By Dr. Jim Dahle, WCI Founder

By Dr. Jim Dahle, WCI FounderLet's get more into it, especially as it relates to new residents and attendings.

White Coat Investor Financial Waterfalls

Doctors love this kind of thing—a list that tells them exactly what to do with their money. Reality is a little more complicated than just a list, and a hardcore hobbyist can usually pick a few nits with any list. But they're still pretty useful as a rule of thumb. What I would like to do today is present a “waterfall” for both new residents and new attendings. I'm sure the comments section will be full of nits, which is great. None of this is set in stone. But I think it will still be useful to many readers.

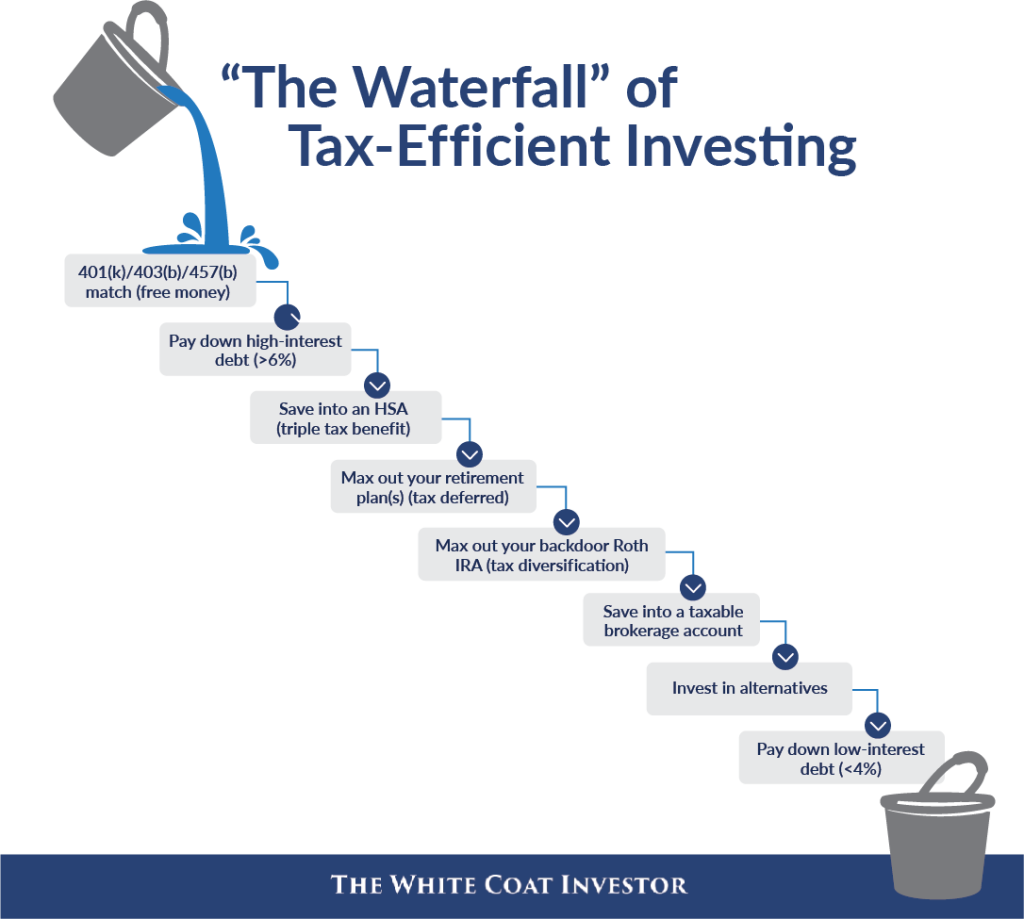

Here's the original chart, as inspired by SC Gutierrez.

Now, let's get to the waterfalls that are specific for residents and new attendings. Be aware that I'm not just talking about money in my “waterfalls;” I'm also talking about time and life energy.

Resident Financial Waterfall

Here's what new residents should be thinking about.

