Contribution limits for 401(k)s, 403(b)s, 457(b)s, IRAs, Roth IRAs, HSAs, FSAs, SIMPLE IRAs, and SEP-IRAs are all indexed to inflation. While the retirement contribution limits do not go up every year, and while every account does not use the same formula for when there will be an increase, you will generally see an increased contribution every year or two.

Although inflation exploded in 2022, meaning the 2023 contribution limits increased in a relatively significant way, it's mostly been tamed in the past three years, and as a result, the increases in those limits for 2026 are back to normal. If you know the latest inflation numbers, it is possible to calculate the increase even before the IRS announces it in October or November (in 2025, the IRS officially released its figures on November 13).

Note that 2022's Secure Act 2.0 changed catch-up contributions in significant ways. The 401(k)/403(b) catch-up for those 50 years old or older has always been indexed to inflation. But the law stated that, starting in 2024, if you have Social Security wages of $145,000+ (indexed to inflation), those catch-up contributions would now have to come on the Roth side. In 2026, the Social Security wage threshold will rise to $150,000+. That means tax-deferred catch-up contributions would no longer be allowed for these high earners.

Eventually, the IRS announced that it was pushing back that provision until 2026, so unless something changes in the next few months, catch-up contributions for most white coat investors will have to come via Roth [in September 2025, this provision was moved back to 2027].

Also remember that beginning in 2025, catch-up contributions were increased even more for those who are 60-63 years old (it'll be the larger of $10,000 or 50% more than the regular catch-up contributions).

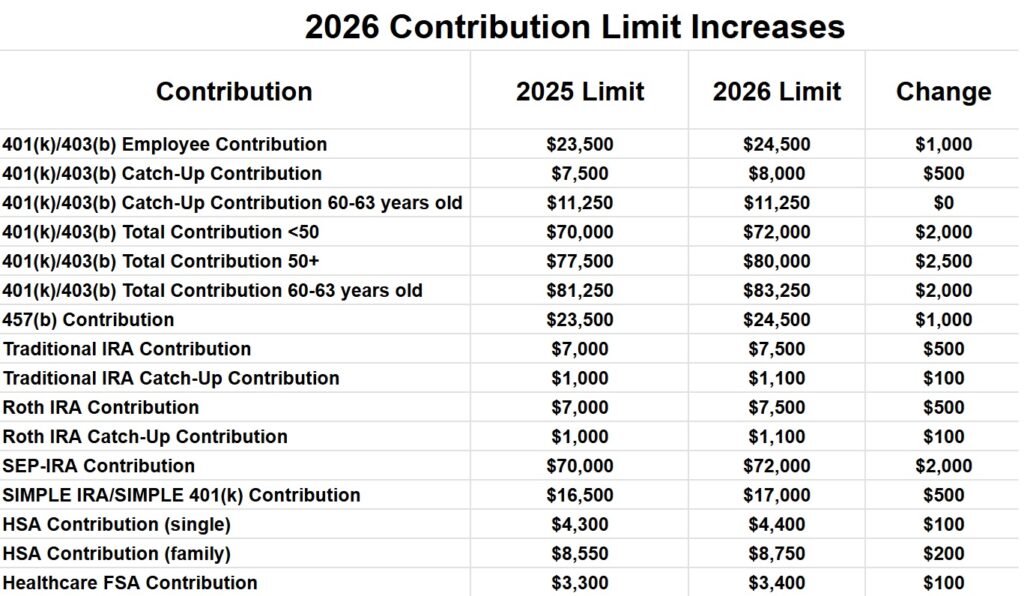

All that said, here are the limits for 2026 retirement plan contributions.

2026 401(k) and 403(b) Employee Contribution Limit

The total employee contribution limit to all 401(k) and 403(b) plans for those under 50 will go up from $23,500 in 2025 to $24,500 in 2026. The catch-up contribution limit will rise from $7,500 in 2025 to $8,000 in 2026, so if you're 50+, your 401(k) employee contribution limit will be $32,500 in 2026.

But if you are aged 60-63 by the end of 2026, your catch-up contribution will be $11,250, meaning you can contribute a total of $35,750.

2026 401(k)/403(b)/401(a) Total Contribution Limit

The total of all employee and employer contributions per employer will increase from $70,000 in 2025 to $72,000 in 2026 for those under 50. With the catch-up increasing to $8,000, the total contribution for those 50+ will be $80,000. If you're 60-63, that contribution increases to $83,250.

Note that the 401(a) limit is separate from the 403(b) limit. So, you could theoretically get $72,000 into each of them.

2026 457(b) Contribution Limit

457(b) contribution limits will increase from $23,500 in 2025 to $24,500 in 2026. 457(b)s have unique catch-up contribution rules, so consult with your plan administrator if you are interested in putting more in your 457(b).

2026 Traditional and Roth IRA Contribution Limits

IRA contribution limits will increase from $7,000 in 2025 to $7,500 in 2026. The catch-up contribution limit will rise from $1,000 in 2025 to $1,100 in 2026.

2026 SEP-IRA Contribution Limits

SEP-IRA contribution limits will increase from $70,000 per year for 2025 to $72,000 in 2026.

2026 SIMPLE IRA and SIMPLE 401(k) Contribution Limits

The SIMPLE IRA and SIMPLE 401(k) contribution limits will increase from $16,500 in 2025 to $17,000 in 2026.

2026 Health Savings Account (HSA) Contribution Limits

For single people, the HSA contribution limit will increase from $4,300 in 2025 to $4,400 in 2026. Family coverage will increase from $8,550 to $8,750. The $1,000 catch-up contribution for those 55+ remains the same.

2026 Flexible Savings Account (FSA) Contribution Limits

Healthcare FSA contribution limits will increase from $3,300 in 2025 to $3,400 in 2026. Note that there are other types of FSAs (such as dependent care FSAs) with different limits.

Other Interesting Increases

The 401(a) compensation limit (the amount of earned income that can be used to calculate retirement account contributions) will increase from $350,000 in 2025 to $360,000 in 2026. This is always 5X the maximum 401(k) plan total contribution limit.

The deductibility phaseout for IRA contributions for those with a retirement plan at work increases from $79,000-$89,000 in 2025 for singles to $81,000-$91,000 in 2026, and it'll move from $126,000-$146,000 in 2025 for those Married Filing Jointly to $129,000-$149,000.

The Roth IRA Direct Contribution Limit phaseout will increase from $150,000-$165,000 in 2025 for singles to $153,000-$168,000 and from $236,000-$246,000 in 2025 for those Married Filing Jointly to $242,000-$252,000. If your MAGI is above that, you'll need to contribute indirectly via the Backdoor Roth IRA process.

While Social Security benefits increased by 8.7% for 2023, the bumps for 2024 and 2025 were much more modest at 3.2% and 2.57%. For 2026, the increase will be 2.8%.

The definition of a highly compensated employee will remain the same in 2026 at $160,000.

While it feels like all of these are increases, they are really just keeping up with inflation. On a real (after-inflation) basis, they're basically the same as this year.

What do you think? Are you surprised by any of these? Are you glad they're indexed to inflation?