By Dr. Jim Dahle, WCI Founder

By Dr. Jim Dahle, WCI FounderAfter creating a post on Financial Waterfalls for Residents and New Attendings, we received a lot of requests for a waterfall for older docs, particularly pre-retirees and retirees. It turns out that people want to be told exactly what to do—they love step-by-step instructions. While there are many similarities from one financial plan to another, every financial plan is unique. The standardization that is commonly seen in the financial plans of early-career doctors gradually dissipates throughout the career.

By the time a doctor is approaching retirement, there is little standardization left. For example, a doctor with a $500,000 portfolio at 60 is likely to have a dramatically different financial plan than one with $15 million.

What Does a Waterfall Look Like?

The concept of a waterfall is very useful for someone in the accumulation phase, particularly at that stage of life when they have more great uses for cash than they have cash. It helps them to prioritize their uses for cash. As each “pool” is filled, it spills over into the next highest priority pool. When they run out of money, they stop. For example, a waterfall might look like this:

- Get 403(b) match

- Pay off consumer debt

- Health Savings Account

- Roth IRA(s)

- 403(b)

- 457(b)

- Pay extra on student loans

- Invest in taxable

A waterfall usually ends with investing in taxable, since there is no limit to how much can be invested there.

A Waterfall for Retirees?

When it comes to pre-retirees, this process breaks down quite a bit. I mean, it's possible that an investor doesn't even need to put anything toward retirement anymore. Maybe their savings are going straight into a Donor Advised Fund (DAF). An investing waterfall is nonsensical for a retiree with no earned income who may not be saving at all.

However, just because your financial life is now more complicated than that of a new residency graduate, that doesn't mean that we can't help you. I just don't think the right concept for this stage of life is a waterfall. A much more helpful concept is a simple checklist. So, the remainder of this post will explore a checklist that should take you from nearly retired well into retirement.

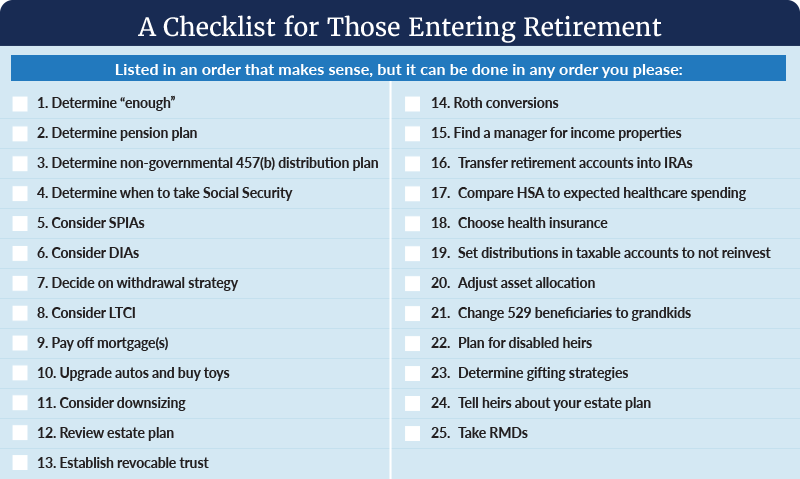

A Checklist for Those Entering Retirement

As you approach retirement, I suggest you go through this list. There are a few assumptions I'm making here. I assume you've paid off your student loans and consumer debt. I assume you actually saved something for retirement. I assume you have a budget and a written investing plan. If none of this is true, you have a longer checklist because you'll need to include a bunch of items that, frankly, you should have done years ago.

Note that this list is in a specific order that makes sense to me, but you can do most of this in any order you please. If an item doesn't apply to you, just check it off and move on. Some items are cheap, quick, and easy. Others will require time, money, thought, and difficult conversations with your loved ones and professionals. Without further ado, here is the list:

Whew! Long list, huh? Now that you've seen the whole list, let's go through each item individually.

#1 Determine “Enough”

The 4% rule isn't very useful as a withdrawal strategy, but it's quite handy in giving you a general idea of how much you need in retirement. If you reverse-engineer it, you will see that your nest egg needs to be something like 25 times as large as what you spend each year. If you have guaranteed (or even less than guaranteed) income in retirement, you can subtract that from your spending needs before multiplying by 25. Less than guaranteed income should be discounted. I suggest a 25% discount for investment property income. Your formula looks like this:

Needed Nest Egg = (Annual Spending – Guaranteed Income – 75% * Non-Guaranteed Income) * 25

Note that if you are using investment property income in this formula, you should NOT include the value of that property in your nest egg.

More information here:

6 Tips for Those Who Have Enough

#2 Determine Pension Plan

Are you eligible for a pension? Does it give you options such as:

- Taking a lump sum

- Monthly payments until you die

- Monthly payments until you and your spouse die

If so, you'll need to choose what to do with it.

#3 Determine Non-Governmental 457(b) Plan

Governmental 457(b)s can be transferred into IRAs, but non-governmental 457(b)s cannot. You will need to choose from the various distribution options available to you. As a general rule, this is money that should be spent relatively early in retirement.

