Investing is a critical life skill. It's actually not even that complicated. However, it is apparently very difficult for a large percentage of people. The main problem is that people don't do it. Investing, at its core, is deferring spending that you could do now so you can (hopefully) spend more later. While most people think they want to be a millionaire, what they actually want is to spend a million dollars. Those two things are polar opposites. You become a millionaire by NOT spending a million dollars you could have spent.

Wealth Is Not Income

OK, you've decided you want to be rich. You want it “real bad.” In fact, you want it so badly that you're willing to NOT spend money right now that you could spend and you're actually going to invest it so you can spend it later. Congratulations! You've taken the first step to becoming rich. Lots of people think rich people just make a lot of money. While it's true that many rich people make a lot of money, it's also true that:

- Many rich people only USED to make a lot of money,

- Quite a few rich people hardly make any money at all, and

- A fair number of rich people never made all that much money.

The main concept to understand here is that while having wealth and having a high income at some point in life are two highly correlated activities, they are not the same thing. Wealth is not income. Income is what you make in a given year. Wealth is what you have—whether you earned it or whether it was given to you. The best measure of wealth is net worth: everything you own minus everything you owe. If you're going to track just one financial number in your life, track this one (not your credit score).

More information here:

The Nuts and Bolts of Investing

What to Invest In

Now, the easy part. What should you invest in? Stocks? Bonds? Rental properties? Bitcoin? There are gazillions of investments out there. However, you don't actually have to invest in any one of them and certainly not all of them to be successful.

Perhaps the greatest place—and certainly one of the easiest—to invest your money is in the most profitable corporations in the history of the world. When someone starts a really successful company that makes lots of money, they'd eventually rather have a big lump sum of cash than own the company. If the company is really big, nobody can really afford to buy it from the owner by themselves. So, the owner of the company doesn't sell it to just one person; they sell it to everybody. That's called an Initial Public Offering, or IPO.

After an IPO, shares of these big successful companies that make lots of money trade on the stock markets of the world. When you own shares of these companies, you share in their profits. It turns out that people have studied the best way to invest in these corporations. That method is called “index funds,” which are mutual funds (groups of investors who have pooled their money together and hired a professional manager to invest their money) that just buy all of the stocks. They buy the best ones and the worst ones and all the ones in between. As silly as it may sound, it turns out that it is so hard to just buy the good ones that you're actually better off buying all of them.

Conveniently, these index funds are available in all kinds of different types of investing accounts like a “brokerage account” (that anyone can open and use for anything), a 401(k) (a type of retirement account offered by an employer to its employees), a Roth IRA (a type of retirement account that anyone who earns money can open without an employer), 529 accounts (a special type of account for college savings), or a Health Savings Account (a special type of investing account for money that is set aside to pay for healthcare).

It turns out there are a lot of index funds out there. Most of them aren't that good, but there are a few dozen that are. If you're having trouble identifying the good ones, maybe just start with one or both of these:

- Vanguard Total Stock Market Index Fund (VTSAX)

- Vanguard Total International Stock Market Index Fund (VTIAX)

More information here:

How to Build an Investment Portfolio for Long-Term Success

150 Portfolios Better Than Yours

When to Invest

When I first started writing about investing, I didn't realize how hard this was for people to understand. It is really hard for people to invest at the right time. I'm going to tell you when to invest so the mystery goes away. Ready? OK, here we go.

Invest now. Now. Again. Now. Now. Do it now. Now.

Whenever you wonder when you should invest, remember that advice. Do it now. Don't pay any attention to those voices in the back of your head screaming at you. Don't pay any attention to the voices on TV and in investing magazines and on websites. If they're not saying “invest now,” they're wrong. Actually, there is a better time to invest than now. Ten years ago would have been better. But that time is no longer available to you, so go ahead and do it now.

Did you get paid this month? Then, invest this month. Did you get an inheritance this month? Go ahead and invest that. Did you just sell something? Did you just roll over a retirement account? Go ahead and get the money invested. Right now.

But What If the Market Goes Down Right After I Invest?

