[EDITOR'S NOTE: As of May 2025, entities formed inside the US no longer have to register for FinCEN. That rule now only applies to “those entities that are formed under the law of a foreign country and that have registered to do business in any US State or Tribal jurisdiction by the filing of a document with a secretary of state or similar office.”]

I'm really sorry to be the bearer of bad news, but if you own a small company, you have some work to do. Don't worry, it won't cost you any money, and it really won't take you that long. I just did it for six companies in less than an hour. But you definitely want to make sure you do it because the penalties for not complying with the Corporate Transparency Act are quite severe.

What Is the Corporate Transparency Act?

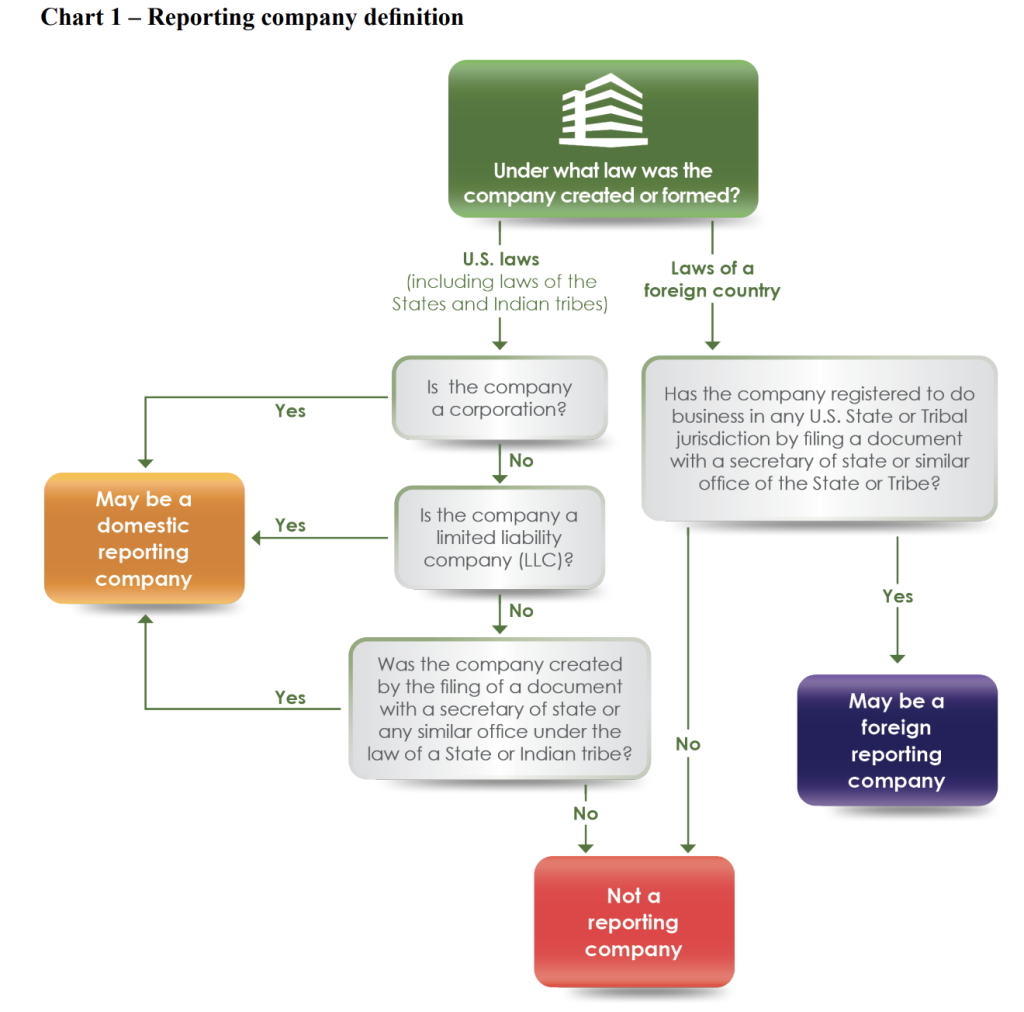

The Corporate Transparency Act was passed as part of the National Defense Authorization Act for Fiscal Year 2021. It requires businesses to file “beneficial ownership information” with the Financial Crimes Enforcement Network (FinCEN), a part of the Treasury Department. Its purpose is to prevent nefarious individuals from hiding their illicit activities behind shell corporations and LLCs.

You know how those asset protection guys were always telling you that if you created enough LLCs in enough states, nobody could figure out what you own? Apparently, there was some truth to that. In an effort to stamp out financial crime, we're now all required to register the “beneficial ownership” of our companies in a database at FinCEN. The information will not be publicly available, but it will be available to lots of government entities and, with the permission of the company, financial institutions.

Who Is a Beneficial Owner?

A beneficial owner is an individual—never another company or a trust or any other sort of non-person entity. If the owner of a company is a trust (like in our case), the trustees are listed as the beneficial owners. Beneficial owners have driver's licenses, birth dates, and residential addresses. They own at least 25% of the company or they are trustees of a trust that owns at least 25% of the company or they “exercise substantial control” over the company (i.e., they function in the company as president, CEO, COO, or CFO, or they have the ability to remove such senior officers). The act requires that each beneficial owner registers with FinCEN their name, residential address, birth date, driver's license (or similar ID) number, and a copy of their driver's license (or similar ID). It's free to register, and it only takes a few minutes to do online at this website.

