[EDITOR'S NOTE: Please be advised, the PAYE plan was reinstated at the end of 2024. The SAVE repayment plan is currently held up in the courts. We will update you at a later date when we have answers.]

Since its introduction in the summer of 2023, the Saving on a Valuable Education (SAVE) repayment plan has exploded as the most popular repayment choice for student loan borrowers, with nearly 8 million enrolled. While SAVE offers several advantages, such as lower payments and an interest subsidy, it’s essential to understand that it’s not the best repayment plan for all borrowers. In fact, there are situations where you would be worse off enrolling into SAVE rather than staying in Pay As You Earn (PAYE) or Income Based Repayment (IBR).

PAYE has been a common strategy for many student loan borrowers—white coat investors, in particular—because of its features to cap payments and exclude spousal income through Married Filing Separately. PAYE's 12-year life is coming to an end in 2024. Created during the Obama presidency in 2012, it is now phased out to new entrants, effective July 1, 2024. However, you can stay in the PAYE program if you are already in it or if you enroll before July 1.

Today, let's dive into key considerations and deadlines to help you determine if SAVE is the best option for you while PAYE is being phased out.

How Does Income Driven Repayment Plan Work?

There are four Income Driven Repayment (IDR) plans: SAVE, PAYE, IBR (old and new), and ICR.

Income Driven Repayments are calculated on a percentage of discretionary income. Here’s the method to calculate it.

Discretionary Income = Adjusted Gross Income (AGI) minus between 100%-225% of the poverty threshold for your family size (HHS Poverty Line)

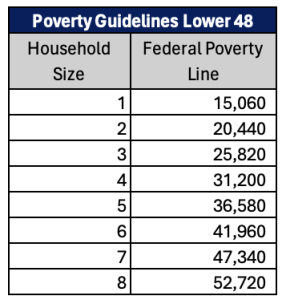

Here's the HHS Poverty Line for 2024:

For SAVE, discretionary income is the amount by which your AGI exceeds 225% of the poverty threshold for your state and family size.

For PAYE, Old IBR, and New IBR, discretionary income is the amount by which your AGI exceeds 150% of the poverty threshold for your state and family size.

For ICR, discretionary income is the amount by which your AGI exceeds the poverty threshold for your state and family size.

Family size is determined by how many children are in your home, including any unborn children who will be born during the year. Children must receive more than half of their support from you to be claimed in your family size.

Here’s a summary of eligible requirements and what percentage of discretionary income payments are across IDR plans.

A partial financial hardship is when your IDR payment is lower than the standard 10-year repayment plan. This means that if your income swells to $100,000 greater than your student loans, you cannot enter the PAYE or IBR repayment plans. You can enter those repayment plans when your income is lower. This is a common strategy we see for doctors in training. They’ll enroll in one of the IDR plans that requires a partial financial hardship when they have a lower income. Then, when their income increases, their payment caps in these programs, and they can stay in the repayment plan if desired.

Remember the eligibility dates to enroll in PAYE and old and new IBR. These are critical in the selection of your repayment plan.

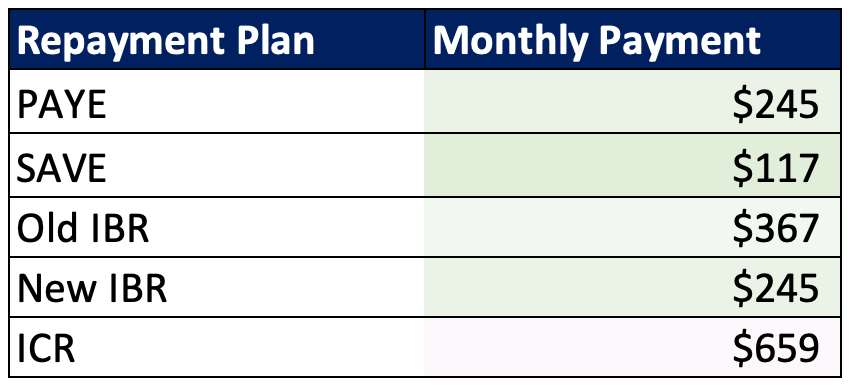

Here are IDR payments at $60,000 of income for a household size of two.

