By Travis Christy, White Coat Insurance

By Travis Christy, White Coat InsuranceWhen doctors assess disability insurance options, understanding the profound impact such coverage can have on their lives is essential—not only for financial security but for emotional and psychological support as well.

Let me share an example from my professional encounters that bring this point home. A physician client experienced the heartbreaking loss of his partner to terminal brain cancer, a tragedy that struck shortly after the birth of their daughter. Amid their search for treatments across the western United States, he never imagined how crucial his decision to obtain disability insurance during his residency would become. Following his partner's death, this insurance became his lifeline, providing financial relief and the invaluable time needed to grieve, emotionally heal, and be there for his daughter during this incredibly difficult time.

This experience emphasizes the invaluable role of disability insurance for physicians. As doctors explore what to look for in a disability insurance policy, it's important to consider policies that offer robust support—including own occupation coverage, flexible benefit periods, and comprehensive coverage for injuries and illnesses (including mental health events). Such features make sure that, in moments of adversity, they have the resources they need to recover fully, allowing them to focus on healing and family without the added burden of financial worry. In this post, we’ll explore the Big 5 disability insurance carriers that independent agents can offer (Ameritas, Guardian, MassMutual, Principal, and The Standard). We’ll explore how to build a good policy with features every physician should consider and why each is important.

Building a Policy for a Physician

Elimination Period

Ask yourself, “How soon do you want to get paid?”

The elimination period in disability insurance is the waiting time before your coverage kicks in while you're unable to work due to illness or injury. It's the initial stretch, say 60 or 90 days, where you'll need to manage your financial responsibilities without the insurance providing income replacement. Opting for a longer elimination period can help reduce your insurance premiums (the cost to you), but it requires careful planning to ensure you can handle your commitments during that waiting period. You’ll need to put together a good emergency fund to get through those first few months before disability benefits kick in.

Notice below that elimination periods can be as short as 30 days, but it will cost almost double what a 90-day wait would cost. Many physicians opt for a 90-day waiting period when purchasing disability insurance; however, it's important to note that the first benefit check won't be received until 30 days after whichever elimination period is chosen. In this case, the 90-day wait period would pay on Day 120, as disability benefits are paid in arrears.

Benefit Period

Ask yourself, “How long do you want to get paid?”

The benefit period in a disability insurance policy determines the duration for which the insurance company will provide disability benefits after the elimination period as long as you meet the definition of disability (more on that below). This critical component offers various options, including two, five, or 10 years per occurrence up to age 65. More common, though, is the longer benefit periods to age 65, 67, or 70. The significance lies in the fact that this decision directly affects the length of time an individual receives financial support in the event of an inability to work due to illness or injury. Opting for a shorter benefit period may result in lower premiums, but it limits the duration the benefit may pay in the event of an irrecoverable disability. Conversely, choosing a benefit period that’s to age 65 or longer insures against a disability that may last longer.

Most physicians will buy coverage until either age 65 or age 67. With that being said, this decision involves a thoughtful balance between comprehensive coverage, budget considerations, and individual circumstances. The bottom line is to buy something even if it’s a shorter benefit period.

Benefit Amount

Ask yourself, “How much do you want to get paid?”

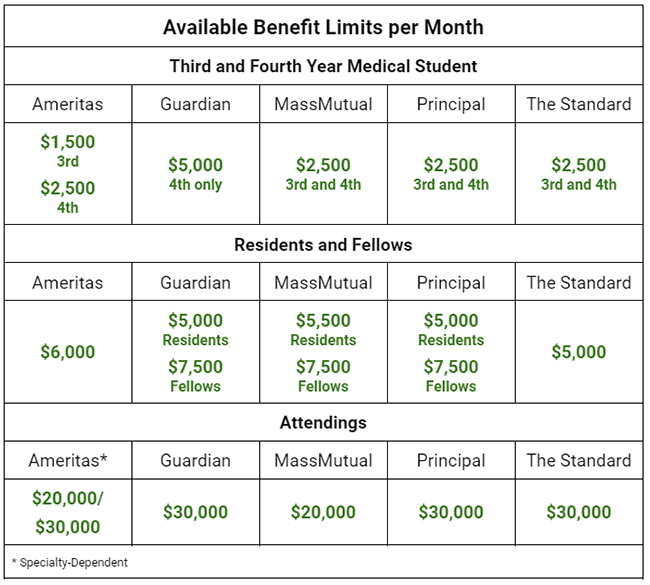

Given the substantial earning potential of physicians, the benefit amounts in disability insurance can vary significantly. During residency, for instance, a medical professional may qualify for benefits of $5,000 a month with the potential to increase substantially when they become an attending to $30,000 a month or more when combining coverage with multiple carriers.

