Qualified Charitable Distributions (QCDs) are the most tax-efficient way for seniors to donate to charity. You can still itemize on your taxes, yet every bit of your donation is made with pre-tax dollars. Plus, it can take the place of some or all of any Required Minimum Distributions (RMDs) for that year. The only downsides of QCDs are that they are limited in size at $108,000 [2025 — visit our annual numbers page to get the most up-to-date figures] but indexed to inflation and that they cannot go directly to a Donor Advised Fund (DAF).

Just like we've done step-by-step guides to take your RMDs at Vanguard, this will be a post showing a step-by-step guide to take a QCD at Vanguard. Note that every time Vanguard changes its website, this guide goes out of date and may stay out of date until we get some new screenshots. But the basic process should remain the same.

Qualified Charitable Distributions at Vanguard

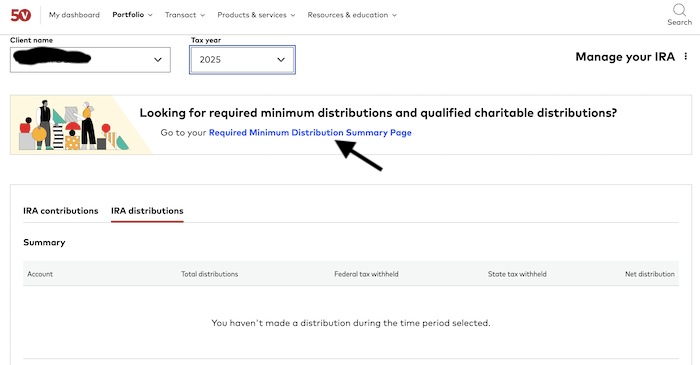

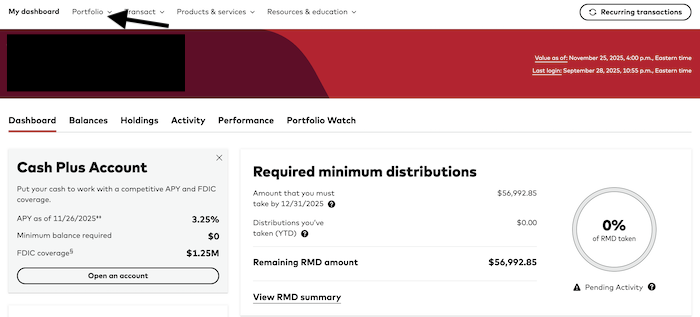

The first step is to log in to your Vanguard personal account. You then go up to the top set of menus, click on “Portfolio” (red arrow), and then go down to “Retirement summary” (black arrow).

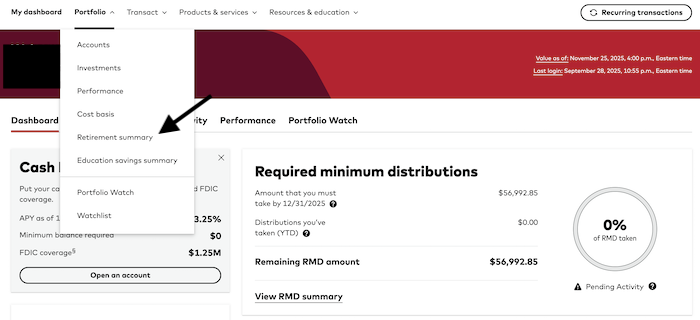

Make sure the client name and tax year are accurate, then click on “Required Minimum Distribution Summary Page” (black arrow).