More information here:

10 Reasons You Should Own a Business

When Does the Corporate Transparency Act Take Effect?

For a company that was already in existence on January 1, 2024, the deadline is January 1, 2025. If a company is formed in 2024, it has 90 days to register with FinCEN. If you become aware of an error or if information changes, you have 30 days from the time you became aware of the error or the information changed to correct it.

Corporate Transparency Act Penalties

The penalties for not registering are quite severe: $500 per day that you don't file. You can even face a fine of $10,000 and up to two years in jail for not filing or filing false information. We won't know how lenient this law really is until at least 2025, but I don't want to try to talk my way out of this, much less pay fines of $500 per day for noncompliance.

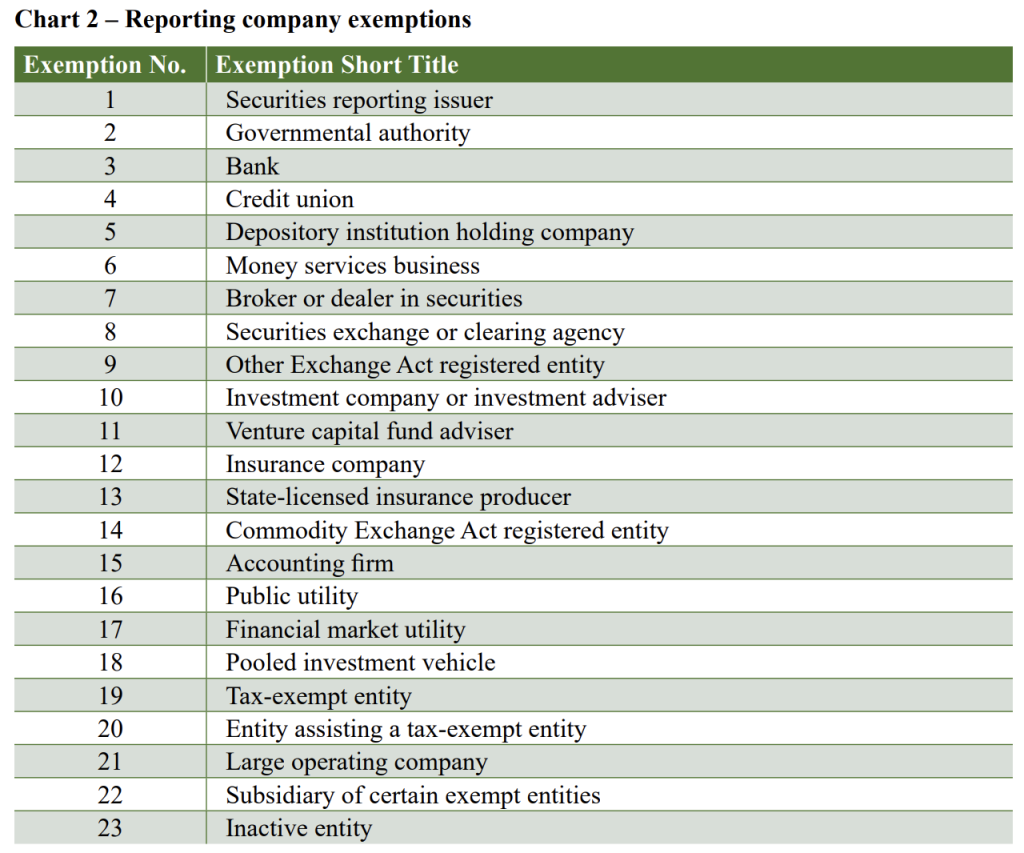

Corporate Transparency Act Exemptions

Yes! There are lots of exemptions in the Corporate Transparency Act. The most notable one is being a “large operating company.” If the company has at least 20 full-time (30 hours+ per week) employees and at least $5 million in revenue, you don't have to file. However, there are plenty of other exemptions, including:

Be careful with the “inactive entity” exception. If the company has done any business in the last 12 months, you still likely need to file. Most small businesses are going to need to do this—including corporations; LLCs; and, if registered with the state, sole proprietorships. I couldn't remember if my sole proprietorship was registered with the state, so I registered it with FinCEN just in case. As far as I can tell, there's no harm in registering a company that is exempt, so when in doubt, report.

Corporate Transparency Act Reporting Requirements

You'll need the following information to report your company:

- Company name

- Any trade names

- Company address

- Company Employer Identification Number (EIN)

- Identifying information for company applicant(s) (name, address, birth date, driver's license) if formed after January 1, 2024

- Identifying information for all beneficial owners (name, address, birth date, driver's license)

More information here:

A Step-by-Step Guide to Starting a Medical Practice

What If I Still Have Questions?

FinCEN has a nice FAQ page and has put out a small entity compliance guide that is very helpful.

How Do I Report My Company?

Want someone to walk you through the process of reporting? No problem. I took some screenshots as I did it.