Selecting the appropriate benefit amount is crucial for physicians to ensure that the coverage aligns with their income and lifestyle. Final-year medical students or residents could qualify for up to $5,000 a month in benefits, and doctors in fellowship might secure $7,500 without financial underwriting. Attending physicians, if they financially qualify, have the potential to acquire tax-free benefits of up to $30,000 a month. There are some nuances to what's available between carriers. For example, Ameritas only offers $20,000 a month to certain specialties and $30,000 to others, while MassMutual caps out their maximum at $20,000 a month in total benefit. Check with a WCI-vetted agent to see what's available to you. In addition, it's advisable to secure as much disability benefit as feasible and the flexibility to increase coverage as income rises utilizing the Future Increase Option/Benefit Update rider (more below on how those features work).

True Own Occupation

For a physician, the importance of true own occupation coverage in a disability insurance policy is paramount. In the medical field, where the nuances and demands of various specialties differ significantly, having this type of coverage becomes a lifeline. Imagine a scenario where a physician, due to a debilitating illness or injury, can't perform the specific duties of their specialized medical practice. True own occupation coverage ensures that, if they are physically unable to continue practicing in their specific field, they can still receive disability benefits. This distinction is crucial because it recognizes the unique skill set and expertise that physicians acquire in their chosen specialties. Without true own occupation coverage, a disability insurance policy might only provide benefits if the physician is unable to work in any capacity, potentially jeopardizing their financial stability and professional identity. For a physician, having true own occupation coverage is a means of preserving their commitment to their specialized medical practice.

Every one of the Big 5 (Ameritas, Guardian, MassMutual, Principal, and The Standard) offers true own occupation coverage.

Specialty Language

It's worth highlighting how most insurance carriers take the definition of disability insurance a step further. All of the Big Five DI carriers offer specialty-specific language, however, it may not be available in all states with Principal. What this means is if you’ve honed in on a particular medical specialty and put in the hard work and training to become an expert in that field, these insurance policies acknowledge that. If something happens and you can't practice in that specific specialty due to a disability, the policy recognizes that as your occupation. Essentially, if you were to become disabled and unable to do the material and substantial duties of your specialty but could do another medical specialty, you could receive all of your new income without your disability benefits being impacted.

While Principal offers specialty language, it is not available in all states. Check with one of the WCI-vetted agents to see current availability.

Other Available Carrier Variations of Own Occupation

Enhanced Medical Definition of Disability

Guardian Life Insurance Company offers a medical definition of disability. It is detailed and tailored, specifically for MDs and DOs. If more than 50% of income comes from surgical procedures or hands-on patient care, Guardian considers an individual to be totally disabled if they can't perform such procedures or duties due to injury or sickness, even if they can continue to do other duties in their specialty. It’s a quicker way to qualify for total disability benefits. None of the other Big 5 companies offers this option.

Transitional Own Occupation Rider

Transitional own occupation insurance, which is offered only by Principal, ensures coverage up to your pre-disability income level. If you can't work in your specialized field and start earning income elsewhere, your total net income (including benefits) can't surpass what you earned before your disability. Essentially, this policy allows you to pursue a new career while receiving benefits, with the company bridging the gap between your previous and current monthly income. This definition of disability will cost less than a “true own occ” definition of disability.

Optional Riders

Non-Cancelable

For physicians, a non-cancelable disability insurance policy guarantees that critical aspects of the policy, such as premium rates and coverage benefits, can’t change. They’re locked in. Premium rates won’t vary with this feature even if the carrier experiences multiple claims. The insurance company can’t go in and change the terms or pricing of the contract as long as the physician continues to pay the premium. Even if you choose a graded premium structure with the carrier, a non-cancelable contract can predict what the premiums will do over time.

Every one of the Big Five offers the non-cancelable language.

