By Dr. Jim Dahle, WCI Founder

By Dr. Jim Dahle, WCI FounderThis post will be a bit of a “back to basics” post. I've written about mutual funds in the past, but it has been a long time and I've never done a post like this one. If you want to see some of the older stuff on mutual funds, check these out:

- Mutual Fund Expenses

- Why Vanguard?

- Avoid Actively Managed Mutual Funds

- Survival Bias- Another Great Reason to Invest In Index Funds

- Mutual Funds Versus ETFs

But today, I'm not going to give you a fish. I'm going to teach you how to fish. Mutual funds make up the majority of my investment portfolio and I think that should be the case for most investors out there. There are other ways to invest successfully, but they will require significantly more time and effort.

Building a Mutual Fund-Based Portfolio

Upsides and Downsides

Mutual funds have a number of sweet benefits you can't get by buying individual stocks, bonds, and properties. These include:

- Diversification – Buy thousands of securities in 10 seconds

- Pooled Costs – Share the costs of the fund with thousands of others

- Daily Liquidity – Buy or sell the entire investment any day the market is open

- Professional Management – Don't know what you're doing? No problem. Hire someone for cheap who does

- Automatic Reinvestment – While stocks often have DRIP programs, try doing that with a municipal bond or a duplex

Mutual funds have a few downsides as well, and in full disclosure they ought to be mentioned.

- Diversification – It works both ways, you (or the manager's) best ideas get diluted

- No Capital Loss Pass Through – While capital losses in the fund can be used to reduce the capital gains passed through, those tax losses that occur on individual securities in the fund won't find their way on to your tax return. You can be assured you'll get a capital gains distribution most years though, whether the fund makes money or not.

- Management Fees – While they can be very low, they often are not

- Loads and 12b-1 Fees- While you don't have to buy a fund with these fees, lots of investors do

- Manager Risk- The reason you hire a professional manager is because you recognize you're an idiot. But what if the manager is too?

What Mutual Funds Should You Buy?

This is a “back to basics” post, so let's make this real basic. If the name of your mutual fund does not have one or more of the following words in it:

- Vanguard

- DFA

- TSP

- Index

you probably shouldn't buy it. That doesn't mean that any fund with one of these words in it is a good fund, nor that every fund without one of these words is a bad fund, but it's a pretty darn good first screen.

What Are Acceptable Fees?

I've written before about mutual fund fees. There are a number of fees associated with mutual funds. Most of them you don't have to pay.

Expense Ratio: Don't pay one over 1% and try to keep it under 0.2%.

Load: Don't pay one at all. This is supposed to compensate your “advisor” for his advice. In reality, it's a commission for a commissioned salesman. Since the best funds don't charge loads, why would you pay extra to get a crummier fund? You wouldn't, unless you don't know. Now you know, and knowing is half the battle. And if you need advice, go to someone who sells advice (i.e. a fee-only, not fee-based planner/investment manager) not products.

12b-1 fee: Just like a load, this is an unnecessary fee. Since the best mutual funds don't have one, if the fund you're looking at has one, then you know it's a crummy mutual fund. It doesn't even matter what the theory behind 12b-1 fees was/is (the theory is BS anyway.)

Buy/Sell Fees: Some funds, including some of those at Vanguard, have buy and sell fees. It might be structured so you get hit with a sell fee only if you don't hold on to the fund for a period of time like 6 months or 5 years. Try to avoid these as much as possible. If you are really, really interested in the fund/asset class and are committed to it for a long time and the fee is low, then maybe it's okay to pay.

What About ETFs?

Exchange Traded Funds are just mutual funds that you can buy and sell during the day instead of at 4:00 pm. They're not necessarily good or bad, just slightly different. They are certainly a little more complicated to use, so have a good reason (such as lower overall expenses) to use an ETF over a mutual fund.

Actively Managed vs. Index Funds

I love it when people call the frequently seen argument about active management a “debate.” It's not a debate and if it ever was, it was over a decade or two ago. An actively managed mutual fund has a manager who tries to buy the good securities and avoid the bad ones. A passively managed mutual fund has a manager (mostly a computer) who just buys all the securities and keeps costs as low as possible. It turns out that it is very hard for a mutual fund manager to add enough value to overcome the costs of active management over the long run, especially in a taxable account. In fact, it is so hard that an individual investor even bothering to choose an active manager is probably making a mistake. The data, which I don't have room to recount here, is pretty overwhelming. So at least until you know something, stick with passive (index) mutual funds. Chances are once you do know something that you won't change your strategy and you'll be glad you started with it. And you'll probably send me a nice thank-you email in a few years and I like those.