#4 Determine When to Take Social Security

The right answer most of the time for healthy people and for the higher earner in a couple is to delay Social Security as long as possible, currently to age 70. But there are plenty of exceptions. Consider reading Mike Piper's excellent Social Security Made Simple.

#5 Consider SPIAs

Purchasing a Single Premium Immediate Annuity (SPIA) can be a great way to maximize how much of a nest egg can be safely spent. In essence, you are buying a pension from an insurance company. While not as good a deal as delaying Social Security, this still has a place for those who don't quite have “enough” as they move into retirement.

More information here:

Functional Longevity: What Use Is Retirement If You Can’t Move and Think?

#6 Consider DIAs

A Delayed Income Annuity is “longevity insurance.” It's a fixed-income annuity like a SPIA, but instead of starting payments immediately, your payments may not start for a decade or more. The benefit is that the payments are dramatically higher but only if you live long enough. Like other insurance products (SPIA, permanent life insurance), this can give you psychological “permission to spend” your nest egg because you know that you have something backing you up so you won't be eating Alpo late in retirement.

#7 Decide on Withdrawal Strategy

Now that we've talked about all of your income sources, we're left with your nest egg. Some sort of variable withdrawal strategy (such as the ever-popular “Start at something like 4% and adjust as you go”) is best.

#8 Consider LTCI

Single people and those with small amounts of assets who face a serious long-term care situation can just spend down until they qualify for Medicaid. Married people with a moderately sized nest egg ($300,000-$2 million?) should consider purchasing Long Term Care Insurance (LTCI). Wealthy people can afford to self-insure this risk. If five years in a nursing home costs less than ¼ of your nest egg, you're probably fine self-insuring, but run the numbers for yourself. Don't forget that if you or your spouse is in a nursing home or getting care in your own home, you're probably not out traveling the world so there will be some offset of that LTC expense.

#9 Pay Off Mortgages

Lowering the ratio of fixed expenses to variable expenses adds flexibility to any retirement plan, and one of the best ways to do that is to pay off any debt. Hopefully, the only debt left to be paid off as you approach retirement is a mortgage. Paying off investment property mortgages also improves your cash flow from that property. If paying off a mortgage isn't at least an option, you may not be ready to voluntarily retire.

#10 Upgrade Autos and Buy Toys

I also think it is a good idea to go into retirement without an expectation of major purchases in the next few years, such as autos, boats, airplanes, second homes, ATVs, and more. Buy that stuff before you retire so you don't end up with unexpected purchase or maintenance costs. Pay cash for them. That way if something happens to you financially, that item becomes an asset that you can sell for extra cash rather than a liability requiring a payment every month.

#11 Consider Downsizing

Another way to go from “not enough” to “enough” is to move into a less expensive house in the same area or a cheaper area. At the extremes, this could mean moving to a cheaper country. You take the difference between your current house and your future house and add it to your nest egg.

More information here:

A New Way of Doing Business (and Saving Tons of Money) in My Retirement

#12 Review Estate Plan

Assuming you have an estate plan (you should have had one years ago), it would be a good idea to review it. Now that your children are adults, it probably needs some changes. Look at the will, financial and healthcare power of attorneys, beneficiary designations, living will, and titling of assets. The focus now is much more on where your money and stuff will go when you die than on who will raise your kids. If you are fortunate enough to have an estate tax problem, the sooner you address it the better.

#13 Establish a Revocable Trust

Most WCIers will want a revocable (living) trust in place at death to avoid probate.

#14 Roth Conversions

Many retirees, especially early retirees, and their heirs will benefit from some amount of Roth conversions, particularly when done in the years between an early retirement and taking Social Security. Put a plan in place for how much to convert and when.

#15 Find a Manager for Income Properties

If you are still managing your own short-term and long-term rentals, consider hiring a manager. You will need one eventually if you plan to hold these properties until death for the step up in basis. While lots of retirees still manage their own properties well into their retirement, hiring a manager will make it much easier to do the travel common in the go-go years. If you do not hire a manager, be sure to subtract that cost before calculating the expected income from the properties when determining if you have “enough.”

#16 Transfer Retirement Accounts into IRAs

It generally makes sense to consolidate retirement accounts (including defined benefit/cash balance plans and governmental 457(b)s) as much as possible to minimize costs, decrease hassle, and maximize investment choices. That typically means a traditional and a Roth IRA for each spouse for a total of four accounts plus a Health Savings Account.

There are only three reasons to have more accounts. The first is to avoid the pro-rata rule that occurs when doing a Backdoor Roth IRA each year. The second is for additional asset protection as some states provide more protection for ERISA accounts like 401(k)s than IRAs. Finally, some employer-provided retirement accounts offer “special” investments such as the TSP G Fund that you may wish to continue using. As you move into retirement, you presumably will no longer be making IRA contributions. For most high-income professionals, liability concerns also decrease. The benefits of simplicity may also trump those of “special” investments for you. Note that in some states a “rollover IRA” may preserve those ERISA protections in a bankruptcy situation.

