We spend much of our time here at The White Coat Investor writing about the best way to save for retirement and how much money you’ll need to live a comfortable life when you’re done working and collecting a paycheck. For physicians who make hundreds of thousands of dollars per year and for those who spend that much, as well, the nest egg will have to be considerable if you plan for it to last at least 30 years (or more!). We’re talking about millions and millions of dollars in the bank.

But most Americans don’t make as much money as the typical physician salary, and they have slightly lower expectations for how much they’ll need to retire. And considering their savings rates are well below what Dr. Jim Dahle has recommended for physicians (20% of your gross income), it’s difficult to see how many people can afford to stop working when they advance into their 60s, 70s, and 80s.

According to a recent Northwestern Mutual study which surveyed about 4,500 adults, Americans believe they’ll need $1.46 million to have a comfortable retirement, but the average amount they’ve saved is only $88,400.

Those numbers, even if they don’t necessarily apply to the majority of white coat investors, are pretty darn bleak.

How Much Do Americans Have in Retirement?

If US adults believe they need nearly $1.5 million to retire, that $88,400 figure is a scary number. And according to the study, the two figures have grown wider apart. Last year, Americans believed they needed $1.27 million in retirement, 15% less than what they think now. In 2020, the average person believed they only needed $951,000.

Meanwhile, Americans said they saved $89,300 for retirement in 2023. That means they have even less saved today.

“The magic number is at an all-time high—it's 50% higher than what it was before the pandemic,” Aditi Javeri Gokhale, chief strategy officer at Northwestern Mutual, told CBS. “The cost of living in general, whether in reality or perception, seems to be more costly now than it was before.”

There is some good news in this survey. The average Gen Z'er started saving for retirement at 22 years old, nine years earlier than the average American. But 30% of Gen Z'ers surveyed (along with Millennials) said they believe it’s likely they’ll live to 100 (only about 20% of Baby Boomers and those who are Gen X feel the same way), meaning they’ll have to make their retirement savings last even longer.

Even high-income earners aren’t immune from this disparity. Those with more than $1 million in investable assets who were surveyed think they’ll need $3.93 million to retire but only have $172,100 saved (as some commenters below are stating, the $1 million in investable assets and $172,100 saved feels contradictory. The “investable assets” phrase is how Northwest Mutual termed it. Perhaps it was meant to imply a $1 million+ net worth).

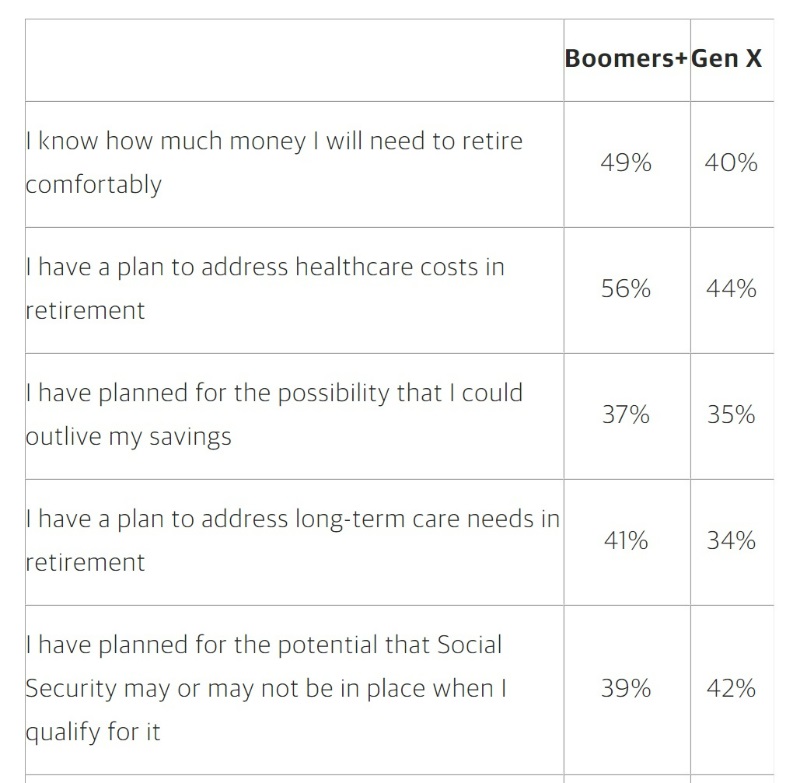

Not surprisingly, the survey found that 33% of people don’t feel financially secure, a large leap from 2023 when 27% of people felt that way. That 33% figure is the highest number the Northwestern Mutual survey has ever recorded. But 59% of those people said they don’t think they’ll reduce spending on restaurants, vacations, and entertainment in 2024. Which means that the numbers in the chart below might not be getting better any time soon.