Which Mutual Funds Should I Invest In?

Okay, you got the message and you're looking for an appropriately risky mix of low-cost, passively-managed, broadly diversified index mutual funds mostly from Vanguard. But then you go to the Vanguard site and it's overwhelming. I mean “there are eight money market funds, and I don't even know what money market funds are.” There are 37 bond funds. And dozens and dozens of index funds. Too many choices lead to paralysis by analysis. I was in a restaurant recently and I was handed a menu. There were three options on it. That was awesome. I think all menus should be like that. The happiness literature tells us that we like to have choices and feel in control, but that the fewer choices we have, the happier we'll be. So let me try to simplify things a bit.

We're going to work our way down the entire page listing the Vanguard mutual funds by asset class. (Remember “asset class” is the type of investment the mutual fund invests in.) By the way, this is one of the most important pages of the internet for a Do-It-Yourself investor. If you don't have an investment advisor, you should know it like the back of your hand.

Money Market Funds

Okay, let's walk through this. First, what's a money market fund? Well, it's basically a bank account. There are some subtle differences, but not enough that you really need to spend a lot of time on them. Basically money market funds make very short term loans to companies and federal, state, and local governments. In return, they are paid interest. After paying their expenses, whatever interest is left over is paid to you. They are very safe investments in that you are unlikely to lose money in them. But don't expect to make much. In fact, for the last 5-8 years, you've made less than the rate of inflation in money market funds. As you can see, there are two types of money market funds. There are “taxable” ones and “tax-exempt” ones. The tax-exempt ones are like municipal bonds. You're loaning money to state and local governments. In order to incentivize you to do so, you get a federal tax break and maybe a state and local tax break on the interest. So as you might expect, the interest on these is generally lower than on a taxable fund, but if you're in a high tax bracket, you may come out ahead after tax even with that lower interest payment.

As we move left to right here, we see the name of the fund, the ticker symbol (ignore this), the expense ratio (never ignore these, but if you're on the Vanguard site, they're all pretty low), and then we come to the price of the shares. In a money market fund, the price is always $1.00. The next two columns give you the change in the share price yesterday, both in dollar terms and percentage terms. Since the price of a money market fund is zero, that should also always be zero. The next column is important. This shows you the yield on the mutual fund. Remember that yield is not return for most mutual funds, but for a money market fund (and a bank account) they are essentially interchangeable. Finally, we come to the “return” figures. Remember that it is not wise to choose a mutual fund primarily based on past returns, but it is a good idea to have some idea of what you can expect from this mutual fund in a given economic environment. The first column is the year to date return (interesting, but not very useful) and then Vanguard publishes the 1 year, 5 year, 10 year, and “since inception” return. As you can see, the last decade has not been kind to money market funds but the “since inception” numbers and dates tell you that things were not always like this.

Bond Funds

Okay, let's move on to bonds. Remember a bond is a loan to someone, but it's a longer loan than the ones that go in a money market fund. Because of this, bond funds can't keep the share price at $1.00. As Jack Bogle has said, you can have stable principal or you can have stable yield, but you can't have both. With a bond, you get a stable yield and a variable principal (unless held to term). With a money market fund, you get a stable principle, but a variable yield. However, when you throw a bunch of bonds into a bond fund, the yield is only kind of stable, especially with economic fluctuations.

Let's go down the left-hand column first. Luckily, at Vanguard the names of the funds actually tell you what they're invested in. At other mutual fund companies, you might actually have to read the prospectus to get that information. No wonder everyone is pulling their assets from other mutual fund companies and sending them to Vanguard. At any rate, the first fund is GNMA. Ginnie Mae is a semi-government agency that does mortgages. So the bonds in this fund are loans to homeowners. You're buying mortgages. Where does the money go when you pay your mortgage? It doesn't go to the bank. They sold your mortgage to someone like this fund two weeks after you got it. So when people pay on the mortgages you own through this mutual fund, you make money. When they don't pay, well, you don't make money.The next fund is “Inflation Protected Securities.” That means Treasury Inflation Protected Securities, or TIPS. These are bonds whose value is indexed to inflation. This is one of my favorite funds and one I've owned for years. The next fund is Intermediate Term Bond Index Admiral Shares. That means it invests in all types of bonds that are of an intermediate duration and uses an index fund strategy. It buys both corporate (loans to Ford and Apple) bonds and government bonds (treasuries.) This fund doesn't hold GNMA bonds. The “admiral” means you have to put at least $10K into it. If you don't have $10K, you have to buy the “investor” shares, which have a slightly higher expense ratio and usually a $3K minimum. I also like this fund and use it in my parent's portfolio. The next fund is just like it, except no corporates. The fifth fund down doesn't have the word “index” in it. It is actively managed and invests only in treasury bonds. Luckily, even the actively managed bond funds at Vanguard act like index funds so there isn't a bad fund on this list.

