By Dr. Jim Dahle, WCI Founder

By Dr. Jim Dahle, WCI FounderAlmost all of us with kids eventually face the dilemma of how much to save for their college education. Some kids don't go to college and some parents can't or don't save anything for their college, but among the high-income professionals that read this site, the vast majority of kids will go and the vast majority of parents will save something. The question is simply how much to save for college.

Philosophy About Paying for College Trumps All

The most important consideration in this process is not the cost of school, but it's simply how you feel about paying for it. Some parents feel an obligation or desire to pay for every cent of a college education while also providing a fancy new car for their child. Other parents want to see their kids with some skin in the game through working, applying for scholarships, or even taking out loans.

In addition, some families view a fancy-pants, high-cost college education as stupid and can't imagine anyone attending anything other than two years of community college followed by two years at State U. Other families reason that there cannot possibly be anything better to spend money on than the very best school that they can afford, even if some percentage of that spending is a waste. “Why would you drive a Tesla and then send your kid to the local state university?” they ask.

You must first resolve these philosophical issues that do not have a right answer before you can really do any sort of calculation about how much to save for college. Once you have resolved these questions, how much to save for college boils down to making a few assumptions and doing a few calculations. Most of this post is going to be about the calculations, not the philosophy, although I am confident there will be plenty of discussion of philosophy in the comments section.

Plans Change

Another tricky aspect of this process is that young people don't always do what they think they're going to do, much less what their parents think they're going to do or want them to do. Exhibit A is our firstborn. She had been talking about being a doctor for years, so we aimed to save up a 529 that would cover an undergraduate education and a significant portion of a medical education. Her pre-medical education lasted one month. It turns out she doesn't actually like studying and learning about science, which is a pretty important trait for a doctor—not just a pre-med.

She is now much happier as a business student with a focus on entrepreneurship. I have no doubt she will be just as successful at that as she would have been as a doctor. However, the undergraduate business degree will be dramatically cheaper than medical school. We saved up a six-figure 529 for her, which she is now much less likely to spend. She actually insists on working pretty darn hard and covering many of her own expenses. Perhaps she will get an expensive MBA or go to law school later or something, but most likely, that 529 is going to jumpstart her childrens' college savings accounts. The more flexible your savings plans can be, the better, because things will change in some way for most young people.

More information here:

How Much Should You Sacrifice to Pay for Your Child’s Medical School Education?

Don't Expect Need-Based Aid for College

I have explained elsewhere that most high-income professionals should not expect ANYTHING by way of need-based aid from their colleges. Exceptions include if you retire while you have kids in college and if you have multiple kids attending expensive schools at the same time. It doesn't take a genius to realize this; you simply have to look at the Free Application for Federal Student Aid (FAFSA). Basically, you're expected to pay 6% of your non-retirement account assets plus something like 25% of your income. For most doctors, this “Expected Family Contribution” (EFC) will be higher than the Cost of Attendance (COA) at the college. Thus, the child will not be eligible for any need-based aid, especially once you take into account any student assets or income.

You and your child are on your own when it comes to paying for college.

Consider the Accounts You Can Use to Save for College

There are various places to save for college. The most common one is a 529 account. Similar to a Coverdell Education Savings Account (ESA) but with a higher contribution limit and frequently an additional state tax benefit, a 529 is a great place to save for school. As long as withdrawals are used for legitimate education expenses, all growth in the account is completely tax-free. The account is generally owned by the parent, so the parent is in control of it. If the child does not use up the account, the beneficiary can be changed to a sibling, grandchild, or another person.

You can also save in a Uniform Transfer to Minors Account (UTMA). This is just a taxable account for a child, and the money becomes the child's at a certain age, usually 21. The main upside compared to a 529 is its flexibility. There are no penalties for withdrawal if used for non-education uses. The main downside is that it is taxed, and before age 18, it can even be partially taxed at the parents' tax rate. Another potential downside is that the parent does not control the money after a certain age, and the child can spend it on a Mercedes and illicit activities if they want.

If you want flexibility and control, you can always save in your own taxable brokerage account.

Some people use savings bonds for college savings, although most high earners earn too much to benefit from the tax-free educational withdrawals associated with those bonds.

It is also possible to make some limited withdrawals from retirement accounts to pay for education, but I'm generally a fan of leaving retirement accounts for retirement.

More information here:

Do Parents Assume Too Much Educational Responsibility?

