Now that the giant stage and video screens in Orlando have been disassembled, all the WCI merch has been placed on pallets and shipped back to Salt Lake City, and everything else from the Physician Wellness and Financial Literacy Conference (WCICON24) has been returned to storage until 2025, let’s reminisce about our favorite moments and highlights from this year’s conference, the fifth one The White Coat Investor has put on in-person.

It was my third time attending WCICON, and yet again, it was enormously meaningful to be around so many smart and motivated people who help inspire us to live our rich lives. Keynote speakers Paula Pant and Tarryn MacCarthy were fantastic, and the camaraderie among the attendees and the positive vibe we felt all of last week left us hungering for next year’s conference.

If you haven’t been before (or if you’ve only attended virtually), make plans to come in person on February 26-March 1, 2025, when we’ll make our Texas debut at the Hyatt Regency Hill Country Resort and Spa in San Antonio. I made a bunch of new friends at WCICON24, rekindled a bunch of other relationships from previous conferences, gave plenty of handshakes and hugs, and had a blast overall. Like usual, just about everybody seemed really happy to be at WCICON.

My Favorite Moments from WCICON24

Here were some of my favorite scenes from the week.

Back to the (Index Fund) Basics

While many of the talks at WCICON24 focused on physician wellness, Dr. Jim Dahle kicked off the conference on Tuesday morning with some of the basics of finance: why he loves investing in index funds.

We’ve written plenty about index funds in the past—about why Jim puts his money there and about why you should use passively managed funds—so why was this keynote needed?

Because, as Jim pointed out, index funds control only about 15%-40% of the market. Is that surprising to you? The Atlantic estimated it’s more like 20%-30%. And while Kiplinger says that index funds grew from 19% of the total fund market to 40% between 2010-2020, the majority of people are not using index funds in their portfolios (interestingly, Morningstar reported this week that, as of January 2024, funds that are passively managed now control more assets than those that are actively managed).

According to Jim, all of this means that the majority of people are making a big mistake with their portfolios.

“What in the world; this data has been out here for 30 years,” he exclaimed. “We’re still doing it wrong. Come on! Read a book, read an article. It’s not that complicated.”

How much does Jim love index funds? How passionate is he about them? Eighty-five percent of his portfolio is in index funds.

“That’s a pretty rousing endorsement,” he said.

Some more data: over 20 years, index funds beat actively managed funds 9 out of 10 times, 19 out of 20 times, and 49 out of 50 times. Look at the right side of the graphic below that Jim used in his talk. Those are the 15- and 20-year performances of the index funds and the percentages of how often they beat actively managed funds.

Even if you want to take a chance on an active fund, most of them don’t last more than 20 years. Depending on the fund, anywhere from 22%-46% survive more than two decades.

“You want to gamble on choosing the actively managed fund that’s going to beat the index?” he asked. “That seems like a stupid thing to do. Don’t do that. Just buy the index fund. It works really well.”

The math is simple. If you just match the market return, you will outperform most investors. That’s because actively managed funds ARE the market. With the fees and costs that actively managed funds pass on to the investor, it’s nearly impossible to outperform the market over the long term if you’re in one of those actively managed funds.

Other reasons to use index funds?

- Time efficiency: Jim’s monthly investing chores can be done in less than 5 minutes. He also manages his parents' portfolio, and in a full year, he spends less than an hour on that chore.

- He doesn’t need to monitor his investments when he’s off the grid: When he’s stuck inside the Grand Canyon for three weeks with barely any communication to the outside world, he doesn’t need to worry about actively managing his index funds.

- It’s the most passive of all passive income.

- There’s no fraud: “Yeah, there’s the occasional Enron or WorldCom out there, but you own 11,000 other stocks,” Jim said. “It’s not going to affect you . . . Vanguard is not going to get taken by a fraudster.”

- There’s no manager risk: You don’t have to worry about an incompetent manager when you’re in index funds. The computers that are running your index funds don’t suck at tracking the market, they don’t retire, and they don’t die unexpectedly.

In essence, Jim boiled it down this way:

“The index funds are clobbering the actively managed funds. If you have a portfolio of actively managed funds, you’re screwing up.”

Paula Cutting a Rug

Three of my favorite moments of Paula Pant’s keynote address on “Retire or Just Tired?: How to Re-Engage and Re-Motivate When Burned Out” came when, after attendees were encouraged to talk amongst themselves, she called their attention back to her presentation on the main stage. And she did that by dancing for extended solos on three separate occasions: once to Taylor Swift’s “Shake It Off,” once to Whitney Houston’s “I Wanna Dance with Somebody,” and once to Fitz and the Tantrum’s “HandClap.”