Moving left to right, we see some various expense ratio, prices that aren't stable (but really don't move much, I mean, you can handle swings of 0.27% per day, which are actually pretty big for a bond fund,) and higher yields and returns than you see from money market funds. Be aware the TIPS fund yield is a “real” (i.e. after-inflation) yield. If it was a nominal yield, you would be better off putting money in your mattress than investing in that.

As you scroll down the page you will also notice there are corporate bonds funds (guess what they invest in) and tax-exempt bonds funds (just like the tax-exempt money market funds.) In the interest of time, we'll skip through all that and get to the Balanced Fund Section.

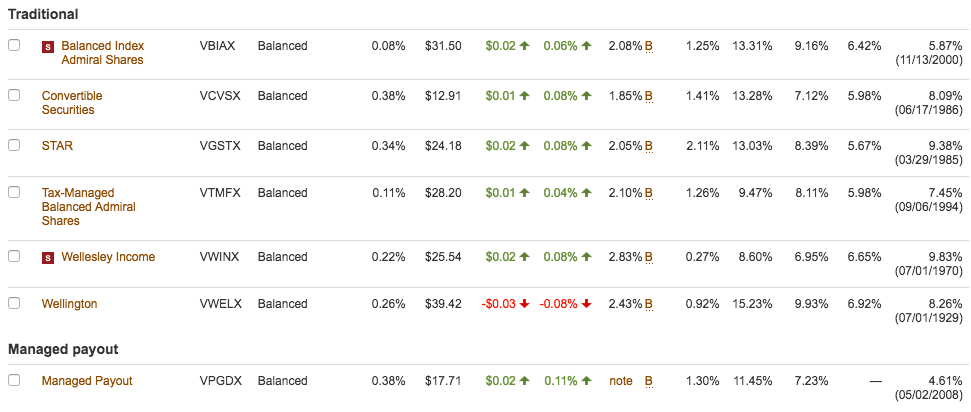

Balanced Funds

What is a balanced fund? It invests in both stocks and bonds at varying ratios depending on the strategy. Why might you want to use one? Mostly to keep things simple. You only have to own one fund and you get to own all kinds of assets all over the world without any hassle. I use them (okay, one of them) for things like my kids' Roth IRAs. Vanguard has a number of different types of balanced funds. The Target Retirement funds are supposed to be chosen by your retirement date. The further you are out from retirement, the more aggressive the fund is (i.e. more stocks, fewer bonds.) Then the fund gradually becomes less aggressive as the years go by. The Target Risk funds are also contain a reasonable mix of stocks and bonds, but they don't become less aggressive as time goes by. They just stay the same. Then there are more traditional balanced funds, including both index funds and some of Vanguard's most successful actively managed funds. Finally, there is the managed payout fund, which tries to keep a constant “pay-out” despite wildly fluctuating asset values. That's kind of fun to watch to see if Vanguard can do it, but I wouldn't actually invest in it.

Stock Funds

Now let's move on to a more exciting part of the portfolio- the stocks! Remember when you own a stock you own a tiny piece of a real, live company with real, live customers. When they make money, you make money. When they lose money, you lose money. In the short run, there is also an impressive speculative component, but in the long run, you're just buying a piece of a (hopefully) profitable enterprise. First we see US Large Cap Stock (or Equity) Mutual Funds. Dave Ramsey (and other people who were investing in the 90s) calls these Growth and Income funds. You'll notice Vanguard has a couple dozen of these. Which one should you invest in? This one.

