By Dr. Jim Dahle, WCI Founder

By Dr. Jim Dahle, WCI FounderLast year I wrote a post about the S Corp tax return, aka IRS Form 1120-S. Near the end of the post, I briefly mentioned Schedule L, the balance sheet. Here's an excerpt from that section.

One of my big beefs with Form 1120-S is that the instructions for Schedule L are very skimpy. It's really hard to know if you are filling it out right. The good news is that I don't get the impression that the IRS cares all that much about what you put on here. It doesn't involve taxable income or deductions so it doesn't affect your tax bill at all. It's just for their information as near as I can tell….I've never really been able to figure out what to put on Line 14. I've been including a value for the URL and the trademarks of the business there and listing them on an attached statement. I should probably stop doing that or else add that value back into Quickbooks so the balance sheet in Quickbooks and the balance sheet on Schedule L match. If you're a CPA experienced with this return, I'd love your opinion on that question….Again, if there's a CPA Schedule L genius who wants to tell me what I'm doing wrong here, if anything, I'm more than open to your input. But as near as I can tell, if I'm screwing it up, the IRS doesn't care very much.

Well, it turns out that I WAS doing Line 14 wrong. And it DOES matter. No, the IRS didn't come after me, but as you'll recall, 2019 was the last year our COO let me file the 1120S myself. In fact, he had our new accountant look over the 1120S for 2019 as we brought her on board this year. Then she wanted to look at 2018. And 2017. She advised me to have her file them all over again, primarily because of Line 14.

There was no additional tax owed for any of those years (it didn't change Schedule K and thus the K-1s a lick), but it could affect the tax bill if WCI is ever sold. More importantly, the book value on the taxes now matches the book value in our books. Here's the bottom line:

You don't include anything for “the value of the business” on line 14.

Which means I don't have to come up with a random figure to put on line 22 (capital stock) to make lines 15 and 27 equal as they should be.

I still blame the IRS. The 1120S instructions for Schedule L (page 44) are absolutely terrible. I guess they figure nobody who has to file an 1120S is going to try to do it without getting an accounting degree first. They only give line by line instructions for 3 of the 27 lines, and no, one of them is not line 14.

All that said, let's go back to the beginning of Schedule L.

Schedule L

First, make sure you actually have to file Schedule L. If your corporation's total receipts for the tax year AND the total assets of the corporation (not counting the value of the business itself) are less than $250,000, you don't have to fill out Schedule L at all. That's probably a majority of S Corporations, including many doctors who file as an S Corp for their clinical work.