Guaranteed Renewable

The insurance company retains the authority to adjust your premiums based on changes in the health of a class of individuals. Premium rates can go up, but if they do, they’ll go up for an existing class of policyholders who have guaranteed renewable policies. Choosing a guaranteed renewable-only contract will shave some premium dollars off a policy, but there is a risk your rates could go up in the future. However, as long as you fulfill your obligation by paying your premiums on time, the insurance company is bound to renew your guaranteed renewable policy, irrespective of any alterations in your health or disability status. Know the risks of choosing this contract before purchasing a guaranteed renewable-only contract by talking to one of our vetted insurance agents. Of the Big 5, only Ameritas and Standard offer Guaranteed Renewable contracts.

Partial/Residual Rider

In your unique journey as a physician, one of the rider choices that holds immense importance when securing disability insurance is the partial or residual disability benefit rider. Why, you ask? Disabilities don't always start as total. Picture this: a gradual decline in health leading to a reduction in income. You might still manage full-time work, but your efficiency drops and patient appointments decrease due to feeling unwell. And what about life's unpredictable challenges, like the loss of a spouse or a close loved one like the story I shared above? Grieving can linger for months or even years, affecting concentration and work capacity. This is precisely where the partial disability benefit steps in, underscoring its serious consideration.

All carriers institute an income loss trigger of either 15% or 20%, with some adding a loss of time and/or duty requirement on certain less expensive riders. To qualify for partial disability benefits, you must meet both income loss criteria and be unable to work full-time or perform all your duties. The policy's language is crucial, emphasizing the need for thorough reading and comprehension. A W-2 employee may be good with an income loss and time/duty loss requirement, but a business owner/1099 employee should seriously consider a loss of income only partial/residual rider.

While all carriers offer the partial/residual rider, it's vital to recognize that the Partial/Residual riders available from the Big 5 carriers aren't all the same. For those who are business owners or foresee entrepreneurial ventures in the future, a policy with an income-only loss trigger—available from all the Big 5 —could be a strategic choice. However, it may make sense to go with a less expensive income loss and time/duty loss requirement Partial/Recovery rider, especially for those who only plan on working for hospitals or as W2 employees with no plans of owning a business. This highlights the importance of engaging with one of our vetted agents, ensuring you choose the carrier whose rider aligns best with your unique situation.

Recovery Benefit Rider

When it comes to returning to work after a disability, the journey goes beyond just physical or emotional recovery—it's about rebuilding financial stability. This is especially true for professionals like attending physicians who own their practices. While returning to a W-2 job might alleviate some financial strains, the narrative changes for those managing their own clinics.

For practice owners, bouncing back to pre-disability income levels could be a lengthy process, spanning months or even years, depending on the duration of the illness or injury. Patients may seek care elsewhere during the absence, and regaining their trust and patronage can be challenging, leading to a loss of income for a disabled doctor who has recovered.

Enter the recovery benefit feature/rider—a game-changer in this scenario. For entrepreneurs, selecting a recovery benefit aligned with the full benefit period of the disability policy—whether up to age 65, 67, or 70—is a strategic move. Even for W-2 employees, opting for a minimum 12-month recovery benefit provides a safety net during the financial adjustments post-disability. The significance of this benefit cannot be overstated—it's indispensable for maintaining financial resilience after a disabling setback.

The good news is that the Big 5 disability insurance carriers all provide recovery benefits. The crucial step is to verify that your policy includes this vital feature. Whether you're an entrepreneur or a W-2 professional, never underestimate the significance of a recovery benefit. It serves as your financial lifeline in the aftermath of a challenging disability.

Guardian has a notable advantage when it comes to recovery before completing the elimination period. If a physician has a 90-day waiting period but is only disabled for 60 days yet still experiences an income loss from days 60 through 90, Guardian allows these days to count toward fulfilling the rest of the elimination period. This means that even if the physician recovers before the elimination period is officially met, Guardian may still pay benefits once that period is completed. So, the elimination period can be met with Guardian being totally, partially, or financially (due to a disability) disabled. On the flip side, other carriers require that the elimination period be satisfied with total or partial disability before any recovery benefit can be considered. Guardian's approach offers more flexibility, especially for 1099 and business owners, in handling situations where recovery starts before the elimination period concludes.