Here are some still photo examples:

We’ll write more about her keynote talk in a couple weeks, but it seemed to me that dancing in front of hundreds of people at a financial conference took plenty of intestinal fortitude. The next day, I asked her how she had the guts to do that.

She said she learned from an influencer named Vanessa Van Edwards that whenever somebody feels good, their physical being grows bigger, like when a runner crosses the finish line of a race and spreads their arms wide like a bird. When people feel low, though, they tend to shrivel within themselves.

“When I was thinking about stage presence, I thought, ‘OK, I need to look like I’m landing an airplane. Make yourself big, because that signals confidence,’” she said. “What the audience wants to see is a presenter who’s confident. It’s going to make the audience uncomfortable if they think the presenter is uncomfortable. Most people are empathetic, and they want to see you radiating confidence, because that’s going to make them more comfortable.”

But how can you be comfortable dancing like no one is watching when hundreds of eyes are actually watching?

“Just let go of the idea of being good and just move in whatever way the music makes you feel,” she said. “I’ve got people breaking to talk to their neighbor, and the purpose of the musical in-cue is to get them to turn their attention back to the stage. What can I do to get their attention? I just dance, and that’s going to grab their attention.”

Even the next day, people couldn’t avoid Paula’s charisma. One attendee told her that she had a girl crush on Paula, and a few minutes later, another woman said she wanted to be Paula’s best friend.

The Candy Crush

It was a great idea in theory. During Margaret Curtis’ talk on “Advanced Topics in Physician Contracts,” she moved people into the first few rows of the ballroom and had them pass around bags of candy. Once they accumulated all of the Reese’s Peanut Butter Cups, Kit Kats, Starbursts, and Jolly Rancher lollipops, Margaret had them trade pieces with each other to try to get their ideal asset allocation of candy.

The raisins were supposed to be the poison pill that would thwart the quest for the perfect collection of candy. So, when she asked attendees if anybody had gotten the perfect assortment of treats (and she would tie it back to the idea that there’s no such thing as a universal “best contract” you could sign), some people said yes—even though they had the box of raisins in their pile.

It’s because, unbeknownst to Margaret, some people actually wanted to eat the raisins.

“I’m stunned,” she said during the talk (she later told me that she hadn’t been expecting a curveball like that). “I thought people were going to be throwing those raisins. This is an interesting crowd.”

A crowd that apparently likes their fruit dried and wrinkly.

Our First Foray into Florida

Sadly, for the second year in a row, we had to move the opening cocktail reception indoors because of the threat of inclement weather. It was cold and rainy at WCICON23 in Phoenix, and the first evening of WCICON24 in Orlando was also supposed to be a wet one. A few days before the conference began, the executive decision was made: thanks to a less-than-ideal forecast, the outdoor reception scheduled at one of the Rosen Shingle Creek Resort’s pools had to be moved indoors (there were murmurings among WCI staff that, if the originally scheduled opening reception would have occurred outdoors, the company’s founder might have taken an unscheduled (and probably unwanted) dip into the pool).

But the bad weather never showed up, and moving it indoors was all for naught. Oh well, at least the lo mein and pork buns served during the reception were delicious (and Jim got to stay dry).

It was also interesting that I ran into more attendees from California than I remember seeing at previous conferences. Even though WCICON traveled to the East Coast for the first time, I met a stretch of people during conference check-in that went: Los Angeles, Los Angeles, San Francisco, San Diego, California, and Idaho. We also welcomed new attendees from Texas and North Carolina and old friends from Ohio, New York, and Virginia. Naturally, I also met a number of doctors from Florida who were attending the conference for the first time.

I suppose it doesn’t matter too terribly much where WCICON lands. People from both coasts and the middle of the country enjoy this community so much that they’re willing to travel thousands of miles to be with us.

Need proof? Look at how much fun people were having.

Is Lorelai Gilmore Actually a Crappy Mom?

Lorelai Gilmore might be considered a good parent. But acting as your child’s best friend, which is basically what she does with her daughter Rory in the popular early 2000s TV show Gilmore Girls, is a sketchy idea. As WCI columnist Julie Alonso spoke about in her “Principles of Positive Parenting” talk, Lorelai might not have the optimal approach to parenting.

