By Dr. Jim Dahle, WCI Founder

By Dr. Jim Dahle, WCI FounderMany investors wonder if farmland investing should be part of their portfolio. Like other “alternative” investments—such as cryptoassets, art, precious metals, viaticals, reinsurance, commodities, peer-to-peer loans, oil/gas, or venture capital—farmland is completely optional to a successful portfolio. My portfolio consists of relatively boring stocks, bonds, and real estate. However, some investors have decided to add farmland to their portfolio, and their arguments can be fairly convincing.

Is Investing in Farmland a Good Idea? The Case for Farmland Investing

When building a portfolio, an investor wants asset classes that have high returns and low correlation with the rest of their portfolio. It is also helpful if you can invest easily in that asset class with low fees, minimal hassle, easy diversification, and plenty of liquidity. That part is usually a lot trickier when it comes to alternatives.

High Returns

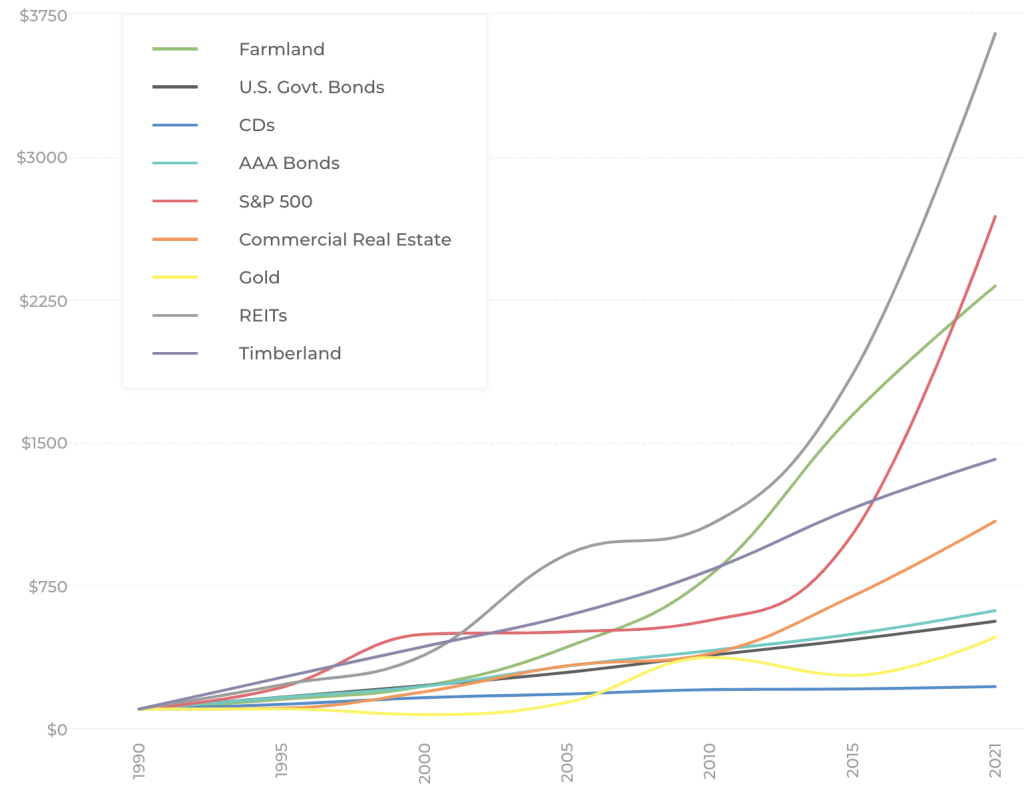

This chart published by AcreTrader makes the case pretty effectively for high returns.

The colors are a little tricky to see, but from 1990-2021, the highest-returning asset classes were publicly traded real estate, stocks, farmland, timber, and private real estate. The order of these asset classes changes all the time. For example, if this period had included 2022, public and private real estate returns would be much closer to each other. But the point is that farmland (and timber if you want to consider it separately) have high returns. Their returns are similar to stocks and real estate and are significantly higher than bonds, CDs, gold, and other low-returning asset classes.

Low Correlation

What about correlation? Well, farmland has actually had a negative correlation with stocks and bonds over the last three decades. It has moderate correlation with private real estate (0.45), but that's still pretty good considering the correlation between US and international stocks can be as high as 0.8 or even 0.9 and the correlation between stocks and REITs is typically something like 0.5.

Farmland meets my criteria for low correlation, too.

Is Farmland Easy to Invest In?

This is the part where farmland breaks down, at least until recently. For many years, it has not been easy to get liquidity, minimal hassle, diversification, and low fees with this asset class. It's easier now than it has ever been, but it still isn't like buying a total stock market index fund. I also worry that, as it becomes easier to invest, returns will fall and correlation will rise.

More information here:

150 Portfolios Better Than Yours

How Can You Start Investing in Farmland?

There are lots of ways to invest in farmland.