Insurance

As you can see, our first bucket on the waterfall is insurance. If your time, energy, and money are so limited that you can't afford to do anything else, I recommend getting disability insurance. An individual policy (with a nice Future Purchase Option rider) is probably best, but get a group policy at a minimum.

Life insurance comes next, at least for those with someone else (usually a spouse and/or kids) depending on their income. If you have children, you also need a will.

Emergency Fund

The next step is an emergency fund, but this should be a resident-sized emergency fund. It is likely a four-figure amount. This is enough money to replace a washing machine, fly to a funeral, and maybe even buy a beater without taking on new debt. Traditionally, an emergency fund is 3-6 months of expenses.

Dave Ramsey recommends against a 3-6 month emergency fund for anyone with debt, simply because they have better things to do with their money. I agree that a huge emergency fund isn't a major priority for residents for a few reasons:

- First, your job and pay are very stable as a resident.

- Second, you have a ton of great uses for your money, probably including a six-figure 6%+ debt.

- Finally, direct contributions to a Roth IRA can be taken out at any time tax- and penalty-free and, in that respect, it can serve as an emergency fund.

It just doesn't make sense to have a five-figure amount sitting around earning, say, 3%-4% interest while passing up the tax benefits of Roth accounts and paying 6%+ interest on a loan. But $1,000? Sure. What about $2,000-$5,000? OK. Maybe even up to $10,000. But no more than that for a family primarily relying on the earnings of a resident to survive. That takes care of the “insurance” section.

Student Loans

Next, we move into the “student loan” section. This is the elephant in the financial room for 3/4 of residents, and it cannot be ignored. You need a plan for your student loans. Private student loans can safely be refinanced any time you can talk someone into giving you a lower rate. If they were mine, I'd start the day I walked out of residency and repeat every six months. You shouldn't have to go into forbearance or deferment since there are private companies that offer payments of $0-$100 per month. You can afford that.

You also need a plan for your direct federal loans. Unfortunately, this is a little more opaque in 2024. The plan you probably would have wanted to explore is SAVE, which was introduced in 2023 and essentially replaces REPAYE. The purpose of SAVE is to stop interest from accruing and effectively lower the rate of your loan. Our advice was that borrowers who make less than they owe in student loans should strongly consider switching to SAVE. But SAVE is now working its way through the court system, and there's a good chance that the program will eventually be erased. If you need help with student loans, get some advice.

Maximize Salary and Pay Off High-Interest Debt

At this point, you want to make sure you don't leave any of your salary on the table. What do I mean by that? I mean the employer match in your 401(k) or 403(b). Go to HR, ask for the plan document, see if there is a match, and determine how much you must contribute to get it. Contribute that much to the 401(k)/403(b) (use the Roth option if available). Your next priority is high-interest debt. What do I mean by that? I mean those credit cards you used to pay for interview expenses. I mean that 9% relocation loan you took out. I mean that 7% car loan you have. Pay it off. Experienced investors salivate over guaranteed 7%-30% returns, and you've got them just sitting around in your filing cabinet.

Financial Education

Your next priority won't cost much money, but it will cost you some time. You need to become financially literate. Maybe this means investing in a few good books or even the Fire Your Financial Advisor Course (we now have specific courses geared toward residents and medical students). Maybe it means paying a few hundred dollars to a financial advisor to help draw up a plan. Maybe it means spending hours while on call pouring through old blog posts, participating in the WCI Forum, or checking out social media groups and Reddit. It'll be different for everyone, but you need to obtain basic financial literacy.

Health Savings Account

Your next investing priority may be a Health Savings Account. This triple-tax-free account is the best deal going in investing, but most residents aren't eligible for one since they don't have a high deductible health plan. That's OK if you're not, but if you are eligible, be sure to use this account. Your employer might even put some money in there for you.

Roth IRA

Next comes the Roth IRA. As a resident, you may be in the lowest tax bracket you'll ever be in for the rest of your life. Take advantage of this tax-free account while you still can. Remember you can even do one for a non-working spouse from your income. One possible exception to this is if you are trying to minimize your income so you can take advantage of Public Service Loan Forgiveness. But in the long run, most people are going to be glad they invested in tax-free accounts during residency. Remember you have until Tax Day of the following year to make your contribution. Also, if you are doing a lot of moonlighting or have a high-earning spouse, you might have to make these contributions through the Backdoor.

