Full-time jobs often come with a number of benefits, but salary is often where we focus the most. That’s because how much we earn dictates how we live, what we can afford in the short and long-term, how long we might stay in a given position, and more.

An annual salary, of course, is not what will be available to you to spend, however. That figure is how much you’re paid on paper, but several deductions will bring that figure down a bit, limiting your actual spending power. To get a better feel for how much of your hard-earned salary will actually be available to you, you can calculate your annual income, or take-home pay. Knowing this figure will help you build a budget and plan your financial future.

Keep reading to learn how to calculate your annual income, the difference between salary and take-home pay, and how taxes factor into your overall earnings.

What’s the Difference Between Gross Income and Net Income?

Your income comes in two forms—gross and net. Gross pay is the aforementioned “on paper” total you earn; it's your salary before deductions such as taxes, health benefits, and retirement contributions coming out of your paycheck. Meanwhile, net pay is your true “take-home” pay. This is the figure you can use to calculate your annual income because your deductions have been tabulated.

To quickly calculate your annual income, you can divide your gross pay by the number of your company’s pay periods (either 52, 26, or 12, depending on whether your employer pays you weekly, bi-weekly, or monthly) and then subtract your payroll deductions, such as your health insurance premiums, 401(k), and taxes.

More information here:

Track Your Financial Goals with These 4 Measurements

3 Big Tax Deductions for Doctors

How Do Taxes Impact Annual Income?

There are some payroll deductions you could opt out of, but income tax is not one of them. You can count on federal income tax withholdings coming out of your paycheck as well as state income tax in many states. State income tax rates vary, while federal taxes use the same tax brackets for earners across the US.

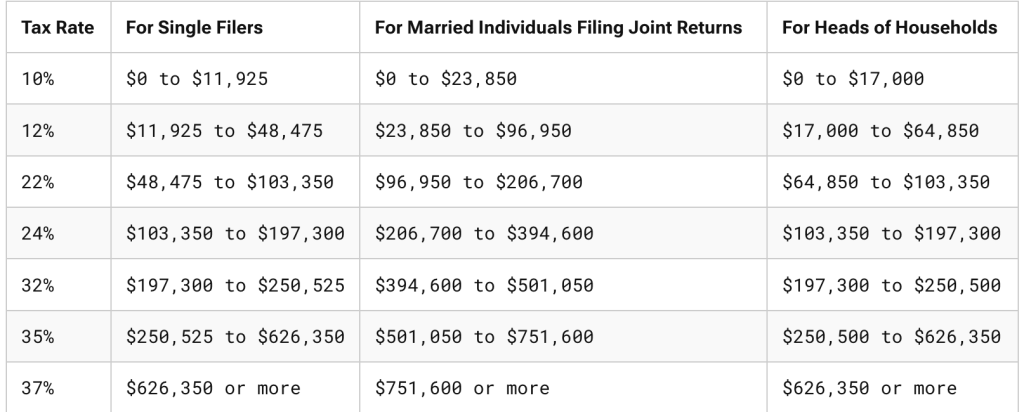

Your gross pay will determine how much you pay in federal taxes. The higher your income, the more you’ll pay in taxes, but your entire income isn’t taxed at a single higher rate. Instead, you pay income tax in different layers, aka tax brackets. As of 2025, for example, the first $11,925 of your taxable income is taxed at 10% (as a single filer). Then, your next $11,926-$48,475 is taxed at 12%.

Here are the remainder of the 2025 federal income tax brackets:

And here's what they'll look like for the 2026 tax year.

Remember, if your salary moves into a higher tax bracket, your entire income isn’t taxed at that rate, just the portion that’s in the new bracket. If you earn $150,000 a year, your salary won’t be taxed at 24%—only $103,351-$150,000 would be. The rest of your salary would only be taxed between 10%-22%.

What Can Be Deducted from My Annual Income?

To truly calculate your annual income, you need to know what’s being subtracted from your gross pay. Income tax for state and federal is just two deductions you can expect. Other deductions include:

- Social Security and Medicare taxes: Also known as Federal Insurance Contribution Act (FICA), the Social Security tax rate is 6.2% and Medicare is 1.45%. Employers must match employees’ contributions.

- Retirement savings: Contributions made to your employer’s retirement plan, like a 401(k), are also deducted from your gross pay.

- Health insurance premiums: Your employer will most likely cover some of your health insurance premiums, but you likely will also have to contribute to those premiums during each pay period.

- Group term life insurance: Your employer may offer basic term life insurance at no cost up to a certain amount of coverage. If you opt for additional coverage or want to buy life insurance for a dependent, the funds to do so would be deducted from your gross pay.

Mandatory deductions such as child support payments or wage garnishments could also be pulled from your paycheck if such a situation were to arise.

How Can I Increase My Annual Income?

Deductions from your gross pay can’t be avoided. At the very least, you’ll see federal, state, Medicare, and Social Security taxes subtracted from your paycheck. You can always attempt to offset such deductions by increasing your pay. Changing jobs to earn a higher salary is one way to boost your income, but there are also ways to do so at your current place of employment:

- Change your tax withholding: Income tax deductions are inevitable, but you have some control over how much comes out of your annual pay. If you decrease your tax withholding, you could see more take-home pay. You’ll likely owe the IRS at the end of the year, but at least you’ll have more cash on hand each month. Just be careful that you don’t withhold too little; otherwise, you could face underpayment penalties. A tax professional can assist you to ensure you’re withholding the right amount.

- Take advantage of company benefits: Contributing to your employer’s retirement plan is a great way to save for your future. Doing so can also help increase your overall compensation package. Be sure to take advantage if your company offers to match your 401(k) or other retirement account contributions. Those matches are essentially free money.

- Find ways to earn extra income: If it’s too soon in your career to ask for a raise, you can try to increase your earnings with another income stream. Generally speaking, this could be taking on a part-time job or freelancing, selling unused items, creating a business with the skills you use for your day job, or seeking opportunities that will allow you to earn passive income to limit your active hours after a long workday.

More specifically for physicians, extra money could be earned by conducting telehealth sessions, reviewing health insurance claims, serving as an expert witness for law firms, medical writing, or performing locum tenens work.

More information here:

How to Make 7 Figures in Medicine

Here’s How Much We Make, Save, and Spend as ‘Moderate Earners’

The Bottom Line

Starting salary is one of the biggest drivers for why any of us take a job. Before accepting a position based on pay, however, remember that number isn’t what you’ll actually see on your paycheck every two weeks. To get that number, you’ll need to subtract some key figures from your gross pay: federal and state income tax, Social Security and Medicare taxes, health insurance premiums, and retirement contributions, just to name a few.

When you calculate your true annual income, it will be easier for you to map out a monthly budget, understand what you can afford, and plan for retirement.

The White Coat Investor is filled with posts like this, whether it’s increasing your financial literacy, showing you the best strategies on your path to financial success, or discussing the topic of mental wellness. To discover just how much The White Coat Investor can help you in your financial journey, start here to read some of our most popular posts and to see everything else WCI has to offer. And make sure to sign up for our newsletters to keep up with our newest content.