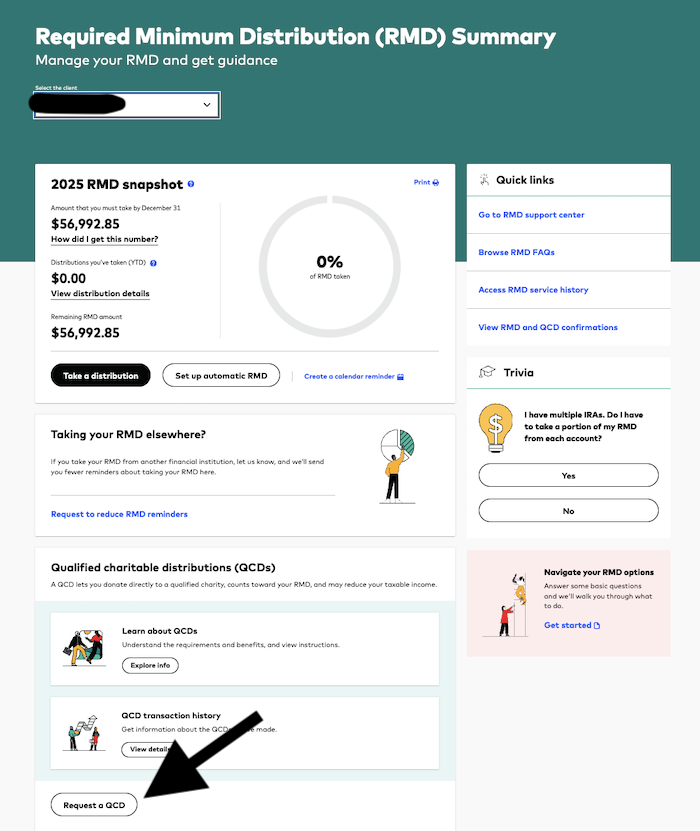

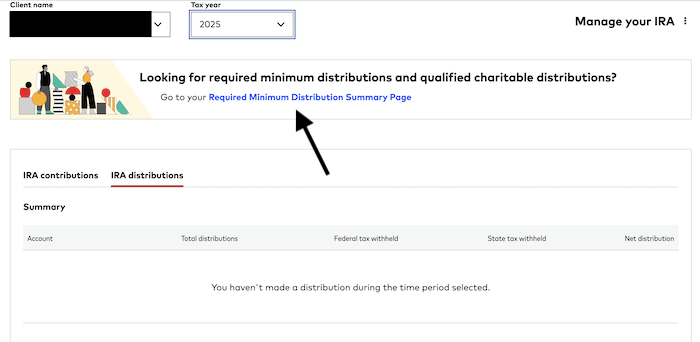

Now, click the “Request a QCD” button, way at the bottom left.

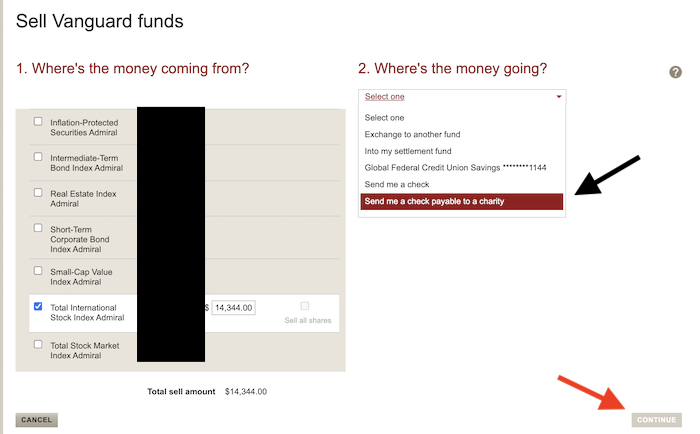

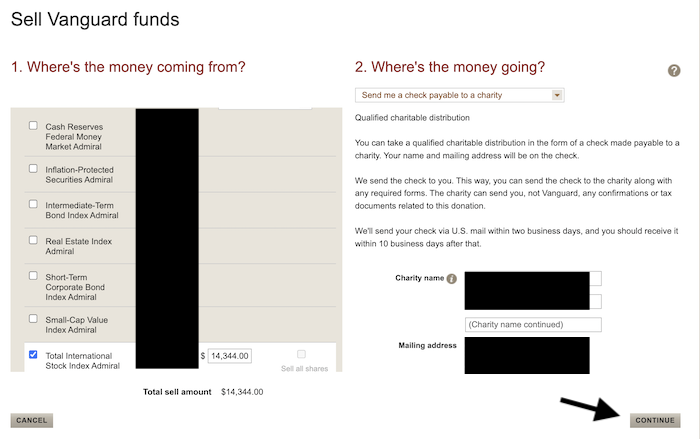

Next, select the fund you wish to take the QCD from (in this case, I selected a fund I knew had more than its allotted percentage and that I would need to sell some shares to rebalance), put in the amount you wish to give of a QCD, and then hit the “CONTINUE” button (all black arrows). Note that you can take a QCD from more than one fund all in one step here.