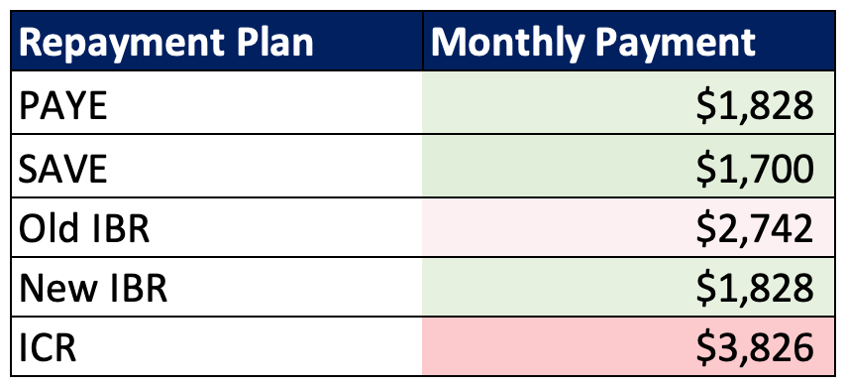

Here’s another for a borrower who makes $250,000 with a household size of two.

Notice the difference between IDR plans. At $60,000 income, it can be a $500 difference. At $250,000, there's a more than $2,000 monthly difference between SAVE and ICR. Selecting the best IDR plan is pivotal for your student loan plan.

Key Student Loan Deadlines for 2024

Beginning in July 2024, borrowers will no longer be eligible to enroll in PAYE or the ICR repayment plan. The ICR plan will only be an option for parent borrowers. ICR is a legacy IDR plan, and very few situations will benefit from ICR when compared to the new IDR options. Generally, the only situation we’ve seen where ICR can benefit borrowers is if you’ve recently discovered you were a candidate for loan forgiveness and your loan balance is less than half of your income.

PAYE is phased out to new entrants beginning July 1, 2024. Prioritizing your decision on whether PAYE is the right choice is crucial. If you want to enroll in it, you need to apply before July 1, 2024. If you are already in PAYE, you can stay in it even after it is phased out.

Another key data point for your student loan plan: you can’t leave SAVE repayment for another IDR plan after you’ve made 60 payments beginning on July 1, 2024.

How SAVE Impacts Student Loan Repayment Strategy

In years past, the advice was simple for most doctors. REPAYE while in training and switch to PAYE if you decide to do Public Service Loan Forgiveness (PSLF) after training.

The two big reasons why many switched to PAYE were:

- PAYE has a payment cap based on the standard 10-year repayment plan and

- You could file separately to exclude spousal income

REPAYE (the predecessor to SAVE) didn’t allow you to exclude spousal income via Married Filing Separately. SAVE does. But SAVE still lacks the payment ceiling, which can be problematic for borrowers whose income will be $100,000+ more than their student debt after training.

If we follow the trend of previous advice, then SAVE in training and PAYE after training. However, with PAYE phasing out to new entrants, time is running out to make this move.

If you need help determining your repayment plan strategy, schedule a time with one of our StudentLoanAdvice.com experts now.

More information here:

Want to Shorten Your Student Loan Repayment? The PSLF Buyback Can Help

Should I Pay Off Student Loans or Invest?

SAVE Can Be a Great Tool to SAVE

SAVE repayment has made the selection of repayment plans easier for many borrowers. A huge component of SAVE is the interest subsidy. The interest subsidy means that unpaid interest is covered by the government and ensures that your loan balance will never go higher. All other IDR plans lack the interest subsidy, and they can have a higher monthly payment.