For this reason, Guardian is the best for business owners.

Cost of Living Adjustment Rider

When it comes to must-haves, the Cost of Living Adjustment Rider, often known as the “COLA” rider, deserves a place right next to the Partial/Residual rider, especially if you're under 45. Let me break it down for you. Have you noticed the spike in grocery prices lately? It's a real concern as our buying power is gradually slipping away.

A few years back, a client of mine called to express his gratitude for introducing him to this rider, emphasizing its importance. He recounted attending a seminar where a disabled dentist, on disability claim for over two decades, chose not to buy COLA. As a result, that dentist was stuck with the same monthly disability benefits he had been receiving since his disability began nearly two decades ago. His purchasing power had taken a substantial hit, underscoring the critical role of having COLA in my client's policy.

In essence, this isn't a rider to be skipped over; it should be seriously considered. With prices rising and the value of our money diminishing, having the COLA rider can make a significant impact on maintaining financial stability, making it a key element in your insurance strategy.

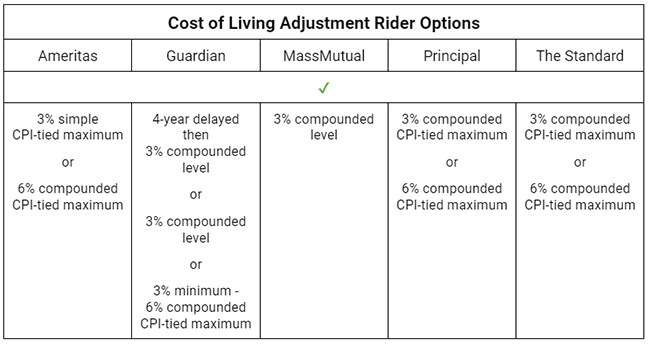

There are differences between what is offered in the marketplace as noted below.

Simple COLA

With a simple COLA, the benefit amount increases by a fixed percentage each year. However, the increase is based on the original benefit amount. For example, if your benefit is $1,000 per month and your simple COLA is 3%, your benefit will increase by $30 each year. After 10 years, your benefit would increase to $1,300 per month. This is the least expensive COLA option.

Compounded COLA

A compounded COLA increases your benefit each year based on the previous year's adjusted benefit amount. Using the same example, if your benefit starts at $1,000 per month with a compounded COLA of 3%, the first year it would increase to $1,030. The next year, the increase would be 3% of $1,030, and so on. Over time, this leads to significantly higher benefits compared to a simple COLA because each year’s increase is larger. Expect to pay more for a compounded COLA option because over time the benefit can grow even more substantially.

This chart shows a person who goes on a disability claim receiving a $10,000 a month benefit over a 20-year period and the difference in a level simple COLA, level compound COLA, and having no COLA. The first three months in the first year of the claim would not be paid because of the elimination period. Keep in mind there isn’t a carrier offering a level Simple COLA, as of this writing. This is for example purposes only. The Simple COLA example assumes the CPI stays at or above 3% for 20 years.

Consumer Price Index (CPI)

The Consumer Price Index (CPI) is a measure of inflation and reflects changes in the cost of goods and services. Some disability benefit increases are based on actual inflation rates while others offer Level Percentages. This allows the benefit to adjust in line with inflation, helping with purchasing power. Tying the CPI to the COLA will vary the results of the chart above because the percentage received on a COLA will be determined by the CPI.

In the chart below, you can see which companies offer different types of COLA. As mentioned, a Simple COLA generally comes at the lowest cost, followed by a Compounded COLA. Companies offering level COLA options tend to be more expensive compared to those tied to the Consumer Price Index (CPI) except when purchasing the 6% maximum CPI-tied COLA rider. However, CPI-tied COLAs often include a cap on the maximum percentage increase. For example, Ameritas offers a CPI-tied COLA with a 3% cap, meaning that even if the CPI rises above 3%, the benefit increase is limited to this maximum percentage.