401(k) or 403(b)

Next comes your 401(k) or 403(b), again using the Roth option if available—a potential exception might be those going for PSLF who may wish to use a tax-deferred account. If there is no Roth option available, convert the whole thing to a Roth IRA in the tax year you become an attending (assuming you separate from your employer).

If you still haven't run out of money at this point, you're probably some kind of super-saving resident (or married to an attending, in which case you might want to combine this waterfall with the one below in a way that makes sense for your situation). But if you've got the cash, here's what to do next. Pay off your private loans (and even your federal ones if not going for PSLF). No loans? Then, start playing attending. Build up your emergency fund, start saving up a down payment (or paying down the mortgage if you bought a house in residency), and start investing in taxable. And for heaven's sake, go on a vacation.

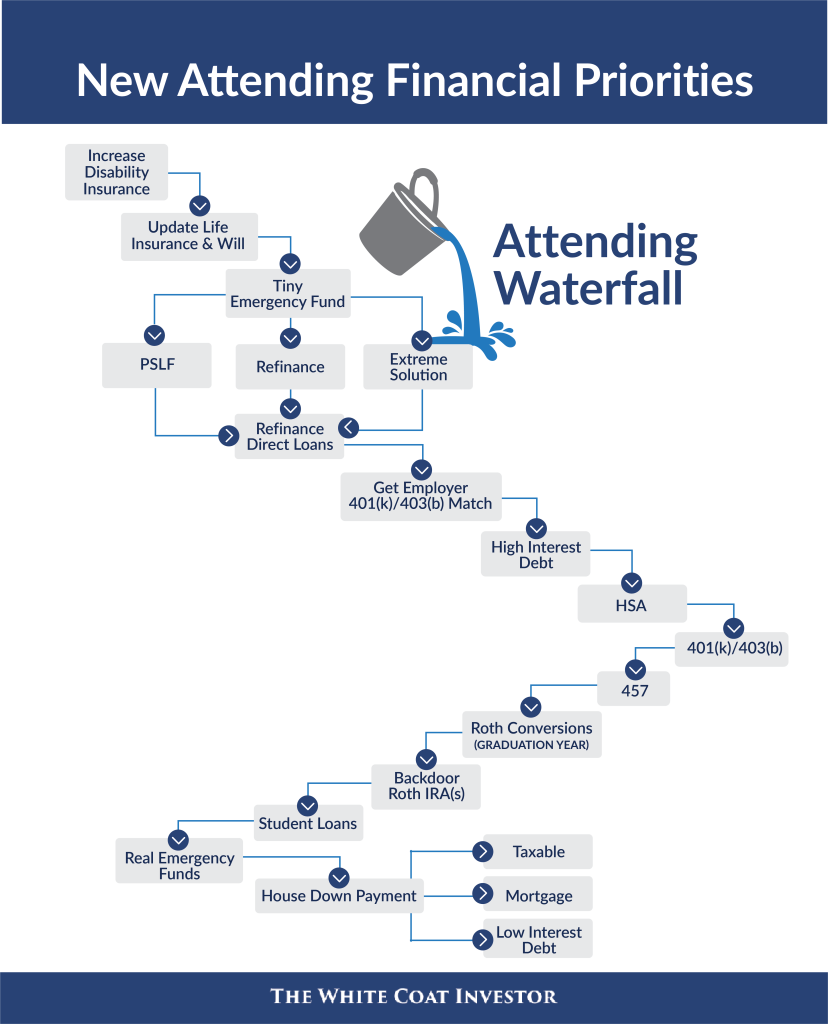

Attending Waterfall

Insurance

As a resident, you likely couldn't afford or qualify for all of the insurance you needed. Now is the time to add on another disability insurance policy (or exercise the Future Purchase Option rider) and, if needed, another life insurance policy. Got married, had a kid, or moved to another state? Update that will! You still need that tiny emergency fund if you don't have one.

