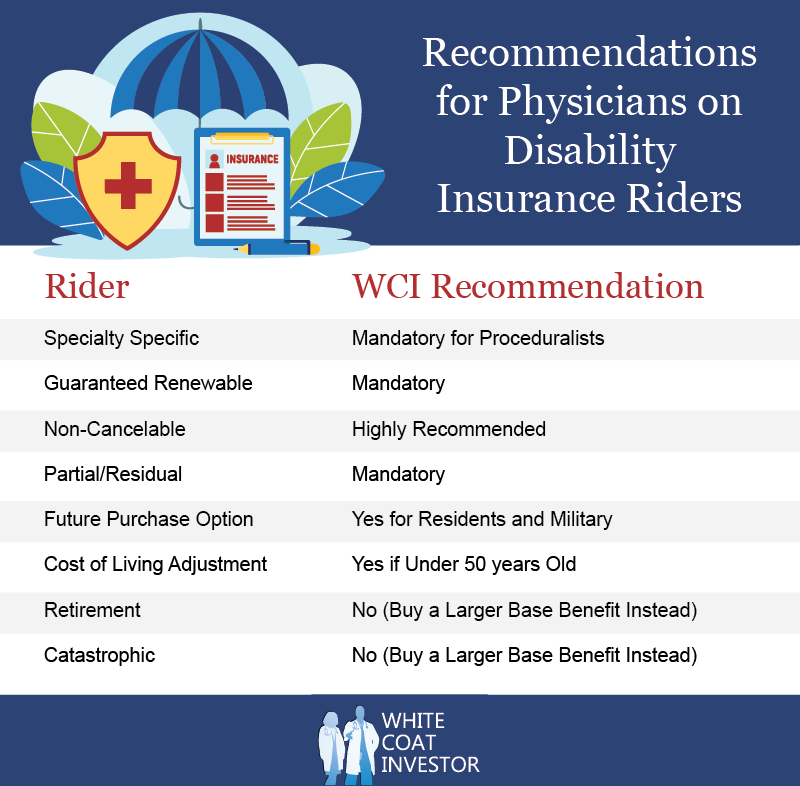

Disability Insurance Riders for Physicians

Disability insurance policies are generally sold with “riders.” Disability insurance riders are additional features of a policy that may or may not cost an additional premium. There are a half-dozen or more of these riders, and some are more important than others.

Residual/Partial Disability

This rider should be purchased by everyone. It covers a partial disability and provides a partial benefit as you recover from your disability.

Inflation Protection

Sometimes called a Cost of Living (COLA) rider, this rider indexes your benefit to inflation, usually starting one year after you become disabled. This is a particularly important rider if you are disabled at a young age, so I recommend it for anyone buying a policy in their 20s-40s. If you are already 55 and the policy is only going to pay until you are 65, you can probably skip this rider.

Future Purchase Option

This rider allows you to buy a larger benefit at a later date without any pesky questions about your health or hobbies. If you are in a position (such as a resident) where you cannot afford as much as you need, purchase this rider. Given the stress and relatively unhealthy lifestyle most residents lead, it is not unusual to develop a medical condition during training. If that occurs, you may not be able to buy another policy at all when you become an attending. Even if you can, that condition is likely to be excluded. A future purchase option rider allows you to buy that additional needed coverage. Some companies call these “future increase options” or “benefit purchase rider” and they all work slightly differently. This is one of a myriad of differences between the policies offered by the various companies that make comparing apples to apples particularly challenging. Make sure you understand how your particular rider works if you elect to purchase one. Some only allow you to exercise it during certain periods of time.

Catastrophic Disability

This Catastrophic rider pays out an even larger benefit if you are REALLY disabled, usually defined as not being able to do two or more activities of daily living. Unless you are already up against the maximum amount you can purchase, I think you are probably better off just buying a larger primary benefit instead of this rider.

Retirement Benefit

This rider, in the event of disability, causes the insurance company to put some money into some type of retirement vehicle for you in addition to paying your monthly benefit. Unfortunately, these are generally high-expense, insurance-based investing products and not the best way to save for retirement. You are better off purchasing a larger primary benefit with the money that would have gone toward this rider. Just don't forget you need to continue to save for retirement using your disability benefit money since the policy will only pay to age 65 or you will be living only on your Social Security benefits. If you're interested in the details of this rider, check out this post on disability retirement protection.

