By Dr. Jim Dahle, WCI Founder

By Dr. Jim Dahle, WCI FounderSome people think I'm a glutton for punishment. They're probably right. You see, I've been doing my corporate income taxes without the assistance of a professional tax preparer. To make matters worse, I've been doing it by hand. To be honest, it is much easier than doing my very complicated personal tax return. Although our new COO tells me this will be my last year doing it. Something about my time being too valuable to spend doing that stuff.

I probably inherited this affliction from my parents who refer to themselves as “Scottish” (they can't possibly be more than about 25% Scottish). My dad is still doing his own C Corp return and he hasn't even been earning any money in that corporation for the last decade. He just formed it to minimize Super Cub related liability. Like any tax return, once you do it the first time, you're mostly just copying what you did each year.

At any rate, doing your own taxes, and especially doing them by hand, might not be a good use of your time, but it is a great way to really understand how taxes work. If you, like me, have a relatively simple corporation and need to file the 1120S, you might try filling one of these suckers out yourself. This post will walk you through the steps. Remember I'm not a CPA, I screw up my tax returns all the time, and if you need serious help, find an accountant, not a blogger. This is not something I recommend most attempt to do.

How to File S Corp Taxes

The first thing to know about the 1120S is that it is the form for a corporation that has made an S election or, in my case, an LLC that has first elected to file taxes as a corporation rather than a sole proprietor or partnership and then made an S election. If you are filing as a sole proprietorship, file Schedule C on your personal tax return. If you are filing as a partnership, file Form 1065. If you are filing as a C Corporation, file form 1120. The 1120S is only for S Corps. This tax form is due to be postmarked by March 15th, but you can file an extension on Form 7004. It's literally one page, 8 lines, and will take about 30 seconds. You see, with an S Corp being a pass-through entity, you pretty much put $0 on every line. Extending has no cost and pushes the due date on your return back to September 15th. In fact, I might file it just for fun in case I discover an error on my corporate return while doing my personal return later this summer (which I will certainly need to file an extension for, as well.)

Okay, let's get into it. There are five pages on the 1120S, but most of the interesting stuff is on Page 1. I'll divide that up into several sections.

Form 1120-S, Page 1

The first section has lots of identifying information.

As you can see, these lines/boxes are lettered rather than numbered.

First, fill out the corporation (or LLC) name and address. If you use a different tax year than a calendar year, fill that out. (I just use the calendar year to keep things simple.)

Line A is when you became an S Corp.

Line B is your type of business. There's a big long list at the end of the 1120S instructions, but my business is code 519100 – “Other Information Services (including news syndicates, libraries, Internet publishing, & broadcasting)”.

If you have to attach schedule M-3 (I don't), check box C. Basically if you have business assets over $10M, you have to check that box.

Line D is your EIN.

Line E is the date you incorporated, for me, it's the same as Box A.

Line F is your total business assets. Remember this is the return for your business, not for you personally. If you're not sure what this is, check the balance sheet in your books like Quickbooks.

Check Yes on G if this is your first time filing this form.

Line H is for changes to the business.

Line I is for the number of “shareholders.” Don't get confused if you're an LLC like me, it's just the number of members. Two, in our case.

The boxes under J are for companies making films, farming, or searching for oil and gas, i.e. “section 465 activities.” I leave it blank.

Now we're into the meat of the return. The truth about a corporate (or really any business return) is that the hard part is doing your books, not filling out the return. Once the books are done, you're simply transcribing numbers from your books to your return. So learn to do your books right and the tax return is a piece of cake. I simply go to Quickbooks, pull up the profit and loss statement for the year, and start transcribing numbers. Here's the first part of my income statement:

So lines 1A and 1C are the amount under “Total Income” on the profit and loss statement. We leave 1B blank. Line 2 comes from the “Cost of Goods Sole” line on the profit and loss statement. And line 3 (and line 6) comes from “Gross Profit” line on the profit and loss statement. We don't have anything on lines 4 and 5. Line 4 is all about selling business assets (which we didn't do) and line 5 is for some unique kinds of income a business may have had such as interest on accounts receivable. Super easy, right? As you'll see, you have to fill out a separate form for line 2, called Form 1125-A. It's super easy. It looks like this:

Basically, you put what you put on line 2 of the 1120S (Cost of goods sold) on lines 2, 6, and 8. That's it for us because we don't carry inventory around. If you do, then your form will be a little more complicated, but not too bad. Alright, let's get back to the 1120S.