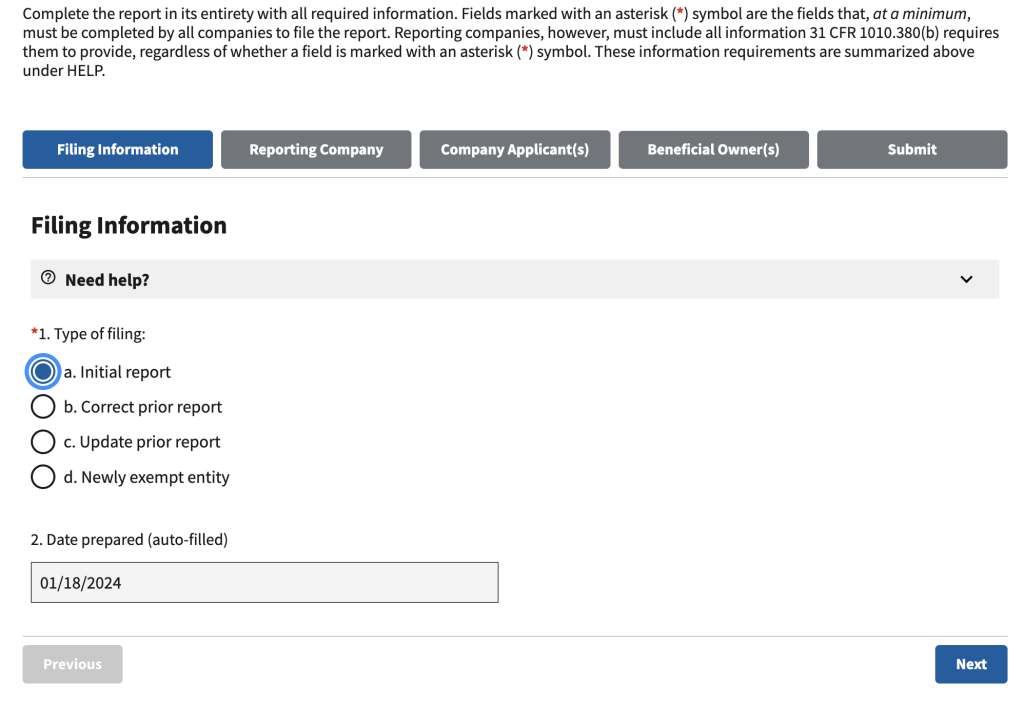

First, go to https://boiefiling.fincen.gov/boir/html

Click box 1a for Initial Report and hit Next.

That will take you to the reporting company tab.

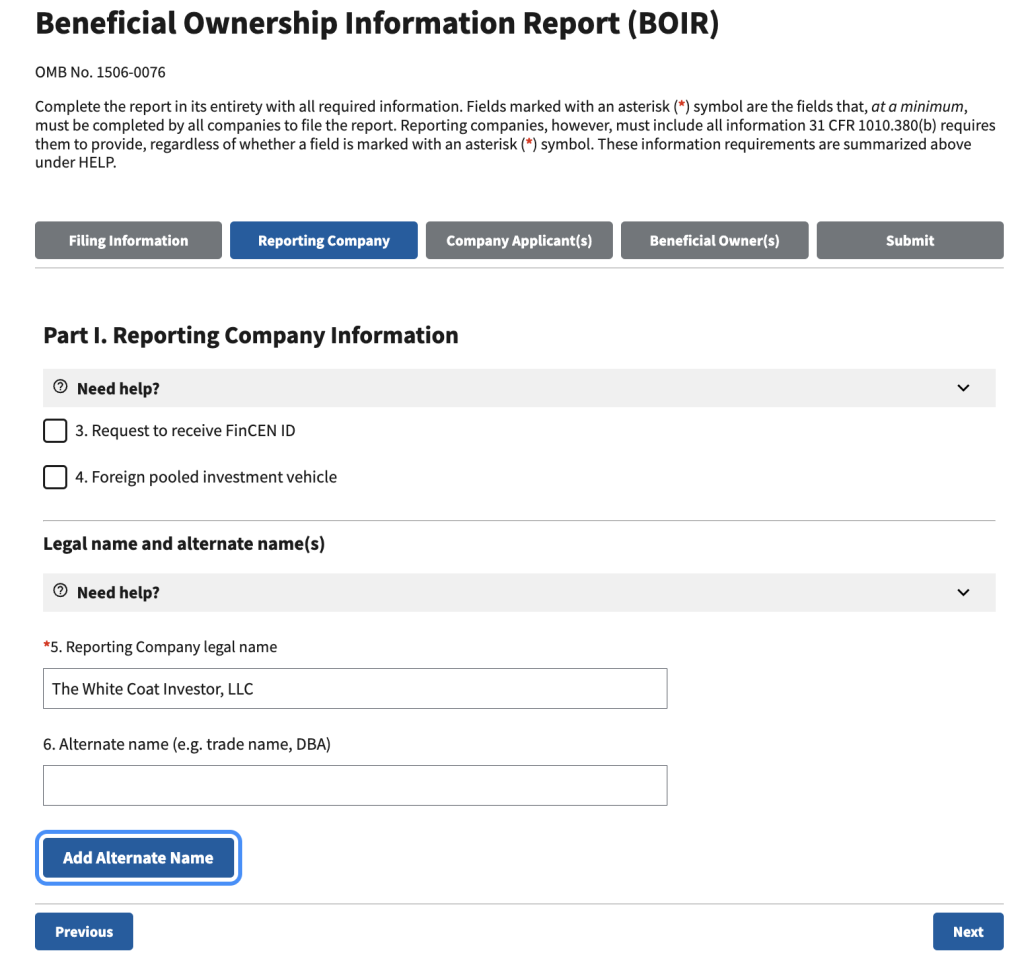

If you're reporting dozens of companies, it might be worth getting FinCEN IDs for the company and the beneficial owners. I decided I didn't own enough companies for that to be worth the hassle. Type in the legal name and trade name of the company and scroll down.

