By Travis Christy, White Coat Insurance

By Travis Christy, White Coat Insurance

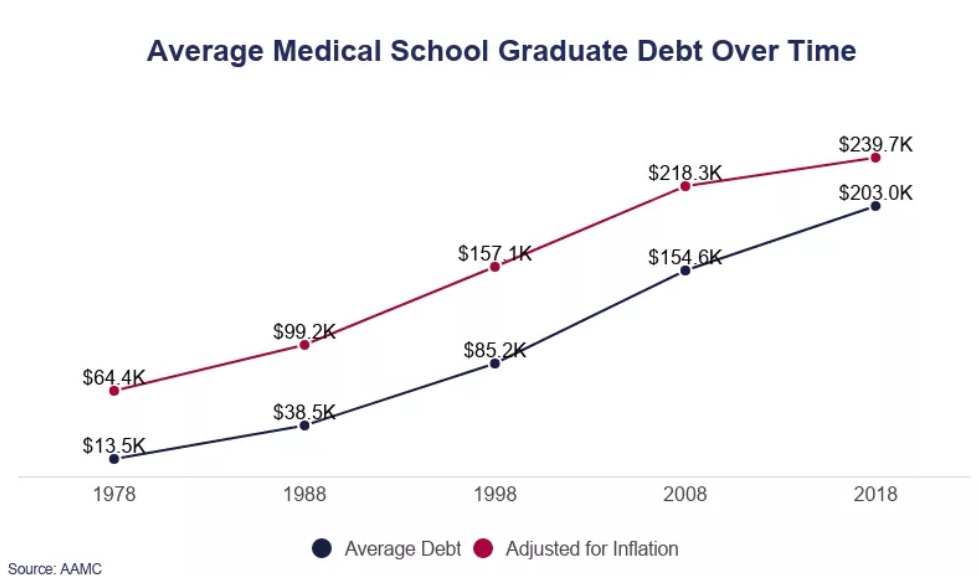

The statistics from the Association of American Medical Colleges (AAMC) regarding student loan debt among medical school graduates are staggering. On average, medical school debt surpasses $200,000, not including undergraduate or other educational expenses. When tallying it all up, the typical medical school graduate faces a jaw-dropping quarter-million-dollar debt burden. This financial strain is widespread. Approximately 73% of medical school graduates carry educational debt, and roughly 31% also grapple with pre-medical educational debt.

To put things into perspective, medical school graduates end up owing four times more than the average college graduate. Moreover, a significant 70% of medical school students rely on loans specifically tailored for medical education. Given these figures, it's no wonder insurance companies have introduced disability products geared toward protecting physicians' ability to repay loans in case of illness or injury.

In this post, we'll dive into the mechanics of the “Student Loan Disability Rider” available as an add-on with some disability insurance company offerings and whether it merits consideration when you're looking into income protection. Discover which insurance providers offer this feature and understand the distinctions between it and government or private loan forgiveness programs. Let's unravel the details together.

What Is the Student Loan Rider on Disability Insurance Policies?

For physicians who have heavily invested in their education, the student loan rider is an option worth considering. This rider offers supplemental financial assistance aimed specifically at student loan payments, which can be particularly beneficial during a doctor's early career. By providing an additional monthly benefit amount on top of the basic coverage, it offers an alternative approach to addressing the financial strain of educational debt. The rider's payout is directly tied to the amount of coverage purchased and the monthly student loan obligations, offering a tailored solution to an individual's specific circumstances. Here’s an example of what a policy may look like with a student loan rider:

$5,000 base monthly benefit + $2,500 student loan rider benefit = $7,500 total coverage

Which Carriers Offer the Student Loan Rider?

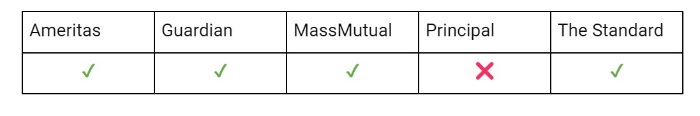

Most of the Big 5 disability carriers have the student loan rider as an option on their policy. The only carrier not offering the rider is Principal.

More information here:

What Disability Insurance Riders Do Doctors Need to Buy?

Disability Insurance: The Vital Role of the Residual/Partial Disability Rider

How Does Each Carrier's Rider Work?