Oh, it will. Actually, about one-third of the time, it will go down right after you invest. Sorry. That's part of investing. As the investor, it's your job to lose money (temporarily) every now and then. I know you think you should somehow have the ability to identify in advance when the market is going to go down, but you actually can't. Neither can anyone else. Don't believe me? Start keeping a journal of your own (and other people's) predictions about the future. It likely won't take long before you realize all crystal balls are cloudy, including yours.

Still don't believe me? Let's try an exercise. Which of the following instances would be a good time to invest? These are charts showing the overall level of the stock market:

Yes? No? Not sure? How about this one:

That sure doesn't look like it's going in the right direction, does it? It's even worse than the one above it. Or is it about to turn around and go back up? So hard to tell.

That sure doesn't look like it's going in the right direction, does it? It's even worse than the one above it. Or is it about to turn around and go back up? So hard to tell.

Oh, this one looks bad. Who wants to invest at all-time highs? Not me, that's for sure. That market must be about to decline, right?

Oh, this one looks bad. Who wants to invest at all-time highs? Not me, that's for sure. That market must be about to decline, right?

See, that's what happens after all-time highs; it goes back down. But is it done going down? Aarrgh, so hard to tell.

See, that's what happens after all-time highs; it goes back down. But is it done going down? Aarrgh, so hard to tell.

What about this one? Up? Down? What comes next? Wouldn't want to invest at an all-time high, would you? Or would you?

What about this one? Up? Down? What comes next? Wouldn't want to invest at an all-time high, would you? Or would you?

Oh, this one is way down low. That surely must be a good time to invest, right? Or maybe it's going to keep going down. I'm just not sure. I guess I won't invest.

Oh, this one is way down low. That surely must be a good time to invest, right? Or maybe it's going to keep going down. I'm just not sure. I guess I won't invest.

Another all-time high. It's probably better to avoid investing.

Another all-time high. It's probably better to avoid investing.

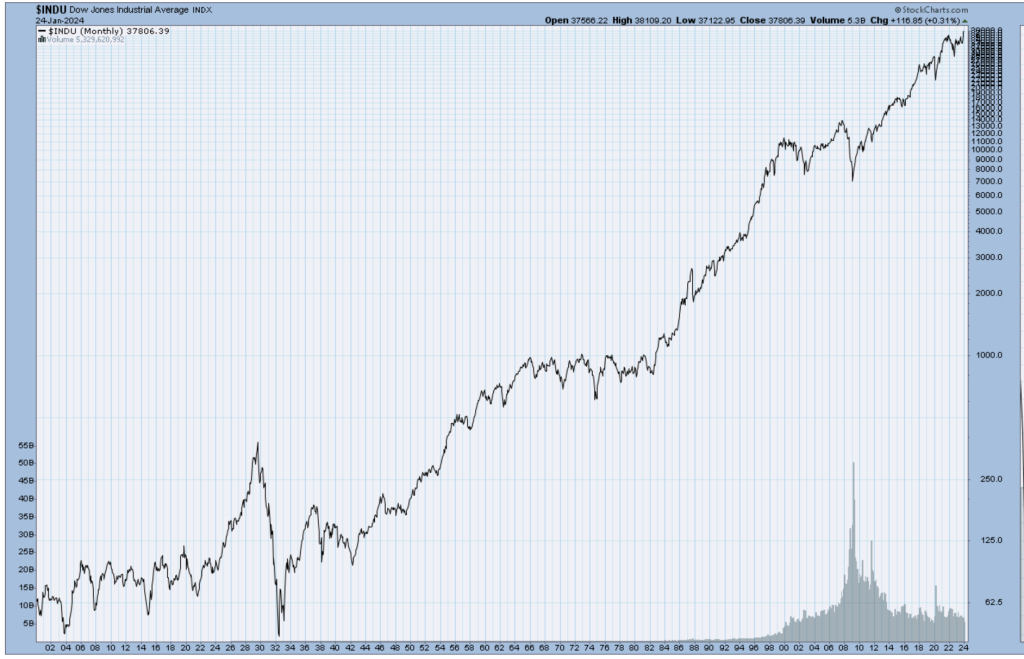

As you have probably deduced by now, these are all small segments of the same chart. Want to see the whole thing? Here you go.