Once you hit “CONTINUE,” the page changes to allow you to also interact with the right side. Use the menu on the right, scroll down to “Send me a check payable to a charity” and select it (black arrow). Then, hit the “CONTINUE” button (red arrow).

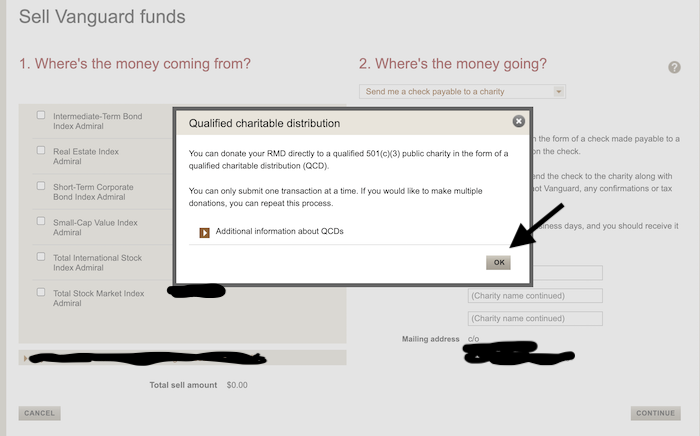

When the informational screen pops up, hit the “OK” button (black arrow).

Note a couple of things here.

First, Vanguard's goofy IT interface often makes you restart the left side at this point, so you might have to select the fund again and/or put in the amount of the QCD again. Don't be surprised; it happens a lot. Second, Vanguard will use your default mailing address to send the check. I don't think you can change this without changing your default mailing address. It's a security thing.

Type in the name of your chosen charity and make sure it's a legitimate charity as far as the IRS is concerned (Vanguard won't check for you; it'll just put what you write in that box on the check and send it to you). Then hit “CONTINUE” (black arrow).

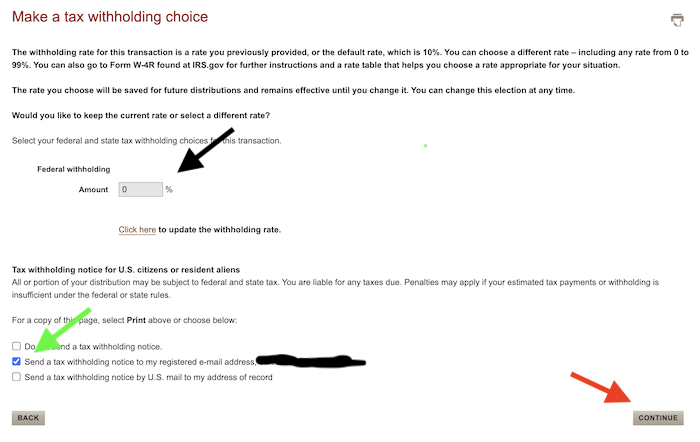

Next, go to the tax withholding page, which is the same as what you see at this point in the RMD process. I don't think most will withhold part of their QCD for taxes, but it is an option if you like. If I were you, I'd set this to 0% (black arrow), and then select how you want the notice sent—if any (green arrow)—before hitting “CONTINUE” (red arrow).

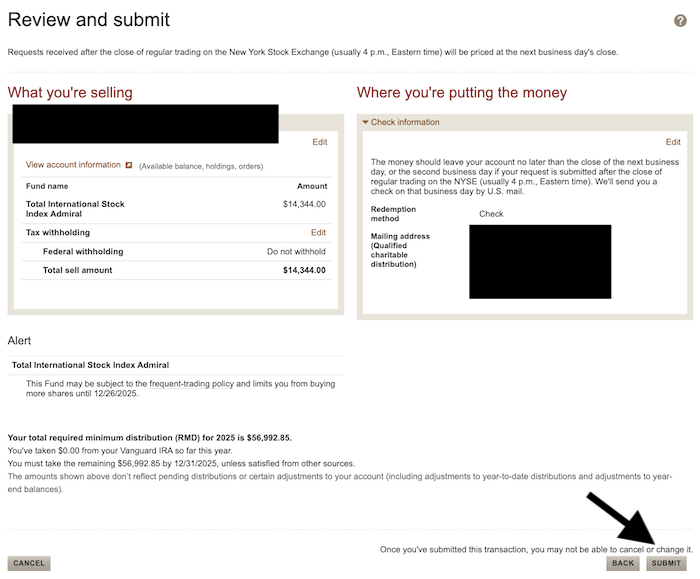

Next is the review page, which should look pretty familiar to you. Double-check everything, and then hit the “SUBMIT” button (black arrow).