The SAVE interest subsidy is a large factor for a borrower when they are early in their career or have income less than their student loan balance. SAVE can help keep your student loan balance from spiraling out of control. If you’re making less than you owe, SAVE is likely the optimal choice of repayment plan.

However, if in the future you have income that is greater than your debt, SAVE may not be the best option for you. You should consider a repayment plan like PAYE or New IBR that caps your payment. The difference can be large over the life of your loan. In this next section, we will run through scenarios to illustrate this.

More information here:

10 Changes to Know About IDR Plans for Your Student Loans

3 Key Strategies for Borrowers Prior to July 2024

We foresee three scenarios that are important for borrowers.

- SAVE to PAYE,

- SAVE to New IBR, and

- SAVE to SAVE

Before we explore which repayment strategy is best, you need to ask yourself two questions.

- Did I borrow prior to Oct 1, 2007?

- Did I borrow prior to July 2014?

If you answer yes to both of these questions, you are likely not eligible for PAYE or New IBR. Your pick of IDR options is SAVE or old IBR. Most should be in SAVE, but there are a few unique circumstances where old IBR could be more cost-effective.

If you answer no to 1 and yes to 2, you'll need to decide on SAVE vs. PAYE. It’s imperative you decide before July 1, 2024, and time is of the essence.

If the answer is no to both, you need to decide on SAVE vs. New IBR. PAYE and New IBR are basically the same, but New IBR is not going away this year.

