When I first started selling life insurance over 10 years ago, I would often get asked “will this affect my credit?” or “Do you pull my credit for this?”.

I used to always answer with a stern “NO,” and I honestly didn’t understand why someone would think their credit would be pulled to purchase life insurance.

However, here’s the thing:

Little did I know that not only can your credit be pulled for specific types of insurance like auto insurance, renters insurance, and homeowners insurance, but you also have an actual insurance score that is used to help determine your insurance rates.

Today I am going to discuss how an insurance score works, how it affects your insurance premiums and what actions you can take to increase your insurance score to help lower your monthly insurance payments.

Understanding Your Credit Score

“In plain English,” credit scores are used to help lenders get a clear picture of your ability to pay back a loan; the higher the score, the better the likelihood you will pay the mortgage back.

If your score is in the mid-range, you will deal with higher interest rates to get the loan, and if your score is too low, you won’t be approved for the loan at all.

The FICO Score

Like there are multiple search engines (Google, Bing, Yahoo), there are also numerous credit scores (FICO, VantageScore).

There is a company that goes by the name of Fair Isaac Corporation that created their version of a credit score which was commonly called a FICO score.

Different credit scores can have different score ranges; however, your FICO score is a 3 digit number that ranges from 300 to 850.

FICO uses predictive analytics to come up with your FICO score, and the information is pulled from public records as well as the three major credit bureaus (Transunion, Experian, & Equifax).

FICO Is the Score of Choice for Top Lenders

Just as Google gets about 90% of search traffic, the FICO score has become the score of choice for 90% of the top lenders to help them determine your ability to pay back a loan.

So when you are looking to purchase a car, buy a home, get a personal loan, apply for a business loan, lease a car, or rent an apartment, there is an extremely high probability that these creditors will be looking at your FICO score to make their lending decision.

Eventually, the Fair Isaac Corporation changed its name officially to FICO in 2009.

Understanding Your Insurance Score

Your insurance score is based on the same factors as your FICO score in regards to risk, but with one big difference.

Your insurance score is only used to determine the probability or likelihood of you filing a claim as an insurance customer.

Insurance scores are most widely used to determine rates for auto and home insurance but depending on the state that you live in, it can also be used for other types of insurance like health insurance, life insurance or even RV Insurance.

When it comes to life insurance and disability insurance you won’t have to worry about companies pulling your insurance score for coverage.

This isn’t a report they use to determine your insurability. There are instances (if you have a large policy amount) where your personal credit report may be pulled to help confirm income, but this is only on rare cases and the pull wouldn’t hurt your credit score.

In regards to getting auto insurance, your driving history doesn’t have any effect on your actual insurance score; however, your driving record is used as part of the final answer to your insurance rates.

The Credit-Insurance Claims Connection

Now, If you are like me, you’re probably wondering “how the heck can an insurance score determine if I will file a claim?”

Well, the answer is that insurance companies have been analyzing data for years and using studies like the one completed by the University of Texas in 2003 (PDF).

This study determined that people who are less financially responsible with their credit are also more likely to be in an accident. Higher accident risk means higher claims payouts and more losses for insurance companies.

The Federal Trade Commission (PDF) also completed its own independent study and they determined that credit-based insurance scores are effective predictors of future risk.