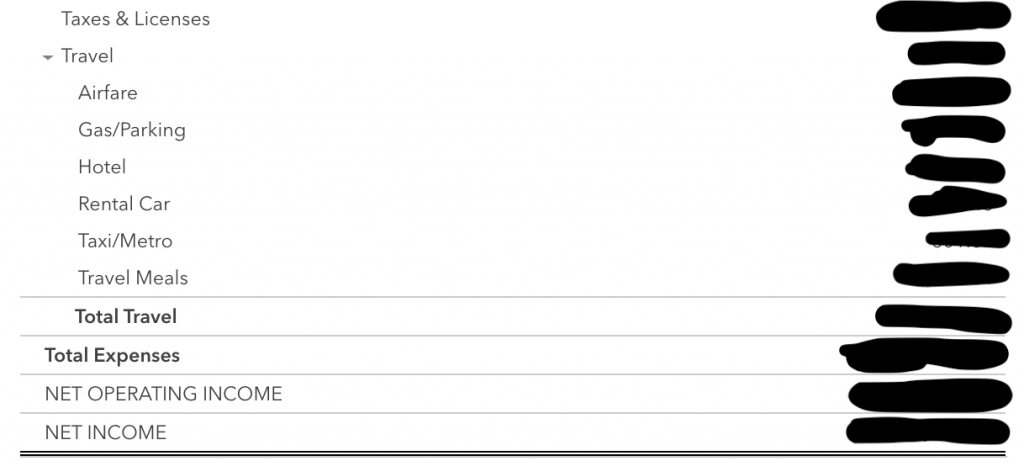

This is also a very important part of the return, but super easy to fill out using your profit and loss statement. Again, here is our profit and loss statement:

The interesting thing about the deductions section on the 1120S is that there are business expenses you want to keep track of in your books that the IRS doesn't care about. I mean, they care, but they don't have a separate line for them. So you have to separate out the ones they care about, put them on the appropriate lines, then take all the other ones and put them onto a separate statement and put the total onto Line 19. Most of our business expenses are on that line and listed out separately on an attached statement. In fact, we only have totals on a handful of the other lines. If you want to simplify your life, use the same categories in your books that the IRS actually cares about.

Line 7 is where you put the “compensation of officers.” This is where Katie and I put our salaries. Remember the whole point of being taxed as an S corp is to only take some of the money the business makes as wages and take the rest as ordinary business income or profits. There is even more incentive now to take money as profits instead of wages due to the 199A deduction, which is 20% of the ordinary business income (line 21) subject to certain restrictions (most importantly in our case, the 50% of wages limitation.) Last year the only wages we paid were officer compensation, which was almost precisely 28.6% of business profit, the total that maximizes the 199A deduction.

This year we have employees, so we'll be able to pay ourselves even less as officer compensation (as long as it is a reasonable amount according to the IRS for the work done) on our 2020 taxes and thus save some payroll taxes. You actually have to break this all out on Form 1125-E. No big deal. We simply list our names, social security numbers, our percentage ownership (50/50 in our case) and the amount we were paid as W-2 income during the year and total it up at the bottom. Remember that the percentages of ownership do not have to reflect how much you were paid as W-2 income. We saved a lot of money in Social Security taxes this year by paying Katie a lot less than I was paid. We paid her just enough to max out her Mega Backdoor Roth IRA contributions.