#17 Compare Health Savings Account to Expected Healthcare Spending

Health Savings Accounts (HSAs) make for lousy inheritances, as they are fully taxable to heirs in the year of death. Thus, an HSA should be spent prior to death or left to charity. If you are not planning on leaving that much to charity and you do not expect to spend it all on healthcare (still its best use since that provides the classic “triple-tax-free” benefit), then you can use it as a Stealth IRA after age 65, paying taxes but not penalties on withdrawals.

More information here:

Healthcare in Retirement Could Cost You $500,000; Here’s How to Plan for It

#18 Choose Health Insurance

There are lots of different options for health insurance for retirees including

- Medicare (note that Medicare is not free)

- COBRAing your previous employer's plan

- PPACA exchange plan

- Health sharing ministry

- Buying health insurance on the open market

- Veterans Administration benefits

- Benefits provided by your employer as part of your retirement package

Be sure to decide the best plan for you and budget adequately for it. While paying for healthcare in retirement is no different than paying for groceries, many former employees get sticker shock when they realize how much their employers have been paying for their health insurance all these years. It is not unusual for a plan for an early retiree couple to cost $10,000-$30,000 a year. If you don't have enough money to cover that cost, you may not have enough to retire yet. Going bare isn't wise for a 25-year-old. It's downright stupid for a 55-year-old.

#19 Set Distributions in Taxable Account to Not Reinvest

We never have our mutual fund dividends and LTCG distributions reinvested in our taxable investing account. This becomes more important for a retiree as those are the first funds that should be spent each year since you're paying taxes on them anyway. You may even want them to be automatically paid into your checking account instead of your settlement fund.

#20 Adjust Asset Allocation

Most retirees have a less aggressive asset allocation than they did as accumulators. Asset allocation is very personal, but if you have not been decreasing your stock/bond ratio as you go along, consider making an adjustment now. You want to balance the concept of “When you've won the game, stop playing” with ensuring you still have enough risky assets in the portfolio to allow it to keep up with inflation. The rule of thumb is

Stock Percentage = 100 – Your Age

but lots of people adjust that to as high as

Stock Percentage = 120 – Your Age

That would suggest a stock-to-bond ratio of somewhere 30/70 and 65/35 for retirees. This is particularly important in the last few working years and the first few retiree years since that is when the Sequence Of Returns Risk (SORR) is highest.

More information here:

The Buckets Strategy for Retirement

#21 Change 529 Plan Beneficiaries to Grandkids

Still have leftover 529 money from the education of your children? Change those beneficiaries to the grandkids. You might also consider using some of that money (up to $35,000) to do the new 529 to Roth IRA rollovers.

#22 Plan for Disabled Heirs

If any of your children are disabled, you may need to make special plans for them. This might include determining who will take care of them and their assets. Will they need to be institutionalized when you can no longer provide the care needed? Will they need a bigger chunk of the inheritance than other heirs? Consider the use of ABLE accounts, trusts, and permanent life insurance.

#23 Determine Gifting Strategies

What are your charitable desires? How much will go to heirs? How much will you give with “warm hands” vs. “cold hands”? Consider the use of Donor Advised Funds (DAFs), charitable foundations, charitable annuities, and charitable trusts. Remember that Qualified Charitable Distributions (QCDs) are one of the best ways for older retirees to give to charity.

#24 Tell Heirs About Estate Plan

I think this is a really important step. It doesn't necessarily have to be done right as you retire, but it should be done long before you lose the capacity to manage your own affairs. If you're taking Required Minimum Distributions (RMDs), it's time that this should be done. Call a family meeting and tell all of your children and other important people what your estate plan is. Opening a will should not be a surprise to anyone. Surprise wills are a great way to cause conflict and resentment. If someone is told by grandpa in front of the rest of the family that they aren't getting an inheritance (or that their older brother is going to be the trustee for their inheritance) because they have a cocaine problem, they are far less likely to contest the will and create drama later.

It's your money and you can do whatever you want with it, but it's a good idea to keep it simple and communicate it well before death and in the actual documents.

More information here:

Is Now a Good Time to Retire? Here’s What Christine Benz Thinks

#25 Take Required Minimum Distributions

One of the worst penalties in the tax code is the failure to take Required Minimum Distributions (RMDs) each year. It used to be 50% of the amount you were supposed to withdraw, but the Secure Act 2.0 reduced that to 25%. It's still a massive penalty. Don't forget the age at which you have to take them currently is 73, but by 2033, it will be the year you turn 75.

There might not be a “waterfall” for pre-retirees and retirees, but there is a checklist you should work your way through. By the way, there is a bit of a waterfall for how to spend your money that varies by your estate plan, but that is the subject of a different post.

Are you saving enough for retirement? Get a personalized answer with this FREE retirement calculator powered by Boldin, formerly known as NewRetirement. Find out how much YOU need, get a “chance of success score,” suggestions to do better, and more.

What do you think? What else should be on this checklist? What shouldn't be there?