Non-Cancelable and Guaranteed Renewable Rider

If your policy is not non-cancelable and guaranteed renewable, you'll need to buy a rider to get these important features. It's important to understand these terms.

Conditionally Renewable

This means the company gets to decide what the conditions will be for you to renew your policy and at what price. You DO NOT want a policy that is conditionally renewable. In fact, it would be unusual for a salesperson to even try to sell you one.

Guaranteed Renewable

This means the company can change your premium, so long as they change it for everyone in your state, your policy year, or your occupational class. But they must renew the policy at some price.

Non-Cancelable and Guaranteed Renewable

This means the company cannot change anything about the policy—not the premiums, not the monthly benefits, and not the policy benefits up until age 65 (or whatever the specified age in the policy is). Even if you change occupation to something in a more risky class with a lower income, the benefit will remain in place at the same price.

The policy I used to have technically wasn't non-cancelable by itself, but the company gave me the non-cancelable rider for free. That's my favorite price. I recommend against buying any policy that isn't at least guaranteed renewable, but I have seen a few reasonable arguments to not buy a non-cancelable policy if it saves you a significant amount of money.

Recommendations for Physicians on Disability Insurance Riders

Here's an easy cheat card to help you know at a glance what we think about all of the various riders available.

Who Needs Disability Insurance?

Nearly every high-income professional in their first decade or two out of school should own a policy. Your most valuable asset is your ability to work. So, if you do not own a disability insurance policy, you need to go get one, now. If you have an income, it's time to buy a policy, even if money is tight as a resident. The only exception is if you do not rely on your income to live. If you are already financially independent, it's OK not to buy disability insurance. However, even if you are frugal and married to another high earner, you may wish to still have a policy. You could both become disabled, or you could become divorced.

Is My Employer's Plan Good Enough?

The most important rule of disability insurance is that any disability insurance is better than no disability insurance at all. If you are disabled without disability insurance, you will be limited to what is offered by the Social Security Administration, which provides relatively low payouts and can be difficult to qualify for. My last Social Security statement says my disability benefit would be $2,471 a month. Living on that would be a dramatic decrease in our standard of living.

Many employers (and professional associations) also offer disability insurance. If your employer is paying the premiums, be sure to take advantage. If they are not, you will have to compare the group policy to the individual policies that an independent agent can sell you. As a general rule, individual policies have a stronger definition of disability and higher (but flat) premiums but can be taken with you from one job to the next. Group policies are less expensive (although premiums generally rise as you age) and often don't ask pesky questions about your health and hobbies but cannot be taken with you when you leave.

In some cases, an individual policy is best. In other cases, the group policy makes sense. Occasionally, it can make sense to have both. Owning a pre-existing individual policy may limit how much of a group policy you are allowed to purchase.

How Much Physician Disability Insurance Do I Need?

As a resident, you typically cannot afford to buy as much as you need, but you should be able to do so even as a brand-new attending. Basically, you need to buy enough disability insurance to cover both your living expenses and your retirement savings if you were to work to age 65 but not your taxes. Physician disability insurance payouts are generally tax-free since they are usually paid with post-tax dollars.

Note that how much you need has little to do with your income and everything to do with what you spend. The less you spend, the less insurance you need to buy. Insurance agents would love to sell you the largest possible policy (which usually works out to be about 2/3 of your gross income, but it is possible to combine two companies to get even more), so you'll need to decide how much you need on your own. Resident physicians typically buy a $5,000 per month benefit and attending physicians typically buy a benefit in the $10,000-$15,000 per month range, but there are plenty of docs who buy both more and less. If your plan in the event of disability is to rely on the income of your spouse, you may not need disability insurance at all.

Average Cost of Disability Insurance for Physicians

Unlike cheaper insurance policies like term life and umbrella policies, physician disability insurance is expensive, although not quite as expensive as your malpractice insurance. The reason it costs so much is it actually gets used. The likelihood of you acquiring a long-term disability during your working years is approximately seven times as high as your risk of dying in those years. A typical policy bought on a healthy doc in their 20s or 30s will cost something between 2%-6% of the benefit. If your monthly benefit is $10,000, expect to spend $200-$600 per month for that. Perhaps the sticker shock you get upon being quoted prices will motivate you to reach financial independence as soon as possible so you can cancel the policy.