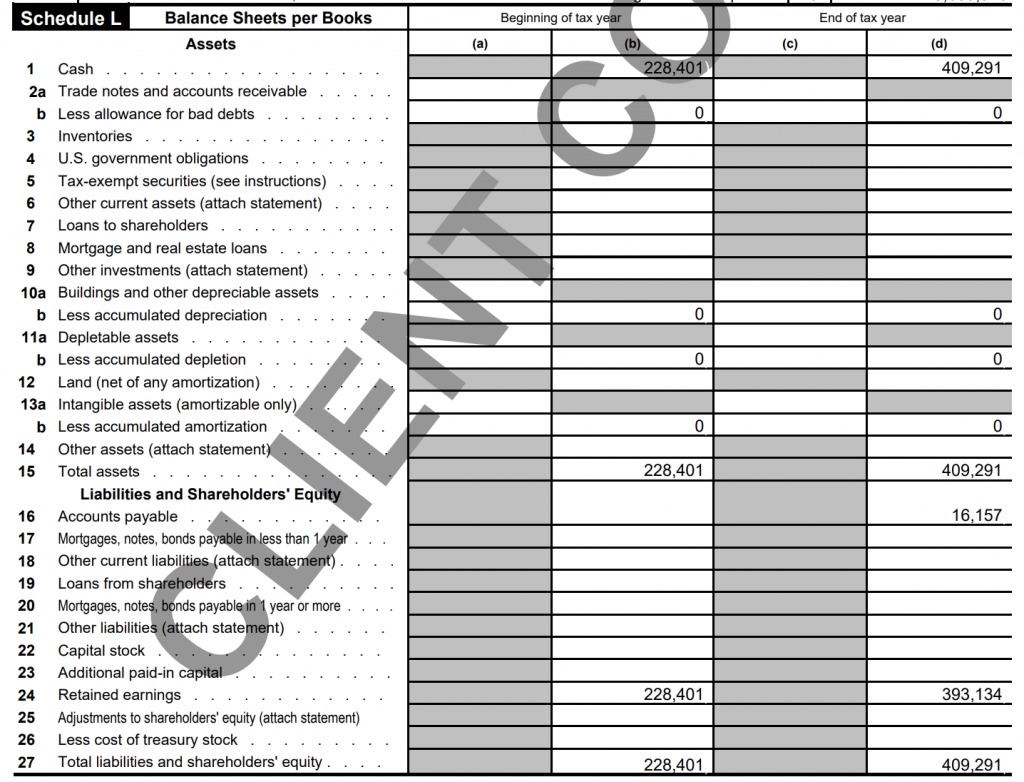

Now, take a look at the form. It includes two almost identical sets of two columns each. The left columns (a and c) include some adjustments and the right columns (b and d) include the totals. In the case of WCI, we only have anything in the right columns. If this is not your first year filling this form out, you simply take last year's form and transfer columns c and d to columns a and b. If this is your first year, then columns a and b will show where the business stood at the beginning of the year. Columns c and d, of course, are how the business stands at the end of the year. Let's go line by line.

Assets

Line 1 (cash) is going to have something on it for pretty much every business. This is simply the money in your bank account. Easy-peasy. Look up the balance on December 31st (assuming you use the calendar year as your business year like most S Corps) and put it on line 1 column d.

Lines 2a (accounts receivable) and 2b (allowance for bad debt, i.e. the accounts receivable you don't end up being able to collect) is generally used only by companies that use the “accrual” basis for the business. We do our books on a cash basis, so we don't use that line. In case you're curious, a “trade note” is just a check.

Line 3 will have something on it for many businesses, particularly those making products. In the past, we have never had any inventory since our books are all print on demand. In the future, that may not be the case (stay tuned for details).

Lines 4, 5, and 6 are for any investments like treasury bonds, municipal bonds, or stocks that the corporation holds. This isn't very common. WCI doesn't own any investments that would need to be reported on these lines.

Lines 7 and 8 are loans the corporation has made to others, including shareholders on line 7 and mortgages on line 8. Remember this is not the mortgage the corporation pays, it is a mortgage paid to the corporation. We don't have any of those, but it does make me ponder the merits of having an S Corp loan me money personally. I haven't been able to think of an advantage to doing that yet. If you can think of one, let me know.

Line 9 is for other investments that the corporation owns, like parts of other businesses. We haven't had anything on this line before, but may in the future (stay tuned for details.)

Lines 10a and 10b are easy. If the business owns any buildings, list their value in line 10a. List how much has been depreciated on line 10b. WCI doesn't own any buildings (although it does rent out our home 14 days a year-one of my favorite tax deductions), but maybe someday. Other depreciable assets should also be included. Ideally, you want to expense (i.e. take a full deduction for) everything in the year you buy it, but there are some items you can't do that with and must depreciate.

Lines 11a and 11b are for “depletable assets”. This is for businesses that extract natural resources (timber, minerals, and oil) from the earth. If your business does that, you better figure out how to calculation depletion or better yet, find an accountant who does. WCI certainly doesn't.

Line 12 is for land. Yes, you have to split up the value of any property owned. The building goes on line 10a and the land goes on line 12.