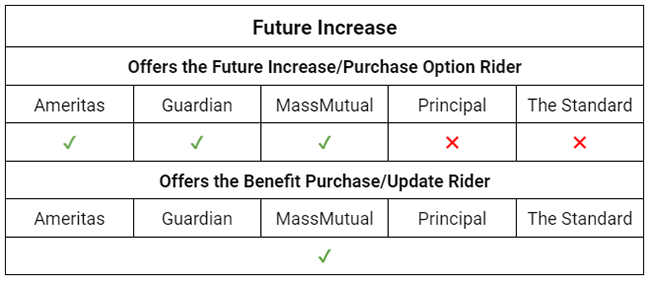

Future Purchase/Increase Option/Benefit Purchase Rider

The Future Increase Option (FIO, FPO, etc.) and the Benefit Update Rider (BUR, BPR, etc.) become crucial, especially for those with high earning potential like young physicians and dentists. These riders play a pivotal role in securing financial protection by allowing policyholders to increase their benefit amount without the hassle of proving their health.

The FIO rider, despite being an additional expense, brings valuable flexibility to the table. It enables annual adjustments, giving you control over decisions to accommodate income increases. This flexibility remains important even if you transition to a riskier profession, ensuring robust income protection.

On the flip side, the BUR (BPR), often included at no extra cost, operates on a stricter schedule, requiring exercise every three years. While it comes with a lower cost, its stricter exercise rules demand careful consideration. You have to exercise every three years or the rider falls off the policy. If you forget about the rider, you’re out of luck.

For young physicians, the decision between flexibility and cost-effectiveness is paramount when selecting the Future Increase Rider that aligns best with their career trajectories and financial goals. It's a strategic move that not only safeguards your financial well-being but also ensures adaptability to the evolving dynamics of your profession.

Mental Nervous/Substance Abuse Benefit

In a 2023 survey by The Physicians Foundation, the well-being of physicians—both current and future—was found to be distressingly low. In fact, the study revealed a concerning trend over the last three years, with 6 in 10 physicians reporting frequent burnout, a significant increase from the 4 in 10 recorded in 2018. This burnout phenomenon extends to residents and medical students, where 7 in 10 students also reported grappling with these feelings.

Given the urgency of this issue, it's paramount to delve into the mental nervous/substance abuse benefit. Many carriers limit this benefit to 24 months and offer a 10% policy discount for doing so. However, declining this discount ensures that benefits persist for the entire benefit period, whether it's up to age 65, 67, or 70, in the case of disabilities stemming from mental, nervous, or substance abuse issues.

At present, all of the Big 5 insurance carriers provide unlimited mental nervous coverage for most physicians. Yet, certain specialties—including anesthesiologists, CRNAs, ER physicians, and pain management physicians—may be subject to a mandatory 24-month mental nervous/substance abuse limitation with all carriers (gynecologists and OB/GYN with Ameritas). General dentists (Guardian, MassMutual) and pharmacists (Principal) might also face this limitation with specific carriers.

It's crucial to note that some carriers impose limitations on all contracts, in particular states like California, New York, Louisiana, Florida, and Nevada. Furthermore, those eyeing a Guaranteed Issue Disability Contract should be aware of the mandatory 24-month limitation on those types of policies. Considering its nuances, this benefit is something not to be taken lightly.

Other Riders to Consider But Not Required

Student Loan Protection Rider

The Student Loan Protection Rider is designed to assist with student loan payments in the event of total disability, operating within a specified maximum duration or term. Typically, it aligns with the contract's definition of total disability, such as true own occ/specialty language. It's important to note that most of the Big 5 carriers who offer this rider do not pay student loan disability benefits on partial or recovery claims except for Ameritas. If you decide between opting for this rider or increasing your base benefit, prioritizing a higher base benefit is advisable.

However, if you've already reached the maximum limit of your base benefit, considering this rider may be beneficial, particularly if you have significant student loans. The rider offers benefits ranging from $250-$2,500 per month with a fixed term of either 10 or 15 years. It's crucial to understand that it's a fixed “term,” not a flexible benefit period, meaning it ends after either 10 or 15 years once you take out the disability policy. All carriers who offer this work pretty much the same.

Principal is the only Big 5 company that does not offer this rider.

Catastrophic Disability Benefit Rider

The Catastrophic Disability Benefit aims to aid individuals confronting severe and enduring disabilities, significantly restricting their capacity for routine daily tasks. This crucial financial support is extended to those grappling with catastrophic conditions—like permanent limb loss, paralysis, or profound cognitive impairments—hindering their ability to perform essential activities. The primary goal is to provide a safety net for individuals necessitating extensive and continual care, covering expenses related to medical care, rehabilitation, and other essential needs.

