By now, everyone knows that the demand and the number of transactions in the housing market have seen a significant slump as homebuyers delay purchasing a home in hopes of improving affordability.

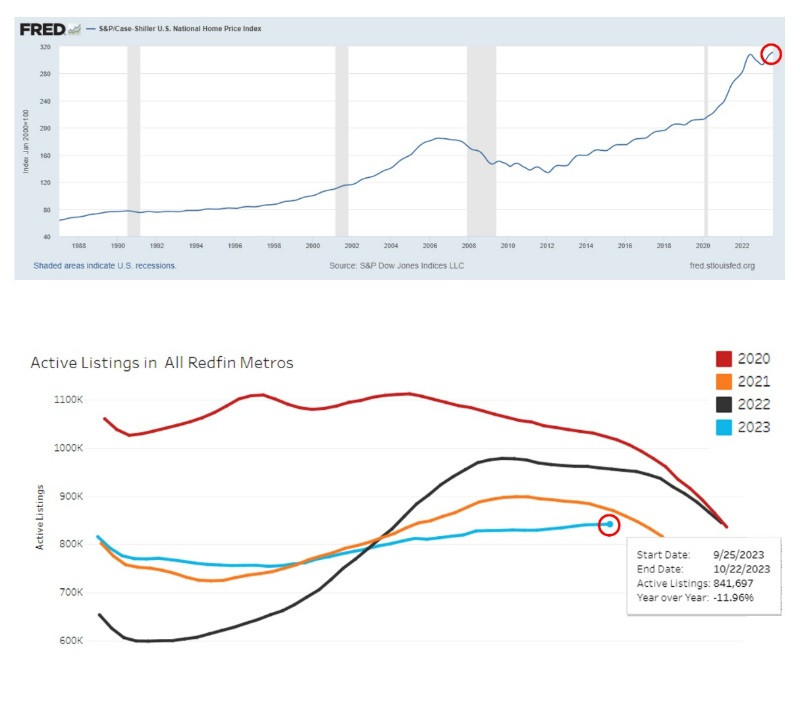

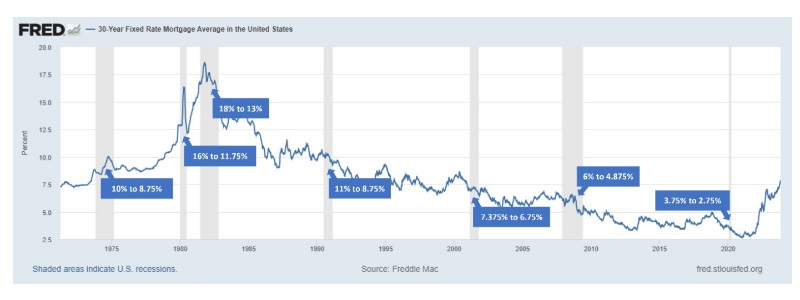

Nationally, home prices are still at all-time highs, and in October 2023, the average 30-year fixed mortgage rate hit a 23-year high cresting above 8%. Despite higher mortgage rates and a lack of affordability, there are still less than 900,000 homes for sale nationally (77.5% fewer homes for sale than in 2010). That is continuing to push up prices despite the common narrative that the housing market is crashing.

How is this possible? Most would assume that when homebuying costs skyrocket, demand would significantly drop, homes would flood the market, and the 2008-2010 housing crash would repeat. Yet here we are, looking at a housing market with anemic inventory and prices still very high nationally. What gives?

Let’s dive into what got us here and what it might take to see more homes come to the market in the coming year.

Why Are There So Few Homes for Sale Right Now?

The housing market is highly unusual right now, and it has been for a while. In fact, since the pandemic, the US housing market really hasn't been “normal” at all.

The housing market came to a halt in early 2020 as the world stopped, and then it took off like a rocket. Fueled by 30-year fixed mortgage rates under 3% and the work-from-home movement, demand for homes absolutely exploded.