SAVE to PAYE

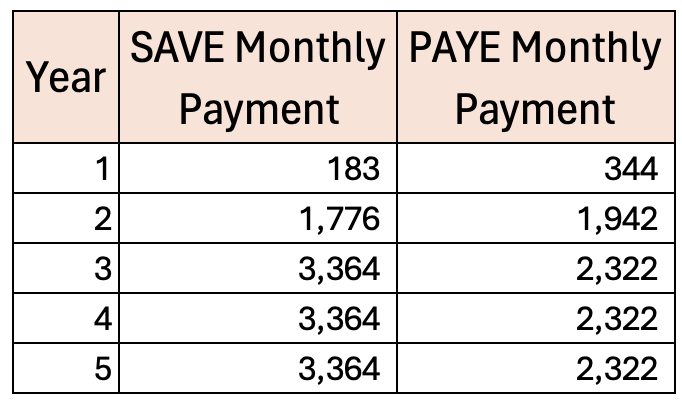

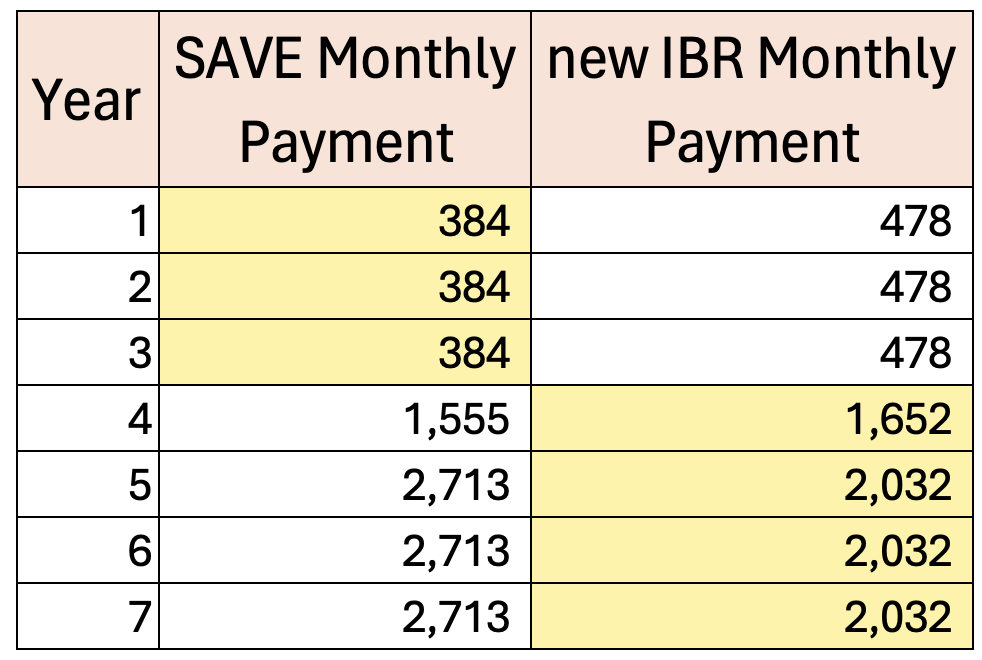

For this example, we have a married couple with a stay-at-home spouse and a soon-to-be attending doctor. They have one child. The doctor has signed their first attending contract, making $450,000 per year. Their student loan balance is $200,000.

The doctor was in the SAVE program due to the interest subsidy, which helped curb much of the interest growth while they were in training. But this year, their physician income will jump from $80,000 to $450,000 since they finish their training in June. They have five more years of payments until they reach PSLF.

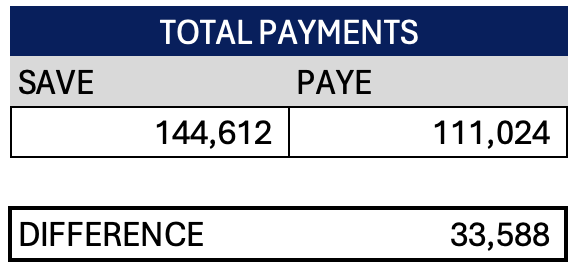

Here’s an idea of their monthly payments over the next five years.

Payments are a little cheaper in Years 1 and 2 in SAVE. But in the last three years of repayment, the borrower is saving around $1,000 per month in PAYE. PAYE monthly payments are capped at $2,322, and SAVE has no payment cap. Total savings over the next five years is $33,588 in PAYE vs. SAVE.

If you're in a scenario where your income is going to be significantly greater than your debt, you should give PAYE a long hard look before it goes away this July.

SAVE to New IBR

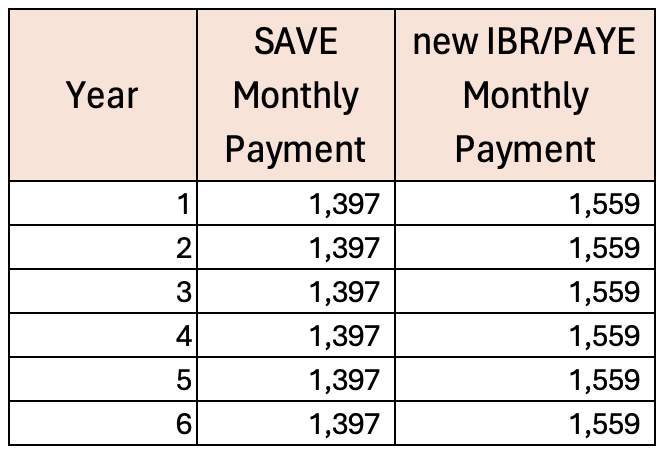

In this scenario, we have a resident doctor who’s single. They are starting their third and final year of training this summer and are planning on pursuing PSLF. Their income while in training is $80,000, and they will make $350,000 as an attending doctor. Their student loan balance is $175,000. Because they didn’t start borrowing until 2018, they are eligible for the New IBR plan.