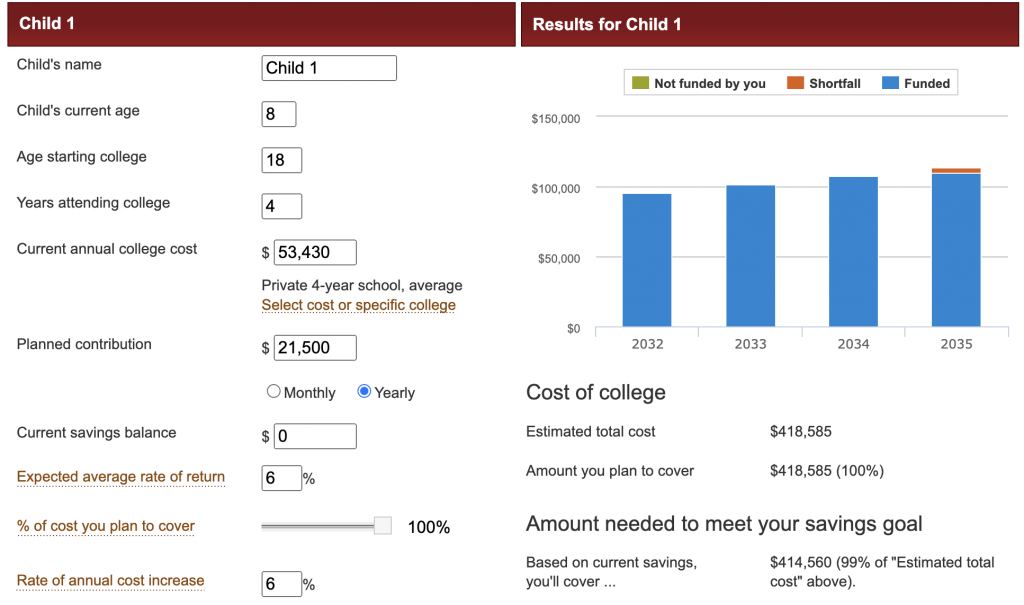

Introducing the Vanguard College Savings Calculator

OK, enough preliminary information. Let's get into some hardcore calculating. The best tool I have found for this comes from our friends at Vanguard. If you don't like this tool, build your own using a spreadsheet. But I think once you see this one, you won't bother.

Vanguard College Savings Calculator

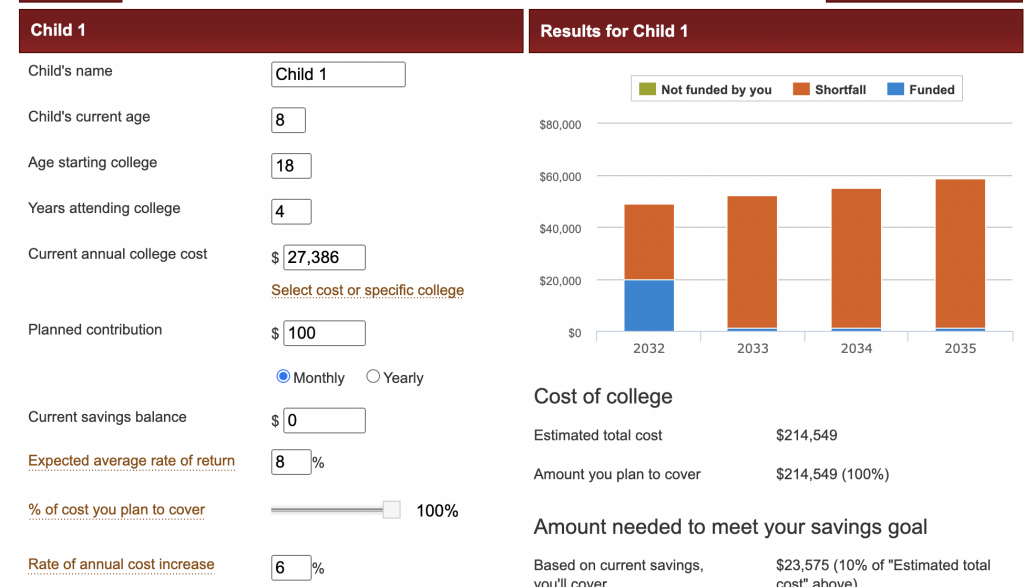

Let's say you have an 8-year-old child and have decided to save up 100% of the cost of attendance at the most expensive state university in your state for four years. You're going to invest your 529 aggressively, so you're expecting an 8% return on it. You look up the state university in 10 seconds with Google (“University of Utah Cost of Attendance”) and find that the COA for in-state residents is $27,386. You currently have nothing saved for college. You expect the cost of college to rise at 6% per year. How much do you need to save per year? Let's look at the results if you save $100 a month.

