By Dr. Rikki Racela, WCI Columnist

By Dr. Rikki Racela, WCI ColumnistAs I delved into my financial literacy journey—which included reading the first couple of WCI books, reading this blog, and taking the Fire Your Financial Advisor online course—I would continually come up with one name over and over again when it came to academic retirement research outside of WCI: Wade Pfau.

His work is prolific, delving into all aspects of retirement—from questioning Bill Bengen’s 4% rule all the way to (much to my chagrin) supporting uses of whole life insurance in retirement. His support of products like whole life insurance and annuities is controversial. To me, it's almost like a smart Houdini who, instead of pulling a rabbit from a hat, uses phenomenal skill and keen intellect to make these products seem reasonable in retirement.

But one thing is for certain: Pfau's perspective on a retiree’s feelings on creating a retirement income is profoundly creative and thoughtfully unique, and it seems quite accurate. Even the leader of this website has great respect for Wade's work and acknowledges the merits of Wade’s safety-first vs. probability-based paradigm. And nothing sums up the culmination of his research on retirement behavior and spending as his latest tool: the RISA.

The RISA was worked on by Wade, Alex Murguia, and Bob French (son of famed Ken French) under the umbrella Retirement Researchers. I had the pleasure of virtually attending free informational workshops on the RISA, and I even had the chance to go through it myself. What follows is my review of this latest paradigm and how it can be helpful to certain white coat investors trying to define their retirement plan.

[AUTHOR'S NOTE: Super important disclaimer: There is no financial relationship between WCI and those who run RISA, and this column contains only my thoughts on the product and should not be considered a WCI endorsement.]

What Is RISA?

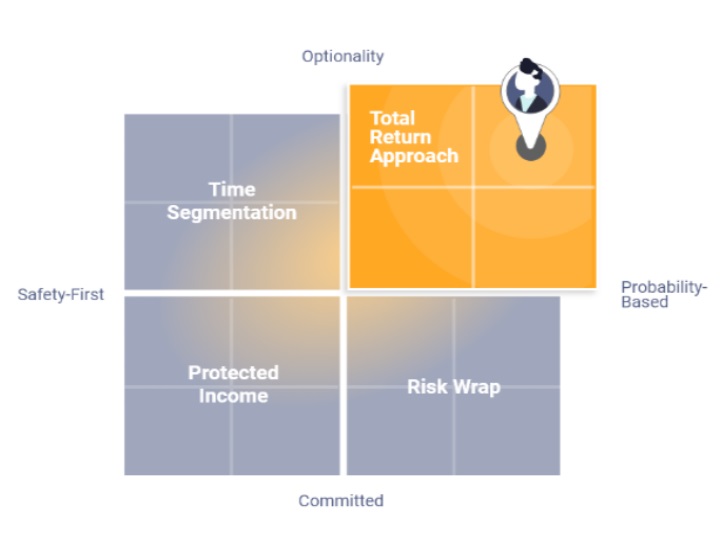

RISA stands for Retirement Income Style Awareness, and it identifies how a particular retiree feels and prefers to fund retirement. Famed Morningstar finance writer Christine Benz wrote an excellent summary of the RISA, but I will try to be more specific on how the RISA can be applied to white coat investors. It goes beyond just the basic selection of your asset allocation based on your risk tolerance. You look at funding retirement through how you feel on a spectrum of two different dichotomies: safety first vs. probability and commitment vs. optionality. You can plot these two metrics on a graph, and a retiree can fall within four quadrants: total return, time segmentation, protected income, and risk wrap.

To find out where you lie in this RISA matrix, you're asked a series of questions—similar to a risk tolerance questionnaire, with a slight bend toward how you feel about where your retirement money will come from. For example, one question in determining safety first vs. probability asks how much you agree with the following statement: “I see my investment portfolio as funding the majority of my retirement expenses.” For an example of determining where you fall in the optionality vs. commitment spectrum, you might be asked how you would rate agreement with this statement: “I prefer more flexible retirement income strategies to accommodate my changing preferences as I age.”

There are a lot of these types of questions, all honing in on your feelings about drawing down your nest egg in retirement along the safety first vs. probability and commitment vs. optionality spectrums. This ensures that you are placed accurately in one of the four quadrants.

Now, what does it mean to be placed in one of these quadrants? Well, I’m glad you asked! Let’s start with the quadrant where I landed.

RISA Result: Total Return Approach

This type of income style is exactly what it’s called. The total return approach retiree wants to maximize as much money they can for retirement, and they are willing to take more risk on the amount of income they might have in retirement to accomplish that goal. Realize that this doesn’t necessarily mean you have high-risk tolerance and that you should be 100% equities in retirement, although I would argue that there is likely a strong relationship between risk tolerance and your retirement income style.

More accurately, a total return approach will forego the use of annuities or paying for other insurance products that might guarantee a retirement income stream. While risk tolerance is more to assess how you would respond when the stock market tanks, the RISA is trying to see how you respond to swings in income during retirement. And with the total return approach, you can tolerate possible swings in income to max out how much you could possibly spend during your retirement years.