Ameritas

The Student Loan Protection Rider from Ameritas offers an additional benefit to help cover student loan payments during a disability. It can be added to existing DInamic Foundation policies at the policy anniversary, subject to underwriting approval. The rider requires a disability policy with a base benefit of at least $1,000, and it is available across various occupation classes. It provides coverage for up to five- to 15-year terms, and up to three student loans can be covered on one policy. The student loan rider benefit ranges from $100-$2,500 per month. Where Ameritas may have a competitive advantage with this rider is with a residual or partial disability. Under the policy, the rider reimburses up to 50% of the monthly loan payment (when the disability is residual or partial). Other carriers only pay under a total disability scenario.

Guardian

Guardian's Student Loan Protection Rider gives you the choice between a 10- or 15-year term. It kicks in only if you're totally disabled, and unlike Ameritas, it does not have any partial or residual benefit component. As a physician, you can receive monthly benefits ranging from $250-$2,500. It is reimbursement, meaning you must provide receipts and proof of your student loan payments to receive benefits at claim time. However, Guardian offers something called the Supplemental Benefit Term Rider as an option instead of the Student Loan Protection Rider. It costs more than the loan rider, because, instead of it being reimbursement, the rider is indemnity. That means Guardian will pay out the benefit directly without needing receipts. Plus, even if you manage to pay off your student loan early, you're still eligible to receive proceeds from the Supplemental Benefit Term Rider, as long as the term hasn't expired.

MassMutual

MassMutual’s Student Loan Rider (SLR) operates by providing a monthly benefit to cover student loan debt in the event of total disability. The coverage term can be either 10 or 15 years. Maximum benefit amounts range from $100-$2,500. You can opt for waiting periods of either 90 or 180 days, and it doesn't have to match the base policy. When it comes to reimbursement, you'll receive the lesser amount between the maximum benefit amount and the verified reimbursement amount. For example, if your verified student loan debt is $1,500 but the maximum monthly benefit is $2,000, you'll receive $1,500 as your benefit amount under the SLR (this works the same for the other reimbursement riders with the other carriers).

The Standard

The Standard's Student Loan Rider is designed for specific occupation classes and age groups, offering either a 10-year or 15-year term. To qualify, your base policy must provide benefits until either age 65 or age 67. Under this rider, Standard will reimburse you for your monthly student loan payments if you become totally disabled while the rider is active and you meet the conditions for total disability benefits. Additionally, you must fulfill the waiting period for student loan benefits, make monthly student loan payments before the rider expires, and provide proof of loss each month. The amount reimbursed ranges from $100-$2,500 per month.

More information here:

People Aren’t Buying Disability Insurance, But They Should

A Pain in the Butt – My Dental Disability Story

What About Student Loan Forgiveness?

You might wonder if there's any way out of debt through loan forgiveness. It’s possible with what’s called Total and Permanent Disability (TPD) discharge, but it comes with specific requirements. First off, your student loans need to be under a federal government loan program like the Federal Perkins Program or the William D. Ford Federal Direct Loan Program. Plus, you'll have to prove your total and permanent disability by submitting documentation from the Department of Veterans Affairs (if you're a veteran), the Social Security Administration, or a trusted physician to the US Department of Education.

The Bottom Line: Opt for a Bigger Disability Base Benefit Unless You’ve Maxed Out

If you've been following The White Coat Investor for a while, you probably know we're big on maximizing your base benefit before considering the student loan rider. When it comes down to choosing between the two, it's all about picking the option that sets you up for the most benefits in the long haul. Now, the student loan rider works as a “term rider,” meaning the coverage clock starts ticking as soon as you start your policy.

For example, if you grab a 15-year student loan rider and end up disabled after 10 years of having the policy, you've only got five years left for the rider to pay. On the flip side, if you beef up your base coverage, those benefits stick with you until your policy ends (until age 65 or 67). But if you've maxed out your base benefit and you still need more coverage—especially to tackle hefty student loan debt—grabbing the rider might be a smart move. And remember, you can always ditch the rider once those loans are all paid off.

Obtaining quality disability insurance is a must for any physician, so you can be sure to protect your hard-earned income. Get a quote from one of our recommended insurance agents and cross this task off your to-do list today!

What do you think? Would you consider buying student loan disability insurance? Why or why not?

[This updated post was originally published in 2017.]

The White Coat Investor may receive compensation from White Coat Insurance Services, LLC; licensed in all states including MA and DC; CA license #6009217; NY license #1758759 (exp. 6/2025); Registered address: 10610 S. Jordan Gateway, #200 South Jordan, UT 84095. This does not affect the cost or coverage of insurance.