An interesting point about Line 7 is that despite the instructions saying you put “total compensation” on that line, the next paragraph says this:

Don't include salaries and wages reported elsewhere on the return, such as amounts included in cost of goods sold, elective contributions to a section 401(k) cash or deferred arrangement, or amounts contributed under a salary reduction SEP agreement or a SIMPLE IRA plan.

So both employee and employer contributions to the 401(k) go on line 17, NOT lines 7/8.

Line 8 is where you put the wages for all your employees.

Line 9 is for repairs and 10 is for bad debts. Those were all blank for us.

Line 11 is one of my favorite lines on this tax form and one of my favorite deductions. This is where you put rent for your business. Well, as you know, we operate our business out of our home. If you have dedicated space that is used exclusively and regularly for your business, you can take a home office deduction, the simplified version of which is $5/square foot up to 300 square feet, or $1500/year. However, you are allowed to rent your home out up to 14 days a year to anyone you like without reporting the income to the IRS on your personal return. That includes renting it to your business. Well, we certainly have at least that many business meetings at our home each year, so we decided to rent it to the business. How much do you rent it for? Well, it's pretty easy to find comparable homes on AirBNB. Be sure to include the cleaning fee. Needless to say, it's a far bigger deduction than the home office deduction (which we also take, but for different space in the home.)

Line 12 is for taxes and licenses. This is where all the payroll taxes you paid on your salaries and any other business taxes or licenses go.

Line 13 is for interest paid.

If you're depreciating or depleting something, those go on Lines 14 and 15. We're not.

Line 16 is advertising. We put all our marketing expenses here, primarily the WCI scholarship.

Line 17 is for pensions. This is where you put matching or profit-sharing dollars that went into your i401(k). We didn't have any this year as we did Mega Backdoor Roth IRA contributions instead, but we've definitely used that line in past years.

Line 18 is for employee benefit programs. Put your health insurance here.

Line 20 is the total of your deductions and line 21 is Line 6 minus Line 20. This is the amount your Section 199A deduction is calculated from.

This is the rest of the first page. We don't put anything on any of these lines. I just sign at the bottom as the “President.” Note that the IRS considers you an S Corporation, not an LLC, once you file as a corporation. Corporations have presidents, not managing members. Remember that when you call the IRS and they ask who you are. Since S Corps are pass-thru entities, I'm not even really sure why this section is on the form at all. All the money we make from our business comes to us on W-2 forms (compensation of officers) or K-1 forms (ordinary business income) and we make estimated tax payments on our personal return. In fact, the instructions skip right over Line 23. Maybe it's just a carryover from the regular Form 1120, which looks just like it. Okay, let's move on to Page 2.

Page 2 (Schedule B)

Schedule B is spread over page 2 and the first part of Page 3. There is not a lot of interesting stuff for a simple corporation like ours on this page.

On line 1, check your accounting method. We use cash basis because it is very straightforward. If we paid it in the tax year, it's an expense, if we received it in the tax year, it's income. Super easy. There is a little trick there at year-end. If you send the check on 12/29 and they cash it on 1/3, it's a deduction for your business for the first year but isn't income for the second business until the second year.

Line 2 is the business activity again (see the codes at the end of the instructions.) Basically, you're just copying and pasting from page 1. We check the “no” box on every other line of this page. Read through it and make sure you can answer all the questions no too. If you can answer yes to Line 11, it'll save you some hassle later in the return. We can't. First world problem.

Page 3

Page 3 is the rest of Schedule B and the first part of Schedule K.

Read carefully here at the end of Schedule B. We do have a couple of “yes” answers here as we pay contractors on 1099s. Our Schedule K is super duper simple. We fill out line 1 (comes from line 21 on page 1) and walk away. The rest of it is $0 for our simple corporation. Well, that's not entirely true as we'll see on page 4.