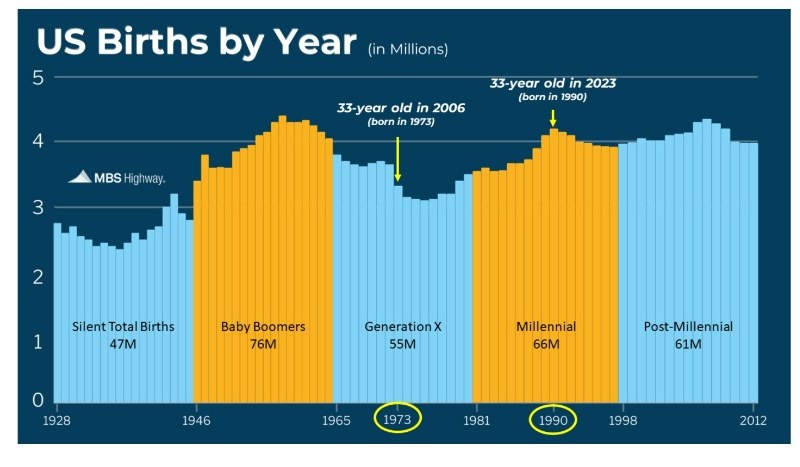

Massive demand from those who were waiting to move up when homes became more affordable collided with an already record-high wave of first-time homebuyers entering the market (the average age of a first-time homebuyer in the United States is 33 years old). Sixty-six million millennials were coming of age, forming new households, and looking to buy homes.

At the same time, current homeowners and investors took advantage of low rates to purchase second homes and investment properties in the hopes of profiting off the growing rental market (Airbnb and short-term rentals were all the rage).

This quickly depleted the supply of homes on the market, which was already trending downward thanks to a lack of new-home construction after the 2008 housing crash. As foreclosures and short sales skyrocketed in the Great Recession, builders significantly pulled back on new construction and, as a result, decimated inventory levels. They've been trying to catch up for the last decade, but it just hasn't been enough to keep up with the growing housing needs of Americans.

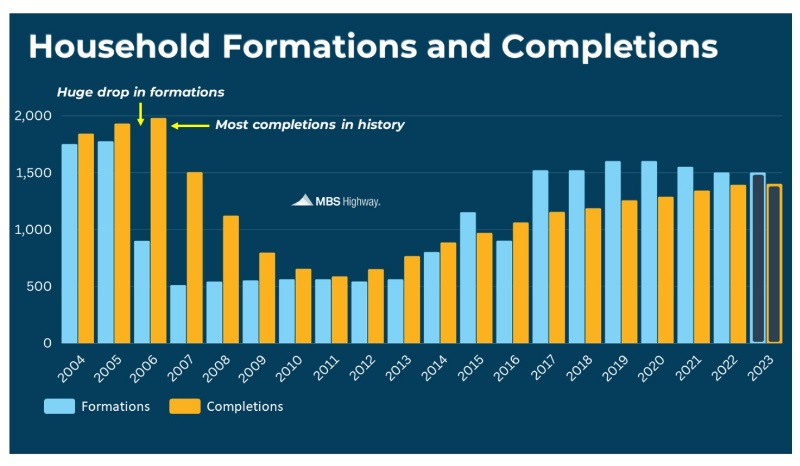

Take a minute to digest the graph below. From 2004-2014, housing completions (supply of new residential units) exceeded household formations (demand from new buyers) for a decade.

In 2006, something odd happened; household formations saw a large drop while housing completions hit an all-time high. This drop in household formations was due to the decline in birth rates in the 1970s—attributed to the 1973 Supreme Court decision in the Roe v. Wade trial legalizing abortion—and contraceptives becoming mainstream. This resulted in a huge drop in household formations 33 years later.

From 2015-2023, the exact opposite has happened. The millennial generation has been pushing household formations back to similar levels that the Baby Boomer generation experienced, and the builders cannot keep up. Household formations have crushed completions for eight years, and there’s no end in sight. Homebuilders are still not building enough to meet demand, likely due to higher construction costs, construction interest rates, labor shortages, and bureaucracy at the municipal level that can often delay construction projects for years.