That was easy, wasn't it? It is also a good example of why you shouldn't choose a fund based on performance since inception. As you scan down that list, you'll see funds with very different inception dates, and the date has more to do with the return since inception than anything the mutual fund actually does or has control over. But moving left to right, you'll see slight changes in the asset class column. Some funds invest in Large Cap Growth stocks, some invest in Large Cap Value stocks, and most invest in Large Cap Blend (growth and value) stocks. You can also see the difference in expenses between an index fund and an actively managed fund. Even at Vanguard, you can see an 8-fold difference in expense ratio. That is not easy for a manager to overcome. Stock funds have yield too, although instead of coming from a bond coupon, they come from stock dividends, and thus aren't nearly as stable. You'll also notice that returns, particularly for the last few years, are dramatically higher for stock funds than balanced, bond, and money market funds.

As you scroll down, you'll come to Mid Cap stock funds (Dave Ramsey calls these “Growth” funds) and Small Cap stock funds (“Aggressive Growth.”) “Cap” means market capitalization, or the size of the stock. Large caps are companies you've heard of (Amazon, Exxon) and small caps are companies you've never heard of. Then you move into international funds.

International Funds

Remember this section includes both stock funds and mutual funds, but again, the names are descriptive. Developed Markets include mostly Europe, Australia, and Japan. Emerging markets are places like Brazil, Russia, India, China, most of the Pacific Rim, and most of Central and South America. The best thing for most investors to do is scroll to the bottom of this section and look at the two “Total International” funds. The first buys all the bonds in the world outside of the US and the other buys all the stocks in the world outside the US. I've been using the Total International Stock Index fund for more than a decade in my portfolio.

Global Funds

The next section down is for “Global” stock funds. There is an important bit of terminology here. When it comes to investing, “International” means outside the US and “Global” means the entire world including the US. These funds are all a bit small and a bit expensive. I've never invested in any of them. The Total World Stock Index has potential, but still hasn't caught on much after almost a decade. You can buy its components cheaper separately.

Finally, we get to the bottom. If you want to invest at Vanguard, but still want some excitement in your life, this is your place. Why buy a diversified portfolio of stocks when you can get a concentrated one? If you learned something in the previous 3000 words of this post, you have no business buying any of these funds. That said, I've owned all of them at one point or another and they're a lot of fun. I mean, look at Energy, 33% last year alone! And Precious Metals, 76% last year! Whoohooo! (And I owned both of them last year- bragging rights for cocktail parties.) Guess what? They go down just as fast. In fact, precious metals still has a markedly negative return over the last 10 years. Health Care is one of Vanguard's long-term successes in active management. But they had a pretty rough year last year, underperforming the overall market by 10%. Lots of people hold a little slice of REITs in their portfolio in hopes that they will act differently from other stocks due to the slightly different structure. I lost 78% of my money in that fund in the 2008 bear market. Use extreme caution with any of these four funds, even if they do have the word Vanguard in their name. You should not have a large portion of your portfolio in any of them.

Prospectus

As you can see, this page alone gives you a lot of information about a mutual fund once you know how to read it. You can get even more information from the Prospectus and Annual Report, which I also recommend you at least skim. In fact, let's look at one now. Just click on a mutual fund link. Let's do the REIT Index Admiral Fund for convenience. It'll take you here:

This is the fund page. It gives you even more information about the fund including what it invests in, what the fees are, what the past performance is etc. If you want even more information, click on “View Prospectus and Reports.” Then read the prospectus. There's a short version (8 pages) and a long version (53 pages.) The short version is probably good enough. I would concentrate on these sections:

Tons of interesting information on the 2nd page. First, you learn what it invests in. Unsurprisingly, it invests the entire fund in Real Estate Investment Trusts. You also learn the strategy- it tries to track the performance of an index. In other words, it just buys all the publicly traded REITs.