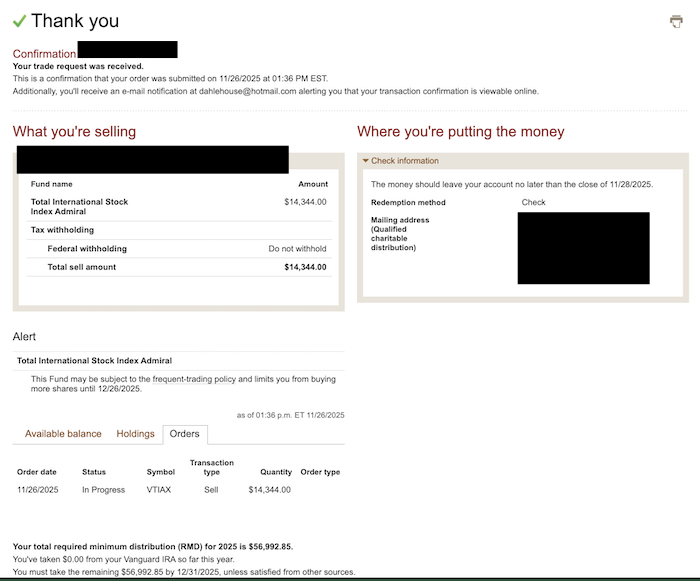

The next page is just the confirmation page.

That's it. In a week or so, the check will show up in the mail, and you can hand-deliver or mail it to your chosen charity. You can do more than one of these; just follow the same process.

More information here:

Why Wealthy Charitable People Should Not Do Roth Conversions

4 Things You Can Do with Required Minimum Distributions (and 1 You Can’t)

Bonus! How to Take an RMD at Vanguard

This section is particularly relevant if you want your Required Minimum Distribution to go to your brokerage account at Vanguard, NOT your bank account. Most of this has been covered on the blog in the past and is periodically updated, but I noticed a slight tweak in 2025 when trying to move the RMD to the brokerage account. So, I took some additional screenshots this year.

You will notice if you look carefully at the screenshots above that the QCD was $14,344, but the RMD total was $56,992.85. After the QCD, an RMD of $56,992.85-$14,344 = $42,648.85 was still required. Let's take it!