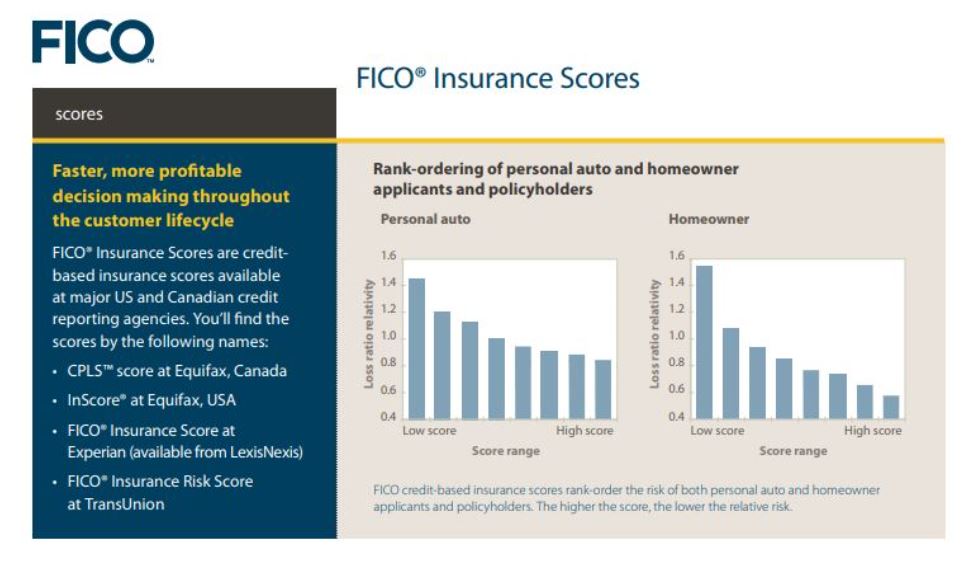

Screenshot illustrating the credit-insurance claims connection from FICO's Insurance Scores Resource

What Your Insurance Score Looks Like

Just like the FICO score, your insurance score will have a 3 digit number and is determined based on information from your credit report like:

- Credit History Age

- Number Of Accounts In Good Standing

- Number Of On-Time Payments

- Amount of Available Credit

- Credit Mix

Below is what an insurance score looks like from TransUnion:

How to Check Your Insurance Score

Three different companies offer Insurance scores, Fico, LexisNexis, and Transunion.

If you are already a member of Myfico.com, then all you have to do is look through the different scores to find your home and auto insurance scores.

You can also get your Transunion Auto & Home insurance scores and by using Credit Karma for free.

Also, lastly, you can get a copy of your Lexus Nexus C.L.U.E. Report here.

Insurance scores range from 150 to 950 and just like a traditional credit score the lower the score, the higher the risk.

A good insurance score is going to be anything over 720 and a bad score is usually anything below 580.

How to Get a Better Insurance Score

Here is some great news, If you want to improve your insurance score, it’s the same process that you would use to increase your traditional credit score.

As your traditional credit score increases, so will your insurance score.

I won’t go into all the details of how you can increase your score because that is a whole other topic but some quick tips are:

- Pay your bills on time

- Keep your credit utilization low

- Have a mixture of credit (installment loans, revolving loans, credit cards, etc.)

- Monitor your credit and dispute inaccuracies.

Why Your Insurance Score Matters

It might not seem like your insurance score is essential when you first learn about it, but I can assure you it is imperative.

Since your insurance score is going to be a part of the underwriting process to determine your monthly plan premiums, having a good score is essential.

Using a mock profile in Salt Lake City, and only changing the credit score, Value Penguin created the below chart to show exactly what happens to insurance premiums depending on your credit score:

As you can see from the above chart, neglecting your credit is going to have a significant effect on your financial future, along with paying higher interest rates for a mortgage you will pay higher auto insurance premiums as well as higher home insurance premiums.

Do Insurance Companies Really Use This Score?

Yes, insurance companies will use any means necessary to determine the probability of risk.

According to FICO, who is also a significant generator of insurance scores, around 95% of auto insurers and about 85% of home insurers use insurance scores in states they are legally allowed when determining your underwriting risk.

You can check out your department of insurance to see if insurance scores are allowed in your state; if they are, there is a high chance that it will be used to help determine your risk when purchasing auto or home insurance.

However, your score is only checked when you initially apply for coverage so you don’t have to worry about your premiums changing in the middle of your coverage period.

Insurance agents also don’t have access to your insurance score, your score is pulled internally and is generated by the insurance companies and the credit reporting agencies.

Your insurance score is only one part of determining your insurability, but just like having a “bad” claims filing history, it can still affect your monthly premiums.

Taking Action

In conclusion, taking care of your credit will allow you to have a solid insurance score.

If you don’t have any established credit, then you should get some immediately and if your credit needs to be repaired don’t waste any time getting it fixed.

The sooner you have better credit, the lower your overall living expenses will become, and the more comfortable life can get.

Don’t wait to get started on your credit journey, no matter the type of score, the higher your scores the lower your payments on either loans or insurance.

What do you think? Have you ever checked your Insurance Score? Did you know Insurance Scores could affect your rates?