At the current pace, we expect to see 1.41 million new housing completions and 2.07 million household formations in 2023, meaning we are still running a deficit of around 600,000 housing units in 2023. When demand for housing (household formations) exceeds supply (housing completions) for a decade, odds are that prices will continue to rise.

More information here:

How Our Portfolio Performed in 2023 (Including Real Estate!)

Your Crystal Ball Predictions for 2024

Will Low-Rate Mortgage Holders Ever Sell Their House?

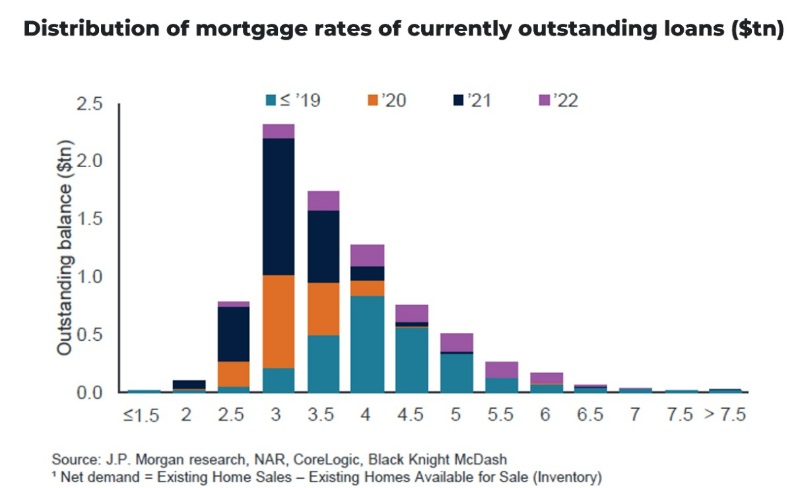

Another unique issue affecting housing supply is a concept known as mortgage rate “lock-in.” Today’s homeowners have such low mortgage rates that they either won’t sell or they simply can't sell and take on a more expensive housing payment at a higher rate.

And this isn’t just a small number of homeowners. Keep in mind that one-third of all residential homes in the US are owned free and clear with no mortgage. Of those homes that do have a mortgage, nearly two-thirds have an interest rate at or below 4%, and nearly a quarter have a rate below 3%. Most of these homeowners will not budge and will continue to enjoy their low, fixed-rate mortgage for many years to come.

Why would these owners ever want to sell? Why wouldn’t they rent out their homes and enjoy the cash flow from rents that have been pushed higher due to inflation while benefitting from their 30-year fixed mortgage rates that are well below the real rate of inflation?

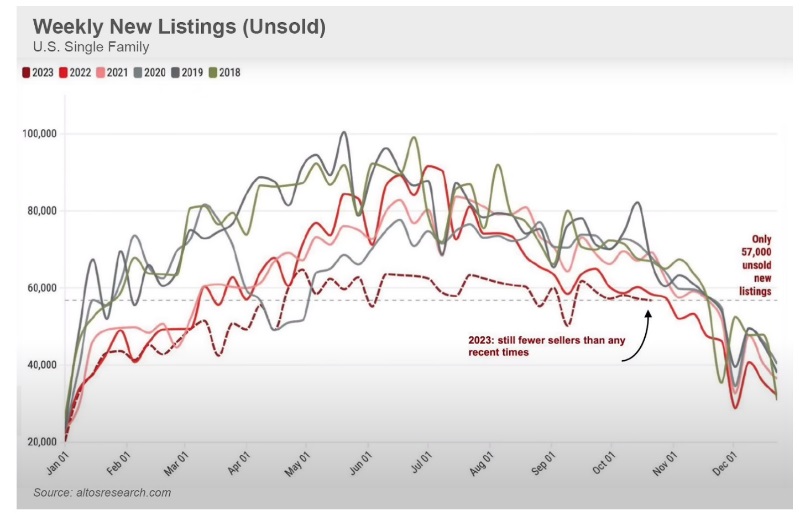

Existing home inventory listings climbed 1.4% month over month in September 2023 but remain below inventory levels this time of year in 2022, 2019, 2018, and 2017. Listings dropped 8.9% on a year-over-year basis in September and remained far below pre-pandemic levels.