As Gokhale said, via Kiplinger:

“In 2023, the soaring cost of eggs in the grocery store symbolized inflation in America. In 2024, it’s nest eggs. People’s ‘magic number’ to retire comfortably has exploded to an all-time high, and the gap between their goals and progress has never been wider.”

More information here:

Paula Pant Asks: Do You Want to Retire or Are You Simply Tired?

What to Do to Save More for Retirement

If you find yourself feeling the same as the Americans who were surveyed, there are steps to take to better prepare yourself for your post-work life.

In its own survey from last year when it found that 52% of people were not on track for retirement, Fidelity recommends the following:

- Aim to save 15% of your pre-tax income each year (remember, Jim says 20% is more like it).

- Make sure you’re comfortable with your asset allocation

- Reevaluate your retirement plan and determine if you might need to work past the median retirement age of 65.

Or you can take Jim’s advice when he wrote a post titled “I Forgot to Save for Retirement!”

#1 Decrease Spending

Every dollar you’re not spending can be saved and invested (so hopefully you can spend more of it later). You might even have to make a budget. Does that mean you should halt all of your pleasure spending? No. As Jim wrote, “If you're spending it on vacations, remember that you can go on just as many vacations; they just have to be cheaper. There is a big difference between a week camping in the National Park a few hours away and a week in Paris.”

Not everyone agrees with this solution, though.

My least favorite financial advice is “cut your spending.”

Not only is it limited in its effectiveness, but it gives your money control over you rather than you control over your money.

— Nick Maggiulli (@dollarsanddata) May 20, 2024

#2 Use Your Tax Money to Increase Savings

Are you maxing out all of your retirement accounts? If not, direct your money to those 401(k)s, 403(b)s, 457s, HSAs, etc. It’ll get your money into accounts that can make you money (and if you’re over the age of 50, take advantage of the catch-up contribution limits), and it’ll lower your tax bill. Use those tax savings to put more into your nest egg.

#3 Turn Non-Income Producing Assets into Income-Producing Assets

As Jim wrote:

“Most docs in their 50s, especially those with inadequate retirement savings, have some assets sitting around that are worth something. It might be an expensive boat, airplane, or automobile. This can be sold and the proceeds can be used to purchase stocks, bonds, or real estate. If you have a vacation property, you can start renting it out (or rent it out more often) so it at least covers its own expenses. You can rent out the mother-in-law apartment in the basement or the guest house. Selling an asset is especially useful for an asset that was sucking up a lot of your income previously. Not only do you get the cash out of it, but you can quit feeding it every month.”

(And let me add my own No. 4.)

#4 Don’t Panic

This is what Konstantin Litovsky—the founder of WCI-recommended Litovsky Asset Management, which offers comprehensive retirement plan advisory and investment management services—told me a few months ago:

“The standard of living for those in the lower income brackets is also usually lower,” he said. “Many people will end up with jobs in retirement, so there is really no such thing as fully retiring, even for those who may have pensions or other sources of income in addition to Social Security. We live in Sarasota, Florida—which has a higher proportion of retirees and older people—and while there are some who are happy living on a fixed income, many work part-time. There is also the family structure, which can help mitigate some of the issues related to lack of retirement assets. Family members tend to help each other, and assets are passed on over time. Social Security/Medicare will definitely help.”

Even if you make hundreds of thousands of dollars a year (and if you’re a WCI reader, there’s a good chance that you do), just know that you’re not guaranteed a luxurious retirement. You still have to make good choices with your money now and in the future. As Jim previously wrote, “Saving for retirement is the greatest financial challenge of your life. For most people, even doctors, it will take your entire career to save up a nest egg large enough to provide your desired level of comfort in retirement.”

