I often receive a question like this one that came in via email:

“Do you have any advice on what to do with a 401(k) from an old employer? It is currently with ADP and rather than move to my current employer with Insperity, is there a benefit to moving it to a different platform that has better investment options?”

Changed Jobs? Here's What to Do with an Old 401(k)

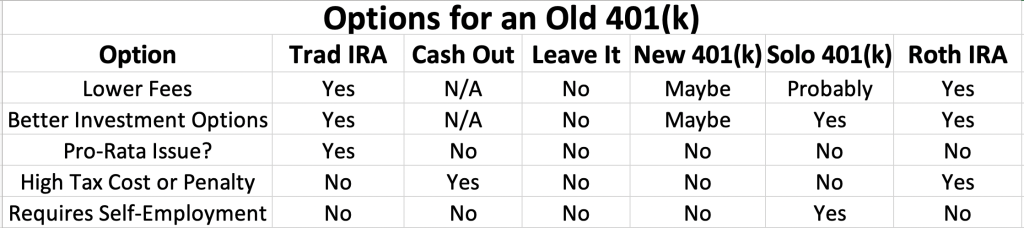

Just about everyone will run into this problem at least once during their career. You have six options for dealing with a 401(k) from your old job, some of which are better than others.

#1 Roll Your Old 401 (k) (Transfer It) into a Traditional (Rollover) IRA

For a typical American, the usual answer is to just transfer the money into a traditional IRA. The old company wants you to do this (to reduce their costs), but you probably want to do it, too. That's because you usually get better investing options and lower costs in an IRA you can choose than in the 401(k) your employer designs. There can be a concern in some states about the IRA getting less asset protection than the 401(k) did in a bankruptcy situation, but that can typically be alleviated by putting it into its own separate rollover IRA.

However, most white coat investors don't want to use this method because of the pro-rata issue with the Backdoor Roth IRA process. Roth conversions are always prorated across all IRAs, so if you're doing the Backdoor Roth IRA process each year, you don't want to have a balance in a traditional IRA (including one labeled rollover IRA), SIMPLE IRA, or SEP-IRA.

WCIers need a better option, at least for the tax-deferred (traditional) subaccount of the 401(k). A rollover into a Roth IRA is a great option for the Roth subaccount of the 401(k). I suppose if your old 401(k) balance is so large and the old plan is so terrible that it is worth giving up your annual Backdoor Roth IRA, it might still be worth it. Those who want more money in self-directed accounts (that you can use to buy crypto, precious metals, private real estate, etc.) might also choose this option.

More information here:

Multiple 401(k) Rules – What to Do with Multiple 401(k) Accounts

#2 Cash Out Your Old 401(k)

Another lousy option, perhaps the worst of all, is to just cash out the 401(k). If you do this, you'll pay taxes and you'll owe an additional 10% penalty. That's a rookie move if there ever was one. But I guess if the alternative is starving or something, maybe you should just cash it out. You might also find yourself in a very low tax bracket if you just separated from your employer, so maybe the tax bill won't be too bad even with that 10% penalty. Incidentally, that penalty goes away for 401(k)s at age 55 if you've separated from your employer, even though it exists until age 59 1/2 for IRAs. In early retirement, this might work out just fine for you if you want to spend the entire 401(k) that year anyway.

#3 Leave That 401(k) Where It Is

One option that too few consider is to just leave it where it is. Most 401(k)s will allow you to leave your money in there indefinitely. The company might not want you to do it, but if you read the plan document, you are probably allowed to do it. In my physician partnership, as long as you have at least $7,000 in the 401(k), we can't throw you out of it when you separate. This is usually an excellent short-term plan, and if it's a decent plan with good investments and low costs, it might even be a good long-term plan if needed.

The main downside of this plan is that it can be very difficult for some people to remember old retirement accounts. They literally forget about old 401(k)s. Don't do that.

#4 Transfer Your Old 401(k) into Your New 401(k)

The best option is usually to just transfer it into your new 401(k). You might have to wait a few months or even a year until you are allowed to use the new 401(k), but that's often the best long-term play. Contact the new 401(k) (or HR at the new job) to initiate the process. You can almost surely leave it where it is long enough to be eligible to put it in the new 401(k).

#5 Transfer It into a Solo 401(k)

The very best option is probably to transfer the old 401(k) into a 401(k) that you have total control over, such as a solo 401(k). In order to have a solo 401(k), you need to have some self-employment income, but that is frequently the case for WCIers. Some businesses can be pretty simple—such as just consistently “consulting” for pharma and other companies interested in your opinion by taking paid surveys.

More information here:

Comparing 14 Types of Retirement Accounts

#6 Convert It to a Roth IRA

Another option that allows you to get it away from the old 401(k) and still avoid the pro-rata issue with the Backdoor Roth IRA process is to convert the old tax-deferred 401(k) into your Roth IRA. This will give you a larger Roth IRA and more tax-free future spendable money for you or your heirs. However, there is a serious downside. A Roth conversion is a taxable event.

Typically, you will owe taxes on the entire amount converted at ordinary income tax rates AND at your current marginal tax rate or higher. If it is a large (six-figure) 401(k), you may not be able to afford the taxes on the Roth conversion—at least without using the money in the 401(k), which is less than ideal. This is a great solution, however, for a relatively small 401(k). Certainly, this can be a great option for a four- or low five-figure 401(k). Most high earners can easily afford the tax bill on a conversion that small.

Here's a chart to help you keep all this old 401(k) talk straight.

What do you think? What have you done with your old 401(k)s and why? In retrospect, was there a better option?