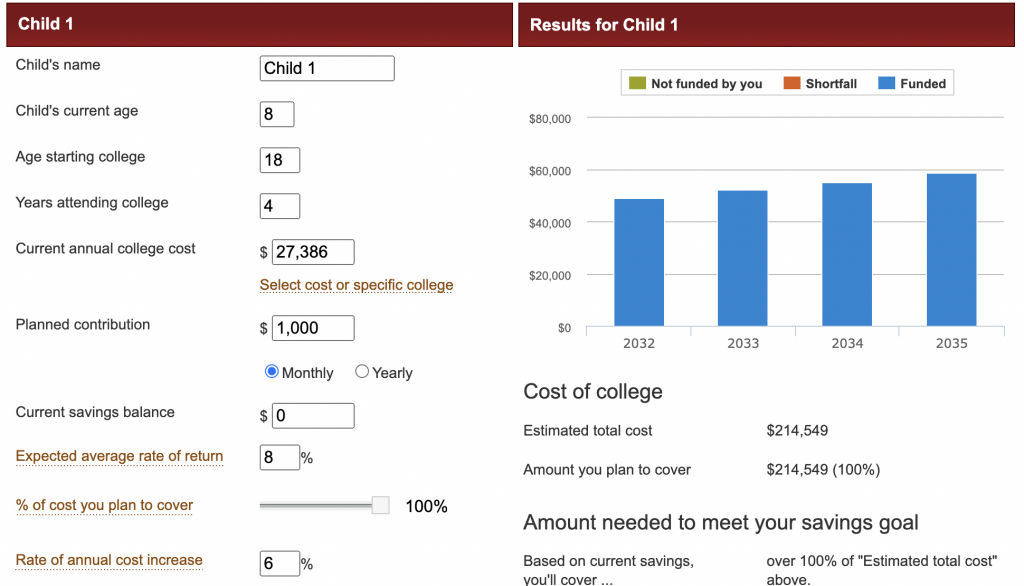

That doesn't look so good. You're not even going to be able to cover the first half of freshman year. I guess you better save a little more. Let's run it again, but this time by saving $1,000 a month instead of $100 a month.

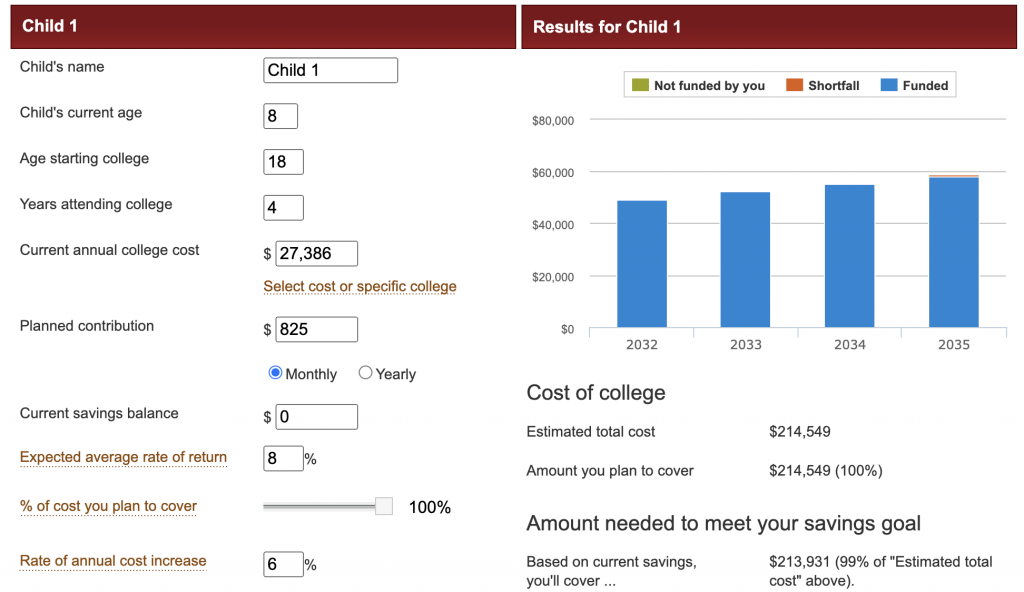

Oh great, now you've oversaved. Clearly the amount to save is more than $100 a month and less than $1,000 a month in this scenario with these assumptions. Let's try putting in a few numbers and see if we can get it so that we just barely cover the cost of college. Using trial and error, $825 per month gets me there.

