By Dr. Rikki Racela, WCI Columnist

By Dr. Rikki Racela, WCI ColumnistThe founder of this website is often baffled by the amount of questions/grievances/headaches that WCI followers face when attempting the Backdoor Roth IRA. It seems such an easy process, especially when comparing it to renal physiology or medical pharmacology! The Backdoor Roth IRA simply consists of making a contribution to a traditional IRA and, once that money settles, converting that amount to a Roth IRA. Then, you never have to pay taxes on that money again.

Even though I am financially qualified to be writing this column today, I myself have failed to do the Backdoor Roth. In my defense, I was only just getting financially literate, but I think my experience reflects the experience of many white coat investors when they have questions or concerns or problems when doing the Backdoor Roth. I, like many of you, started somewhere with the Backdoor Roth, and unfortunately, it was a failure. But I got more financially literate and more confident.

Now, I dominate the Backdoor Roth every year, and I'm planning to keep doing so until I stop making qualified income.

Dude, I’m a Failure

It was early 2019 when I finally became financially literate. I had just completed the original White Coat Investor book. Within those pages was the mention of the Backdoor Roth, and after diving into the WCI blog, I saw how Dr. Jim Dahle outlined the simple steps for people who made too much money to contribute to a Roth IRA. Instead, those high earners had to contribute money to a traditional IRA and then convert that to a Roth IRA. However, also within the depths of the blog post, webpages, and the WCI forum were countless nuances and questions regarding the maneuver.

I also needed to get out of two stupid whole life insurance policies, get appropriate true own occupation disability insurance, and buy appropriate term life insurance before getting rid of those whole life insurance policies. There was a lot going on financially, and I had already planned on doing a 1035 exchange, but I still needed a written financial plan to help guide me as this financial thing seemed incredibly overwhelming. Finally, because I was still in the depths of losing money to whole life insurance, there was not really much money to contribute to a traditional IRA and then perform the Backdoor Roth maneuver. My wife and I had just gotten out of $31,000 of credit card debt, and having just learned the concept of three months of expenses for an emergency fund, I was not sure I wanted to risk putting in money for the Backdoor Roth. Money was so tight.

In addition to a not-so-liquid financial situation, there were mountains of questions surrounding the Backdoor Roth looming in my mind. Posts on WCI seemed to answer every conceivable question on the Backdoor, but just like everybody else, my situation was unique. I was making 1099 income with medical surveys and I wanted to contribute to a SEP-IRA to at least take a tax deduction on my 1099 income. But would that be subject to the pro-rata rule? It should not be. According to the WCI blog posts, it only matters if you have money in an IRA on December 31 of the previous year. But I still had my doubts. Also, tax day was fast approaching. Could I make the traditional IRA contribution and then convert that to Roth in enough time before April 15? In the back of my mind, I knew that it should all be OK, but I was still nervous. Add to this that I was short on cash and just becoming financially literate.

So, what happened on April 15, 2019? I failed to do the Backdoor Roth for tax year 2018.

More information here:

My Financial Plan Calls for Me . . . Being Hung by My Fingernails????

The 1 Portfolio Better Than Yours

Dude, I’m a Dominator

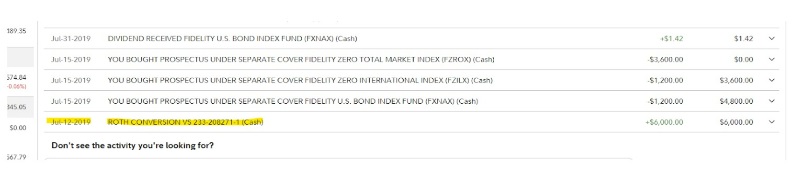

Fast forward a few months past Tax Day 2019. I had taken my SEP-IRA and rolled it over into a newly minted solo 401(k), had completed a couple of 1035 exchanges on our whole life insurance policies, and had finished WCI's Fire Your Financial Advisor course (it's freakin awesome, by the way). I had some more financial experience, enough money freed from whole life premiums to fund the Backdoor Roth, a lot more financial confidence, and (most importantly) a written financial plan that specified to do the Backdoor Roth for 2019. This was the result (click on the image to make it larger):

Booyah! My first Backdoor Roth! I also did it for my better half. Highlighted was the conversion from my traditional IRA. Note also in my screenshot that I immediately invested that money once it settled as per my chosen asset allocation. You might also note that this was not really the perfect asset location since I initially had bonds in our Roths (now, it’s all small cap and value equities in there). I subsequently fixed that as I learned more about asset location. Just comes to show you that you don’t need to know everything before doing the Backdoor Roth maneuver.

Shoot, Did I Make a Mistake?