While infrequently utilized, this benefit becomes exceptionally valuable for those who ultimately require it. Evaluating whether the additional cost of this rider is justified necessitates a consideration of whether the benefits outweigh the risks, demanding a thoughtful decision on its worth. If not maxed out on the base benefit, then this could be something to consider. When deciding to add the rider, pay close attention to the details of the rider because not all carriers work the same. While some carriers will trigger with an inability to do two or more activities of daily living, some require more of a presumptive disability (permanent loss of use of hands, legs, eyesight, hearing in both ears, or the loss of use of a hand and a foot). Also, you may find one may have a built-in cost of living feature (Guardian’s Enhanced Catastrophic Benefit) making the rider more expensive. The bottom line is to choose what’s important.

Every Big 5 company offers this rider.

Retirement Protection Rider

Retirement Protection disability insurance is designed to substitute the retirement contributions that would typically be made if an individual is not disabled. This insurance option is available either as a standalone long-term disability policy or as a rider on an individual disability policy. However, go for maximizing your base benefit rather than buying this rider. It's crucial to note that for this rider or policy to pay, you must be totally disabled and not working. The reasoning behind this is once you resume employment, you are likely eligible to make retirement contributions again.

Guardian, MassMutual, and Principal offer this rider.

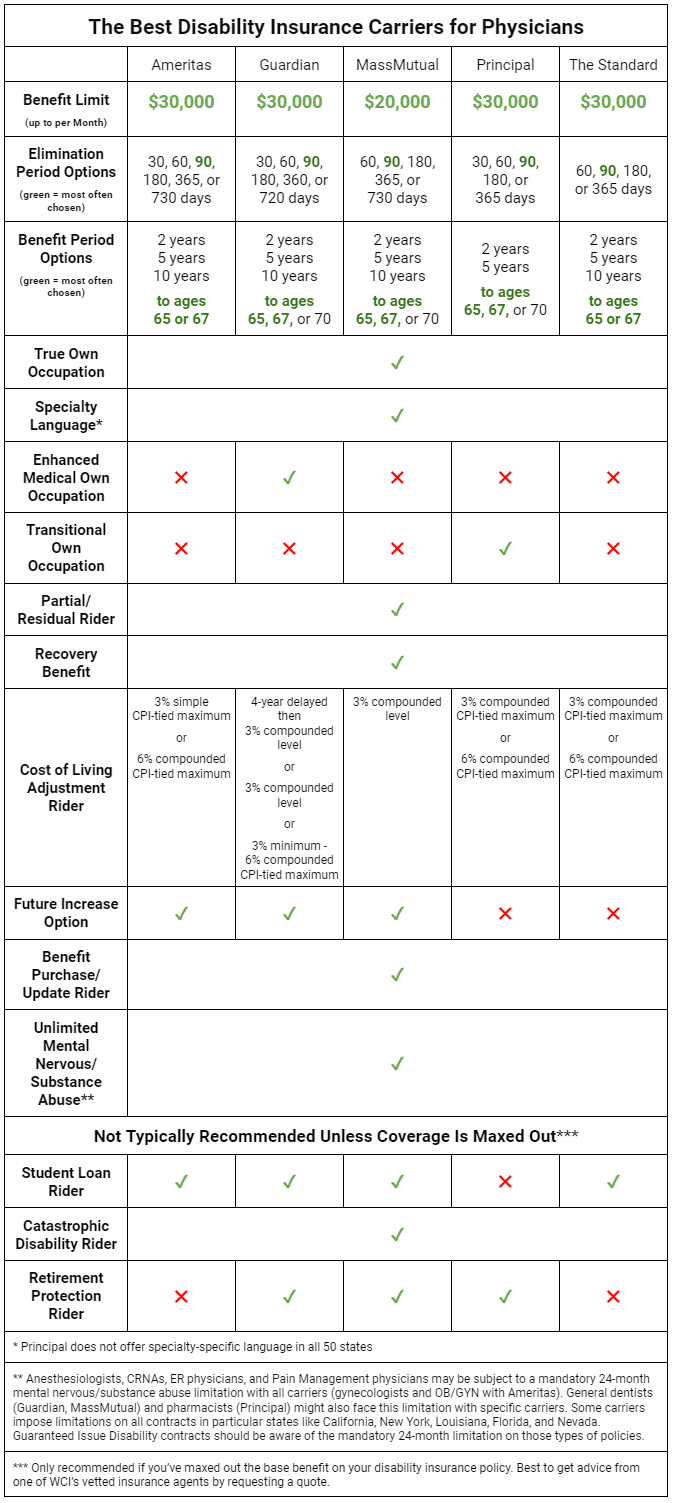

The Best Disability Insurance Companies

When it comes to the best disability insurance companies for doctors, Ameritas, Guardian, MassMutual, Principal, and The Standard top the list. Each of these providers offers unique features tailored to different medical specialties. Specializing in serving the medical, dental, and white-collar sectors, all five companies deserve consideration when seeking income protection options.

While these carriers generally share similar definitions of “true own occupation,” and all offer “specialty-specific language,” with Principal not offering specialty-specific language in a few states. Guardian, for instance, stands out with its enhanced medical specialty language, expediting total disability qualification—a valuable feature for those involved in procedures or hands-on patient care.

When crafting a policy, careful consideration of riders is essential. Partial/residual coverage is a must, as disabilities often start gradually, and recovery disability becomes crucial for those returning to work but experiencing continued income loss. Cost of living protection is equally vital, ensuring benefits keep pace with inflation during a disability, maintaining one's ability to afford living expenses.

Another critical factor is the flexibility to increase benefits without medical underwriting in the future. This underscores the significance of options like the Future Purchase/Increase Option and the Benefit Update Rider, particularly beneficial for individuals (such as those in residency) anticipating rising incomes in the coming years.