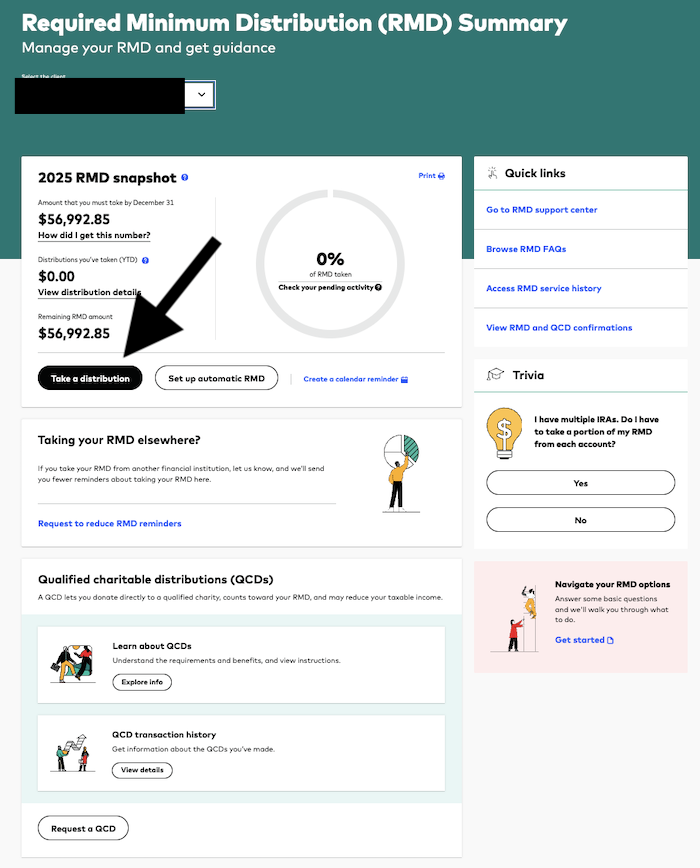

Start by going back to the main page after you log in. Go to “Portfolio” (black arrow) and get the drop-down menu. Note that if you're of RMD age, you may have the “Required minimum distribution” section there front and center. Thanks, Vanguard! Very helpful.

Again, select “Retirement summary” (black arrow).

Next, check that the name and the year for the RMD you want to take are correct, then click on the “Required Minimum Distribution Summary Page” link (black arrow).

Click on the “Take a distribution” button (black arrow).

Select the fund or funds from which you wish to take the distribution. In this case, I chose to take it from cash and then rebalance the portfolio a day or two later. I could have done all the rebalancing by taking varying amounts from each of the funds in the account, but that seemed overly complicated. Hit the radio button next to your chosen fund (black arrow), then hit the “CONTINUE” button (red arrow).

On the next page, choose a specific dollar amount (black arrow), put it in the box (red arrow), and then hit the “Continue order” button (green arrow).

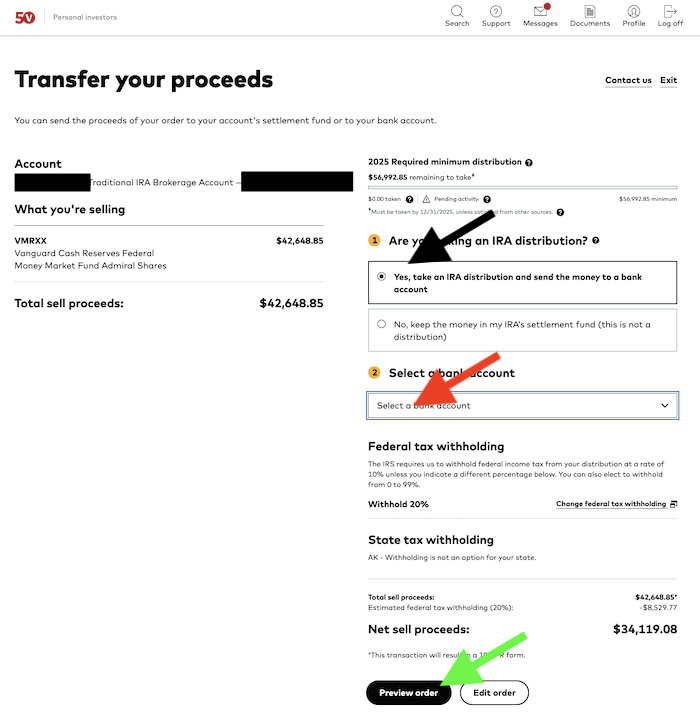

Here's where things got interesting in 2025. If you want to move your RMD to a bank account, no problem, this would work fine. You just check the radio button next to “Yes, take an IRA distribution and send the money to a bank account” (black arrow), choose your linked bank account (red arrow), make sure you're good with the tax withholding choice, and hit the “Preview order” button (green arrow).

But I didn't want to move the money to a bank account. I wanted to move it to the brokerage account, and it wouldn't let me. It's also worth noting that despite the fact that I had already put in a QCD order earlier in the same day, the website was still telling me no RMD had been taken for this account yet. That doesn't update until the next day. Bottom line is that I realized this wasn't going to work.