Lines 13a and 13b are for “intangible assets subject to amortization”. As you'll recall from all that business training you got in medical school, amortization is the process of periodically reducing the book value of a loan or an intangible asset. Think about the “amortization schedule” of your mortgage. Tangible assets are land, vehicles, equipment, and inventory. Intangible assets are goodwill, brand recognition, patents, trademarks, and copyrights. They are non-physical assets that can be assigned an economic value. Now WCI has lots of intangible assets and they do have economic value (although they are all admittedly difficult to value), but none of them are amortizable. If another company purchased WCI, they could amortize the goodwill of the WCI brand and the White Coat Investor trademark, but we can't amortize them because we never bought them. We built them. So nothing goes on line 13 for us.

Line 14 is my nemesis. Most companies don't put anything on this line. Apparently, we are like most companies in that regard. So nothing here. But you can see why Schedule L is so tricky to figure out when there is line 6 “other current assets”, line 9 “other investments”, and line 14 “other assets”.

Line 15 totals up all of the assets.

Liabilities and Equity

Line 16 is accounts payable. This is all your debt except as otherwise listed on the schedule. In our case, it's the balance on the business credit card on 12/31.

Line 17 is for mortgages, notes, and bonds payable in less than 1 year. If your business property is mortgaged, the balance of the mortgage on 12/31 goes here.

Line 18 is for “other current liabilities”. Current means payable in the next year. No, I have no idea what would go on this line that isn't already included on lines 16 and 17. Neither does the IRS, so they ask you to itemize them on an attached statement.

Line 19 is for loans from shareholders. Remember if your business needs money for whatever reason you, as a shareholder, can contribute capital to the business or you can loan money to the business. There are advantages and disadvantages either way (for example, the business needs to pay you interest on the loan), but they are accounted for differently. If it is a loan, it goes on this line.

Line 20 is for mortgages, notes, and bonds payable in more than 1 year. What a mess to have to somehow split up your mortgage into “payable in the next year” for line 17 and “payable long-term” for line 20, but I guess you can pull that figure off the amortization schedule. The total of the two should equal the total of the mortgage. Glad we don't have one.

Line 21 is for other liabilities not due in the next year. Again, you have to attach a statement.

Lines 22 and 23 can be confusing. Capital stock is any stock that has been issued by the corporation. So let's say you sell off 20% of the corporation, giving the buyer stock in the company in exchange for cash. The current value of that stock now gets entered on line 22 every year. More commonly, you started the business as a sole proprietorship or LLC years ago and injected a bunch of personal money into it that was counted toward your capital account. When you convert the business to a corporation, that capital account has to be converted to something. That something is either capital stock or additional paid in capital (line 23). Most accountants recommend you put as much of that onto line 23 and as little of it onto line 22 as possible to provide flexibility in taking future shareholder distributions without affecting capital stock. These two lines are essentially where the accountants massage the books to keep them straight when changing business entities and when records have been incomplete (as they often are for small businesses). Luckily in our case, both of these lines are $0 since we never really put any money into WCI.

Line 24 is retained earnings. Now we're getting really complicated. In a general sense, retained earnings are profits the business made that you didn't pull out as a distribution. In a practical sense, this number comes from Schedule M-2 (Schedules L, M-1, and M-2 all basically work together). I believe it is the sum of lines 8a-d that goes on Line 24.

Line 25 is any adjustments needed to line 24. As a general rule, accountants recommend you make this adjustment on M-2 if possible, not line 25.

Line 26 is the cost of treasury stock. Treasury Stock is a fancy term for the amount of stock the corporation has bought back from shareholders this year.

Line 27 is where you total up all of the liabilities. Yes, line 15 should be equal to line 27.

At the end of the day, ours is still really simple. It's even simpler now that we don't put anything on Line 14. Here's what it looked like after the accountant finished with it:

Most of what goes on it is the business bank account balance (lines 1, 15, and 27) and the credit card balance (line 16). Line 24 is simply the difference between the two, although it matches precisely line 8a of Schedule M-2.

There you go. Schedule L in a nutshell. I hope you found that walkthrough helpful.

If you need help with tax preparation or you’re looking for tips on the best tax strategies, hire a WCI-vetted professional to help you figure it out.

What do you think? Do you file form 1120-S? Ever tried to do it yourself? What questions do you have about Schedule L?