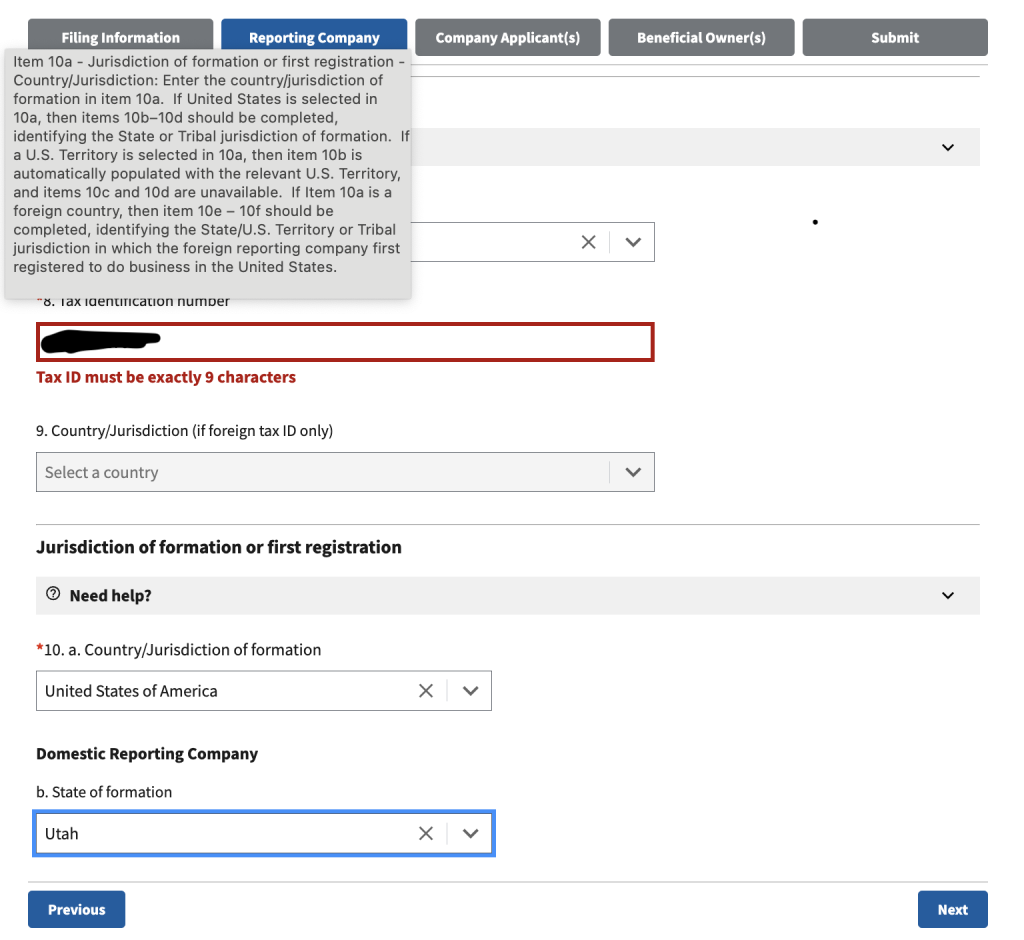

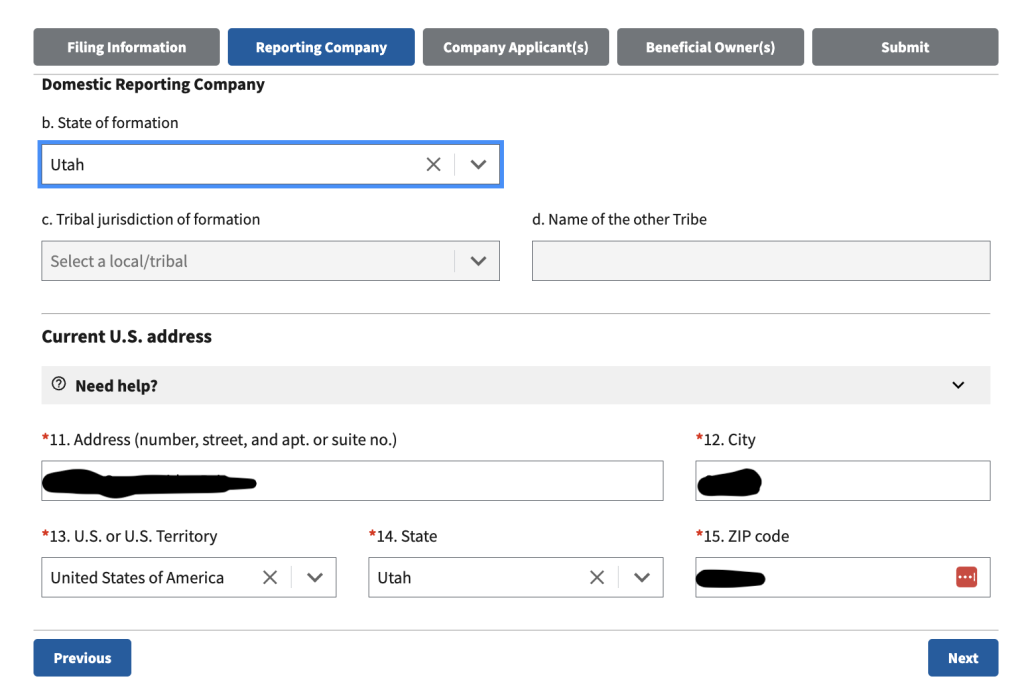

Put in your EIN, select the USA and your state, and then put in the company address. Easy peasy.

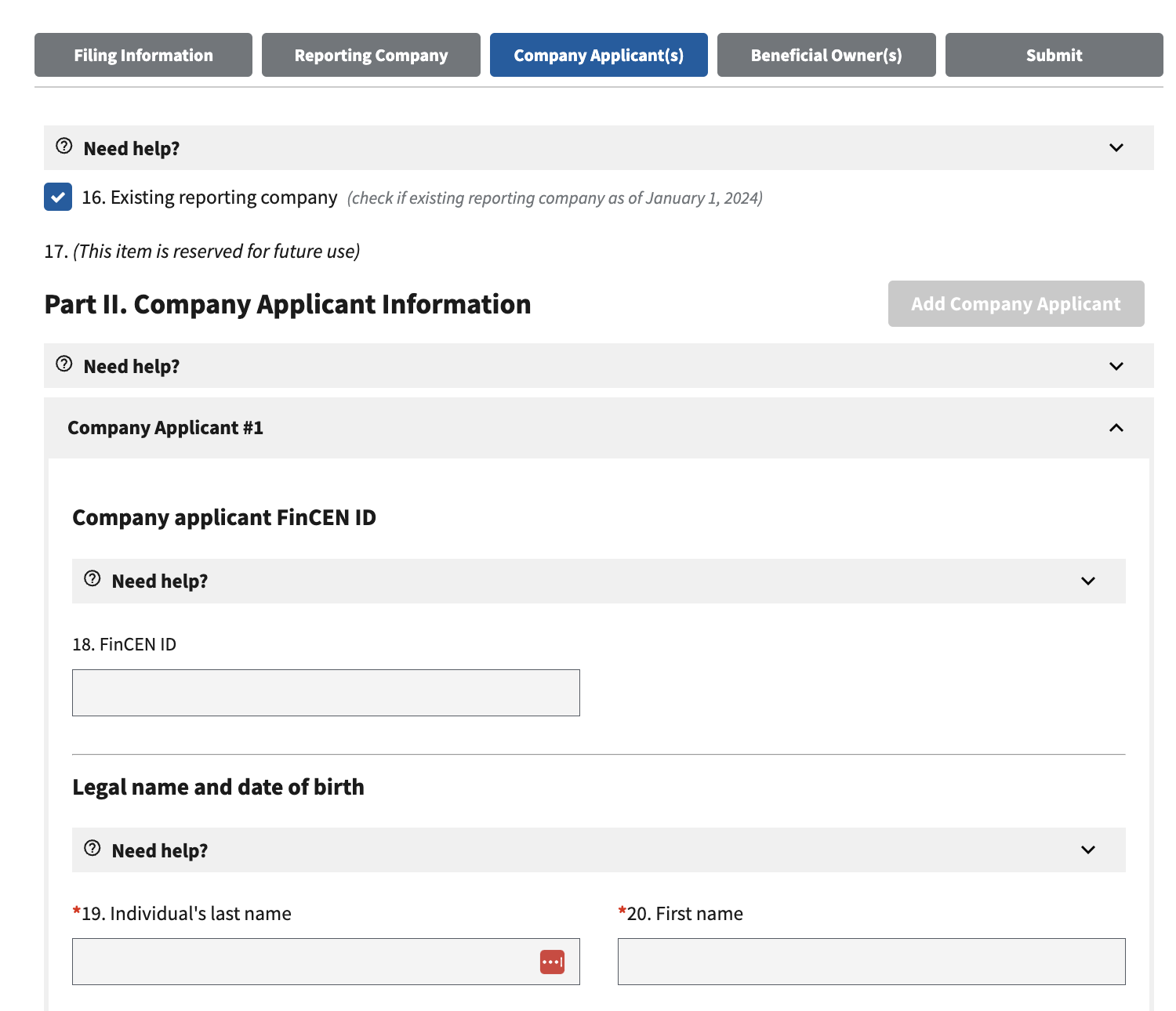

Hit Next, and you'll move to the company applicants tab. I didn't read the directions very well. Since all our companies were formed before 2024, we didn't actually have to fill out this part. Company applicants are 1-2 people who registered the company with the state. I can't really remember, but I'm pretty sure I signed off on all of them so I just put my name down for each company. Here's what I should have done:

