By Dr. Rikki Racela, WCI Columnist

By Dr. Rikki Racela, WCI ColumnistAs the WCI poster child victim of losing $50,000 to stupid whole life insurance, I have fielded many questions from fellow victims about the best way to get out of this detrimental financial product. Two words . . . actually one number and one word: 1035 exchange.

In this column, I will walk through the steps of how and why to do a 1035 exchange on whole life insurance and whole life’s evil permanent life insurance cousins: indexed universal life, variable universal life, and other variations. For those of you who had the financial foresight to not get into these products, I applaud you. But I also encourage you to keep reading since you probably know a fellow doc who has one of these terrible products that is killing their ability to build wealth and gain financial freedom. You can be immensely helpful to your fellow colleagues by discussing the 1035 exchange.

Whole Life Insurance and the 1035 Exchange

But first, should you even do one?

Before we delve into how to do the 1035 exchange, we must first ask if it's worth doing in the first place. If in the unlikely event that a whole life policy was sold to you appropriately, then you don’t need to do the exchange. WCI Founder Dr. Jim Dahle has written on appropriate uses of whole life insurance, and these include having a disabled child (who is dependent on your income even if you die in your 80s), having an estate tax problem (ex: you have a huge farm that will cause your kids to pay a massive tax bill after you die that could be covered by the death benefit), and “keyman” insurance if you are the head and an integral part of a company. Most of the people reading this would not have been sold whole life appropriately, and this column will still apply to you.

But Rik, what about the death benefit? Isn’t worth it to pay those high premiums for the death benefit? Easy answer: NO! You are paying WAY too much for a death benefit to cover your whole life, whereas premiums are at least 10x cheaper if you get a term life insurance policy where the term covers when you actually need the insurance. However, if you were sold a policy and now you have an unfortunate terminal health condition, it makes sense to keep whole life for the death benefit given your diagnosis. Otherwise, don’t keep your permanent insurance policy just for the death benefit. Get term life instead.

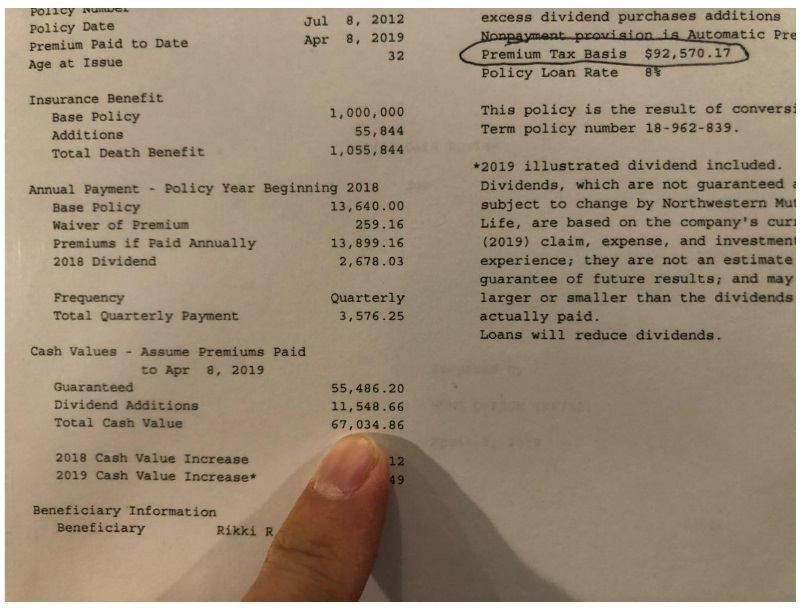

A more likely scenario where you might keep your whole life policy is if your cash value exceeds your cost basis. For those who don’t know these terms, don't worry. While I was getting financially literate, I didn’t know what “cost basis” was either. Cash value is the amount of money you have saved up in your policy, and it's the money you would receive if you were to surrender the policy. Cost basis is the amount of money you paid in premiums overall. If your cash value is greater than your cost basis, then serious consideration has to be made about keeping the policy, as the returns going forward when paying your whole life premiums are not so bad. All the bad returns you’ve paid previously are water under the bridge.

In fact, I recently talked with a physician friend who mentioned that he was happy with his whole life policy since the bad returns were behind him, and he uses it to “bank on himself” where he is taking out a loan on his cash value and not paying it back. I didn’t get into details, but he likely would have been a lot wealthier by just initially investing those whole life premiums in a taxable account. But his policy is at a point which works for him. If you are at this point, you likely don’t need to do a 1035 exchange. Also, if the cash value of your permanent life insurance policy is less than $10,000, don’t even bother with a 1035 exchange since this is the minimum you need to fund a low-cost variable annuity.

But for those who got screwed like I did and your cash value is less than the cost basis and you have at least $10,000 of cash value, this is for you.

