By Dan Miller, WCI Contributor

By Dan Miller, WCI ContributorDoctors spend years mastering the art of medicine, but they're not necessarily equally skilled at managing their finances. With high incomes and often equally high levels of student debt, many physicians find themselves navigating a financial minefield. While a slight majority of doctors polled by Doximity currently have a financial advisor, however, a majority of The White Coat Investor readers choose to manage their own finances.

How Many Doctors Actually Have a Financial Advisor?

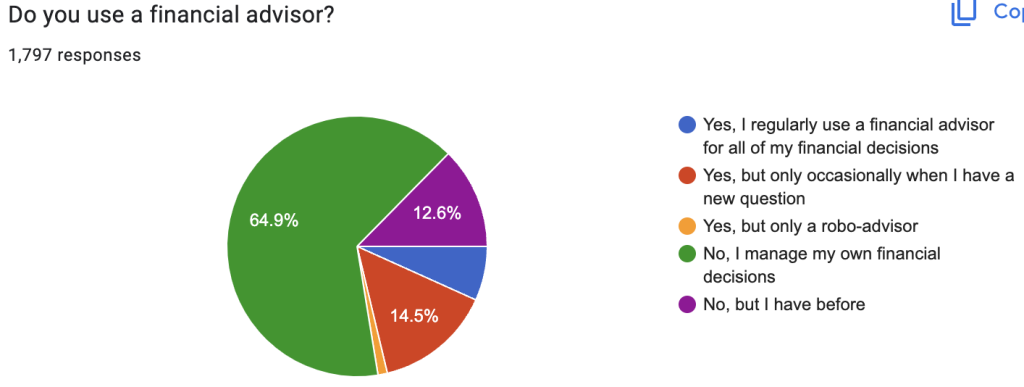

A recent Doximity poll of 2,087 physicians showed that 53% currently have a financial advisor and 15% more report that they plan to find a financial advisor soon. However, the 2024 WCI survey results showed that 65% of respondents do not use a financial advisor, and even those that did, generally only do in limited circumstances.

While neither of these polls is scientific, they do paint an interesting picture. While some doctors prefer to focus on medicine and let someone else handle their finances, others prefer to have control over their finances as well.

More information here:

Why Do Doctors Consider Financial Advisors?

There are a few reasons why doctors consider having a financial advisor. Doctors are no strangers to complexity, but when it comes to managing money, it's easy to feel overwhelmed. Doctors often have years of medical school debt, irregular income streams from bonuses or partnerships, and the pressure to plan for a comfortable retirement, All of that can make financial decisions feel like a second full-time job. With a demanding medical career, it's easy to see why many doctors can choose to outsource their finances to an expert.

Benefits of Financial Advisors for Doctors

A financial advisor can offer more than just investment tips—they can provide clarity, strategy, and peace of mind in the face of financial uncertainty. For many doctors, the real question isn’t why to hire one but when.

Here are a few potential benefits of having a financial advisor as a doctor:

- Debt management guidance: Advisors can assist with structuring and prioritizing student loan repayments to balance debt reduction and wealth building.

- Tax optimization strategies: Financial advisors can help physicians minimize tax liabilities through deductions, retirement contributions, and strategic planning.

- Work-life balance support: By managing complex financial decisions, advisors free up time for doctors to focus on their patients and personal lives.

Do All Doctors Need a Financial Advisor?

As shown by the survey results, many doctors do not use outside financial advisors, so clearly not all doctors feel like they need a financial advisor. In fact, WCI founder Dr. Jim Dahle laid out eight reasons he felt you could (and possibly should) be your own financial advisor, originally written way back in 2016 and updated since.

Deciding whether you want to manage your own finances or hire a separate financial advisor will depend on several factors, including how much time you have to dedicate to it, how interested you are in money and finances, and how complicated your situation is. Someone with more spare time who is already interested in money is probably more likely to manage their own money than someone with a complicated financial situation with no time to manage it. The second person may benefit more from expert guidance from an outside financial advisor.

More information here:

Think Twice About Your Advisor

Picking a Financial Advisor

If you have decided that your situation warrants working with an outside financial advisor, you then need to find the right one. While it may be difficult to find the perfect financial advisor, there are a few steps you can take to find the right one for you.

- Research qualifications and credentials: Look for certifications like CFP (Certified Financial Planner) or CFA (Chartered Financial Analyst) to ensure the advisor has the expertise you need.

- Evaluate their experience with physicians: Choose an advisor who understands the unique financial challenges and opportunities in the medical field.

- Clarify fee structures: Ask whether they charge a flat fee, commission, or percentage of assets under management to avoid hidden costs and align with your budget.

You can also check our list of curated financial advisors that work with physicians to see if any of those might work for you.

The Bottom Line

Managing money can be challenging for anyone, and physicians have added complexity to deal with—which is one reason why some doctors choose to work with a financial advisor. However, many doctors choose to manage their own money and serve as their own advisor. No matter how you choose to do it, financial health is just as important as physical health—both require proactive care and trusted expertise.

The White Coat Investor is filled with posts like this, whether it’s increasing your financial literacy, showing you the best strategies on your path to financial success, or discussing the topic of mental wellness. To discover just how much The White Coat Investor can help you in your financial journey, start here to read some of our most popular posts and to see everything else WCI has to offer. And make sure to sign up for our newsletters to keep up with our newest content.