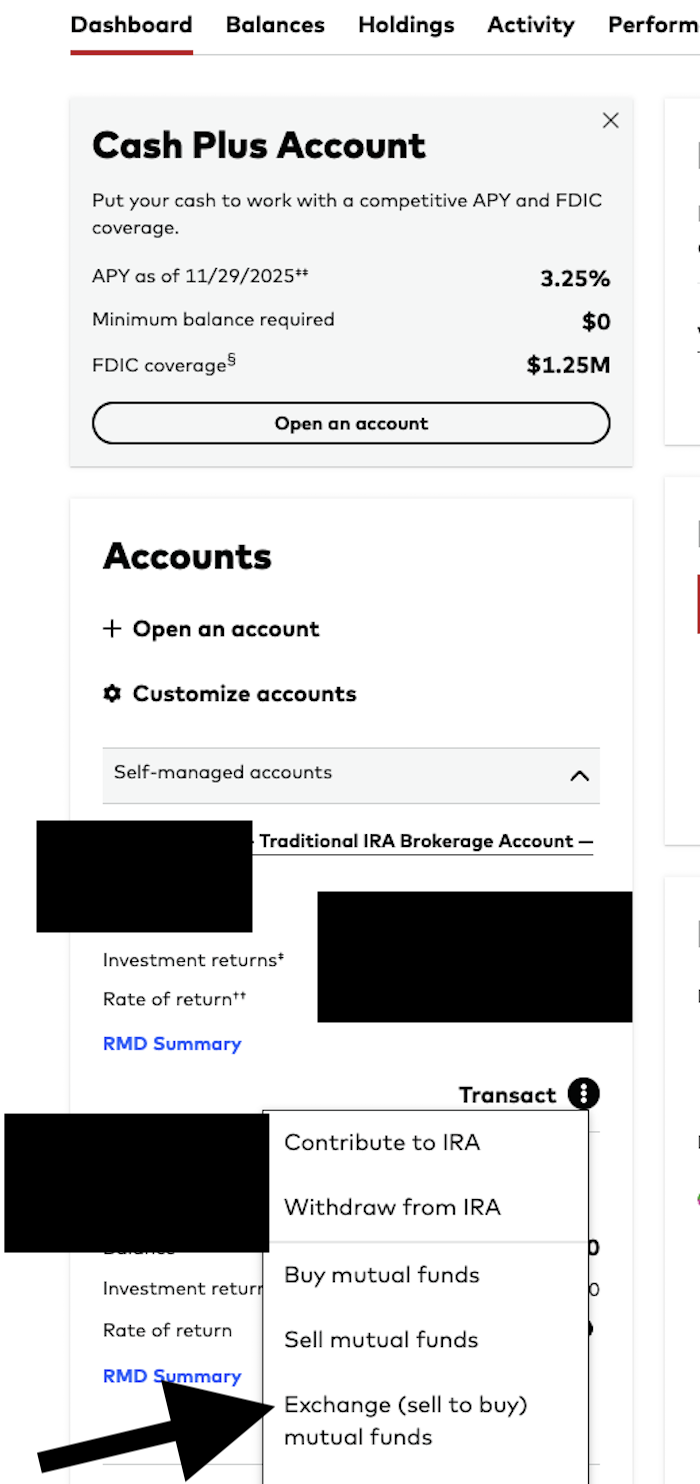

I went back to the main page, aka the dashboard. Then, I scrolled down the left side to the traditional IRA account I wanted to take an RMD from, opened the “Transact” menu, and clicked on “Exchange (sell to buy) mutual funds” (black arrow).

