Income protection should be the foundation for any financial plan. It should be the first thing addressed and taken care of on any working individual's list, whether you work as a physician or in another vocation. For physicians and medical professionals in federal and state government roles, ensuring financial security in the event of disability is key. Injuries and/or illnesses or other unforeseen circumstances can disrupt one's ability to work, potentially jeopardizing income streams and financial stability. In such instances, having robust disability insurance isn't just a luxury. It's a necessity.

It’s the old adage of, “One can’t afford not to have this coverage,” that comes to mind as it relates to disability insurance. This is the financial parachute allowing for a safer impact when disability occurs, and it ensures peace of mind for professionals and their families.

Within the scope of government employment, two retirement systems are key factors in providing disability benefits: the Federal Employees Retirement System (FERS) and the Public Employees Retirement Benefits (PERS). Established to support federal and public sector employees, these programs offer essential benefits to help workers cope with disabilities that may impede their ability to work. Understanding the workings of FERS and PERS and their eligibility requirements, benefits, and limitations is crucial for medical professionals. It's better to know the ins and outs before a disability occurs in case more income protection is needed (and it almost always is).

History of FERS and PERS

Before we get into the workings of the programs, let’s delve into the history. First, the Federal Employees Retirement System (FERS) traces its origins to the passage of the Federal Employees Retirement System Act of 1986, which took effect on January 1, 1987. FERS aimed to modernize federal employee retirement benefits, integrating elements of the Social Security system with a defined benefit pension plan and a tax-advantaged Thrift Savings Plan.

Similarly, Public Employees Retirement Benefits (PERS) vary across states and localities, but they generally serve as defined benefit retirement plans for public sector employees, including medical professionals working within state and municipal governments. Both of these programs are designed to provide retirement income, survivor benefits, and disability benefits to eligible public employees, offering financial security during retirement or in the event of disability or death. While the specifics of PERS may vary from state to state, the overall goal remains consistent: to support public employees through their careers and into retirement.

More information here:

A Personal Look at Disability Insurance

How Physicians Are Affected When a Government Shutdown Is Looming

FERS Disability Eligibility Requirements

To qualify for disability benefits under FERS, federal employees must meet specific eligibility criteria. Federal employees with at least 18 months of service who can no longer perform their duties at any age are eligible. In addition, the following conditions are required:

- You must have become disabled while employed in a position subject to FERS, because of a disease or injury, for useful and efficient service in your current position.

- The disability must be expected to last at least one year.

- Your agency must certify that it is unable to accommodate your disabling medical condition in your present position and that it has considered you for any vacant position in the same agency at the same grade/pay level, within the same commuting area, for which you are qualified for reassignment.

PERS Disability Eligibility Requirements Vary by State and Locality

I live in Utah, and the list is quite extensive to qualify for state disability benefits. For physicians working for other state and local governments, the rules could be different. Here are a few of the Utah requirements:

- Employees qualifying for disability due to a work-related physical objective medical impairment may receive a monthly benefit equal to 100% of their regular salary, reduced by required reimbursements.

- Successive periods of disability are considered continuous if resulting from the same or related causes and separated by less than six months of continuous full-time work.

- The office reserves the right to have any claiming employee examined by a physician selected by the office to assess total disability.

- An employee's ongoing disability is assessed either during or after the pilot period based on physical or mental objective medical impairments.

- Other requirements are found here.

How FERS Benefits Are Calculated

For Those Under Age 62 and Not Eligible for Voluntary Retirement

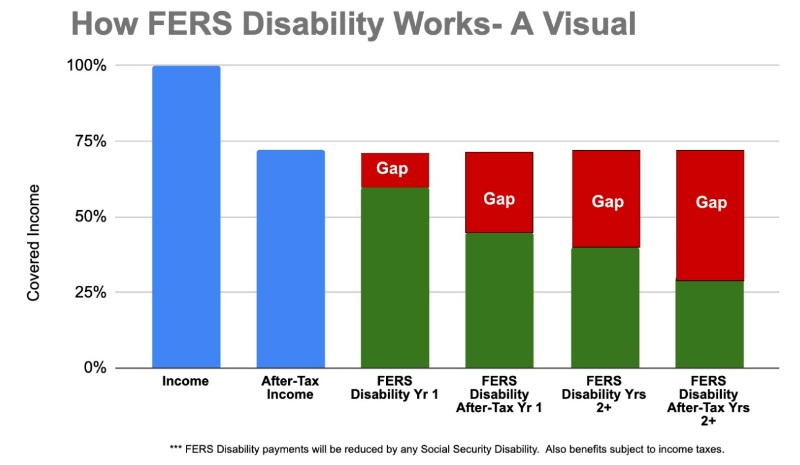

- For the first 12 months of disability, you receive 60% of the highest three-year average salary; subtract 100% of the Social Security disability received.

- For Month 13 and beyond of disability, the benefit is reduced to 40% of the highest three-year average salary; subtract 60% of the Social Security disability benefits received.

As a Federal Physician Employee, Can You Live on Half of Your Income (or Less)?

From a visual perspective, the after-tax benefit of FERS could drop a beneficiary's income to less than half of their salary. There are significant income gaps when a federal employee is faced with an injury or sickness preventing them from working and they start receiving benefits for a long period of time through FERS.