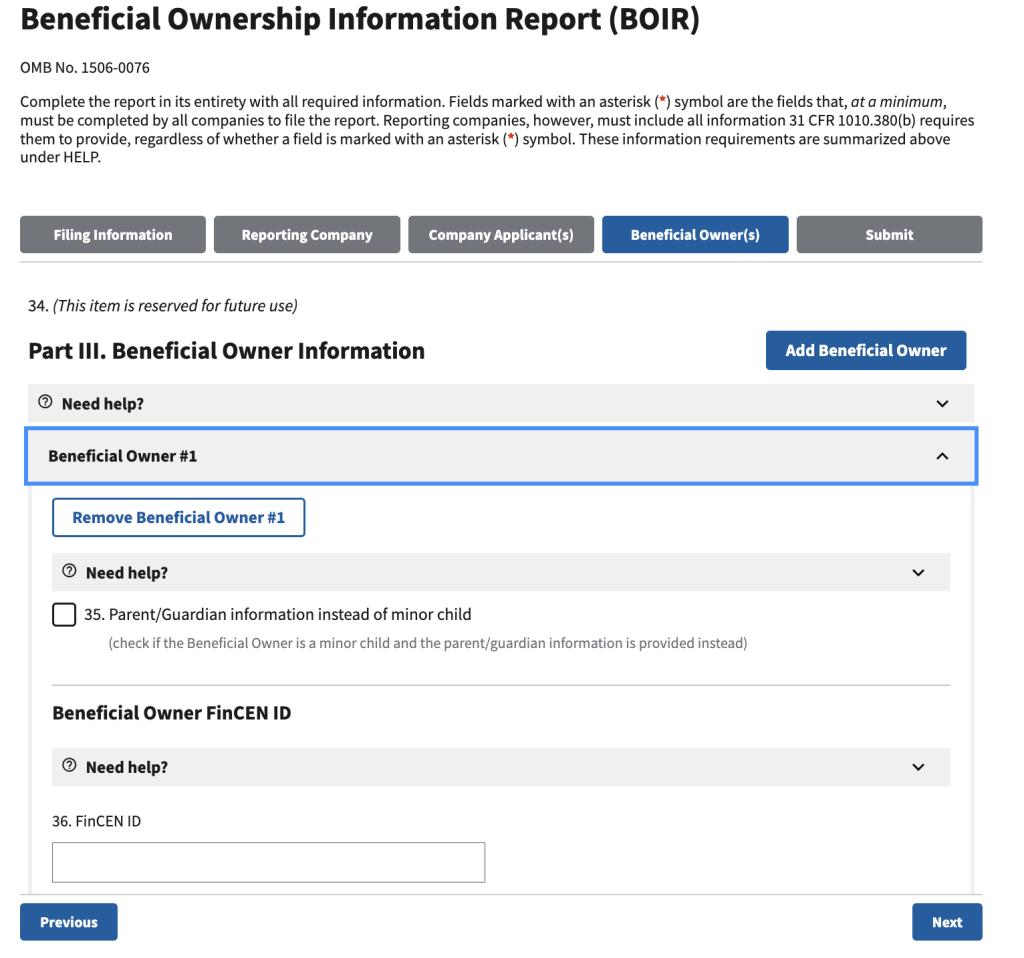

Click Box 16 saying the company was in existence already on January 1, 2024. The information you supply for company applicants is exactly the same as what you put down in the next section: the beneficial owners section. You do this once for each beneficial owner. If there is more than one, just hit the Add Beneficial Owner button after you complete each one.