Page 4

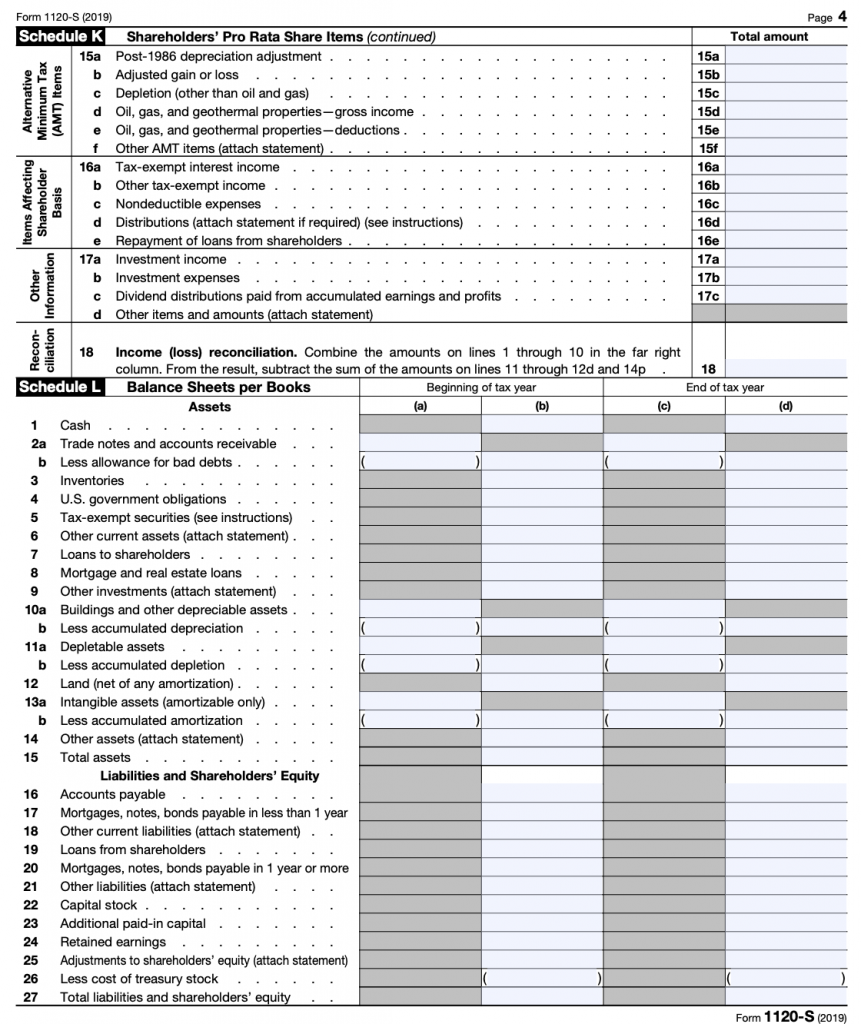

Page 4 is the end of Schedule K and the entirely of Schedule L.

Be careful here at the end of Schedule K. If you're like us, you'll have something on 16c. Remember when you deduct business meals, you don't get to deduct the whole thing. You only get to deduct 50%. So while it is truly a business expense, it isn't a deductible one, and this is where that shows up. So the difference between Line 1 and Line 18, is what's on line 16c, or half of what we spent on business meals.

Schedule L is your balance sheet. You can skip this if the business made less than $250K and had assets less than $250K. But even if not, if you have done your books well, this becomes very simple to fill out. First, go to last year's Schedule L and take what was in columns c and d and put them in this year's columns a and b. Now go to this year's balance sheet to get the numbers for columns c and d. One of my big beefs with Form 1120-S is that the instructions for Schedule L are very skimpy. It's really hard to know if you are filling it out right. The good news is that I don't get the impression that the IRS cares all that much about what you put on here. It doesn't involve taxable income or deductions so it doesn't affect your tax bill at all. It's just for their information as near as I can tell.