Will More Homes EVER Hit the Market?

This new reality of low housing supply is likely to persist for the foreseeable future as those fortunate homeowners with 30-year fixed-rate mortgages at or below 4% now realize they have two assets: their home and their below-market fixed-rate mortgage. Why would they sell? What housing situation could possibly cost them less than what they already have?

More information here:

Rates Are Rising: How to Navigate Buying a Home in the Current Market

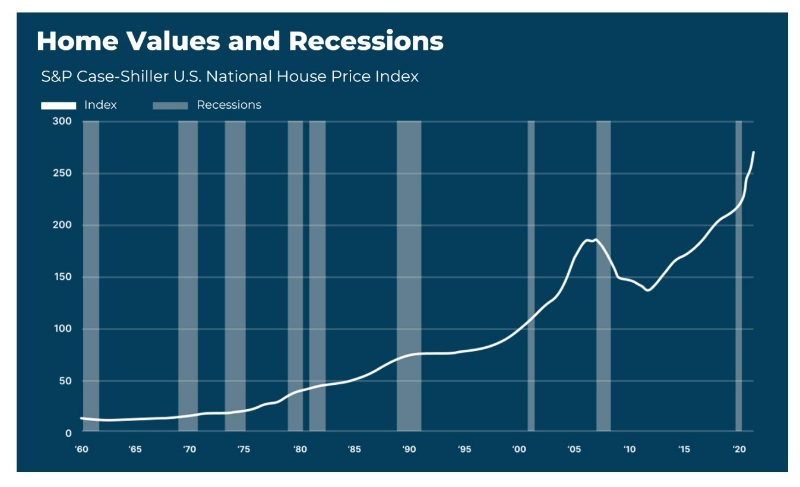

Won’t a Recession Cause a Housing Crash?

Many believe that economic turmoil and a recession will bring a rush of homes to the market, but we see that as very unlikely for a couple of reasons:

- Homeowners today have massive amounts of home equity and record low mortgage interest rates. If they lose their jobs, it's likely they can fall back on their home equity. They can either tap existing home equity lines, borrow from family or private money sources against their homes, or simply rent out their home and pocket the positive cash flow.

- Recessions are deflationary by definition and bring lower mortgage rates. Lower rates create greater affordability and lure those waiting on the sideline into the market.

The clear outlier here is the Great Recession, which was primarily caused by a subprime mortgage credit bubble, declining household formations (huge drop in 2006), and home builders who completed record housing units in the decade leading up to the Great Recession.

Should You Buy a House Now or Wait?

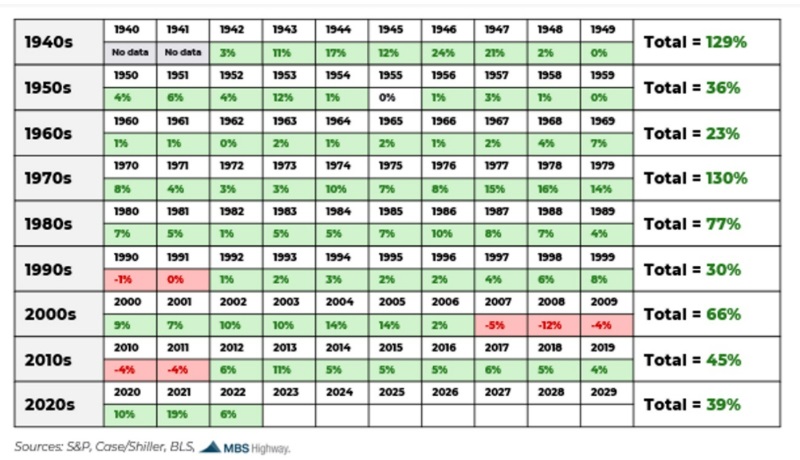

If you look at the history of home prices, trying to time the housing market is a losing game. Going back to 1942, home prices were up nationally for 73 years, down for seven years, and flat for one year in 1955. That means the housing market has a near 90% win rate. Who wants to gamble when you lose 90% of the time?