The fee section is also interesting. Well, maybe not for Vanguard funds, but when you compare it to another fund. You see there are no loads, purchase fees, sales fees, redemption fees, account services fees (I know, it says $20 but that gets waived if you opt for electronic communications or if you have more than $10K in the fund), or 12b-1 fees. The expense ratio is a low, low 0.12%. Just for fun, let's look at a similar page from the prospectus of another mutual fund. How about the Alger Capital Appreciation Fund Class A. It's page looks like this:

They have an investment objective too. But it's so friggin' vague you have no idea what they're doing. And check out those fees. Wow! Let's start with the 5.25% load. Yup, that's money right out of your pocket. Give your commissioned salesman $1000 to invest, and he takes $52.50, puts it in his pocket and invests $947.50. That's going to take a little while to recover from. Oh wait, there's more. Not only do you get to pay a “front-load” but you also get to pay a 1% back-load. I love the little extra kicker there- if the share value goes down, you pay a back load off what it used to be, not what it actually is at the time of sale. The ER is 0.79%, or approximately 16 times as high as a Vanguard Index Fund. But wait, there's more. You can also pay a 12b-1 fee of 0.25-1%. And “other expenses” of 0.19%, whatever the heck those are. All in, you're looking at 1.23% for the front-loaded shares. But wait, there's more. Look at all those asterisks and fine print at the bottom! I'm not saying this fund sucks and you should avoid it….actually, that is what I'm saying. Given those high fees, you won't be surprised to learn its recent performance was kind of crummy too. Last year, while the US stock market generated returns of 12.94%, this fund LOST MONEY. A LOT OF MONEY. -4.94%. That sucks and it certainly doesn't sound like “capital appreciation” to me. Why are people still investing with those chumps? Because they've never read a blog post like this one.

Okay, let's go back to the Vanguard prospectus.

This section is pretty important. It talks about the risks you're running in this fund. Let's just say it is a risky fund, but you should read and understand all of these before buying the fund. There is a reason the government requires them to tell you this.

This is also a really useful page. It may give you some idea of what to expect in the fund. You'll notice it has had some huge losses, such as in 2007 and 2008. -37.05% doesn't sound too bad, right? But wait. Didn't I say I lost 78% of my money in this fund in that bear market? Yes I did. Bear in mind that performance data reported for the calendar years will down play what you will feel as an investor. You feel the peak to trough drop (and trough to peak rise), not the calendar year drop. Notice how few years there are with returns of 5-10%, which is what you expect the long-term return to be. Most years are big losses or big gains. That tells you it's a risky fund.

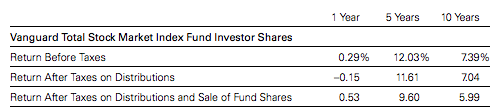

Check out the tax data too. These are also mandatory disclosures. Notice the difference between the 10 year pre-tax return of 7.44% and the post-tax return (assuming maximum tax brackets) of 5.40%. That's a fairly tax-inefficient fund to lose 27% of its return to taxes. Compare those numbers to a more tax-efficient fund, like the Vanguard Total Stock Market Index Fund

which lost just 19% to taxes or a really tax-efficient fund like the Vanguard Intermediate Term Tax Exempt Bond Fund

which only lost 3% to taxes.

Morningstar

Vanguard is pretty good at putting lots of very useful information on their website and in their prospectuses and reports. Probably because they don't have much to be ashamed of. But if you're looking up a mutual fund somewhere else, you may find it a little tougher to get the information you seek. Or you might just want more detail. In those cases, you can go to Morningstar, which provides all kinds of mutual fund information. There is some information behind a paywall, but everything you really want is in front of it. Let's take a look at that Vanguard REIT Index fund there.

Most of the good stuff is under the “Performance,” “Portfolio,” and “Expense” tabs and is summarized at the bottom of the front page.

This tells you what it is invested in (100% stocks, remember REITS are a type of stock) and mostly small to medium slightly growthy stocks.

At the bottom, you can see all of the money is invested in the real estate sector (no surprise there) and that their top holdings are all big real estate companies, some of which you might have even heard of. It is a fairly concentrated fund, with over 20% invested in just the top five holdings. The comparative performance data is also pretty useful. Look at the long-term % rank in category near the bottom. Over 5-10 years, this fund has outperformed 80-83% of the other funds in its category. That's pretty typical for an index fund. Despite whooping up on 4 out of 5 funds for a decade, Morningstar only gives it 3 out of 5 stars. That's another good point- when you go to Morningstar, you're looking for 3-4 star funds. 1-2 star funds tend to stay 1-2 star funds, but 5 star ratings do not predict future performance. Steady eddies are what you want.

This post is way too long already, but I hope it has been educational. You can learn a lot about mutual funds without ever reading an investment book if you just know where to look on the internet and what you're looking for.

What do you think? How did you learn about mutual funds? What do you think a beginning investor needs to know? Do you invest in mutual funds? Why or why not? Comment below!