Saving and investing for retirement is a completely different ballgame than knowing what to do with your money when your working days are over. And many observers say that finding a strategy to live in retirement is much more difficult than all the strategy you used to build a nest egg to actually get there (in other words, the decumulation phase is much harder than the accumulation phase).

There are dozens and dozens of formulas and guidelines for how you should spend your money in retirement without running out of it. The big questions are: 1) how much money do you need, and 2) how do you make sure it lasts?

To come up with a ballpark figure, use your current rate of spending to guesstimate your future retirement spending needs, accounting for inflation, of course. Reduce your requirements by the value of future income streams. Determine a safe withdrawal rate that will make you comfortable. I recommend a number in the 3%-3.5% range (requiring about 28 to 33 years worth of expenses) if some of these apply to you:

You should now have all the information you need to roughly estimate your financial independence target—the amount you should aim for to retire without much worry. Simply multiply your anticipated retirement expenses by a number in the range of 20 to 33. You’ve got your number.

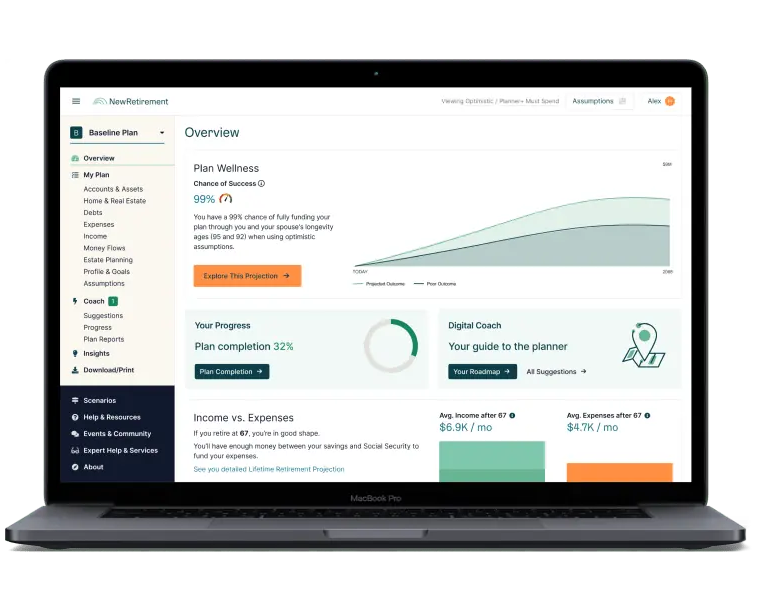

Looking for some personalized answers when it comes to tracking your retirement? Check out Boldin, a WCI partner that helps you build your retirement plan and keeps you on track for the future you deserve. It’s much more than a retirement calculator; it’ll help you get to the retirement of your dreams.

Retirement Calculator

Enroll in WCI Financial Boot Camp, a FREE educational email series, and learn to convert your high income to wealth

You can unsubscribe anytime using the link at the bottom of any email.

Spending in retirement can be scary after so many years in the accumulation phase. Here’s how to best spend your money in retirement and what you can do to make sure it lasts.

A safe withdrawal rate is the amount you can withdraw from a portfolio every year without running out of money during your retirement. It seems straightforward, but it can actually get quite confusing. If you only spend the increase in value of a portfolio (or the income you get from it, which is often even less), you will never dip into principal. You will also end up spending much less than you could have during your retirement. At the same time, you also don't want to spend so much principal that you run out of money.

Very few retirees follow any sort of strict fixed withdrawal rate, much less the 4% rule which is commonly discussed. The 4% rule is really just a 4% guideline. It’s a reasonable place to start. Sequence of Returns Risk is the idea that even if your average portfolio returns are fine over your retirement years, you could still run out of money if the market performs badly at the beginning of your retirement. If that happens, batten down the hatches and cut your spending. If it does not, bump up your spending. You could even spend 5%, 6%, or even more a year, especially if you can cut back when the market does poorly. The ability to be flexible in retirement is extremely valuable, and it will likely allow you to significantly exceed a 4% withdrawal rate.

Whether you're looking to retire in your 60s or you want to FIRE in your 40s, making a retirement plan is key. That way you can enjoy your post-work life while also knowing you can afford it.

Figuring out how to spend in retirement can be complicated. It can also be downright daunting. Trying to determine how much you can spend to satisfy yourself in your post-work life while also making sure you don't run out of money before you die might end up being the hardest part of your financial journey. The good news: you almost certainly won't run out of money. But you need to also remember this: your financial education doesn't end just because your working career is finished.

Medical school may not have taught you about money, but we will.

We will never sell your information. Modify your preferences or unsubscribe at any time.

Get ready to take control of your financial life. You can do this, and we can help.

We won't sell your information. Modify your preferences or unsubscribe at any time.