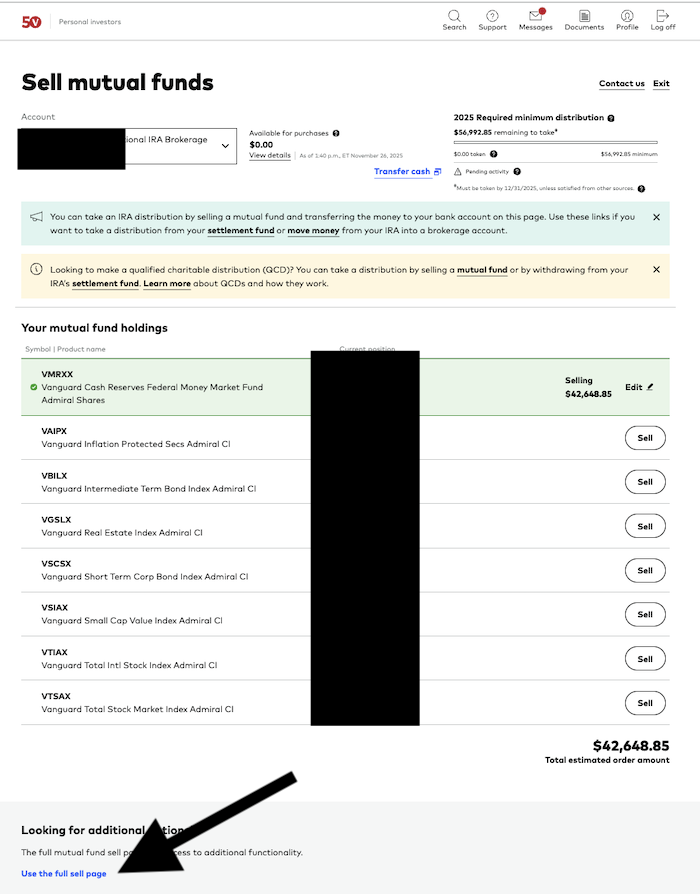

Actually, that's probably what I should have done. What I actually did was click “Sell mutual funds,” which took me here:

Realizing this wasn't quite where I wanted to be, I saw the link I wanted: the “Use the full sell page” link. I don't know why Vanguard does this sort of thing. Maybe it's to try to make things simpler for people, but in reality, I think it makes it more complicated. I needed more options, so I figured the “full sell” page would work, and I was right. That link takes you here:

Choose “Sell in dollars” (black arrow), select the fund you want to sell, put in the amount of the RMD (red arrow), and hit the “CONTINUE” button (green arrow).

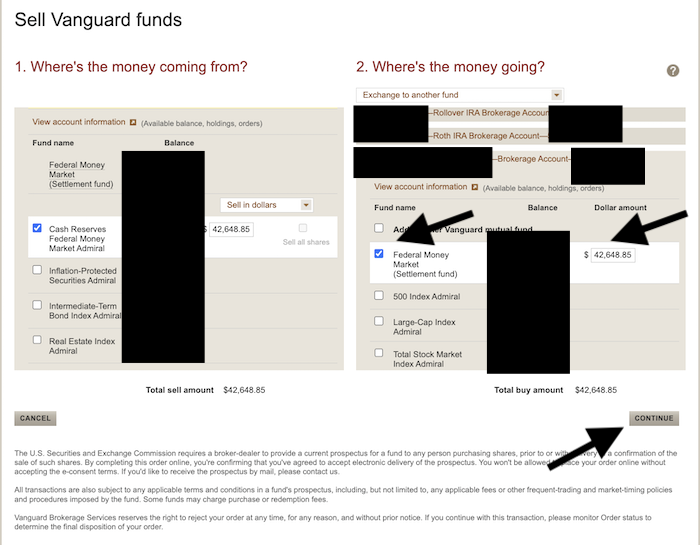

There's the option we want, “Exchange to another fund.” Hit that and “CONTINUE,” and you will arrive here:

Now, I can choose a fund in the brokerage account, put in the RMD amount, and hit “CONTINUE” (black arrows).

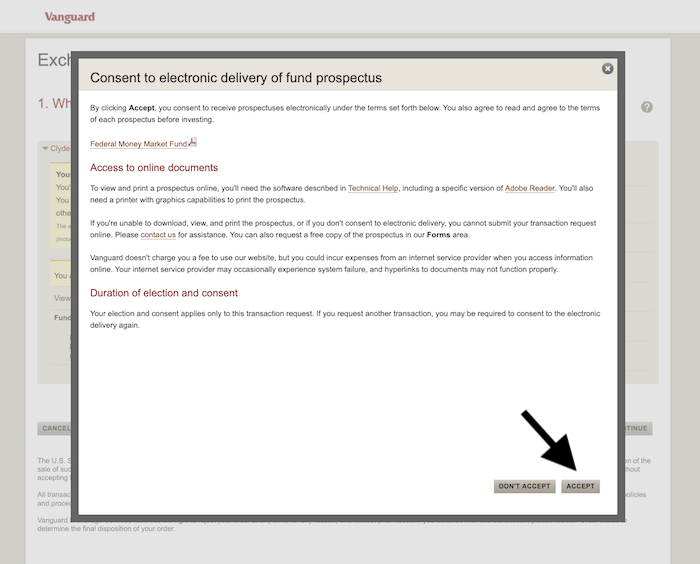

Accept delivery of the electronic version of the fund prospectus if necessary by hitting “ACCEPT” (black arrow).