Graded vs. Level Premiums

One way to save money on your policy is to get graded premiums. Not all policies offer this feature, but those that do will charge you less in the first few years and more in later years. Level premium policies charge you the same amount in premium every year. A graded premium policy accounts for the fact that you become more likely to become disabled as you go through life. However, it can be very beneficial to you because your need for insurance actually falls continually throughout your career as your build your retirement nest egg.

Once you become financially independent, you can drop the insurance completely. This is a good idea since the total benefits a policy could potentially pay are also dropping throughout your life (since the policy will generally only pay until you are in your mid- to late-60s). Many white coat investors who are great savers hit financial independence by mid-career. If you are one of those, you are likely to come out ahead using graded premiums instead of level premiums.

Why Is Disability Insurance More Expensive for Females?

Disability insurance generally costs more for women than for men. This is simply due to the fact that women are much more likely to make a claim than men are, partly due to the unique risks of pregnancy. As a result, men should generally buy a “gender-specific” policy and women should generally buy a “unisex” policy whenever possible. It is also best to buy a policy prior to becoming pregnant. Note that unisex policies are becoming less and less common every year.

An actuary once explained WHY women were more likely to be disabled. He acknowledged that pregnancy complications can result in a lot of disabilities. However, he also suggested that women are more likely to go to the doctor sooner in an illness. Thus, they survive the illness but are disabled by it whereas by the time a man catches it, he ends up dying from it and that's why disability insurance costs more for women and life insurance costs more for men. He also suggested that women are less likely to feel as great of an incentive to go back to work as they are more likely than men to have a working/high earning spouse helping to provide and are thus more likely to stay on disability. Whatever the reason (which I'm not convinced is very clear), the statistics remain that women are more likely to use disability insurance and thus it costs more for women.

What Disability Insurance Discounts Are Available for Doctors?

Like other types of insurance, disability insurance is sold by agents who are paid commissions by the insurance companies to sell their products. It is a very competitive business. The insurance companies want agents, especially the independent agents you should be buying from, to preferentially sell their products. To incentivize the agents, they offer discounts that are only available through certain agents. Experienced, high-volume agents can often provide you with the same policy at a cheaper rate than a newer, lower-volume agent. Thus, it pays to use an experienced agent and shop around with two or three of them. Nearly every doctor should qualify for some type of discount on their policy—10%-30% premium discounts are not unusual. Types of discounts include:

- Unisex discounts

- Student/Resident/Fellow discounts

- Multi-life institution discounts

- Guaranteed Standard Issue (GSI) institution discounts

- Association discounts

Learn more about physician disability insurance discounts.

How Do I Buy Disability Insurance?

The key to physician disability insurance is the independent agent. The agent is going to be paid a great commission by the insurance company no matter which policy you choose. Assuming policies with similar benefits, the commission isn't going to be all that different. Plus, these agents get plenty of business and none of them are starving, so they have little incentive to sell you an inferior policy for a slightly higher commission. Their reputation is worth far more than a few extra dollars in commission. Since you are (indirectly) paying the agent a very nice commission, don't feel bad about using their time and expertise to fully understand this complicated product.

For most doctors, this is a purchase that is only done once or twice in their life. Have the agent quote you different physician disability policies from each of the “Big 5” companies and show you the strengths and weaknesses of each. If you have a policy from work or your professional association, bring it in with you and have it included in the comparison. Then, you can know you made an educated decision and you can buy it and forget about it. Also, be sure to ask for a discount. The vast majority of doctors will qualify for a 5%-30% association or employer-related discount, and a top-notch agent will help you get that.

What to Know Before Shopping for a Disability Policy

There are a number of things you should know prior to beginning the process. These will help you decide how much insurance and which policy to buy.

These items include:

- Your income (check your last W-2, 1099, or tax return)

- How much you spend each month

- If your employer or professional association offers any disability insurance

The process of buying disability insurance is best done by following these steps:

- Figure out how much insurance to buy

- Choose an agent or agents to purchase from

- Find out if you are eligible for group or association policies and bring them when meeting with the agent

- Have the independent agent quote the best policies for your specialty, state, and gender, including discounts

- Make a rational selection of base policy and needed riders

Application and Underwriting Process for Physicians

Underwriting is the process an insurance company uses to determine the final terms and conditions of your policy. After selecting which disability insurance policy to apply for, you will need to go through the two- to six-week underwriting process for approval. After submitting an application, it takes 3-6 weeks to receive an offer. However, that period could be shorter or longer, depending on how long it takes to receive and underwrite (review) the required medical, financial, and occupational information. In fact, there are several unique strategies to consider when putting your insurance in place.

