By Dr. Jim Dahle, WCI Founder

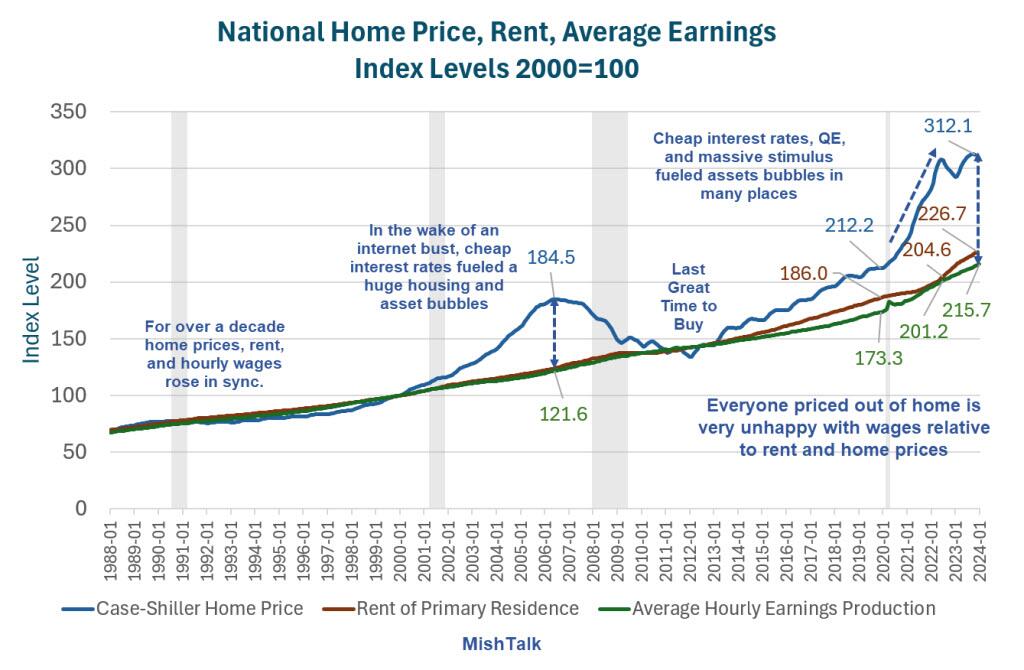

By Dr. Jim Dahle, WCI FounderHousing is unaffordable. This is the new chief complaint of our society. It used to be that healthcare was unaffordable. That problem wasn't fixed; it's just that the housing issue became a bigger deal in the last few years. The price of housing soared due to low supply and a few years of very low interest rates, and that has now been combined with high interest rates without an accompanying decrease in prices. That, at least, is what most people think and most pundits say. I think they're wrong.

I mean, they're not completely wrong. The supply issues caused by builders not building at all for a few years after the 2008 Global Financial Crisis and the COVID-related supply shortages are very real. The demand issues caused by the ability to borrow money at ridiculously low, sub-inflation rates are also very real. But that's not why you're worried about where your kids are going to live. That's not why you can barely afford an average house as a doctor and a nice house as a two-doctor couple.

Where Will My Kids Live?

While Salt Lake City doesn't have the highest housing prices in the nation, the change from being a relatively low-cost-of-living area to a relatively high-cost-of-living area has been pretty impressive since we moved here in 2010. I won't use my own house since we've done a big renovation that skews things; instead, I'll use my neighbor's house which had about the same value as mine when we moved in 2010, just under $500,000. Perhaps it was $480,000—not bad for 4,000+ square feet just a few miles from world-class ski resorts, a good school district, a nice neighborhood, and a 100-mile view. It was expensive but affordable on a single doctor's salary (I was making about $200,000 at the time as a pre-partner emergency physician). Today, it's worth $1.12 million. That's with interest rates at 7%.

How much income do you really need to afford a $1.12 million house? About $500,000, according to my 2X rule. That's a two primary care doctor couple or one high-earning doc.

The median household income in Utah is pretty good these days, about $86,000. But that's a far cry from $500,000. Only 11% of households make $200,000+ here, but our average price of homes for sale is $502,000. You can't afford the average home on the average income. You can't afford the average home on twice the average income. Fewer than 11% of households can afford the average home. That's a real problem. As bad as it is in Utah, it's far worse in many coastal cities ($984,000 in Boston, $640,000 in Washington D.C.) and small ski towns ($1.9 million in Telluride, $2.2 million in Park City) throughout the West.

Why Housing Costs So Much

Sometimes people long for the 1950s. Dad went to work each day at a job that didn't even require a college degree, and that provided enough income to afford to buy a house just like everyone else's. Mom stayed home, kept house, raised the kids, and participated in the community. Some people today still see that as an ideal situation. There are two reasons that's mostly an impossibility now.

More information here:

Rates Are High and Demand Is Low . . . So Why Aren’t Home Prices Falling?

The Two-Income Trap

The first reason is what Elizabeth Warren so eloquently described in her The Two-Income Trap book many years ago. However you feel about Warren's venture into politics afterward, she got this right. When mothers went out into the workplace en masse, it provided additional income to the household. With that income, the family decided to up their standard of living. They decided to move to a bigger house in a safer neighborhood in a better school district. That's logical. More sacrifice and more work get you some economic advantages.But what happens when EVERYBODY does that? We've just shifted the goalposts. Now, everybody wants a bigger house in the safest neighborhoods in the best school districts. So, they go buy them. But after a while, the natural economic effects are seen. Labor isn't worth as much as it used to be, because the supply of it is twice as large as it used to be. Now it takes two earners to get what you used to get with one. Heaven forbid you lose your spouse to disability, death, or divorce. Now the family is on the verge of poverty despite the fact that one parent still has a reasonably well-paying, steady job. Maybe that job pays $50,000 or $60,000 as a nurse. What house are you going to buy in Salt Lake City on that income? None of them. There aren't any affordable houses on that income. Maybe if you drive an hour and a half into the boondocks you can find a tiny townhouse in a small town, but any savings are just going to be eaten up by the tangible and intangible costs of that commute.