RISA Result: Time Segmentation

It would seem that those retirees who prefer an optionality-based way of creating retirement income, as opposed to committing their money to a product like an annuity, would also prefer probability-based investments as well. However, Pfau’s research suggests otherwise, and some individuals want to keep their investment options open in creating a retirement income but want those options to provide safe and stable cash flows.

This is sort of a hybrid personality where you want stable income yet don’t want to lock up your money for a contractual guarantee of income. Pfau refers to these retirees as “time segmentation,” and the previously mentioned Christine Benz falls into this quadrant. The preferred solution for these types of retirees is the bucket strategy, where safe investments like cash and short-term Treasuries that provide short-term cash needs stay in one bucket, moderately risky assets that are needed a little further into the future hang in the second bucket, and risky assets to fight inflation and provide longer-term cash needs grow in the third bucket.

More information here:

Is Now a Good Time to Retire? Here’s What Christine Benz Thinks

RISA Result: Protected Income

These retirees want the safety of their cash flows, and they are willing to lock up their money/buy a contractual guarantee like an annuity to provide safe and stable income without the options that characterize the previously mentioned time segmentation folks. It is important to note that not all spending has to be safe and committed to satisfy the people in this quadrant. Many protected income retirees would rather have just their fixed expenses fall into the protected income quadrant and have riskier assets to cover more discretionary spending needs. This is why the RISA does not necessarily dictate a particular asset allocation. Instead, it shows how you feel about where certain money should come from during retirement. Based on your feelings, the RISA will place you in a quadrant that just helps guide how you use investment assets and insurance products to fund your retirement.

RISA Result: Risk Wrap

We come to the final quadrant of the RISA universe. Risk wrap is just how it sounds. You are still taking volatility risk to boost retirement income because you prefer being probability-based, but you want that risk limited by locking it up in a particular contract or strategy. These retirees want to invest in riskier assets for possible higher retirement income, but they don’t want their retirement income to tank too much and are willing to pay and commit to a contract or guarantee for downside protection. This is where Wade and the rest of the retirement research team mention . . . brace for it . . . the use of variable and indexed annuities for these types of retirees (I just vomited in my mouth!).

Not to sound too much like a horror story (though I did mention annuities already), this is a nice lead-in to a somewhat sinister feature of the RISA . . . Getting scared yet? You should be.

More information here:

Some Sobering (and Scary) Statistics on People’s Retirement Preparedness

NewRetirement Review: An Online Retirement Calculator on Steroids

The Sinister Side of the RISA: Bad Annuities Have Found Their Problem!

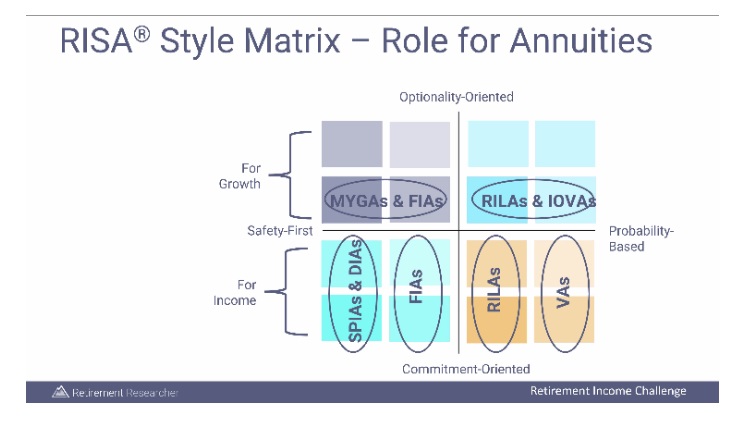

During the RISA seminar I took, the following solutions to these four quadrants were depicted below:

When I saw this, I was freakin' floored. I experienced commotio cordis of the brain! Many of the “bad” annuities are seen in this picture: VAs (Variable Annuities), RILAs (Registered Indexed Linked Annuities), and FIAs (Fixed Indexed Annuities).

Dr. Jim Dahle is not a huge fan of annuities, although he can see uses for SPIAs (Single Premium Immediate Annuities), DIAs (Deferred Income Annuities), MYGAs (Multi-Year Guaranteed Annuities), and IOVAs (Investment-Only Variable Annuities). These other “bad, evil” annuities were always touted as solutions looking for a problem. Well, the RISA is that problem!

I can unfortunately see salespeople touting themselves as financial “advisors” and using the RISA to justify the sale of these expensive and wealth-sucking annuities. The team at Retirement Researchers is not wrong in suggesting the use of these “bad” annuities. The “bad” annuities can solve and satisfy the retirement income styles uncovered through the RISA. What makes the annuities “bad” and evil is the fees and loss of wealth through commissions that are hidden in the complexity of these products.