At any rate, we only have something on six lines of this form. Line 1 is the amount of cash in the business checking account on December 31st. I've never really been able to figure out what to put on Line 14. I've been including a value for the URL and the trademarks of the business there and listing them on an attached statement. I should probably stop doing that or else add that value back into Quickbooks so the balance sheet in Quickbooks and the balance sheet on Schedule L match. If you're a CPA experienced with this return, I'd love your opinion on that question.

Line 16 is simply the business credit card balance on 12/31. That's our only liability as we run our business debt-free.

Line 22 is super confusing. The idea behind a balance sheet is that things have to balance. So your line 15 (total assets) should match your line 27 (total liabilities and shareholder's equity.) So I set the capital stock amount to ensure they match. Basically, it's total assets minus the credit card balance. Then line 27 matches line 15. Again, if there's a CPA Schedule L genius who wants to tell me what I'm going wrong here, if anything, I'm more than open to your input. But as near as I can tell, if I'm screwing it up the IRS doesn't care very much.

Page 5 (Schedules M-1 and M-2)

On page 5, you find two more short schedules.

If you thought Schedule L was wonky, Schedule M-1 can be really confusing. The only reason this is interesting at all for us is those business meals again. So we're basically just reconciling the books with the tax return since we have non-deductible business expenses. So line 1 is our ordinary business income. Line 3b is the non-deductible portion of those meals and the total goes on lines 4 and 8. Just include all your other income and deductions on the books and you can skip the rest of this form. Schedule M-2 is for corporations that don't distribute all their taxable income. Just distribute it (i.e. pay it to yourself personally) and you get to skip this form. The form basically makes sure you don't pay taxes twice on that money. The IRS says this about the form:

An S corporation without accumulated Earnings & Profits (E&P) doesn't need to maintain the Accumulated Adjustments Account (AAA) in order to determine the tax effect of distributions. Nevertheless, if an S corporation without accumulated E&P engages in certain transactions to which section 381(a) applies, such as a merger into an S corporation with accumulated E&P, the S corporation must be able to calculate its AAA at the time of the merger for purposes of determining the tax effect of post-merger distributions. Therefore, it is recommended that the AAA be maintained by all S corporations.

So I think it's optional for me, but if a CPA out there wants to write up a guest post about how to fill out Form M-2, I'll run it.