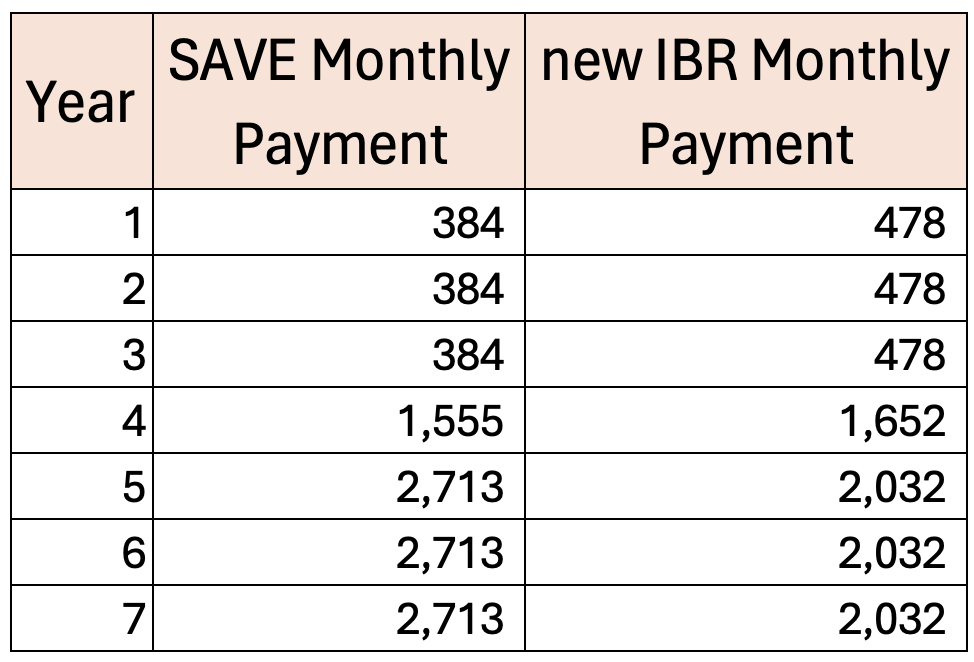

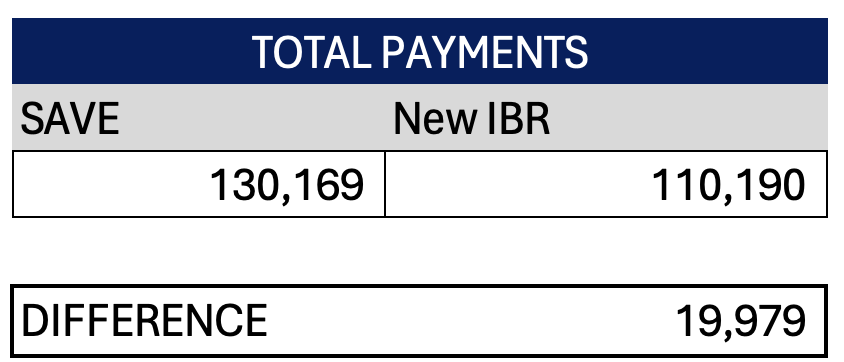

They plan on working at an academic hospital and have seven more years until they reach PSLF.

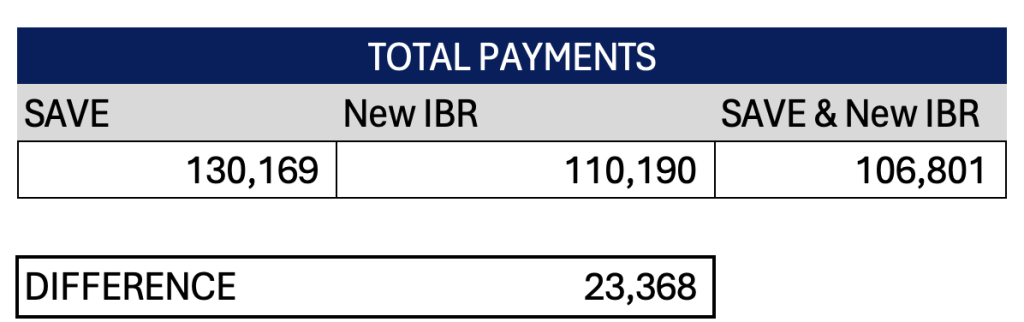

Here are the total payments compared.