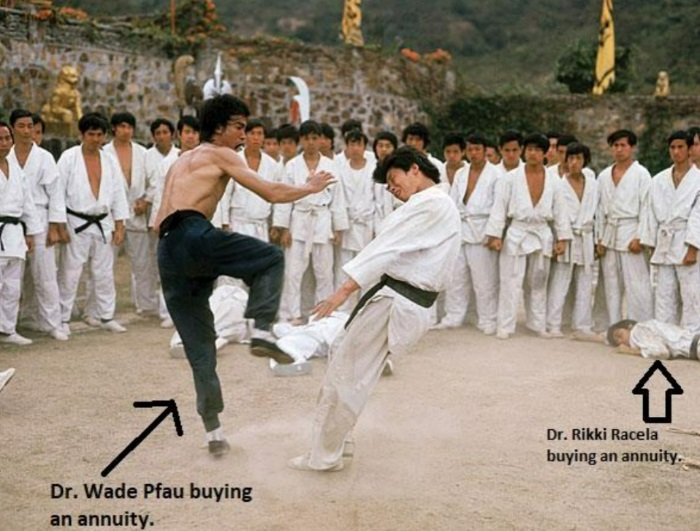

If I were super-duper smart Princeton PhD like Wade Pfau, I could appropriately discern and prevent the loss of wealth when purchasing a “bad” annuity to fulfill my retirement income style. But most of us do not come close to Wade’s intellect. If we, as mere math mortals, try to satisfy our RISA needs with bad annuities, we will get burned.

Wade Pfau is Bruce Lee on Hans Island of annuities—he will dominate because his financial smarts will dissect bad annuities—while I (we) would just get screwed in fees and commissions. The RISA might make that boat to Hans Island of annuities look attractive, much to a future retiree’s detriment. Whereas Wade will survive the island of annuities with the lowest-cost variable annuity to meet his retirement income style, I (we) will be whimpering on the ground during retirement as our wealth was eaten up by thousands of dollars of fees within a VA, lining the pockets of the insurance company and salesperson.

We must recognize the danger the RISA holds in justifying the purchase of financially evil VAs, RILAs, and FIAs.

(For those that don’t understand the above reference, stream the kung-fu classic, Enter the Dragon!)

Should You Take the RISA?

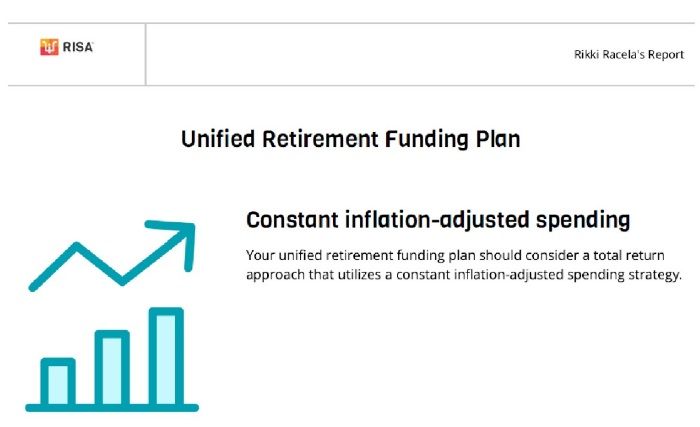

For the individual retiree and the pre-retiree, the RISA is an insightful tool that I would encourage anyone serious about retirement to take. I definitely do not agree with the use of “evil” annuities to satisfy your retirement income preferences, but insights from the RISA could help you identify how you should structure your asset allocation, plan your withdrawal of said assets, decide whether to annuitize a pension or pay out a lump sum, and/or possibly purchase a “good” annuity like a SPIA. When I took the RISA, I fell into the total return income style, and the report that I got back not only explained what this quadrant meant but also had a recommended plan to fit my retirement income style.

I am not sure of the recommendations for the other quadrants, but based on the RISA characteristics, you could build a retirement plan that fits your needs in a framework that is fully unique from just asking somebody’s risk tolerance. I mentioned above the time segmentation folks would use a bucket strategy where you have the options of what assets to put in each bucket, yet each bucket has a safety-first quality where it covers a particular spending need at different times. A protected income retiree might partially or even fully annuitize their nest egg and any pensions they have available to them. Finally, risk wrap retirees might want to commit a portion of their retirement to a SPIA or DIA (I am going to emphasize again, avoid the “bad” annuities!) while also having a buy-and-hold strategy consisting of low-cost index funds. That way, the risk wrap retiree fulfills their feelings for being committed to a strategy but still has some fluctuation in their portfolio to make potential excess returns.

I do have to congratulate Dr. Wade Pfau and the entire Retirement Researchers team for an innovative insightful tool into how to plan for retirement. Though I don’t agree with the use of some types of annuities to fulfill the needs of these different retirement income styles, a retiree can build their retirement assets and buy good annuities within this perceptive RISA framework to maximize the happiness and security they can squeeze out of their nest egg.

What do you think? Have you heard of or even taken the RISA? Do you find it accurate and innovative like I did? Were you disgusted with the promotion of annuities within the RISA framework? Have you ever thought Wade Pfau would be compared to Bruce Lee?