Direct Investment in Farmland

The most basic and straightforward method of investing in farmland is to go out and buy land yourself. You can even farm it yourself if you want, but if you're looking for an investment, you're probably thinking of renting the land to a farmer. In a lot of ways, this is just a subcategory of real estate investing. You can rent apartments, or you can rent a pasture. Same, same. Your return comes from appreciation of the land and the income paid by the renter. If you have a loan on the property, some of the return comes from paying down the mortgage too.

Farmland Syndications

Don't have a few million lying around to buy a 500-acre farm? Join the club. Just like with a big apartment complex, you can band together with dozens of other investors and syndicate a farm. Usually set up as an LLC or limited partnership, the investors hire a manager (more likely the manager, or general partner, goes out and finds the investors), buy a farm, and then sit back and enjoy the mailbox money coming in for a few years. Five or 10 years later, they sell the farm and split up the profits.

Just like with real estate, there are online platforms that facilitate the formation of these syndications for an additional fee. These include AcreTrader, our partner in this space, and platforms such as FarmFundr, FarmTogether, Steward, and Harvest Returns. None of these have particularly long track records. A decade in business would be an eternity for these platforms. AcreTrader, for example, was founded in 2018. A quick glance at its track record in March 2023 shows only five projects having gone round trip (with IRRs ranging from 11.5%-30.3%) while 103 projects are currently in progress and two are currently available for investment.

Publicly Traded Stocks

Just like with real estate and oil and gas investments, you don't have to leave publicly traded equities to invest. There are stocks traded every day that invest in farmland. OK, not a lot, but there are some. Consider the specialty REITs Farmland Partners (FPI) and Gladstone Land Corporation (LAND). Want liquidity, transparency, and convenience? You can just buy those. You'll have the same issues you have with more traditional public REITs, of course. That's mostly the higher correlation with the overall stock market. These aren't huge companies either. Both are only worth around a billion dollars each. You also already own them if you own a total stock market or a REIT index fund, so putting more money into them is just tilting your portfolio toward farmland.

Mutual Funds and ETFs

The problem with individual stocks—even companies that own hundreds of farms like these two REITs—is almost as bad as buying an individual farm or even a handful of farms via syndications. You're not diversified. There are single property risks and manager risks. The most natural approach to minimizing these risks is to diversify using a fund of some type. However, you have to be careful and look under the hood. If you search for a “farmland ETF,” you will find them, but what most of them do is buy crop futures contracts. This is an investment in the commodities that farmland produces, not in the farmland itself. That investment comes with all the problems that you see with commodities investments. Other ETFs invest in agriculture companies. These are investments in farmers, not the farmland itself. Look at the Fidelity Agriculture Productivity Fund (FARMX). The top holding (23% of the fund!) is John Deere, a tractor manufacturer.

Frankly, there just aren't enough farmland REITs to have a fund that invests in them.

Private Funds

What about in the private world? Can you invest in a private fund that truly invests in farmland? There are a few. Most are aimed at the institutional investor with very high minimum investments. Farmland LP is a private farmland REIT with a $50,000 minimum investment, and it charges 1.75% plus 20% of profits above a preferred return of 6%. Those are a little higher than you see with many real estate funds that WCI recommends.

More information here:

Investing in Collectibles: Is Investing in Jewelry, Coins, and Ferraris Worth It?

How Does Timber Investing Work?

You may or may not consider timber to be just a subclass of farmland, but it has a rather impressive track record on its own. Here's the fun part about timber: unlike most crops, if you don't like the price you're being offered for your lumber, you can just wait until next year and those trees will just keep on growing. You can buy timberland directly, buy publicly traded timber REITs (Weyerhaeuser, Rayonier, PotlatchDeltic), buy syndications via the platforms above (AcreTrader has offered seven timberland investments over the years; none have gone round trip), or buy private funds or even a dedicated account with your own manager. The private funds are again mostly aimed at institutional investors with very high minimum investments. There is an index for private timberland REITs, but when you dive into it, there are only 464 total properties in the index. This is a pretty niche investment.

What to Do? Should You Start Investing in Farmland?

If you want to invest passively in farmland—and I stress that this is a totally optional investment—using a platform such as AcreTrader is a reasonable approach for a small percentage of your portfolio. Investment minimums are relatively low ($25,000 or less) so you can buy 10 properties and achieve a certain level of diversification with just a quarter of a million dollars. Note that this approach will result in you getting 10 K-1s, and you likely will have to file taxes in multiple states. If that sounds like too much of a hassle, you can buy the publicly traded farmland and timber REITs at your favorite brokerage. Or just do what most investors do and buy total stock market and REIT index funds and know that some tiny portion of your money is invested into farmland and timber.

When people brag about their farmland investments at cocktail parties, you can confidently say that you own some of those, too—just like you can say you owned the latest high-flying stock before it became popular.

If you are interested in private real estate investing opportunities, start your due diligence with those who support The White Coat Investor site:

What do you think? Do you invest in farmland? Why or why not? How do you do it?