Since I started as The White Coat Investor content director four years ago, I have accumulated a huge document of column ideas. Some ideas seem good at the time and then just don’t work when I try to write them onto the page. Some ideas are half-baked. Some ideas I end up hating after spending time trying to figure out what I want to write.

And some thoughts are good but not necessarily strong enough for an entire column. I figured I would string some of those ideas together into today’s column.

(Maybe, on second thought, that’s not a good way to present the following ideas to you: “Ah, here’s a bunch of schlock thrown together that wasn’t good enough for their own column. Enjoy!”)

Maybe let’s present it this way. When I was a sports writer, I’d always have little tidbits from games and practices and interviews that weren’t strong enough for their own article—it’s the minutiae that was left for the cutting room floor. But much of the time, especially if you were on the Major League Baseball or NFL beats, you’d write what was called a “notebook.” There’d be four or five random items that were pieced together like fish on a string, and that notebook of random minutiae would be good enough to land in the newspaper or on the website. It was basically a random grab bag that hopefully still served (or amused) the reader.

That’s what I’m doing today. It’s not a bunch of shlock. It’s a grab bag that will hopefully serve (or amuse) you.

My Random Financial Thoughts

People Are Losing Money Thanks to Bad Social Media Advice

I don’t always enjoy experiencing social media and AI kind of scares me, but I love writing about the intersection of social media, artificial intelligence, and financial advice. I’ve written about physician social media stars, about the unbelievably bad advice from TikToks and tweets, and about my own conversations with ChatGPT. Seemingly every week, I come across an article or story about how people are losing money or being scammed by following online advice.

According to a recent TSB Bank survey, more than half of the people who took advice from somebody on social media actually lost money. In the survey of nearly 2,000 people, 31% said they acted on advice from social media. Of those people, 55% ended up with less money than they had before.

Perhaps not surprisingly, the young investors are the ones who are most susceptible, with 70% of 25- to 34-year-olds saying they trust that content and 62% of 16- to 24-year-olds. Of those who are over 55 years old, only 27% said they trusted social media financial advice.

A couple of other interesting statistics from the study:

- 83% of respondents received financial advice content that they weren’t actually seeking out.

- 90% said they had seen an investment “opportunity” on social media.

- 42% said they didn’t know how to check the legitimacy of online content.

- 67% of 16- to 24-year-olds and 61% of 25- to 34-year-olds felt worse about their finances after visiting social media.

Oof, all of that makes me sad. It’s also scary for my kids and their friends, who will enter their adult phases in a world where the truth and facts (and how to find both) are getting blurrier.

As Josh Brown, the CEO of Ritholtz Wealth Management, told Vox: “I love the content, but people should not invest on the basis of a TikTok video. People would be better served reading books than following TikTok gurus on trades.”

Are 529s Getting Less Popular?

Though WCI founder Dr. Jim Dahle has written about overfunding 529s and how you might not need as much money to pay for college as you might expect, I’m still a little nervous about it for my high school-aged kids. We have healthy 529 balances for my twins, but these days, a four-year private school might cost you $400,000. And what happens if they want to go to graduate school?

But there’s no doubt we (and, by extension, our kids) are in a much better position than many other children in this country who want to attend college.

According to data provided to the New York Times by Harris Poll and Intuit Credit Karma, a strong percentage of parents are saving for college (65%), but less than a quarter of them are using a 529. Meanwhile, 19% of respondents closed their 529s early, and 22% have thought about doing so.

The biggest reason it appears that so few people open 529s is because they simply don’t know about them. As one retirement and college funding strategist told the Times, “They’re like, ‘Oh, well, nobody told me about this—it’s just not advertised on television or anything like that.’”

To me, though, this passage was the most heartbreaking part of the article.

“Mical Marshall’s past experiences played a major role in her decision not to open a 529 plan for her two daughters, ages 9 and 6. Her parents and grandparents had opened one to help cover her tuition at a community college in Casper, Wyoming. But she had decided college wasn’t for her and dropped out after eight months. Most of the remaining funds in the 529 account went unused.

Later, she discovered she could not withdraw much money without penalties. After taxes and fees, she was left with about $2,300, which she used to go on a trip to Florida with some friends.

Now a mother of two, Ms. Marshall, 36, looked into other options. After watching TikTok videos about saving strategies, she came across indexed universal life insurance, a type of life insurance that includes a death benefit and a cash value component tied to the performance of a market index, like the S&P 500.

She decided to open two accounts for her children. Three years later, each account has $1,500 earning interest. This year, after recovering from a divorce, she said, she began contributing $100 a month into policies for each child, double what she used to put in whenever she could. When her children land their first job as teenagers, she plans to have them match her monthly contributions.”

From not knowing that her 529 funds could have been transferred to her kids to using those funds on a vacation, from using TikTok for advice to purchasing an indexed universal life insurance, that whole scenario feels like such a mess. And such a shame.

More information here:

Balancing Retirement and College Savings

4 Pillars for High-Income Families Paying for College

The Headline I Wish I Could Write

I get a ton of work emails that aren’t relevant to me in any way (I'm looking at you, PorkRinds.com PR team), but I enjoyed a recent one from a PR company representing the NHL’s Chicago Blackhawks that was trying to entice me into writing about how the organization auctioned off a $177,000 experience to taste a couple of very exclusive vintage bourbons.

The only reason I penned the preceding paragraph is because I once had an idea to write about whether investing in whiskey or bourbon was a good idea. And the only reason I wanted to write that was so that I could use this headline:

Diving into Gold and Silver

If you follow our monthly newsletter, we’ve spent plenty of time this year talking about how, until very recently, gold and silver have done well (gold is up about 52% YTD, while silver is up about 67%). Now, more and more states are moving to use these precious metals as legal tender.