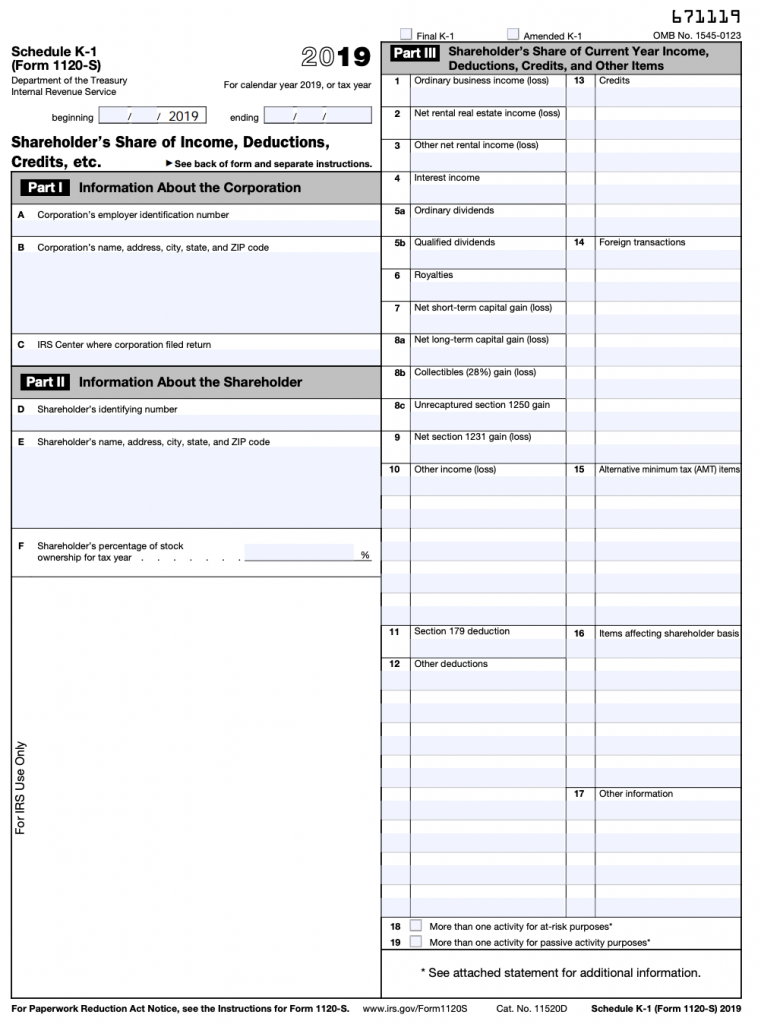

Schedule K-1s

When you do your business tax return, you also need to fill out a K-1 to give to each of the shareholders (or if it is a partnership return, each of the partners.) This is one of the more complicated parts of the return in my opinion and the IRS certainly does care about this as it affects how much the shareholders owe in taxes. We have to do one for me and one for Katie. If you thought it was bad having to figure out what to do with K-1s you receive, imagine having to create them in the first place. Make sure you're filling the right one out. There is a K-1 for the partnership return (1065) and a totally different one for an S Corp return (1120-S).

Section I and Section II are pretty self-explanatory. F is 50% in our case. Section III is where the meat is. You use the Schedule K to fill out the K-1s. So we take Line 1 of Schedule K, multiply it by that 50%, and put that amount on Line 1 of each of our Schedule K-1s. Because our Schedule K is so simple, so are our Schedule K-1s. The rest of ours is blank until we get to line 16. That's where our 50% share of the non-deductible meals go under code C. We put an asterisk there and attach a brief statement saying that's what the amount is for. On line 17, I put code “V*” and attach another statement (the codes are all found on page 2 of the K-1.) Code V is section 199A information and since this is our largest deduction, I pay a lot of attention to this part of the return. The instructions for this section this year are pretty clear about what that statement needs to look like. You can find a sample statement on page 40 of the 1120S instructions. Here is what it is supposed to look like:

There are lots of instructions here on page 39. If you expect to get the 199A deduction, be sure to read them carefully. If you have no idea what the 199A deduction is, how it is calculated, or whether you will qualify for it, you have no business doing your own corporate tax return. Do yourself a favor and go hire help. I'm not even sure I should be doing this honestly and this is probably my last year doing it.

Now repeat the process for any other shareholders (luckily since we're 50/50, this is very easy to do for us) and compile your return. It should look like this:

- Form 1120S pages 1-5

- Form 1125-A

- Form 1125-E

- Statement of Explanation for 2019 Form 1120S Line 19 Other Deductions

- Statement of Explanation for 2019 Form 1120S Schedule L Line 14 Other Assets

- K-1 for me

- Statement for 2019 Form 1120S Schedule K-1 Line 16 for me

- Statement A (QBI Pass-through Entity Reporting) for Form 1120S Schedule K-1 Line 17 for me

- K-1 for Katie

- Statement for 2019 Form 1120S Schedule K-1 Line 16 for Katie

- Statement A (QBI Pass-through Entity Reporting) for Form 1120S Schedule K-1 Line 17 for Katie

That's it. Send it to the IRS and you're done. Be sure you make a copy and enter those K-1s into your personal return. All together this probably takes me 1/2 to 3/4 of a day once the books are done. My COO is probably right. That's not a great use of my time. I can tell you this though–as a result of doing this return for a couple of years, I know exactly how to maximize my largest tax deduction and I'll bet I've more than paid for my time up to this point through a better understanding of just what is deductible and what isn't. If you want to try it, I hope these instructions help.

What do you think? Have you ever done a corporate tax return? Did you regret it? Did you find it easier than your personal return? What other advice would you give to people trying this on their own?

[This updated post originally published in 2020.]