The age-old question of “Does money buy happiness?” has been the subject of extensive research with conflicting conclusions. Some studies claim that money stops making us happier after a certain point, while others suggest that happiness rises indefinitely with income. The answer to that question, as it turns out, is more nuanced than a simple yes or no.

Defining Happiness: 2 Key Concepts

Before diving into the research, it's essential to define happiness, as different studies measure it in different ways:

- Evaluative Happiness: A person’s overall life satisfaction when reflecting on their life as a whole.

- Experiential Happiness: The emotional quality of daily life, measured through moment-to-moment feelings of joy or stress.

Psychologist Daniel Kahneman explains this distinction well:

“The experiencing self lives in the present. It has moments of joy and moments of pain. The remembering self is the one that keeps score and maintains the story of our life.”

Because of this, happiness is measured in two distinct ways—one reflects how we experience life day to day, while the other reflects how we remember and evaluate our lives.

The Kahneman Study (2010): Does Happiness Plateau?

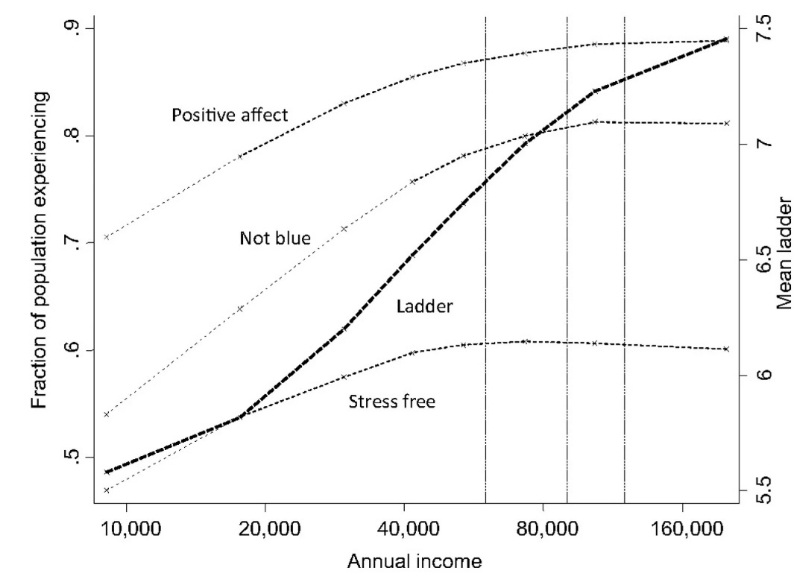

Kahneman, a Nobel laureate and a pioneer in behavioral economics, and esteemed economist Angus Deaton, also a Nobel laureate, analyzed data from the Gallup World Poll in a 2010 study to examine the relationship between income and happiness. They found:

- Life satisfaction (evaluative happiness) continued to increase with income.

- Emotional well-being (experiential happiness) plateaued at around $75,000 per year, suggesting that beyond this point, higher income did not significantly improve daily happiness. With inflation, we’re talking about $100,000-$110,000 in 2025 dollars.

Key takeaway: Money helps up to a certain point, but beyond that, factors like relationships, purpose, and health become more important for well-being.

Positive affect, blue affect, stress, and life evaluation in relation to household income. Positive affect is the average of the fractions of the population reporting happiness, smiling, and enjoyment. “Not blue” is 1 minus the average of the fractions of the population reporting worry and sadness. “Stress free” is the fraction of the population who did not report stress for the previous day. These three hedonic measures are marked on the left-hand scale. The ladder is the average reported number on a scale of 0-10, marked on the right-hand scale.

The Killingsworth Study (2021): No Plateau in Happiness?