More information here:

How to Start Saving for Retirement

Is Now a Good Time to Retire? Here’s What Christine Benz Thinks

Money Song of the Week

I don’t often get suggestions for my Money Song of the Week (but I’m always open to them!), so I was surprised when Jim excitedly approached me at WCICON24 and asked why I hadn’t yet featured Twenty One Pilots’ “Stressed Out” in this space. Honestly, I don’t know much about this two-man hip-hop/alt-rock/pop group (though I have always kind of liked their 2016 release, “Heathens,” probably because the melody sounds to me like early Pink Floyd). And I don’t remember hearing “Stressed Out,” which came out in 2015, won a Grammy, and actually made it to No. 2 on the Billboard charts (that’s a pretty good indication of my lack of knowledge (or my aggressive ignorance) of contemporary pop music).

So, I listened to it, and I dug it. It’s not really a song about money; it’s a song about growing out of adolescence and into the real world and how we can be nostalgic about our youth—a time when you didn’t have to experience many of life’s hardships.

But money plays a role in the song, especially when Tyler Joseph sings about harkening back to a time when you didn’t need to have a job or the money that comes with it:

“We used to play pretend, give each other different names/We would build a rocket ship and then we'd fly it far away.

Used to dream of outer space, but now they're laughin' at our face/Sayin', ‘Wake up, you need to make money.’”

Billboard had an interesting take on the song, writing:

“If any one song captures the Millennial/Gen Z experience of the mid-2010s, it’s a song whose chorus pines for the ‘good old days’ of carefree youth and whose bridge describes the pressures of external voices telling one to ‘wake up; you need to make money.’

He’s speaking to a generation—of which Joseph, in his mid-20s at the song’s release, is a part—that was not only drowning in college loan debt but was also sharing those anxieties and more all over social media, perhaps feigning apathy when in reality they craved peer acceptance more than ever.”

Perhaps Joseph is a Millennial, but what he’s singing about could be tied to any generation that came before him. Perhaps not the social media part, but everything else. Most people, I imagine, have moments of nostalgia about the days of their lives when stress and money weren’t part of their everyday equation. Maybe, someday in the future, we’ll all be so lucky to experience that mindset again.

More information here:

Every Money Song of the Week Ever Published

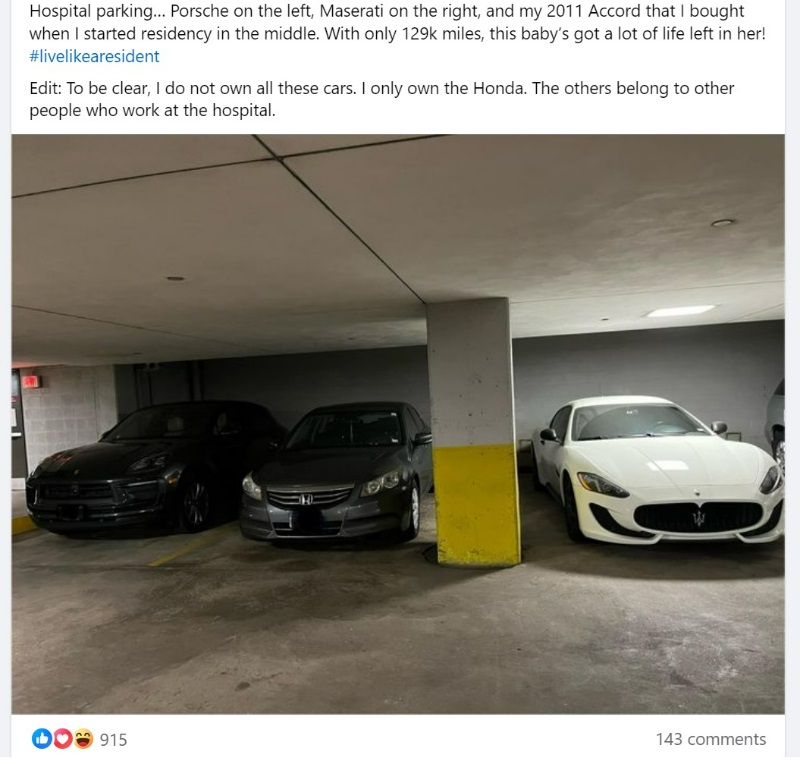

Facebook Post of the Week

This comes from the WCI Facebook group.

Interestingly, the original poster got plenty of pushback on the idea of driving an old car to save money (or people accused her of showing off that she was doing so). The comments on that photo were certainly more mixed than I would have expected.

How much do you think you’ll need to retire? Are you on track to get there? What else can you do if you’re falling short right now?