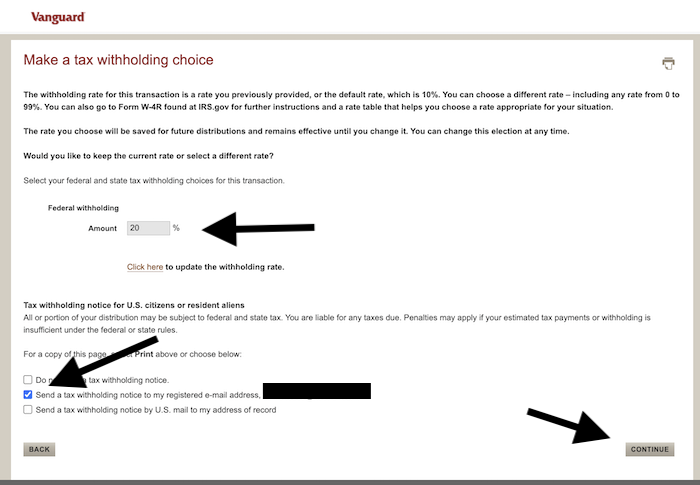

Now it's time to talk about tax withholding notices. While I don't think anyone wants money withheld from a QCD for taxes that aren't due, lots of people have money withheld from their RMDs. In fact, if you take your RMD late in the year, as many do, this is a great way to not loan the IRS a bunch of extra money at 0%. Instead of making quarterly estimated payments, you can just pay a big chunk of or even your entire annual tax bill by using RMD withholding in December.

The IRS doesn't care when money is withheld, but it does care when quarterly estimated payments are made. If you have money withheld in January or December, it's all the same to the IRS whether it is withheld from paychecks, pension checks, Social Security checks, or RMDs. In this case, a decision was made to withhold 20% for taxes. Then, you have to hit a radio button to determine if and how you want a notice that this was done, and hit the “CONTINUE” button (black arrow).

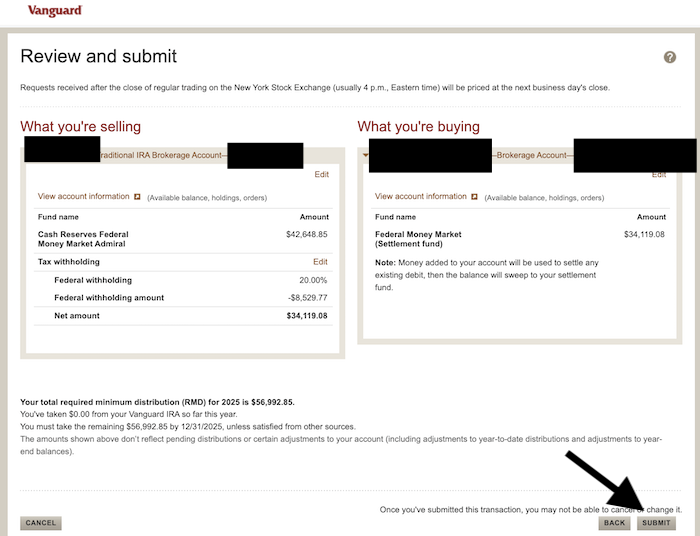

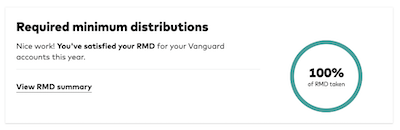

Now, you're on the review page. If it all looks right, hit “SUBMIT,” and the confirmation page will look similar. Note that the notice from Vanguard is still saying none of the RMD has yet been taken. But if you go back the next business day, you'll see this:

Now, you can give yourself a pat on the back! Of course, by the time we publish this and you get around to taking an RMD (probably in 2026 or later), Vanguard might have changed its website again. But the process should be the same each year, even if the pages look a little different.

Does this process make sense to you? Do you have any other RMD or QCD questions?