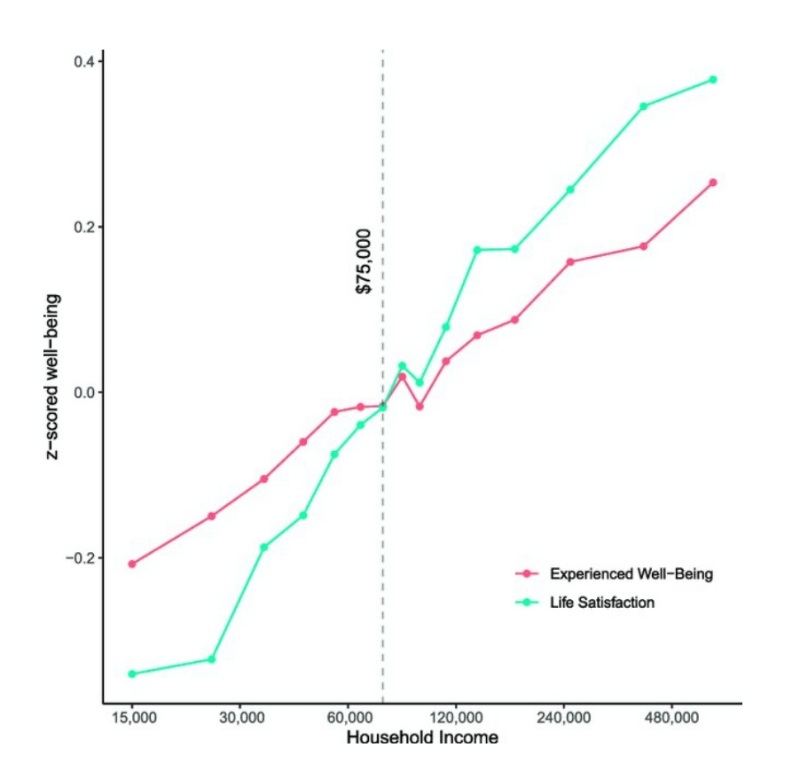

Matthew Killingsworth, a senior fellow at the Wharton School, approached the question differently in 2021 by using real-time experience sampling. He collected 1.7 million happiness reports from over 33,000 individuals via a smartphone app, asking participants about their moment-to-moment happiness.

Unlike Kahneman’s study, which relied on retrospective assessments, Killingsworth’s study measured real-time experiences. His findings showed:

- Both evaluative and experiential happiness continued to increase with income, with no clear plateau.

- Higher earners generally reported greater happiness at every level of income.

Key takeaway: Killingsworth found that 74% of the relationship between income and happiness was explained by how respondents answered a single question:

“To what extent do you feel in control of your life?” This suggests that higher income increases happiness. It's not necessarily because of wealth itself but because it provides greater autonomy—the ability to make choices, reduce stress, and avoid unpleasant situations.

Mean levels of experienced well-being (real-time feeling reports on a good-bad continuum) and evaluative well-being (overall life satisfaction) for each income band. Income axis is log transformed. Figure includes only data from people who completed both measures.

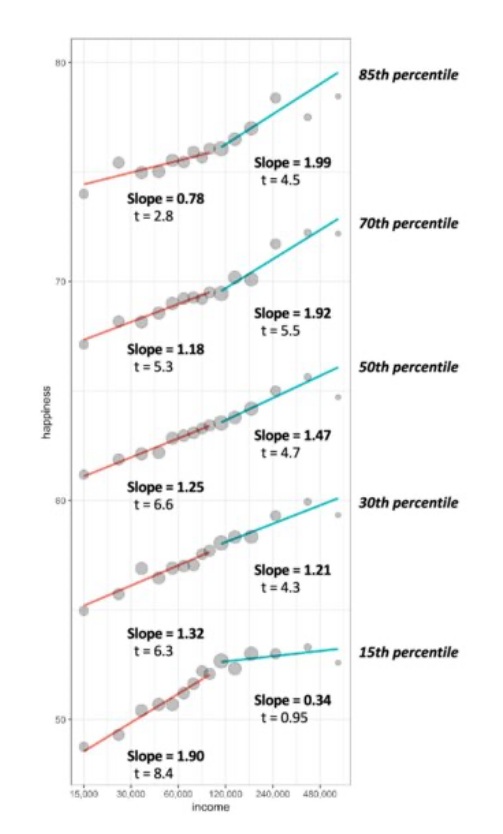

The Collaboration (2023): Reconciling the 2 Studies

In 2023, Kahneman and Killingsworth worked together to resolve their conflicting findings. Their reanalysis found that both conclusions were partially correct:

- For the least happy 20%, emotional well-being plateaued at around $100,000.

- For the majority of people, happiness continued to increase with income.

- For the happiest individuals, the impact of money accelerated beyond $100,000.

Key takeaway: The effect of money on happiness depends on baseline well-being—those who are already struggling may not see much benefit from higher income, while those who are content may experience increasing returns.

Emotional well-being of the 15th, 30th, 50th, 70th, and 85th percentiles of the person-level happiness distribution in MK, calculated within each income category. Slopes were calculated below and above $100,000, using quantile regression.

More information here:

Flourishing at Work: What Physicians Get Wrong About Career Happiness

The Other Side of Hedonic Adaptation: When Life Knocks You Down

Why Perceived Control Matters More Than Money

Killingsworth’s study revealed that autonomy (control over one’s life) is one of the strongest predictors of happiness. This aligns with decades of research in psychology, particularly Self-Determination Theory (Deci & Ryan), which highlights three psychological needs that drive happiness:

- Autonomy: The ability to make choices aligned with personal values.