What Type of Disability Insurance Should I Buy?

There are two main types of disability policies: individual policies and group policies. As a general rule, individual policies have stronger definitions of disability. Many group policies are not own-occupation policies. Individual policies are also portable, in that you can change jobs and take them with you.

Individual Disability Policy

There are a number of benefits of an individual policy. The main one is that you are in control of all the details. You get to choose how much insurance you want to pay for. You get to choose which of the bells and whistles you are going to pay for. The policy is also “portable,” meaning you still have it if you change employers (or if your employer just decides to change the policy). As a general rule, the policy is also “stronger,” meaning it is more likely to actually pay you if you get disabled.

Group Disability Policy

A group policy provided by your employer is usually not portable, although sometimes you are allowed to take over the entire premium and take it with you. Group policies also frequently have premiums that increase every year or every five years, whereas an individual policy usually has level premiums. Group policies paid for by your employer may also pay a taxable benefit, rather than the tax-free benefit provided by an individual policy. Aside from the lower cost, the main benefit of a group policy is that it may be easier to qualify for. It may not require any sort of medical exam or blood work, and it may not ask any pesky questions about your medical conditions and dangerous hobbies such as rock climbing, skydiving, scuba diving, or flying.

Choosing a Waiting Period

Policies will usually give you a choice of a 30-, 90-, or 180-day waiting period. I recommend the 90-day period. A waiting period is the time between the date you are disabled and the date when the policy starts making payments to you. With a three-month emergency fund, you can easily self-insure for those first 90 days, avoiding the need for a short-term disability policy. Policies with 30-day waiting periods are too expensive and a policy with a 180-day waiting period does not provide much of a discount over one with a 90-day period.

How to Compare Disability Insurance Policies

The most important feature is the definition of disability. You want a policy with a strong, broad definition of disability that will cover any possible type of disability. That usually means “own-occupation, specialty-specific” and no limitations on things such as psychiatric conditions or addictions. This is the main difference between the “Big 5” companies and others.

Since disability is complicated, disability insurance policies are complicated. There are dozens of differences from one policy to another, making them difficult to compare. Use your independent agent for recommendations on what matters most. Just for an example, take a look at this chart of all the differences you could see between one policy and another.

See what I mean? The differences between the policy from one of the “Big 5” to another are not quite so large, but they still exist. Comparing one policy to another may be the most time-consuming part of the process of purchasing. Take your time and don't be afraid to use your agent's knowledge. They get paid about the same no matter which policy they sell you, so at least in this regard, you can trust their advice. (By the same token, you probably don't want to necessarily trust their advice on how large of a policy to purchase. Decide that before you go see them.)

When to Buy Disability Insurance?

You should buy disability insurance just before you become disabled. Since you don't know when that time could be, earlier is generally better. However, disability insurance is also expensive, and when you are young and poor, you have lots of other great uses for your money. A good compromise is to buy a small policy as you enter residency and then upgrade to a more robust disability insurance plan just before leaving residency. The younger you are, the healthier you are, and the fewer dangerous hobbies you engage in, the cheaper your premiums will be for the same benefit.

Who Do I Buy Disability Insurance From?

Disability insurance should be purchased from an independent agent. An independent agent can sell you disability insurance from any of the “Big 5” disability insurance companies. These include The Standard, Guardian/Berkshire, Principal, Ameritas/Union Central, and Mass Mutual. Each of these offers a strong “own-occupation” disability insurance policy appropriate for physicians. Note that until recently, Northwestern Mutual was NOT one of these companies. Aside from the fact that its definition of disability was weaker than those of these other companies, the experience of many white coat investors is that their agents also often use disability insurance as the “gateway drug” to sell you an unnecessary and expensive whole life policy. Northwestern Mutual recently improved their definition of disability, but there are still enough other weaknesses in the policy (and especially the company culture) that I would still avoid it. If you already have a Northwestern policy bought many years ago, it may be worth keeping rather than buying a stronger policy now that you are older and more expensive to insure.