Where Is the Investment Opportunity in 2024?

Airbnbs, short-term rentals, and mid-term rentals may be in for a tough 2024. I see two headwinds for this investment class that have me currently turning my three privately owned mid-term rentals back into long-term rentals.

The wave of pent-up vacation demand post-COVID lockdowns is largely behind us. The massive personal savings increases that occurred during lockdowns have, by and large, been spent. We are now seeing credit card balances hit new all-time highs and personal savings rates plummet well below long-term averages. This tells me the American consumer is about tapped out and is not likely to spend big on expensive vacations in 2024.

The unemployment rate is also on the slight rise and historically a rise off the cyclical bottom has been a harbinger for recessions. Unemployment bottomed out in April 2023 at 3.4%, as of December 2023, it was up to 3.7%.

If the unemployment rate rises in 2024, we will enter a recession, forcing both companies and families to spend less on discretionary travel. That tells me 2024 will not be a great year for short- or mid-term rentals.

But long-term rentals should do quite well in 2024. Going into the Great Recession, I owned 63 single-family homes in Salt Lake City, all with long-term tenants in them. I watched the Great Recession unfold, and I was certain I was going to lose everything. But all those people who walked out on their homes and gave the bank back their keys still needed somewhere to rent. As it turned out, I had a lower vacancy rate and higher rental rates and collections during the Great Recession than I had in the run-up years from 2000-2006.

Over the last 23 years of owning long-term single-family rentals, times of recession and economic uncertainty have been some of the best times to own property. This is a period where some people are forced to exit homeownership and rent for a period of time. Additionally, mortgage rates drop precipitously in recessions, giving investors the opportunity to refinance to lower rates and to pull tax-free cash out to acquire additional rental units.

Those of us sitting on fixed rate mortgages below 5% should consider turning our current primary residences into long-term rentals, because it’s highly likely most people would see positive cash flow due to the massive run-up in residential rents since COVID.

More information here:

6 Reasons We Lost Money on Our First Rental Property

3 Strategies Home Buyers Should Consider in 2024

- Buy before the seasonal summer buying season. Historically, the greatest opportunity to buy a home with a discount or concession from a seller is in the winter months. There are fewer buyers (competition) in the market, and many are consumed with the holiday season. The slowdown in demand can make sellers who need to sell fast feel nervous.

- Refinance when rates go down. Nobody knows for sure when rates will reverse and go the other direction, but we do know that mortgage rates are cyclical. They historically follow inflation, which follows the business cycle, and after a huge run-up, it's now already starting to swing in the other direction. As the unemployment rate climbs, inflation will fall, and so will mortgage rates. Waiting to buy until mortgage rates fall will inherently put buyers in a more competitive environment.

- Consider making an offer to acquire the property subject to the existing financing. If you have cash, you could possibly pay the seller their equity while taking over their existing low-rate mortgage. Wendy Patton has acquired hundreds of homes with this investment strategy and recently updated and rereleased her book on this topic called Investing in Real Estate with Lease Options and Subject-To Deals.

My main point here is that, despite all the negativity around the US housing market, there are just as many (if not more) reasons to be bullish on residential housing than there are reasons to be bearish. With US housing going up nearly 90% of the time, your odds of timing the market to get a better deal are not great.

But who knows, maybe Warren Buffett—who has said that only an idiot tries to time the market—is wrong this time.

Don't forget to sign up for the free White Coat Investor Real Estate Newsletter that will alert you to opportunities to invest in private real estate syndications and funds while giving you important tips for how to invest in this asset class.

Do you have home-buying plans for 2024? What worries you about the possibility? What makes you excited?