- Competence: Feeling capable and effective in life.

- Relatedness: Strong social connections and meaningful relationships.

So, why does autonomy matter? Research by Angus Campbell found that, “Having a strong sense of controlling one's life is a more dependable predictor of positive feelings of well-being than any of the objective conditions of life we have considered.” Studies across different cultures confirm that autonomy is a universal driver of well-being, even in collectivist societies. And for physicians, one of the biggest contributors to burnout is a lack of autonomy—whether in patient care, scheduling, or career flexibility.

The implication is that increasing income enhances happiness only if it translates into greater control. For example:

- Reducing financial stress (paying off debt, building savings).

- Allowing career flexibility (working fewer hours, choosing meaningful work).

- Enabling fulfilling experiences (travel, personal growth, philanthropy).

- Strengthening relationships (more time with family and friends).

Other Research on Money and Happiness

Experiential vs. Material Purchases

Spending on experiences (travel, dining, events) leads to greater happiness than buying material goods. Why? Experiences create lasting memories and enhance social bonds.

Prosocial Spending

Research by Elizabeth Dunn found that spending money on others (charity, gifts) boosts happiness more than spending on oneself. This effect is consistent across cultures and age groups.

Financial Security and Stress Reduction

Having financial security (savings, lack of debt) strongly correlates with happiness. Financial instability creates stress that diminishes well-being.

The ‘Warm-Glow' Effect

Giving money away activates brain regions associated with pleasure and reward. The act of giving itself creates happiness, independent of the recipient’s benefit.

More information here:

Will More Money Make Me Happier?

Leaving Dentistry and Finding Happiness

Beyond Money: What Really Drives Happiness

While income plays a role, other factors contribute far more to long-term well-being:

- High-quality relationships: The Harvard Study of Adult Development found that strong social connections are the single greatest predictor of happiness and longevity.

- Autonomy and control: Research across cultures shows that the ability to make life decisions freely is essential for well-being.

- Purpose and meaning: Living a meaningful life (eudaimonic well-being) is more predictive of happiness than chasing pleasure.

- Emotional and physical well-being: Mental and physical health are more important than financial security for happiness.

How to Apply These Findings

Yes, money matters but primarily as a tool for fostering autonomy and control over your life.

When your income increases—such as after completing residency—consider continuing to live like a resident for 2-5 years. Allocating this additional income toward eliminating debt and front-loading retirement savings builds early financial security, giving you greater control over future career and life choices. To maximize happiness, focus on gaining control over your time rather than solely increasing earnings. This often means reducing work hours, outsourcing unenjoyable tasks like house cleaning, and using financial stability to create more time for activities that bring joy.

Buying Back Time

One of the greatest benefits of financial security is the ability to buy back time by spending less time on tasks that don’t bring fulfillment. Early in my career, I handled every minor home repair myself. Now, I hire professionals for certain tasks—freeing up time to be with my family, fish with my kids or close friends, and engage in activities that genuinely bring joy.

Prioritizing Meaningful Work Over Higher Pay

Throughout my career, I’ve had opportunities to pursue more lucrative positions, but they would have come at the cost of flexibility, autonomy, and purpose. Instead, I’ve chosen work that allows me to:

- Teach a finance course to medical students.

- Mentor and train cardiology fellows.

- Conduct research that I find engaging and valuable.

- Spend one day per week in clinic, watching my patients grow up.

- Spend 1-2 days per week in the Echo lab interpreting echocardiograms and teaching.

- Have 2-3 dedicated office days each week, structured to maximize effectiveness and efficiency.

Investing in Relationships

Money is best spent strengthening relationships and shared experiences. Some of my happiest moments come from spending quality time with my wife and children, hosting friends for dinner, and having the financial flexibility to be present for important life events.

My wife and I also find deep joy in being generous with those in our lives, which further strengthens our relationships. Additionally, I’m fortunate to work alongside some of my best friends, making my daily work more enjoyable.

Prioritizing Mental and Physical Health

Because of financial and time affluence, I can prioritize daily exercise, a healthy diet, and regular therapy. The ability to manage stress, stay active, and eat well contributes far more to my happiness than any material purchase ever could.

More information here:

What We Can Learn About Work-Life Balance and Retirement from the French

Financial Lessons Learned from a Doctor Turned Patient

The Bottom Line

Money is a powerful tool—but only if used wisely. If you earn a high income, the challenge isn’t just making more; it’s using your resources to build a fulfilling life. Invest in autonomy, deepen your relationships, and prioritize purpose and well-being. The question isn’t just how much money you make, but how well you use it to create a truly happy life.

How have you created a happy life? What has worked to your advantage, and what hasn't? How much does money play a role in your happiness?