House Size and Quality Inflation

However, the main reason—and the one I want to talk about today after 800 words of introduction—is the fact that people simply aren't buying the same houses in 2023 that they were buying in 1955. The houses are bigger. In 1950, the average new home sold for $82,000 in today's dollars. It had 938 square feet. Again, that's 938. That's a single story that is 30 feet long and 30 feet wide. We're talking about the size of a single-wide trailer home here. I think my garage is larger than that, and there are two houses within a stone's throw of mine that have larger garages.

In 2023, the median home size in Utah is 2,800 square feet. (It's 2,014 overall in the US). That's 2-3 times the size of what a home used to be back in 1955. We live in bigger houses because we have bigger families now, right? Nope. The average family size in 1955 was 3.6. Now, it's 3.1. Sure, we're a little fatter, but that doesn't account for needing 2 1/2 times as much space per person.

In addition to size inflation, there is a massive difference in quality inflation. Homes are simply much better built now with far nicer amenities. We have hardwood floors and tile where there used to be linoleum. We have higher quality carpet. We have higher quality paint. We have baseboards and light fixtures and granite countertops and stainless steel kitchen appliances. It all adds up. A television was a prestige item at the end of World War II. By 1960, nine out of 10 homes had one and most of them were a foot wide. How many are in your home? We've got three, ranging from 4-10 feet wide. I bet your house has air conditioning, central heating, a dishwasher or two, and a washer and dryer that you actually keep inside, doesn't it?

My point is that houses are bigger and nicer than they used to be. No wonder most people can't afford them.

Let's say somebody decides, “Hey, we don't have much money. We don't even make all that much money and probably won't make much more than we're making now any time soon. We should just buy a little smaller house.” Seems logical, right? But where is that smaller house?

It's in a dumpy, crime-ridden neighborhood with terrible schools. Now, you're not just economizing, but you're sacrificing the safety and education of your children. Who wouldn't do everything they could to avoid that, including leveraging their lives to the hilt, working two jobs, staying in an otherwise bad relationship, and putting off retirement and college savings?

More information here:

Why People Mistakenly Think the US Economy Is Terrible

Your Crystal Ball Predictions for 2024

The Real Cause of Housing Unaffordability

The real problem here, the real cause of housing unaffordability, is that in many cities in America—perhaps even most—it is impossible to buy a small house in a reasonable neighborhood because those houses simply don't exist. Homebuilders aren't making them. Realtors aren't selling them. And people aren't willing to live in them anyway because they think they're entitled to nice stuff even if they can't afford it. There, I said it. But it's the truth.

Cities and Developers Will Have to Fix This

The only solution in most cities is to build more housing, usually smaller housing including higher-density stuff like condos, duplexes, and townhomes. The NIMBY crowd fights it, and cities get behind their biggest taxpayers. Even if developers wanted to help with the issue, they're stymied at every turn by bureaucrats, regulations, and homeowner associations. If cities want affordable housing, they have to make it easier and more profitable to build (or convert) it. Maybe it feels good to see the value of the house you already own go up in value (not sure why; it just means a bigger tax bill), but that rising value is a huge barrier to those who don't already own.

More information here:

Is Renting Better Than Buying? Why We’re Financially Independent and Renting

What You CAN Do

What should you do? Aside from supporting good policies and those working toward them, you still need to make sure that you and yours are taken care of in this horrible situation. Thankfully, most white coat investors have enough income that in most places they can still buy a reasonable house in a reasonable neighborhood. They'll likely be in far better financial standing than their neighbors who will have to use more leverage and dedicate more of their income to housing. The key, for your own personal finances anyway, is to just avoid doing something stupid.

Even in Salt Lake City, a single primary care physician household can afford the median house. Don't make yourself house-poor by trying to buy the 2% house just because you have a 2% income. If you spend 40% of your gross income on housing, you will be working until you have a stroke at 74 and you won't reach any of your financial goals. So, don't do it.

What about your kids? If you want them to live anywhere near or like you—presumably on less income than you make—you're going to have to help. That means you have a new financial goal. Maybe your old list of financial goals included college savings, retirement, and a down payment for your own house. Well, now it also includes some money for your childrens' houses. How much? I'll leave that up to you. But it's really the difference between what your kids can afford without you and what housing costs.

As an example, let's say you want your kids to be able to buy a $600,000 house in Utah. But between them and their spouse, they only make $150,000. If they can afford a $300,000 mortgage and can save up a $50,000 down payment, that leaves $250,000 from you by the time they're 30 (and you're 60ish). Got three kids? That's $750,000. If you start saving for that goal at age 40 and earn 5% real on your savings, that would suggest putting about $23,000 a year toward this goal for the next 20 years. In fact, I would suggest that this goal may be just as important or even more important than saving for college. You see, college costs what you are willing to pay. A similar education can often be had for 25% or even 10% of the price elsewhere. That's just not the case with housing.

The housing unaffordability crisis is real and multifactorial. But it doesn't have to be a crisis in the lives of you and your children,

What do you think? What do you think should be done about the housing unaffordability crisis? What is your housing plan for you and your children?