Two of the most common options people hear about when investing are mutual funds and index funds. While all index funds are mutual funds, not all mutual funds are index funds. Understanding the distinction between actively managed mutual funds and passively managed index funds is important because it directly affects fees, taxes, and long-term performance.

What Are Mutual Funds?

A mutual fund is a type of investment where investors pool their money to buy assets. Often, mutual funds purchase primarily stocks, but there are mutual funds for other assets, including bonds and other securities. Every investor who puts money into a mutual fund owns a portion of the fund, with dividends and other gains being distributed proportionally.

Many mutual funds are designed to target a specific sector (like technology, healthcare, or energy) or a specialized corner of the market (such as small cap growth stocks or emerging markets). However, some mutual funds are more generic. Mutual funds are also usually actively managed, meaning a professional manager is making decisions about which securities to buy and sell. These actively managed mutual funds often have a higher cost (or expense ratio) than other investments.

What Are Index Funds?

Index funds are a subset of mutual funds, where the fund is set up to broadly track a particular index. One of the most common types of index funds is an S&P 500 index, a fund such as VOO. One of the biggest differences between index funds and other types of mutual funds is that index funds are generally passively managed, whereas other mutual funds are actively managed.

A passively managed fund doesn't have to pay a fund manager (or team of fund managers), which helps keep the expenses down and the returns up. Studies have shown that most actively managed funds underperform the market over time, which is why passive investing into index funds has become quite a popular form of investing.

More information here:

How Do You Evaluate and Compare Mutual Funds and Exchange Traded Funds?

Best Investment Portfolios — 150+ Portfolios Better Than Yours

Costs, Fees, and Expense Ratios

As we mentioned, one of the biggest differences between index funds and their actively managed counterparts is the fees that are charged. It's important to understand how fees are charged on most mutual funds. Instead of paying a fee up front, the fees are subtracted from any returns that would be paid to investors. Over a long period of time, these fees can really add up, especially when you consider the magic of compound interest.

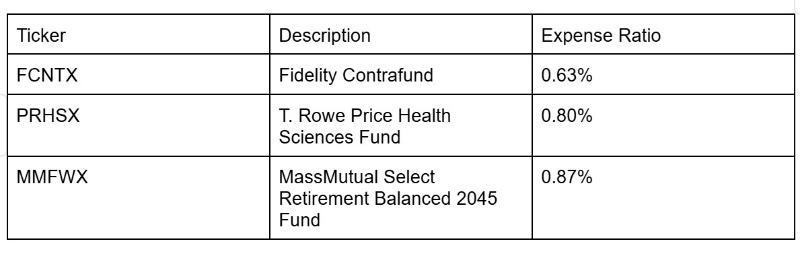

Here's a look at a few actively managed funds and their expense ratios.

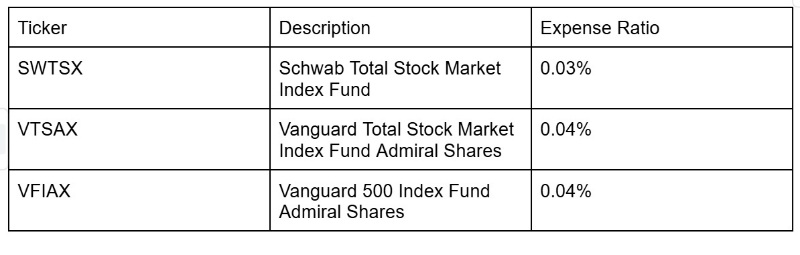

Now, compare that to a selection of passively managed index funds

An actively managed fund would not only have to overperform the market, but it would have to do so by 0.5%-1% to overcome the additional fees that are charged. This is one of the main reasons investing in index funds has become so popular.

Tax Efficiency and Turnover

Another way to compare mutual funds is through their tax efficiency. Buying and selling stocks can lead to short-term or long-term capital gains, which can lead to additional tax consequences for investors in the funds. Because actively managed funds typically buy and sell more frequently than passively managed index funds, you are more likely to accrue capital gains (and therefore have to pay capital gains tax). One consideration to keep in mind, though, is if you hold the fund in a tax-advantaged account (such as an IRA), this is less important to consider.

Performance Over Time and Manager Risk

We have opined before on the site that managers don't beat markets, and studies have shown that a very high percentage of actively managed funds underperform their benchmarks. S&P Dow Jones Indices produces a SPIVA report (S&P Indices Vs. Active) semiannually, and the latest SPIVA report from 2024 showed that 65% of all active large cap US equity funds underperformed the S&P 500.

Underperformance is worse when you stretch the time period to three, five, 10, or more years. Another thing to keep in mind is that even if you have a fund that outperforms its benchmark, there is always a risk that a manager will underperform, lose their edge, change strategy, or do something else that causes underperformance.

More information here:

5 Steps to Help You Choose the Right Mutual Funds

The Bottom Line

Mutual funds and index funds share some similarities, but the differences in costs, management style, and long-term results can have a big impact on your returns. Actively managed funds often come with higher fees and added risk. Index funds, on the other hand, offer low costs and broad market exposure that have historically outperformed most managers over time. Knowing these tradeoffs makes it easier to choose the option that is best for you.

The White Coat Investor is filled with posts like this, whether it’s increasing your financial literacy, showing you the best strategies on your path to financial success, or discussing the topic of mental wellness. To discover just how much The White Coat Investor can help you in your financial journey, start here to read some of our most popular posts and to see everything else WCI has to offer. And make sure to sign up for our newsletters to keep up with our newest content.