It's just a 125-year chart of the US stock market. I want you to notice how small those little downturns look when viewed over the course of a century. Viewed from afar, even the Great Depression of the 1930s, the stagflation of the 1970s, and the Global Financial Crisis of 2008 seem forgettable.

It's just a 125-year chart of the US stock market. I want you to notice how small those little downturns look when viewed over the course of a century. Viewed from afar, even the Great Depression of the 1930s, the stagflation of the 1970s, and the Global Financial Crisis of 2008 seem forgettable.

I want you to also notice how frequently the market was at “all-time highs.” Heck, the S&P 500 had something like 50 “all-time highs” in 2024. This is why the best time to invest is now (assuming you have no functioning time machine). Yes, there's a decent chance the market will go down before it goes back up again. So what? You're not investing this money for next week or even next year. This is money you won't spend for 10, 20, or maybe 50 more years.

More information here:

What to Do After You Invest

OK, you've invested. You dumped that $2,000 you carved out of last month's income into some index fund from Vanguard. Now what? Should you go back and look at what it is worth every day? Should you tune in to CNBC to see what happened? Nope. You should just get ready to do the same thing again next month.

I started investing in 2004. Here are all the months I have invested money in since then:

- January

- February

- March

- April

- May

- June

- July

- August

- September

- October

- November

- December

Here are all the years I've invested in since then:

- 2004

- 2005

- 2006

- 2007

- 2008

- 2009

- 2010

- 2011

- 2012

- 2013

- 2014

- 2015

- 2016

- 2017

- 2018

- 2019

- 2020

- 2021

- 2022

- 2023

- 2024

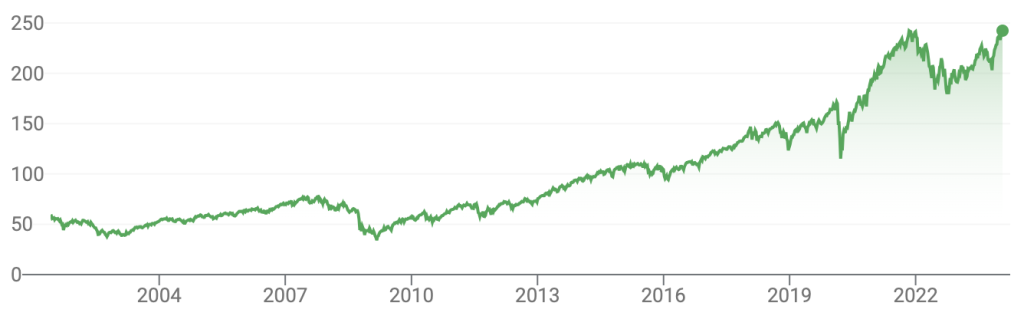

If you multiply those two by each other, you'll see I've invested money about 250 times. That's 250 times I put money into the market, not knowing if the market was going to go up or down. Sometimes, it was July 2008, and the market went down afterward. Sometimes, it was March 2009, and the market went up afterward. Sometimes, it was February 2020, and the market went down and then rapidly back up. Sometimes, it was July 2022 and the market went up and then rapidly back down. But over the last couple of decades, my persistent efforts have been rewarded:

See how today's value is higher than all of the values in all (or depending on the month almost all) of the months that I invested in previously? Those charts don't even include the dividends these stocks have paid me every quarter or so. That's happened about 84 times so far.

See how today's value is higher than all of the values in all (or depending on the month almost all) of the months that I invested in previously? Those charts don't even include the dividends these stocks have paid me every quarter or so. That's happened about 84 times so far.

After you invest for the month, you go fill your life with all of those things that life is full of—work, play, recreation, family, adventure, travel, heartache, whatever. Then next month, when you have money again, you do that thing that rich people do. You invest.

What do you think? Why do we make investing so complicated when it can be so simple? Why do so few people, even white coat investors, understand and follow the simple principles in this blog post? Why is it so hard to stay the course?