Best Disability Insurance for Physicians

I keep a list of those I consider the best disability insurance agents in the country. Save yourself the work of finding a good one you can trust and use the same agents that have been used by thousands of WCI readers in the past. You do not need someone local that you can sit down across the table from. It is better to have someone who has sold policies to hundreds of docs this year working with you by phone, Skype, Zoom, and email than someone you can sit down with who has only sold four policies. In addition, if there is some issue with one of these agents, I can usually help you resolve it quickly.

Information in this space rapidly changes. While we try to keep The White Coat Investor website as up-to-date as possible, our recommended agents are going to be our best source for updated information. I cannot emphasize how strongly I suggest you use them, whether buying your first policy or simply reviewing what you already have.

What If You're Not Healthy

It doesn't take much of a medical problem to cause you an issue obtaining disability insurance. If you have any concerns about prior medical problems or injuries whatsoever, follow these recommendations:

#1 Be honest with your agent. Don't assume the insurance company won't find out about your medical problem if you don't tell the agent about it. They have access to numerous other databases that are likely to reveal the problem (prescription drug databases, insurance database etc.) The agent can't help you if they don't know about the issue.

#2 Check into whether your institution has access to a Guaranteed Standard Issue (GSI) policy. If you're still in residency or fellowship or an academic doc, you probably do. If so, apply for and obtain this policy FIRST, then go and see if you can get a better/cheaper “fully underwritten” policy. Once you have been declined for a regular policy, you can't then go back and get a GSI policy. While most honest agents will point this out to you, that does require them to ignore their own self interest and that can be difficult for even good people to do.

#3 Have your agent shop you around informally to the various companies. They should be able to determine with a high level of confidence whether you are likely to be declined by a given company or not, without actually being declined.

Recognize that sometimes even the agents are surprised when you are declined, but we want to minimize that occurrence as much as possible and the three steps above should help to do that. While it's not the end of the world if you're declined (remember 6 out of 7 DI purchasers don't ever actually need their policy), it does introduce a risk that most docs should not need to run.

A WCIer wrote in after having this experience with one of our recommended agents:

My wife, a PGY1 (internal medicine), recently worked with a recommended agent to find an individual, own-occupation disability insurance policy. Regrettably, her application for a policy from MassMutual was declined on the basis of her medical records. I don't know whether poor communication between my wife and the agent or between the agent and MassMutual is to blame. But either way, the experience didn't meet the (admittedly very high) expectations I had for the agent based on your recommendation. In the aftermath, my wife and I discovered that her program provides access to a pretty good GSI policy (which she is no-longer eligible for), and that such policies are increasingly common among major residency programs and a good option for doctors with less-than perfect health histories. Obviously, we wish we had known to look out for a GSI policy sooner.

I recognize that GSI policies are not widely advertised or accessible to all agents, that medically underwritten policies can often be stronger and/or cheaper, and that no agent can guarantee approval for a policy that requires medical underwriting. Bad outcomes happen sometimes, even when knowledgeable agents do their best to provide good service. This is not like being sold whole life insurance (though the consequences are just as permanent). I also recognize that hindsight is 20/20. Looking for alternatives seems very obvious after being declined. And I know that my wife and I ultimately bear responsibility for getting appropriate insurance in place. It was in our power to thoroughly research our other options before submitting an application and we chose not to. Nevertheless, I thought you would want to know about our experience.

If you have a similar experience with the agents we recommend, we want to hear about it. We'll educate and if necessary for repeated complaints, remove them from our list.

What If You Have Dangerous Hobbies

Pilots, SCUBA divers, climbers, and skydivers are likely to have difficulties obtaining a disability insurance policy. You may be able to get one, but injuries from that hobby are likely to be excluded. (I had a climbing exclusion on my DI policy.) If you have not participated in the activity for the last 6-24 months and have no concrete plans to do so in the next 6-24 months, you may be able to get a policy that covers those activities. In some cases, you won't be able to get a policy at all. Be sure to check into various association policies, although these generally offer life insurance policies, not disability insurance policies.

How to File a Disability Insurance Claim

Legitimate disability claims are processed quickly and without much hassle. You have to fill out a form as the claimant and your employer has to provide some information, and then they request records from your primary doctor. These are the steps for filing a claim.