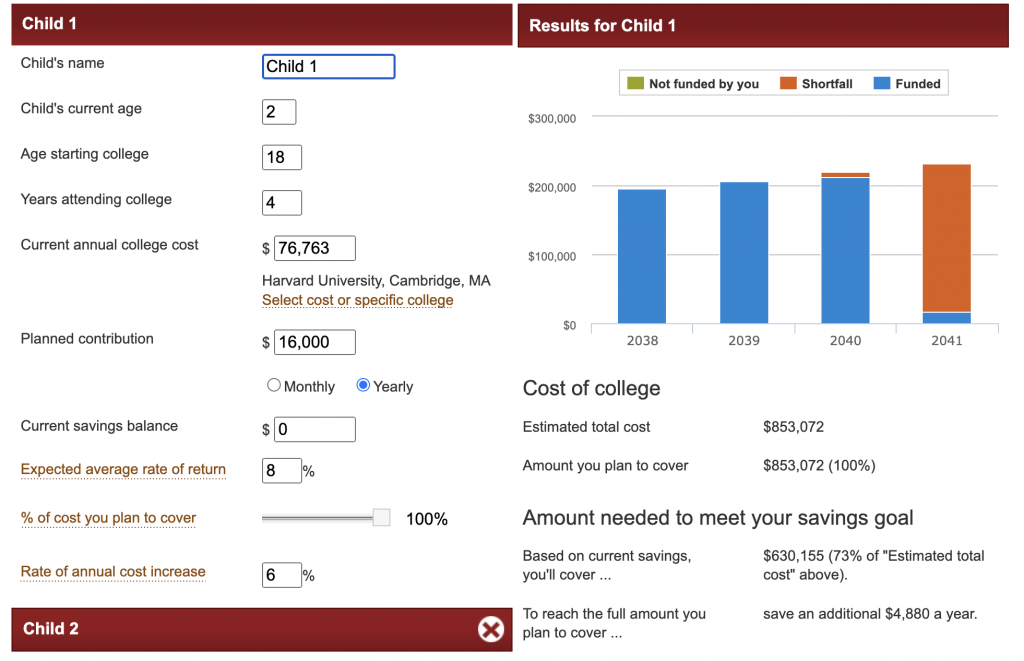

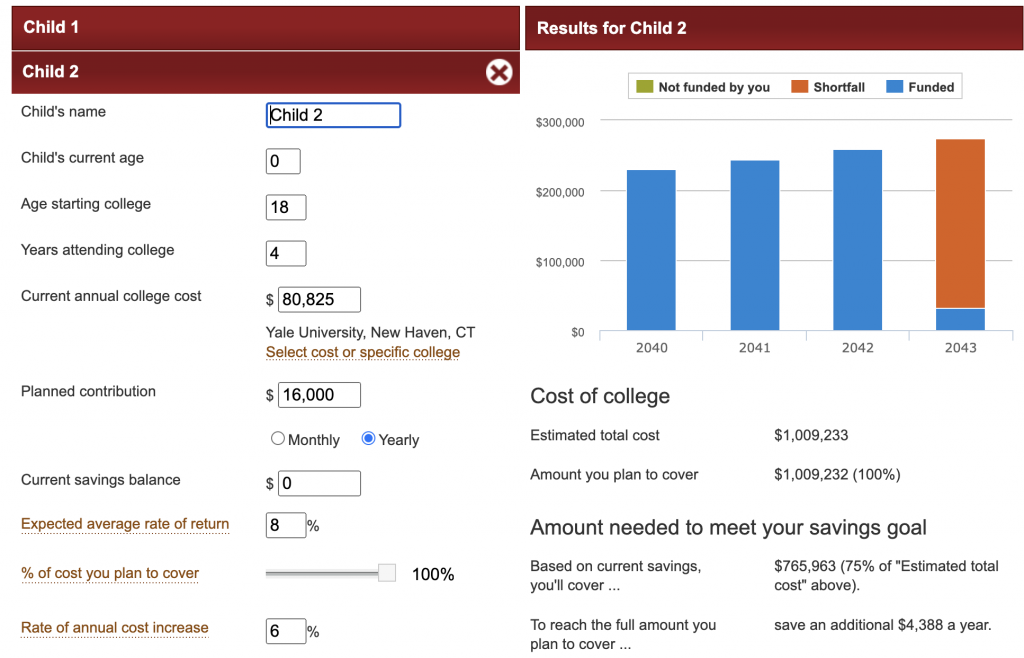

What I really love about this calculator, though, is that you can change everything, including adding in kids. Let's say you want to save $16,000 per year for college for each of your two kids, all at once. You're going to start when the older one is 2 and the younger one is 0. How much education would that allow you to pay for?

Saving $16,000 a year per child starting when they were born will allow you to pay for a little more than three years at Harvard and Yale, respectively. The calculator tells you that you won't meet your goal, though, unless you save another $9,000+ per year. I love the feature that allows you to enter more kids and the feature that allows you to specifically select colleges, both of which were used in this example.