After completing our first Backdoor Roth, I did notice something that caused me a little bit of concern:

Turns out I had an extra $1.97 left over in my traditional IRA. I wondered what I had to do with the leftover money in the traditional IRA? Did I do something wrong? Was this bad? Would I get penalized for this?

Luckily, Jim Dahle had already answered this dilemma in his post Pennies and the Backdoor Roth IRA. The money that had grown just a little bit in the traditional IRA while invested in cash was no big deal. I simply took the $1.97 that was in the traditional IRA and just put it back into my checking account. Now, any extra money that I have, I just convert the whole thing to Roth, pay tax on those few dollars, and end up with a little bit more moolah to grow tax-free.

More information here:

17 Backdoor Roth IRA Mistakes to Avoid

Continuing to Dominate the Backdoor Roth IRA

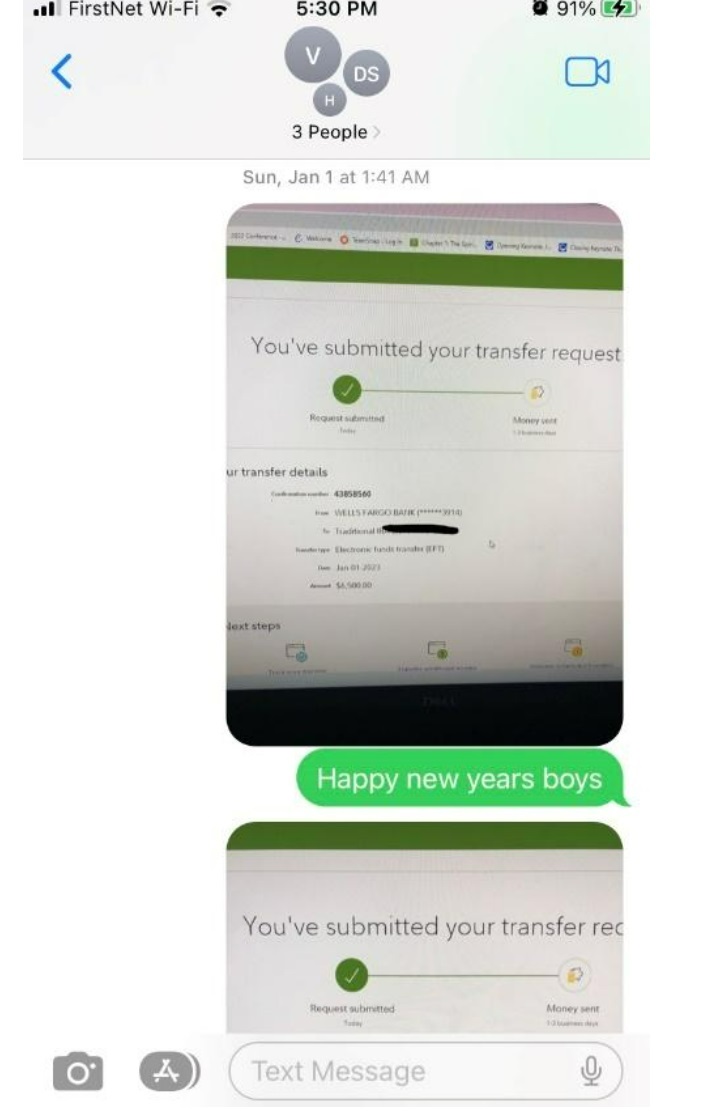

To this day, my wife and I continue to complete the Backdoor Roth every January 1, as per our written financial plan. I am a big believer in getting the money in as soon as possible and then lump-sum it so it can grow tax-free as soon as possible. We make sure to have enough money and budget for the Backdoor Roth conversion every year. It not only helps to have this in our written financial plan, but I also have grouped up with fellow white coat investors to be accountable for performing the Backdoor Roth maneuver every year as seen by the following text message:

Notice the time and date I sent the confirmation of the contribution to the traditional IRA. I think texting the confirmation to fellow white coat investors that I am friends with really reinforces my plan to lump sum and to complete the Backdoor Roth every year. This also encourages them to do the same. It might seem a little obsessive, and that is probably why I am the one writing this column right now.

Lessons Learned in Performing the Backdoor Roth IRA

There are a few lessons I have learned in order to perform the Backdoor Roth correctly and consistently:

- It’s dirt easy to perform.

- It helps to have this written down as part of a written financial plan.

- WCI is here to help.

- Don’t tell your significant other that, once the ball drops, you are going upstairs to do the Backdoor Roth. It doesn’t go over very well!

Has your experience with the Backdoor Roth been easy? Did you make any mistakes? Did you find the posts at WCI helpful?