- Read your policies and understand your coverage

- Check the definition of disability

- See if you are eligible for partial or residual disability

- Consult an experienced attorney

- Get a diagnosis

- Gather additional medical evidence

- Collect other documentation supporting your disability

- Establish a date when your disability started

- Plan administratively and financially for your disability

- Beware of under-reporting your symptoms and restrictions

Do I Need to Get an Attorney Before Submitting My Disability Claim?

In most cases, you do not need to hire an attorney for individual disability income claims. Most cases of disability are pretty straightforward. I think if the insurance company hears first from your attorney, the first thing it's going to say is, “Why did this person get an attorney? Maybe we ought to look at this more closely.” If you're in a gray area, maybe. Otherwise I'd wait until there's an issue. The company does assign you a claims consultant whose job is to help you get all the necessary information to the company and walk you through the process. They may ask you for more information, but I'd just try to be as cooperative as possible. However, if you start running into problems or feel the company is not doing what it should, go ahead and get that attorney. Just recognize they do not work for free.

How Often Do You Have to Be Recertified as Disabled?

It depends on the disability. For a serious condition that you're obviously not going to recover from, you may never have to do anything again—certainly no more than a form once a year from your doc who you're going to be seeing more often than that anyway. For a soft tissue injury or something from which you're expected to recover relatively soon, more frequent certification may be required.

When to Reduce or Cancel Your Disability Insurance?

Disability insurance is a temporary type of insurance, like term life insurance. When you no longer have a need for it or it is no longer a good deal, you should cancel it and use what you would have spent on premiums to save, spend, or give more than you now do. The idea is to have disability insurance in place from the time you start earning money until the time when you no longer rely on that earnings stream. Since any type of insurance is, on average, a losing proposition, you should only insure against financial catastrophe. Acquiring a long-term disability while your family relies on your income is a financial catastrophe. Becoming disabled after you are already financially independent or for only a short period of time is not. So, when you reach financial independence, you can cancel your disability insurance (and your term life insurance).

In addition, since most disability insurance policies only pay out until age 65 or 67, the possible payout becomes less and less as you age. As you move into your 60s, you may decide it is no longer worth the premiums to only get a few years of benefits in the event of long-term disability. If so, it's time to dump your disability policy. I have dumped mine, and if you follow the advice on this site, someday you will wealthy enough to dump yours too.

Key Takeaways

- Your most valuable asset is your ability to trade your time for money at a very high rate for the next few decades. Insure it as soon as you come out of school.

- The best policy is an individual, portable, own-occupation, specialty-specific policy.

- Purchase disability insurance from an independent agent who can show you policies from all of the major companies.

- Buy as much disability insurance as they are willing to sell you as a resident. Include a future purchase option and a cost of living rider. You will probably buy more when you finish training.

Frequently Asked Questions (FAQs)

Didn't find the answer to your question above? Add it to the list in the comments section. Here are some additional questions we have received on disability insurance.

How Much Does the Social Security Disability Insurance Benefit Provide?

It depends on your age, how long you have been working, and how much money you have been making over that time period. The length of period you must have worked just to get anything at all varies by your age. Usually, you will need to have worked and contributed to Social Security in 20 quarters over the last 10 years, but there are exceptions, particularly for the young.

Assuming you have a long enough work history to qualify and you qualify medically, the amount generally goes up over time depending on how much you have earned and paid into Social Security. The easiest way to tell is to check your Social Security statement. At mid career, mine is about $2,471 per month. That's just under $30,000 a year, not exactly living it up.

Can I Add or Remove Riders and Exclusions Later?

The rule of thumb for policy adjustments is that you can reduce the insurance company’s liability without needing additional underwriting. In other words, you can reduce your coverage level or benefit period, increase your elimination period, or remove optional riders with a simple change application that does not require additional underwriting. But anytime you want to increase their liability—such as when adding riders, increasing coverage levels, or removing medical exclusions—they’ll want to review updated information. If you still qualify, you can add riders later, but it might cost you more. Exclusions can be removed, and it is worth pursuing medical exclusions after a certain period of time has passed, such as a five- or 10-year cancer-free period. Risky activity exclusions are much more difficult to remove. Think about it. If you are no longer rock climbing or scuba diving, why do you need the exclusion removed? If you are, why would they remove it?