Something that should not be underscored is the critical importance of mental nervous coverage in disability insurance. Many carriers limit disability benefits to 24 months and offer a discount for this duration. However, declining the discount ensures benefits for the entire benefit period, whether until age 65, 67, or 70—particularly in cases of mental, nervous, or substance abuse-related disabilities. While major carriers presently offer unlimited mental nervous coverage, certain medical specialties may encounter mandatory 24-month limitations. The intricacies of this benefit highlight its significance in safeguarding the well-being of healthcare professionals facing the growing challenges of burnout and mental health concerns.

Lastly, for individuals who have maxed out their base disability benefit, the Student Loan Protection Rider can offer assistance with student loan payments in the event of total disability (possibly some partial claims with Ameritas). While it doesn't cover partial or recovery claims, this rider becomes a viable option for those with significant student loans and no room to increase their base benefit. Benefits range from $250-$2,500 per month over a fixed term of 10 or 15 years, emphasizing the need for careful consideration of this fixed “term” feature.

Similarly, the Catastrophic Disability Benefit becomes relevant when the base benefit is maximized, providing crucial financial support for severe disabilities. However, the additional cost warrants careful evaluation, and details may vary among carriers. Retirement Protection Disability Insurance, an alternative for those with a maxed-out base benefit, is designed to replace retirement contributions during disability. Opting for this rider over maximizing the base benefit requires thorough consideration, as it only pays when totally disabled and not working, aligning with the assumption of resumed employment and retirement contributions.

The choice among these options involves a nuanced assessment of individual priorities and carrier-specific details.

Financial Strength

Comdex Ranking for Disability Insurance Carriers

When it comes to benefits and riders, Ameritas, Guardian MassMutual, Principal, and The Standard are all similar. When it comes to financials, however, there may be things to consider.

Some carriers may be better positioned financially to weather a bad financial downturn. When considering a disability insurance carrier, the financial strength of the company is important, and the Comdex ranking serves as a key metric in evaluating this aspect. The Comdex score, consolidating assessments from various credit rating agencies, offers a comprehensive view of the insurance company's overall financial robustness and assigns a score between 1 and 100 (with 100 being the highest). This score shows that a carrier is well-capitalized and possesses a good financial foundation and that it's well-positioned in its position to fulfill claims—particularly concerning disability benefits—in tough economic times.