With FERS, a disability benefit would leave protection gaps. This would be something to consider when looking into purchasing supplemental income protection as a federal employee.

For Those Age 62 or Older, or Eligible for Voluntary Retirement

- One percent of your highest three-year average salary multiplied by years and months of service

- If 20+ years of service at age 62, it’s 1.1% of your highest three-year average salary multiplied by years and months of service

Here's how the highest three-year average salary is defined:

- Average of highest basic pay over any three consecutive years of service

- Usually the final three years, but it can be an earlier period

- Includes salary increases subject to retirement deductions (e.g., shift rates)

- Excludes overtime, bonuses, etc.

Other FERS Benefits to Know About

The FERS survivor benefit provides financial support to the spouses and children of deceased federal employees and retirees. A surviving spouse can receive a Basic Employee Death Benefit and a monthly annuity if the employee had at least 18 months of service. Children may also receive benefits until age 18 (or 22 if they’re full-time students) and indefinitely if they’re disabled before age 18.

How PERS Benefits Are Calculated

It depends on the state.

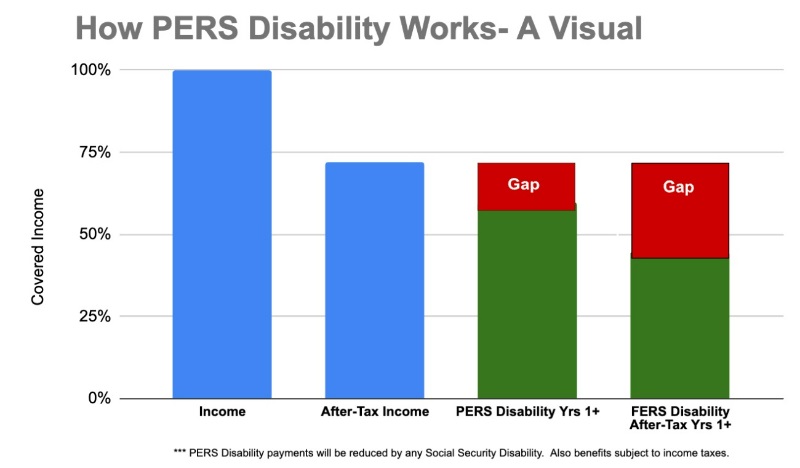

PERS benefits can vary significantly from state to state, but typically, disability coverage is 60% of an employee's income. There are differences in factors, such as final average salary calculations, service requirements, and benefit calculations. Each state’s PERS is tailored to its laws and regulations, which can affect everything from vesting periods to retirement age.

Some states may offer defined benefit plans, while others provide defined contribution plans. The pension replacement rate, or the percentage of a worker’s pre-retirement income that the pension replaces, also differs across states and within different tiers of state retirement systems.

FERS and PERS Physicians Covering ‘The Gap'

Here’s what to look for when trying to cover that income gap if you have to use FERS or PERS.

For FERS, the Big Five insurance carriers typically assume that the program will cover 40% of the employee’s income. This means if an employee earns a certain amount, the FERS disability benefit would provide them with 40% of that income during their period of disability. The maximum amount that can be provided as a benefit to cover the gap this creates, however, is capped by all insurance carriers. Guardian Life and Ameritas set it at $10,000-$12,000, while Principal and The Standard offer up to $15,000. MassMutual did not offer its cap, as of this writing.

Similarly, for PERS—which includes state, local, and municipal employees—the carriers generally assume a disability coverage of 60% of the employee’s income. Again, there is a cap on the maximum benefit amount, which varies among the five carriers but can go up to $15,000.

One thing worth highlighting is that MassMutual offers a government employee discount of up to 25%. For anyone in a federal, state, or municipal role, that’s a meaningful savings.

It is important to note that these percentages represent the portion of the employee’s income that would be replaced by the disability benefit. The actual amount an individual would receive depends on their salary and the specific terms of their insurance policy.

More information here:

What You Need to Know About the Thrift Savings Plan (TSP)

The Bottom Line

While FERS and PERS provide a foundational layer of disability coverage for those in public service, purchasing an individual disability insurance policy is something that should be considered. Such a policy not only offers enhanced financial protection and peace of mind but also ensures continuity of coverage should one transition to the private sector. It affords policyholder control, customization, and a safeguard against any changes to government benefits.

For physicians and medical professionals whose livelihoods depend on their specialized skills, this additional coverage is not just a safety net—it’s an investment in their future, securing the lifestyle and education they’ve worked hard to achieve and offering a layer of ironclad support when faced with life’s ups and downs. As you navigate these important decisions, remember that the right coverage is key to maintaining both your financial health and professional well-being.

What was your experience with disability insurance as a federal or state employee? Did you have to supplement it with an individual policy? Did you ever have to use it?

The White Coat Investor may receive compensation from White Coat Insurance Services, LLC; licensed in all states including MA and DC; CA license #6009217; NY license #1758759 (exp. 6/2027); Registered address: 10610 S. Jordan Gateway, #200 South Jordan, UT 84095. This does not affect the cost or coverage of insurance.