One of the latest is Texas—which joined Arkansas, Florida, and Missouri—in a recent quest to reintroduce gold and silver into everyday financial transactions (I imagine it’ll be really popular in places like trading posts, saloons that sell sarsaparilla, general stores, and blacksmith shops). Utah and Oklahoma already allow gold and silver to be used.

In the case of Texas, the state’s comptroller will establish digital systems that can convert gold and silver holdings into dollars wherever you’re buying a product, and the system will supposedly be fully ready by May 1, 2027.

I doubt many people will be impacted by the new Texas law, but I know of somebody who is pumped about the news.

More information here:

Investing in Collectibles: Is Investing in Jewelry, Coins, and Ferraris Worth It?

Money Song of the Week

If you attend numerous concerts, you know that sometimes you have an internal debate in your head. You might ask yourself, Do I really care about going to this show? Is it too inconvenient to figure out parking and staying out late and avoiding the mosh pit and trying to sleep later on with ringing ears?

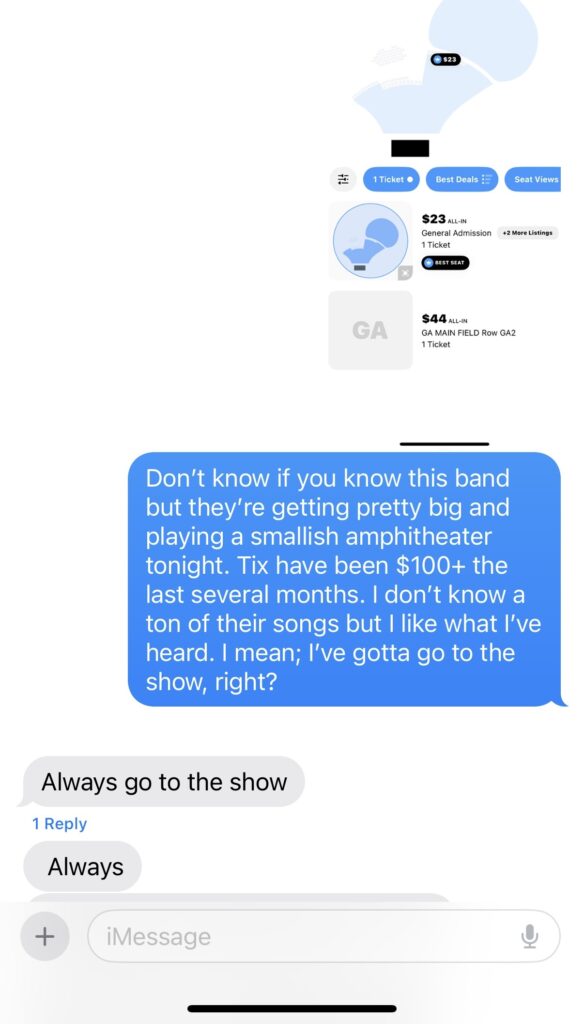

My friend, Trent, is the guy I can count on to convince me that I need to go to a show even when I’m undecided. Take this text I sent him when I found a $29 ticket to go see the punk/hardcore band Turnstile. I had been monitoring the ticket prices for several months, and for most of that time, third-party tickets were going for $100+. Then, a few hours before the sold-out show started, I found a few for less than $30.

So, I texted him, because I knew what he would advise me to do. He would tell me that you always go to the show.

A few days later, post-hardcore band Thrice was coming through town, and Trent knows a guy who works for the group who could get me on the guest list. I had been on “the list” two other times in my concert career—a 2011 Twilight Singers show and Erase Errata’s penultimate show in 2015—and it’s a fun experience.

But did I really care about seeing a band I barely knew anything about, even if the tickets were free? Would it be too inconvenient? Would the parking situation suck?

I didn’t have to ask Trent for his thoughts this time. After all, you always go to the show—especially when you’re on the guest list.

Still, when you get to the ticket window and show them your ID, there’s always that moment of apprehension.

“Am I really on the list? Am I going to look stupid when they look through their pieces of paper, shake their head, and give me the thumbs down? Will I then actually have to bust out my credit card and buy a ticket? Are there even any tickets left?”

But my name was on the list (well, it was on the second list checked by the person behind the window), and a buddy and I walked in with free tickets. Before the show, I had spent about three days listening to Thrice songs, and the way the four-piece performed live (the power, the energy, the freakin’ metal-ness of it) was incredible. And one of the songs that got the 1,500 fans in attendance extra pumped was Black Honey.

Black Honey, released in 2016, is a song about oil and the American obsession with and greed for it (and the military invasions that occur because of it). Black Honey, it turns out, is much heavier than Soul Asylum's take on the matter.

Said frontman Dustin Kensrue, via NPR:

“Lyrically, the song spawned from an image that popped into my head: someone continually swatting at a swarm of bees to get their honey, but somehow not understanding why they would sting back in return. It seemed like a fitting metaphor for much of US foreign policy.”

As Kensrue sings (with the swarm of bees symbolizing oil-rich countries and the swinging hand symbolizing, well, America),

“I keep swinging my hand through a swarm of bees/I can't understand why they're stinging' me/But I'll do what I want/I'll do what I please/I'll do it again 'til I've got what I need.

I'll rip and smash through the hornet's nest/Do you understand I deserve the best?/'Til you do what I want/I'll do what I please/I'll do it again 'til I've got what I need.”

The concert was unexpectedly great. I’m glad I went. And it was a nice reminder to always choose to go to the show. Always.

More information here:

Every Money Song of the Week Ever Published

YouTube Short of the Week

From the guy who brought us “debt shops” and “death pledges,” here’s a sketch on how the idea of car loans might have been invented.