More information here:

Should You Keep Whole Life Insurance Policy and How to Cancel

When to Exchange Your Whole Life Insurance Policy for a Modified Endowment Contract

The Tax Benefit of a 1035 Exchange

Now, let's talk about this fancy “1035 exchange” thing. Basically, it’s a tax benefit. The difference between the cost basis of your permanent life insurance policy and your cash value is how much money you’ve lost to the insurance company. You can’t declare that loss on your taxes. But you can exchange your permanent life insurance policy, where the cash value grows super slow, for a low-cost variable annuity, where the previous cash value of the permanent life insurance policy can be invested in a low-cost index fund and where it can skyrocket much faster.

Yes, variable annuity (VA) is a four-letter word, but in this case, I will outline why the Fidelity low-cost VA product acts as a savior when doing a 1035 exchange. The low-cost VA can quickly grow back to your cost basis tax-free. Once the variable annuity grows to cost basis, you surrender the VA and voila, you’ve made up the money you lost to the permanent life insurance policy without having to pay taxes on it. If you don’t surrender the annuity and it continues to make money, those profits become taxable when you surrender the policy—and if you surrender before age 59 1/2, the profits get hit with an additional 10% penalty. So, do yourself a favor and nix the annuity once it hits the cost basis and invest elsewhere.

Let me use my wife and I as an example. Our combined whole life policies had cost bases equaling $170,000. Again, this is the amount in total premiums we had paid into our policies after seven years. The combined cash value in our policies totaled $120,000. That means we had lost $50,000 to these malicious policies. Some investment, huh! But after I got financially literate, I 1035 exchanged our policies into low-cost VAs at Fidelity (which, in my analysis, is the best low-cost VA), invested those in total stock market and total international subaccounts, and waited a year and a half. By then, our policies grew by $50,000, and we surrendered our annuities. No taxes due! We then placed that money into our taxable account.

Contrast this to if we had just surrendered our whole life policies and directly invested them into taxable. Say we made back our $50,000 loss in that taxable account. Let’s assume we didn’t need the money anytime within a year, so we would be at long term capital gains rates. Since we are high income and very possibly will be spending a lot in retirement, we will assume the highest long term cap gains brackets, which would be 23.8% federal and 8.97% in New Jersey. So, $50,000 x 32.77% = $16,385 is the amount I saved in taxes by doing the 1035 exchange. Not a bad chunk of change, especially given how easy this process is, which I will outline below.

My wife's whole life insurance $25,000 loss . . . painful

Why You Should 1035 Exchange with Fidelity

Now that you want to do a 1035 exchange given its tax benefits, which product should you use? Easy: use Fidelity’s low-cost variable annuity, called the Fidelity Personal Retirement Annuity. No, I am not getting paid by Fidelity, but it has the lowest cost VA out there with the lowest fees. I mentioned earlier that variable annuity is a four-letter word, but after analyzing Fidelity’s low-cost VA product, it has basically eliminated many of the dirty parts—namely fees—of a VA. It’s almost as if Fidelity designed their VA to help clients get out of bad insurance products.

FiPhysician compared low-cost VAs and showed why Fidelity came out on top. As you can see from the article, you can invest in Fidelity’s total stock market subaccount at 37 basis points, total international at 44, and total bond at 39. These are the lowest-cost options of any low-cost VA; in contrast, the average cost to invest in a VA subaccount is as high as 224 basis points. The article is a little outdated since Vanguard no longer offers a low-cost VA and sold their VA business to Transamerica. Finally, there are no surrender fees with Fidelity’s VA. Thanks to its low costs, Fidelity it is!

More information here:

The 1 Portfolio Better Than Yours

What to Do If You’re Not on the Same Financial Page as Your Spouse

How to Do the 1035 Exchange

I have to give credit where credit is due. The original way I learned to do the exchange was by reading a comment by TJ on the WCI post How to Dump Your Whole Life Policy.

I have modified the steps based on my experience. Also realize that my whole life insurance term policies were covering my life insurance needs. Before you do these steps, make sure you have appropriate term life insurance in place.

- Ask for an “in-force illustration” of your permanent life insurance policy from your “advisor” and see if it is worth doing the 1035 exchange. The in-force illustration has all the information about your permanent insurance policy, including the important cash value and cost basis numbers.

- Tell your “advisor” to suspend premium payments because you are having trouble affording the policy (this was totally honest in my case, but you should also do this so you stop throwing good money after bad). If you don't do this but rather just stop paying the premiums, the policy may automatically take premium payments from your cash value. Make sure to formally ask that premium payments get suspended.

- Call your permanent life insurance company and say you want to do a 1035 exchange. Note that you don’t have to call your “advisor;” that way, you can avoid any unpleasantness. Just call the company’s general number. This worked out great in my case. My buddy/”advisor” who sold me the whole life policies later called me to try to convince me to turn the policy into “paid-up” status or to lower the premiums, etc. Ignore these desperate attempts to get you to keep feeding the beast and losing money.