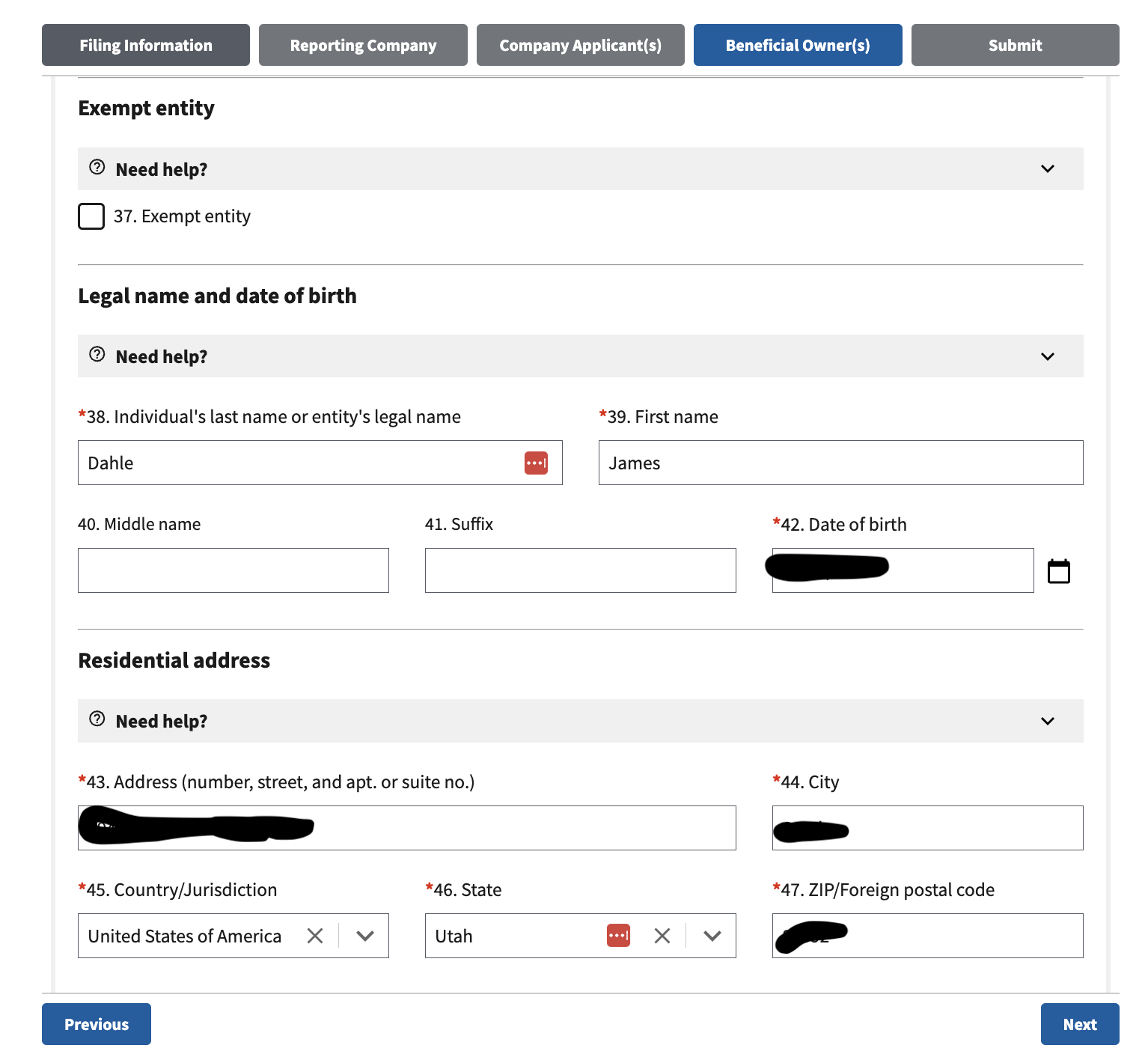

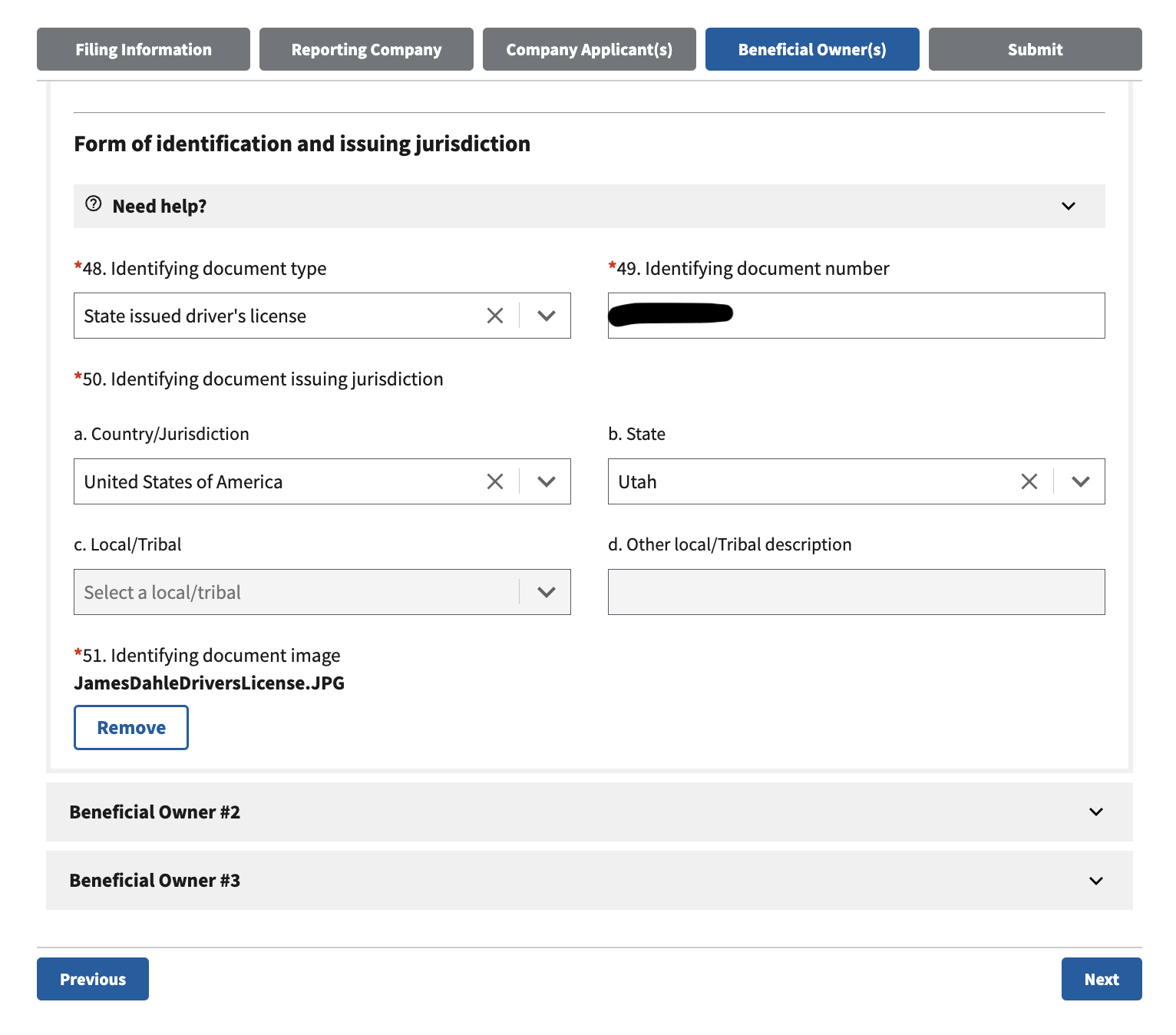

Again, I didn't bother with getting a FinCEN ID for any of our owners. Scroll down and you'll put in the name, birth date, address, driver's license number, and image for each owner.

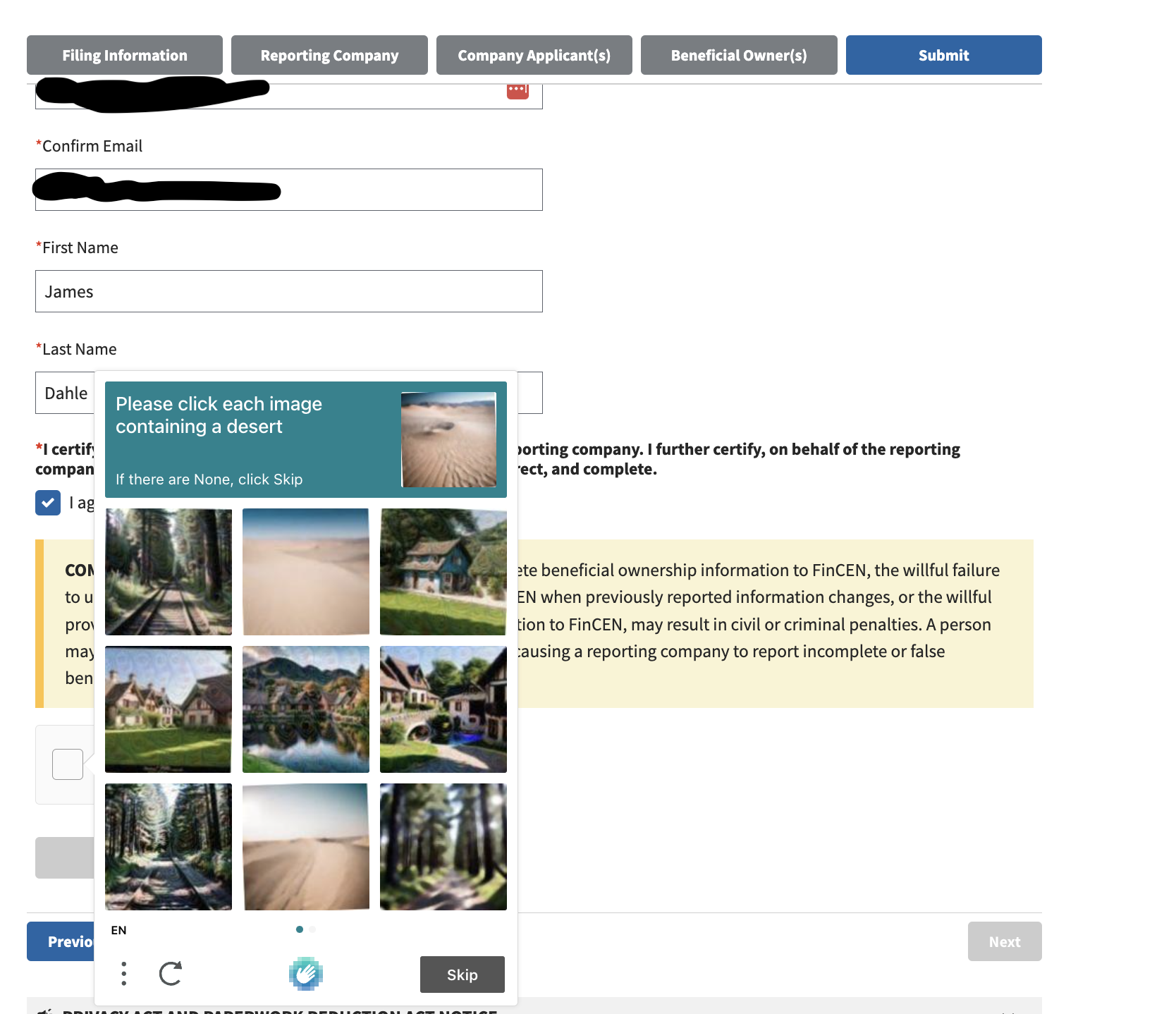

Hit Next to go to the last tab. Enter your email address twice, type in your name again, and solve a CAPTCHA to prove you're human.

Frankly, the CAPTCHA is the hardest part of the whole thing. Download your confirmation transcript somewhere safe, and you're done!

The Corporate Transparency Act is a bit of a pain to comply with, but at least it's free and easy to do.

What do you think? Have you registered your companies yet? How did it go? Were there any surprises for you?