Student Loans

It's also time to readdress the student loan issue. At this point, you should know if you're going for PSLF (i.e. are you directly employed by a 501(c)(3) after making a significant number of small qualifying payments while in training?). If you are, that probably means switching to PAYE (assuming that now gives you lower payments due to the cap). If you are not going for PSLF and are in a typical loan situation owing less than 1.5X your gross income, it might be time to refinance your student loans (though current interest rates might not make refinancing such a great deal). If you are in an extreme situation with monster student loans (1.5-4X+ of your gross salary) and NOT going for PSLF, you probably should get some student loan advice. First, make REALLY sure you can't get a job at a PSLF-qualifying institution. Then consider PAYE forgiveness (20 years of payments in exchange for taxable forgiveness of remainder). Be sure to save up for that tax bomb in Year 20.

If you've refinanced your loans, your next priority is to pay enough toward them that they will be gone within five years. I've had a lot of people push back on this recommendation, but if you live like a resident and don't have extreme debt, you can do this with money to spare. No rule of thumb is ever 100% and correlation is not necessarily causation, but I can tell you this: the majority of doctors who become financially successful are rid of their student loans within five years. The majority of those who did not become financially successful still had loans after five years. If you're going for PSLF (or even an extreme solution like PAYE forgiveness), you still need to make those payments. Just make them into your investing accounts, so if something happens to PSLF, you don't come out behind. Working at a 501(c)(3) is not a permission slip to not live like a resident for 2-5 years after residency.

Retirement Accounts

Take advantage of retirement accounts. Get your employer match and get rid of any high-interest debt as noted under the resident section. Then, go for the HSA. At this point, the priority list is a little different during your first six months out of residency as opposed to every year afterward. During your last six months of residency and first six months of attendinghood, you will be in an intermediate tax bracket—not as low as what you had as a resident but not as high as during your peak earnings years, especially if you're in a partnership track. If you made tax-deferred 401(k)/403(b) contributions during residency, now is the time to convert them to a Roth IRA. If you are eligible for a Roth 401(k)/403(b), use it this year. Your Roth IRA contributions may now need to go through the Backdoor as well, but you still have until Tax Day of the following year to get them done.

Once you're into your second year as an attending and either in or approaching your peak earning years, it's time to prioritize tax-deferred accounts higher than tax-free accounts. That means you're probably done with Roth conversions. No more Roth 401(k)/403(b)/457. Max out your tax-deferred accounts (including your 457 if it has low costs; good investing options; good distribution options; and, if a non-governmental plan, is a stable employer). Then, do your Backdoor Roth IRAs.

Pay Off Student Loans

My next priority at this point for those with additional money would be to pay off your student loans even faster. You have peers paying off their loans in 18, 12, nine, and even six months. The sooner you have them paid off, the sooner you can move on with your financial life. Don't fall into the trap of, “They're only 5%-6%; I'll bet my investments can do better than that.” Maybe you're one of those rare docs who really invest the difference and whose prescribing habits aren't affected by Big Pharma advertising, but you're probably not. Yes, the long-term math is likely to work out, but the long-term behavior usually doesn't.

Boosting Emergency Fund and Buying a Home the Right Way

When the student loans are gone, you're nearly to the end of your live like a resident period. Boost that emergency fund up to 3-6 months of expenses before expanding your lifestyle. If you're not already into a home with a doctor loan, save up a down payment. If you have a doctor loan, consider paying it down and refinancing into a conventional loan if you can get a lower rate. Invest in taxable, pay off low-interest debt, and maybe even throw something extra at the mortgage—dealer's choice. This is also the place where funding 529s and other savings for the next generation can fit.

Hopefully, you find these two “waterfalls” helpful in your financial planning. This financial stuff isn't that complicated—a lot of it is you making a one-time effort and then putting it on automatic pilot. Get your finances in order so you can concentrate on what matters most in your life.

What do you think? Do you agree with my waterfalls? Why or why not? What would you change or add?

[This updated post was originally published in 2018.]