- In my case, Northwestern Mutual referred me to their “1035 Exchange Unit” where I had to ask for a “Request for 1035 Exchange” form to be sent to me. Note: I am not sure if other insurance companies do this.

- Complete your portion of the “Request for 1035 Exchange” form.

- Call Fidelity and say you want to open a low-cost variable annuity and say you are doing a 1035 exchange. Forward them the “Request for 1035 Exchange” form, and Fidelity will fill out its portion and send it back to Northwestern Mutual. Note: I am unclear if other insurance companies have this type of form or even a 1035 Exchange Unit. This was how it was done with Northwestern Mutual, specifically.

- Fill out the required Fidelity forms and send them back.

And that’s it! The process only took a couple of weeks and not even an hour of my time. Fidelity would keep me up to date on the exchange throughout the whole process, and suddenly BOOM! I logged into our Fidelity accounts and there was our cash value, now in the domains of newly minted low-cost variable annuities.

Next came investing that cash value.

Investing in Fidelity’s Low-Cost Variable Annuity

What should you invest in the Fidelity low-cost VA? I would limit it to three subaccounts due to cost (when in a variable annuity, the funds are referred to as “subaccounts”):

- Total stock market index fund (cost of 37 basis points)

- Total international index fund (cost of 44 basis points)

- Total bond index fund (cost of 39 basis points)

There is an S&P 500 subaccount and an extended market index subaccount that are 35 and 38 basis points, respectively, that are also reasonable due to their low cost. All the other subaccounts within the Fidelity low-cost VA have fees that are way too high, so don’t even bother considering them. Out of these 3-5 subaccounts, you would invest as per your written financial plan (I hope you have one!) along with your chosen asset allocation. I would encourage you to fill this VA with all equities as part of your overall asset allocation because:

- You want this higher fee account to grow quickly so you can get out of paying those higher fees.

- You are making up a loss tax-free, and, in general, you want your highest-growing assets to grow tax-free.

- There is a little bit of friction when it comes to buying and selling in this account. You are limited to six transactions per year, and any other trades after that incur a $15 fee. There are also a ton of extra clicks to buy and sell in this VA. But when you see the value of your low-cost VA tank in a bad bear market, that little bit of friction can actually be the barrier you need to stay invested.

After you are fully invested in your VA, just be patient. In no time, you will be hitting your cost basis tax-free, closing your VA, and taking that money you lost on your stupid whole life policy as if nothing happened (at least, try not to think of the opportunity cost of not having that money invested; it’ll just make you mad!). From then, be sure to invest as per your written financial plan. For me, the money was originally supposed to be for retirement, so I placed that money in my taxable account as per my asset allocation of 65% total US, 25% total international, and 10% small cap value.

The Psychological Benefit of a 1035 Exchange

The best benefit of the 1035 exchange was not really the tax benefit of making up my $50,000 loss on our whole life policies tax-free. Instead, it was the psychological lift I got from being proactive about getting my financial life in order. It was amazingly cathartic to have a plan to get out of the evil clutches of whole life insurance. Almost like court victim impact statements, my going through this process was me yelling at my financial perpetrators, “No more!” It was also an affirmation that I was well on my journey to financial literacy.

Permanent life insurance is a legal form of financial battery, and I have PTSD. Trauma survivors have been shown in fMRI studies to have decreased connectivity to the anterior insula, amygdala, and anterior cingulate cortex of the brain. I didn’t check my brain as fMRI’s don’t grow on trees, but I would assume after my $50,000 loss from whole life that these structures would not light up in my brain before doing the 1035 exchange. After completing the 1035, I assume, and at least feel as if, I have regained connectivity within these cortical areas.

Research also focuses on the forgiveness circuit of the brain to be the left ventromedial prefrontal cortex, posterior cingulate gyrus, and right temporo-parietal junction. After doing the 1035, I feel these areas of my brain have reinforced connectivity. I can’t say it’s because I have forgiven the insurance company that screwed me out of $50,000—the equivalent of 25 overnight calls for my wife or 12 weeks of grueling neurology work at the highest RVU weeks for me, time that kept us from seeing/spending time on our marriage or loving our kids.

No, the 1035 exchange helped me forgive somebody who was previously so financially stupid, somebody more important that I will live with for the rest of my life: myself.

Have more questions about life insurance and what kind of policies would be best for you? Hire a WCI-vetted professional to help you sort it out.

Are you a fellow permanent life insurance victim? Are you a good candidate to do the 1035 exchange? Is the potential tax benefit of a 1035 exchange worth your time? Do you think I have overblown the psych benefits of a 1035 exchange?

The White Coat Investor may receive compensation from White Coat Insurance Services, LLC; licensed in all states including MA and DC; CA license #6009217; NY license #1758759 (exp. 6/2025); Registered address: 10610 S. Jordan Gateway, #200 South Jordan, UT 84095. This does not affect the cost or coverage of insurance.