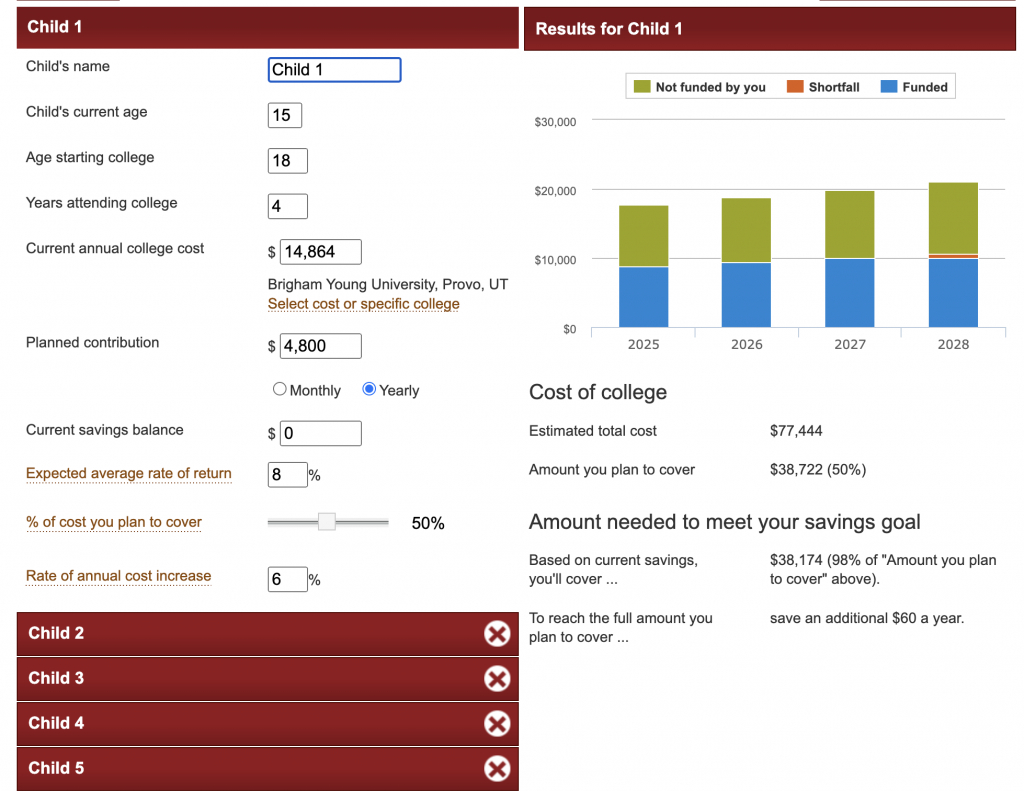

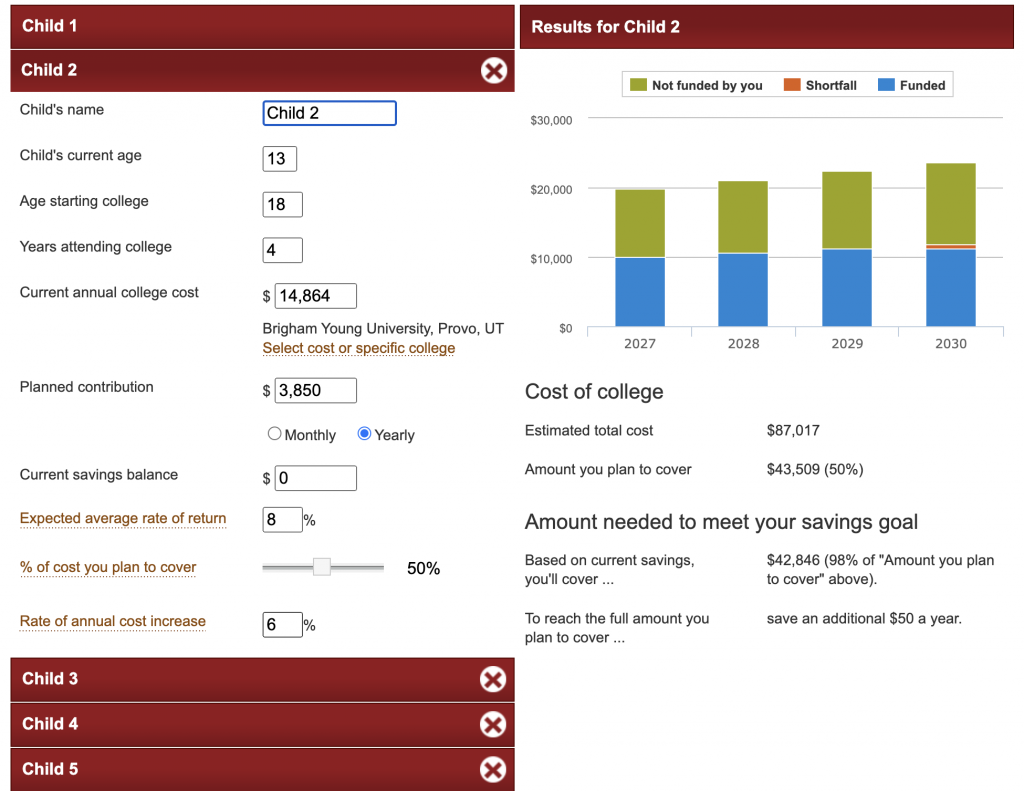

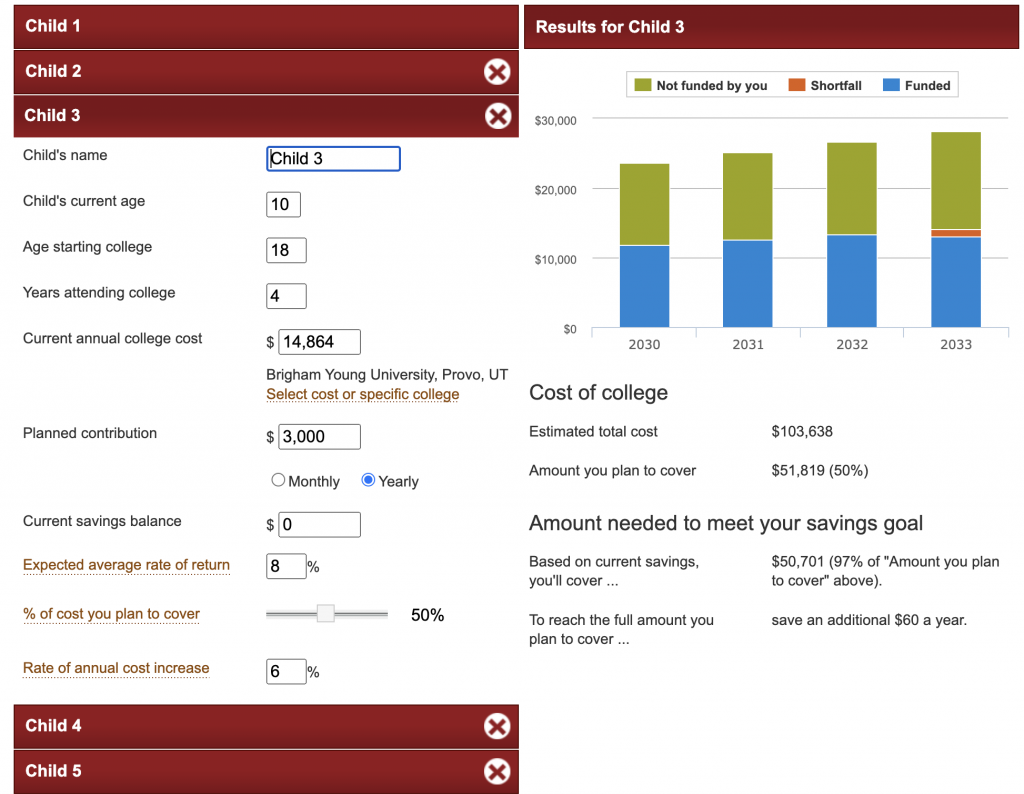

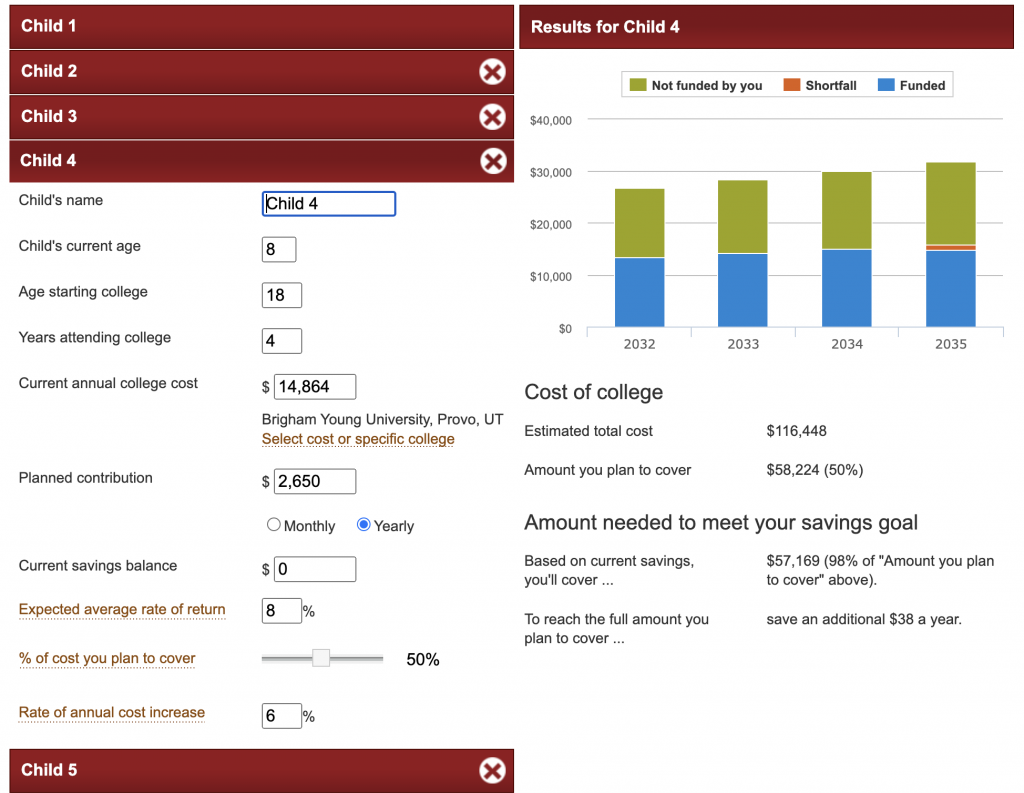

What if you want them to have some skin in the game? Let's say all seven of your kids want to go to Brigham Young University, and you only plan to pay half the cost. They are 15, 13, 10, 8, 6, 6, and 3. How much do you need to save for college each year? It turns out Vanguard doesn't know how Utah works. It only lets you use five kids in the calculator. So, we'll assume the two twins decide to play pro sports out of high school. Or join the military. Or whatever. Here's what it looks like:

OK, what do we learn from this exercise? We need to save the following amounts:

- Child 1: $4,800

- Child 2: $3,850

- Child 3: $3,000

- Child 4: $2,650

- Child 5: $2,000