What Are Some of the Differences Between Disability and Life Insurance?

Perhaps the greatest differences between these two commonly purchased products is complexity and cost. Life insurance, at least term life insurance, is a very simple and straightforward contract because people are either dead or alive. By comparison, disability is “50 shades of gray.” Term life is also much less frequently used than disability insurance, so the premiums are much cheaper. Life insurance is really to protect your loved ones, whereas disability protects you (and your loved ones indirectly).

Is Disability Insurance Tax-Deductible?

As a general rule, no. Individual policies are paid for with post-tax dollars and pay out tax-free dollars. Employer-provided policies can be paid for with pre-tax dollars (a tax deduction for the business) and thus pay out fully taxable benefits in the event of disability. However, self-employed doctors generally do not have a business structure (C corp) that allows pre-tax disability benefits.

Do You Pay Taxes on Disability Insurance Benefits?

If the premiums were paid with post-tax dollars (like most policies), the benefits will be tax-free. If the employer provided the policy, the benefits will be taxable as ordinary income. Social Security disability benefits are taxable, although few on them have enough other income to result in any tax being due.

Does Guardian Really Have the Best Policy for Doctors?

Some agents that sell primarily Guardian policies would love you to believe that, but it is not necessarily true. Guardian does have an “enhanced” True Own-Occupation definition of total disability, which it claims is a stronger definition compared to other insurance carriers. The enhanced specialty language for physicians adds extra language that provides additional ways to qualify as totally disabled based on how you earn your income, even if you continue working in your practice or you work in another occupation. Examples where Guardian might pay but other own-occupation policies might not include specialists like Ophthalmology, Urology, OB/GYN, or ENT where a doctor may gain substantial income from non-surgical clinic work. If these specialists cannot operate but can still make most of their income in clinic, the other policies might not pay out. But Guardian would. Other situations include docs doing some side gig work such as blogging, medicolegal work, pharmaceutical work, or directing a medical spa.

Some Guardian policies have other features that may be slightly stronger than those of other carriers. You should still compare them side by side and decide whether those features are worth a potentially higher premium. You almost surely want a specialty-specific, own-occupation policy from one of the “Big 5 (or 6)” providers, but it does not necessarily have to come from Guardian. As one agent told me:

“Guardian's enhanced true own-occupation definition can only help an insured and never hurt an insured. However, if the sole reason that someone is buying Guardian is for their definition, I would say that they should look at how the overall cost and benefits of the policy compares to the others. Short of a unique side gig or surgical specialist with substantial non-surgical income, unless the cost difference was minimal, I would find it difficult to justify the purchase of their policy solely based upon its ‘Enhanced' Medical Specialty definition of total disability.”

Does the Military Provide Physicians with Disability Insurance?

The military does provide some disability benefits to its members. But compared to a good individual disability insurance policy, most physicians would view what the military offers as grossly inadequate. It can be very difficult to get an individual policy while on active duty, although if you have a policy in place prior to going active, it can usually be maintained during active duty. Two companies that offer policies to military members are Mass Mutual and Lloyd’s of London. Bear in mind that a policy will rarely pay benefits as a result of an act of war, but if you are disabled due to medical issues or a non-war related accident, it should still pay out. More information at these links:

- Disability insurance for reservists

- Disability insurance for federally employed civilian physicians

- Disability insurance for military physicians

Should I Get Disability Insurance as a Resident?

Yes. My general recommendation is to buy your coverage as soon as you get out of school (i.e., your first month or two of residency), although it is possible to buy a very small policy even as a medical student. Then, upgrade your policy (either by purchasing an additional policy or exercising a future purchase option rider) upon completing your training. The younger you are, the less expensive and the more valuable the policy is. Waiting until your last year of residency, until you graduate, or until “you can afford it” leaves you uninsured and may cost you more money in the long run anyway. The insurance companies price them by age and medical problems—the younger and healthier, the better. Residents get disabled from time to time, and they often develop conditions during their long years of training that result in them paying more for insurance, having a policy with exclusions, or not being able to buy a policy at all.

Do I Need the Student Loan Disability Insurance?