New IBR from the get-go would save this doc about $20,000.

What if they wanted to do SAVE while in training and then switch to New IBR as an attending? That's highlighted yellow in the table.

This way, they can maximize their forgiveness strategy with lower payments while in training, benefit from the interest subsidy in SAVE, and have their payments cap in IBR when their income jumps as an attending.

The result? It saves this doc an additional $3,000 to switch into the new IBR plan before their income jumps as an attending.

Please note that if you want to utilize this strategy, you need to switch from SAVE to new IBR before you have completed five years of payments in SAVE and before you file a tax return that indicates you make at least $100,000 more than your student loan balance.

SAVE to SAVE

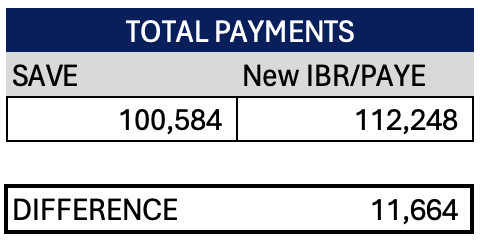

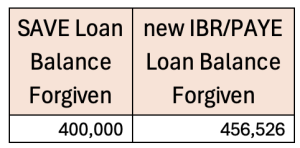

For the last example, we have a dual-income household. Both are doctors, and their student loan balance is $400,000. They both make $250,000, have four children, and file taxes Married Filing Separately. Doc A is the only one with student loans. Their spouse, Doc B, already paid off their loans. Doc A is six years away from PSLF.

Since they file taxes separately, their student loan payments are based on Doc A's $250,000 of income rather than the $500,000 of the household.

Payments in SAVE vs. new IBR/PAYE are a couple hundred dollars less per month.

The overall difference is that SAVE saves this doc around $12,000 over six years.

And their projected loan balance forgiven is lower in SAVE. You'd sleep better at night knowing your balance is not increasing.

SAVE is a great tool for repayment and works for many borrowers as the best way to pay down their loans. But readers need to be wary of cookie-cutter advice the Department of Education and loan servicers dole out. The majority of information from them is applicable to the average borrower who only owes $37,000. Many WCI readers had to borrow a mortgage, $200,000-$400,000+, to obtain their degree, and their approach to tackling their student loans may require a more nuanced strategy.

Does SAVE Work for Those Not Pursuing Loan Forgiveness?

If you’re not planning on pursuing a forgiveness track, such as PSLF or Income Driven Repayment forgiveness, SAVE is a good vehicle for you to simply pay off your loans. In the past, most borrowers who were planning to pay off their loans aggressively and live like a resident would privately refinance their student loans. But as interest rates have increased over the last few years, the ability to lower your rate by refinancing has dried up for many.

This situation has been further complicated by the prospect of potential changes in federal loan policy. Those who refinanced their student loans in February 2020, right before the student loan pause, feel this pain. The Department of Education could pause payments again or perhaps institute a more generous loan forgiveness option. Once loans are privately refinanced, they are not eligible for any future federal loan programs or initiatives.

SAVE repayment is a fine strategy as long as refinancing doesn’t lower your interest rate by 1.00% or more. Usually in the first few years out of training, there could be a little bit of interest savings due to the interest subsidy in SAVE. If you want to pay off your loans aggressively, you'll likely need to pay more than the required monthly payment in SAVE.

More information here:

Capitalizing on SAVE: Loan Repayment Strategies for Students and Residentsca

The Role of Student Loan Refinancing in 2024

Diving into questions like SAVE vs. PAYE vs. New IBR is important and a large determinant of how much you’ll pay on your student loans. But above all, your overall strategy should be the priority. Navigating student loans can feel like a maze with all of the complexities required to chart your optimal path to becoming debt-free. If you need help tackling your student loans, don’t go it alone. Schedule a time with one of the SLA student loan experts today!

What do you think? Are you planning to switch repayment plans now or later on? Are you going to hit the payment ceiling?