That's a total of $16,300 per year for the five of them. Very doable for most reading this site. And if the kids work hard in the summers and/or get a part-time job during school, all five can finish their educations without any debt.

The Problems with the College Savings Calculator

The calculator is not perfect. Aside from the problem inherent in any calculator (garbage in/garbage out), this one has one huge flaw. It adjusts the cost of attendance for inflation, but it doesn't adjust your contributions for inflation. On a real (after-inflation) basis, you're actually saving less and less each year if you follow the directions of the calculator. That's not what most people do. Most people make more money and save more money as they go along through their careers.

For example, when I look at my eldest daughter's college savings account contributions, I see this:

- 2007: $2,000

- 2008: $2,000

- 2009: $2,000

- 2010: $0

- 2011: $3,480

- 2012: $95.10

- 2013: $3,730

- 2014: $3,720

- 2015: $3,800

- 2016: $3,950

- 2017: $14,020

- 2018: $15,000

- 2019: $15,000

- 2020: $15,000

- 2021: $15,000

- 2022: $16,000

- 2023: $0

We did pretty good. We started when she was only 3. We only missed two years after that. For five years in the middle, we made large enough contributions to get the maximum state tax credit. While she was in junior high and high school and talking about being a doctor (and we were making a lot more money), we put in the maximum contribution. I suspect that most people's college savings record looks a lot like ours. Few people start right when the child is born because they have more important financial priorities. They can't afford it. They don't make contributions every year because things come up. Contributions get larger as time goes on.

The Vanguard calculator accounts neither for inflation nor for the fact that life happens.

More information here:

6 Ways to Lower the Cost of College

What About Grad School?