Insurance companies and their agents are always coming up with new products to sell you. I came across a new one recently from a firm called InsureSTAT. It was offering you disability insurance for your medical school loans. The idea is that if you get disabled, this insurance kicks in and pays off your loans. Except you don't have to use it for your medical school loans. You could use it for anything you want.

Say what?

That's right. The whole student loan disability insurance thing is just marketing. Some policies may even offer a student loan rider on their policies, which would make your student loan payments in addition to paying you a benefit. They only do this for total disability, not partial disability, and there are minimum and maximum payments that might surprise you. In general, I see this as a gimmick rider. Spend the money on just getting a larger base benefit rather than this rider.

What Is the Difference Between GSI, Individual, and Group Disability Coverage?

Individual coverage almost always offers better policy definitions, and coverage continues as long as you pay premiums. However, it’s generally more expensive.

Group insurance is typically inexpensive or even employer-paid. Often there is little to no medical underwriting. However, the coverage may not be “own-occupation,” and rates may increase over time. The employer, rather than the employee, owns the policy, and you may not get to keep the policy if you change jobs.

Guaranteed Standard Issue (GSI) coverage is individual coverage, so GSI includes all the same advantages as traditional individual insurance. If you are healthy with no risky hobbies, you can likely get an individual policy that costs less than a GSI policy, but if you have any health problems at all, a GSI policy may be your best or even only option.

What Is the Elimination Period in Disability Insurance?

The elimination period is the period of time between the onset of the disability and when you start receiving payments. The standard is 90 days, but you can get a period as short as 30 days on a long-term disability policy. Short-term disability policies generally have no elimination period. Keep in mind that your payment often does not come until a month later, so a 90-day period is effectively a 120-day period. As a general rule, you should have an emergency fund to cover the first 90-120 days so you do not have to pay extra to get a shorter elimination period. However, there is not much savings in extending that period from 90 days to 180 days, so we generally recommend the standard 90-day elimination period.

Can You Have Two Short-Term Disability Policies?

As with most things related to insurance, the answer to this question will depend on the exact terms of the short-term disability policies that you purchase, but generally yes, you can collect on multiple short-term disability policies. Having multiple short-term disability policies is referred to as stacking disability insurance.

What Mistakes Do Doctors Make When Buying Disability Insurance?

While most doctors have lots of questions about disability insurance, the answers are generally pretty easy to find—either on the internet or from the independent agent you are buying a policy through. Doctors make lots of mistakes when buying disability insurance, but the biggest mistake by far is not getting insurance at all. Here are some other common mistakes:

#1 Buying a Policy Through a Captive Agent

Captive agents are subsidized and incentivized by insurance companies. In return, agents are obligated to sell products for that insurance company, irrespective of the client’s best interest. An independent agent (broker) better serves their clients’ best interests rather than the insurance companies. There are still conflicts of interest, but they are smaller. Even independent agents may receive higher commissions or other benefits for selling policies from one company over another.

#2 Focusing Too Much on Cost

Many physicians shopping for coverage focus too much on low cost, instead of attaining comprehensive coverage. Removing the Own-Occupation Rider or the Partial/Residual Disability Rider is not worth the cheaper premium, because the conditions to file a claim are so much more limited that they end up paying for coverage they will never qualify for.

#3 Waiting Too Long to Apply

Don't wait until you graduate residency/fellowship to apply in order to save money. Many individual disability carriers offer deep discounts for residents and fellows. These discounts often lock in for any increases in the future. In addition, residents and fellows may be offered coverage without a physical exam or blood testing. As an attending physician, even a small policy can trigger blood, urine, and paramedical examinations.

#4 Waiting Until Something Happens to Buy a Plan

Policies are issued based on medical underwriting. Once you are issued a policy, it cannot be taken away or repriced—even if your health changes. If you wait to buy a policy until you are symptomatic or have been diagnosed with a medical problem, chances are you will end up with one or more exclusions and/or modifications of benefits.

What do you think? What have you learned about disability insurance that everyone ought to know? How have you structured your coverage?

[This updated post was originally published in 2017.]

The White Coat Investor may receive compensation from White Coat Insurance Services, LLC; licensed in all states including MA and DC; CA license #6009217; NY license #1758759 (exp. 6/2027); Registered address: 10610 S. Jordan Gateway, #200 South Jordan, UT 84095. This does not affect the cost or coverage of insurance.