With that being said, states diligently regulate insurance companies, with all 50 states implementing protective systems for policyholders in the unfortunate event of an insurance company going out of business. This regulatory framework makes sure that individuals are not left stranded if their insurer faces financial challenges. Despite stringent regulations, insurance companies can still fail due to various reasons, such as underpricing and high claim rates. The state's guaranty system comes into play to safeguard policyholders, and every state has guaranty associations covering disability insurance policyholders but their guarantee has its limits and is capped depending on the state. Still, it’s smart to limit your risks, assess insurance companies' financial strength through independent agencies like AM Best, and utilize tools like the Comdex score to make well-informed decisions when buying disability insurance.

How Much Should You Expect to Pay?

The cost of a quality individual disability insurance policy can vary based on several factors—such as age, state of residence, gender, occupation, chosen benefit amount, and benefit period duration. As a general guideline, for every $100 of gross income you wish to cover, anticipate paying between $3-$5 or roughly 3%-5% of your income if covering 100% of your gross pay.

If your annual income is $300,000, expect annual premiums to range from $9,000-$15,000 for comprehensive income protection coverage. While this might initially appear steep, it's crucial to recognize that disability insurance is frequently utilized, particularly during one's working years, with statistics showing that slightly more than 1 out of 4 adults will experience a disability before retirement. Even within specific professional fields like medicine, where disability rates may be lower, approximately 1 out of 7 doctors will still use the disability insurance they've purchased. These statistics underscore the importance of obtaining adequate coverage despite the associated costs.

What About Northwestern Mutual and New York Life’s Disability Offerings?

Northwestern Mutual and New York Life are two well-established mutual insurance companies offering individual disability insurance to physicians. Both boast strong financial ratings. However, their disability insurance products are exclusively sold only through captive agents, meaning independent agents cannot sell these policies. Additionally, there are several important factors to consider regarding their disability insurance contracts, especially for physicians seeking comprehensive coverage.

Northwestern Mutual

Northwestern Mutual has been a longstanding player in the disability insurance market, but its offerings have certain limitations. While it provides an option for a medical specialty definition of total disability, there are some questions on how it would pay in a claims scenario. In Northwestern Mutual’s policy, even though physicians and dentists can be covered under a variation of their true occupation definition of disability, there are nuances in how partial and total disabilities are handled. For instance, Northwestern Mutual’s Partial Disability Benefit Rider only offers coverage if the insured suffers a 20% loss of income due to disabling sickness or injury and is not working full time. Plus, its recovery benefit is only for 12 months, which can be too short in certain scenarios. Additionally, there’s a mandatory two-year limitation on benefits for mental/nervous disorders and substance abuse.

New York Life

New York Life, after a hiatus, reintroduced individual disability insurance a few years ago with its My Income Protector policy. Although it offers true own occupation coverage for medical professionals, its policies can be more costly compared to the “Big 5” carriers. For instance, while New York Life offers strong protection with true own occupation language, this sometimes comes at a higher price, with premiums being 2-3 times more expensive when adding the true own occupation feature than other options available to physicians. Like Northwestern Mutual, New York Life also mandates a two-year limitation on mental/nervous disorders in all contracts. However, its recovery benefit is a little longer at 18 months compared to Northwestern Mutual’s contract.

If considering either New York Life or Northwestern Mutual, it's a good idea to get a second opinion from a WCI-recommended independent agents.

The Bottom Line

All these features in a disability insurance contract are like puzzle pieces. How they fit together should all be a crucial consideration for any physician. From the elimination period before benefits kick in to the actual benefit paying and to even how long that benefit lasts, it all matters. Making smart choices about contract features is a big deal. It's about aligning the coverage with income, lifestyle, and career trajectory. Getting a disability quote from The White Coat Investor makes sense. Tailor a plan that suits your unique needs. It's about being informed and protecting your finances.

Obtaining quality disability insurance is a must for any physician, so you can be sure to protect your hard-earned income. Get a quote from one of our recommended insurance agents and cross this task off your to-do list today!

Which disability insurance companies have you used? Have you been satisfied? What were the most important factors that you used to make your choice?

The White Coat Investor may receive compensation from White Coat Insurance Services, LLC; licensed in all states including MA and DC; CA license #6009217; NY license #1758759 (exp. 6/2025); Registered address: 10610 S. Jordan Gateway, #200 South Jordan, UT 84095. This does not affect the cost or coverage of insurance.