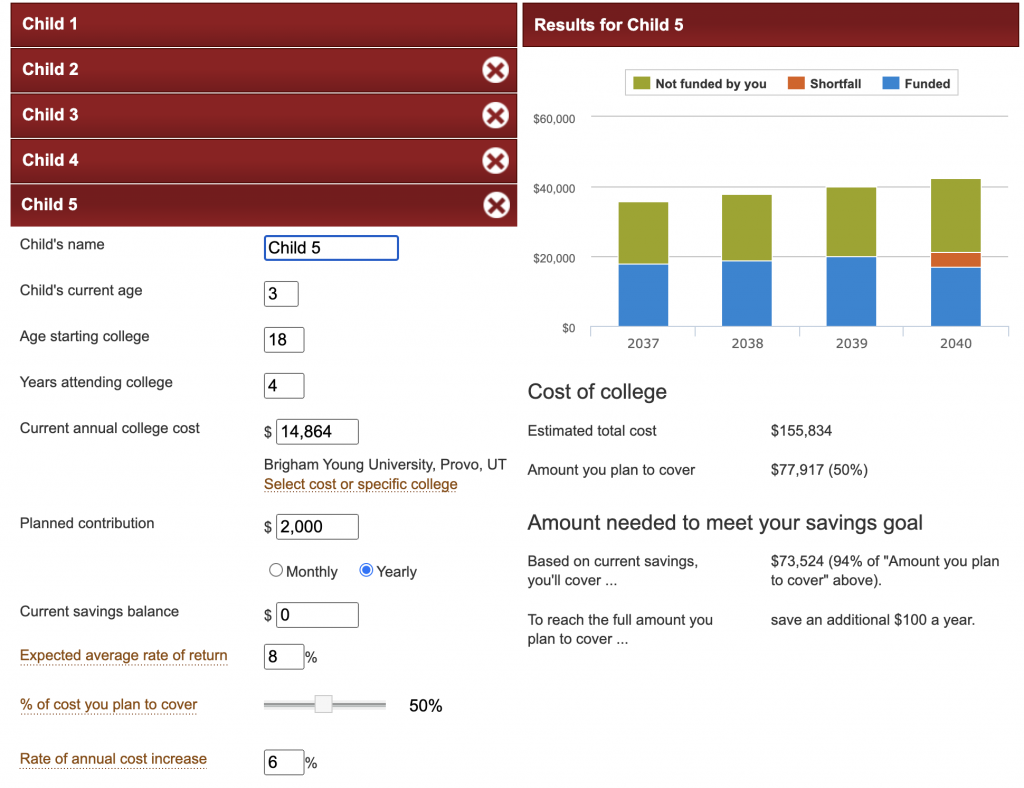

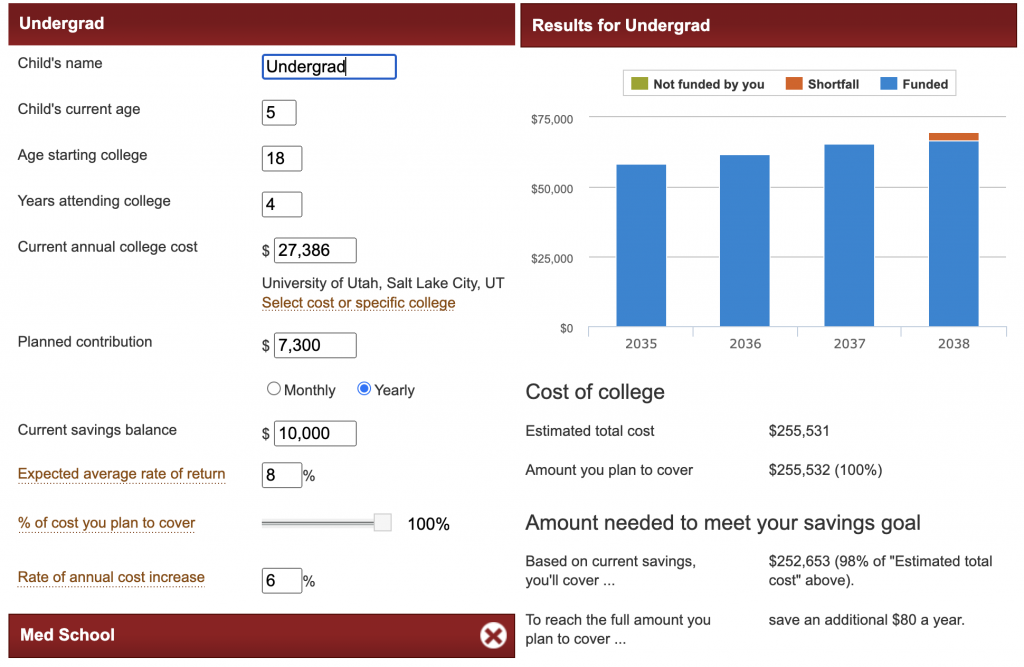

The calculator also doesn't work very well for a kid who is planning to go to medical, dental, law, or grad school. However, it's pretty easy to work around this. You basically do two calculations. Let's say you have a 5-year-old. You have $10,000 saved. You expect investments to grow at 8% and tuition to increase at 6%, and you expect the kid to attend the University of Utah for undergraduate at 18 and Tulane for medical school at 24. You plan to pay 100% of the costs of undergraduate and 50% of the costs of medical school. How much will you need to save each year?

Looks like your total is $7,300 a year for undergrad and $11,900 a year for medical school for a total of $19,200 per year. Obviously, the last six years you're saving less, though, since the kid is actually in college or gap years or whatever and you're no longer saving for undergraduate. See “The Problems With the College Savings Calculator” section above.

How Much Do You Need to Save for College?

How much do you need to save for college? It depends. It depends on where the kid goes, it depends on how much you will be paying for, it depends on how much you now have, it depends on how much you will cash flow during college vs. saving up in advance, and it depends on how much you already have. But if we make some reasonable assumptions that you won't start until the kid is 8, that you will earn 6% on your savings and that tuition will increase at that same 6%, that you will pay the entire bill for four years of undergrad, and that your kid will attend the hypothetical “average private college” ($53,430 per year), you need to save $21,500 per year. That means you're going to need more than just a single 529 account to do it.

Good luck figuring out how much to save for college. Use the calculator, and if it spits out some crazy figure for you, well, just do the best you can. If you're like me, your parents paid for little of your post-high school education, so anything you do for your kids will be better than that! However, don't forget the Four Pillars of Paying for Education:

- School selection

- Parental savings

- Parental cash flow

- Child's contribution (work, savings, scholarships)

You don't have to do it all, and you don't have to do it all in advance. But do something because your success is going to keep them from being able to get any Pell grants or even student loans.

Student loans and the many programs and options are challenging to navigate. If you need help, look to StudentLoanAdvice.com, a WCI company that helps the average client save $167,000 in loans! Check it out today!

What do you think? How did you decide how much to save for college and why? What is your philosophy in this regard? How do you invest your 529s? What will you do if you save too much or too little? What do you think of the Vanguard calculator?