It’s called permissive parenting, where you and your child are basically best friends. According to Julie, this can be a harmful strategy.

“You don’t want to be your child’s best friend,” she said. “It’s OK to have some features of this, but this type has very few rules, very few boundaries, and doesn’t set the good scaffolding framework they need.”

Actually, the teenaged Rory oftentimes is the more responsible figure in their relationship and sometimes acts as Lorelai’s parental figure.

“That,” Julie said, “is not what you want.”

Hey, Lorelai is fun and cool, and she has solid taste in music. Yes, sometimes, she’s cringey and tries too hard to be the cool mom. But Julie points out that you want to be an authoritative parent with a balance of structure, limits, boundaries, understanding, and flexibility. You want a secure attachment.

You don’t necessarily want to be Lorelai Gilmore.

WCI Columnists Take the Stage

For the second year in a row, we conducted a panel with the WCI columnists who were in attendance. Like WCICON23, Margaret Curtis, Tyler Scott, Jim, and I sat on the panel and tried to impart our wisdom and humor. We also welcomed Julie Alonso and Anthony Ellis to the dais for the first time to take part in the fun.

Here we were only a few minutes before WCI Conference Director Chrislyn Woolston, who did a fabulous job as the WCICON24 host, welcomed us onto the stage in front of a packed ballroom.

Margaret Curtis, Anthony Ellis, Jim Dahle, Tyler Scott, Julie Alonso, and Josh Katzowitz just before they took the stage at WCICON.

This Is What Financial Minimalism Looks Like

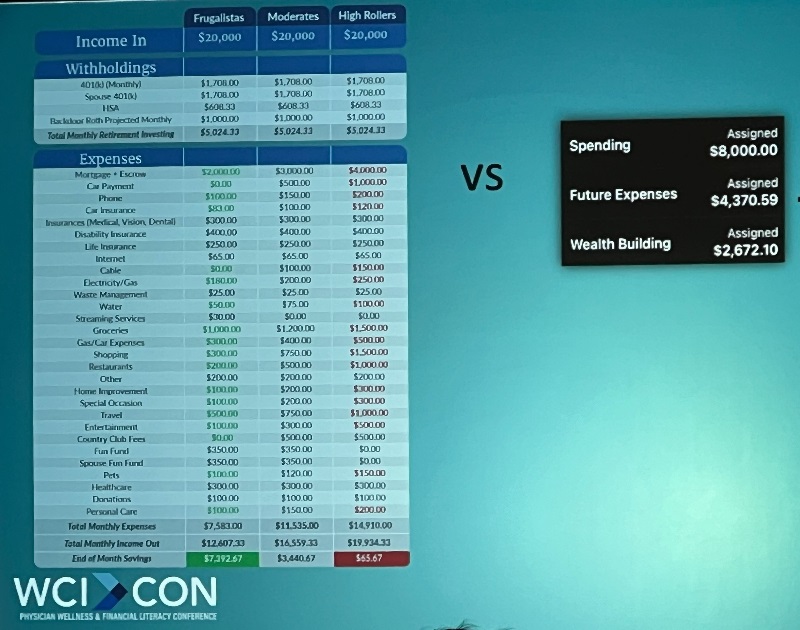

During his talk on “Financial Minimalism: Simplify Your Financial Plan and Declutter Your Mind,” Dr. Jake Zadra clicked on a slide comparing what a budget previously published on WCI looks like vs. what his financial monthly output looks like.

They couldn’t be more different (click on the photo to enlarge it).

If you’re just getting started with a written financial plan and trying to figure out what money is coming in and what cash is flowing out, Jake said, the budget on the left side of the slide is probably appropriate. But if you want to be a minimalist (which means you’ll simplify your goals, automate your investing plans and payments, and declutter your finances and your life), eventually you can boil it down like he does—with the image on the right.

“You don’t need to be Dale Earnhardt to drive yourself to work,” Jake said. “You don’t need to be the Iron Chef to make toast.”

Face of the Week

Man, Jim loves his T-shirt cannon. And in the photo below, I’ve never seen him look happier.

The photo is courtesy of Joel Remke, and it occurred only seconds before Jim shot a T-shirt into the ceiling and actually dislodged a metal beam that clattered to the ground before one of his keynote presentations. At press time, it was unclear who would pay the damages on that.

What were your favorite moments from WCICON24? Are you considering attending WCICON25 in San Antonio?