By Dr. Jim Dahle, WCI Founder

By Dr. Jim Dahle, WCI FounderThere are plenty of arguments among intelligent investors about what diversification actually means. The total market crowd argues that the more companies you are invested in, the more diversified you are. Thousands of companies? Great! They'll often also argue that capitalization weighting is ideal.

“Since that is the way the market allocates capital, that is the most diversified way for you to do so,” goes the argument.

Others will argue that you also want to diversify your risks. Instead of just taking on market risk, maybe you should also take on small company risk, value risk, and leverage risk.

Still others will argue for more of an equal-weighted approach. Instead of capitalization weighting like the Vanguard Total Stock Market Index (where ~27% of your investment is invested in only 10 companies), you could spread your money equally across dozens, hundreds, or even thousands of stocks.

Even beyond diversifying within an asset class (like US stocks), it can also be important to diversify between asset classes by adding more, such as bonds, real estate, international stocks, precious metals, crypto assets, and other unique asset classes that come with their own risks.

All those people are right, and sophisticated investors will argue the merits of one approach to diversification over another until the cows come home. However, there is one thing that all sophisticated investors will agree on but that many unsophisticated investors (and unsophisticated advisors) are still getting wrong about diversification. It's called false diversification.

What Is False Diversification?

One of the best examples of false diversification I've ever seen was mentioned by Bogleheads forum poster “hdn” (edited for clarity):

“My brother had his advisor tell him that the S&P 500 is too concentrated and he needed to diversify better. The advisor had him in six different mutual funds. He sent me the sheet that showed the funds and allocations. I ran it through an analysis and saw that three of the six funds have significant investment in various FAANG stocks even though they weren't in that category. For example, the international and emerging markets funds had both Amazon and Google in them. In one of the US funds, FAANG stocks represented over 45% of the fund. I showed my brother that his top 10 stocks represented a larger percentage of his full portfolio than the S&P 500 did!”

False diversification is when you invest your money across different funds or managers, but the underlying investments are all the same. For example, a novice investor might feel good to be invested in five different technology funds, but the managers are all investing in the same stocks. The investor has added cost and complexity without any benefit! When those stocks go down, all of the funds will go down. When those stocks go up, all of the funds will go up in value. It seems like diversification, but when you look under the hood, it isn't.

Some “advisors” put their clients into dozens of different mutual funds and individual stocks. I prefer to think they are doing this out of ignorance, but it is entirely possible that they are doing it on purpose to make their work seem too hard and complex for the individual investor to take on as a do-it-yourself project. Every time I see it, however, it's obvious to me that the advisor needs to be fired. There is no reason for anybody to own 30 different mutual funds. There are very few good reasons for anyone to own individual stocks. Throw both into a portfolio, and it's a mark of an incompetent advisor or DIY investor.

More information here:

The Nuts and Bolts of Investing

150 Portfolios Better Than Yours

A Quick Way to Do an Analysis

Need a quick way to analyze your portfolio to see if you're falsely diversified? Consider the Morningstar Instant X-Ray tool. It used to be free at Morningstar, and then for a few years, you had to go to TD Ameritrade to use it. Now, it's only available to premium Morningstar users ($249 a year, although there is a seven-day free trial available). There are other resources out there that have similar functionality, some of which are free.

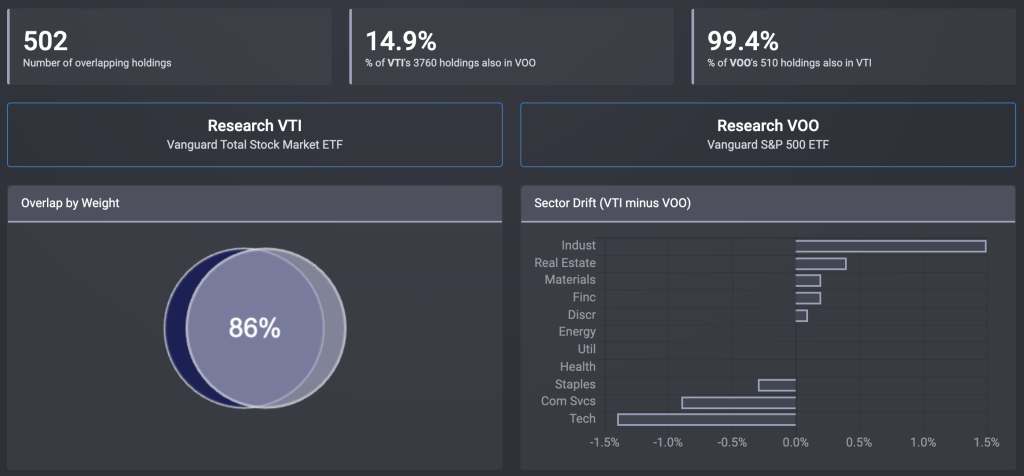

One I recently discovered is through the ETF Research Center. If I put in VTI (Vanguard Total Stock Market ETF) and VOO (Vanguard 500 Index ETF), I see the following:

You learn from this (as expected) that VTI owns everything VOO owns and more, although VOO only owns 15% of the securities that VTI owns. More importantly, you learn that 86% of the dollars in both funds are invested in exactly the same securities. Basically, owning both of these doesn't do you any good. Having both is “false diversification.” You can see this if you look at the stock by stock analysis:

See what I mean? Pretty similar holdings of those big “Mag 7” tech stocks.

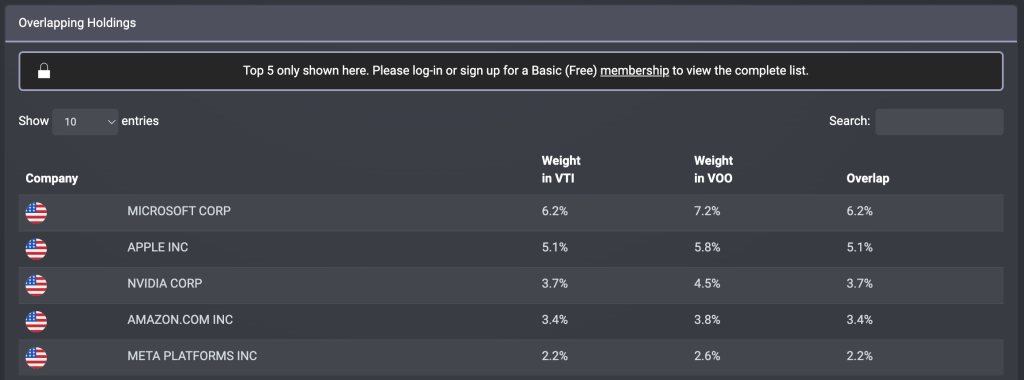

Let me show you what diversification actually looks like. Let's compare the Total Stock Market Index Fund to something like AVUV, a small cap value ETF from Avantis that we also use.

Sure, there are 705 overlapping holdings, but when you look at the dollars invested, only 2% overlap. That's way different from 86%.

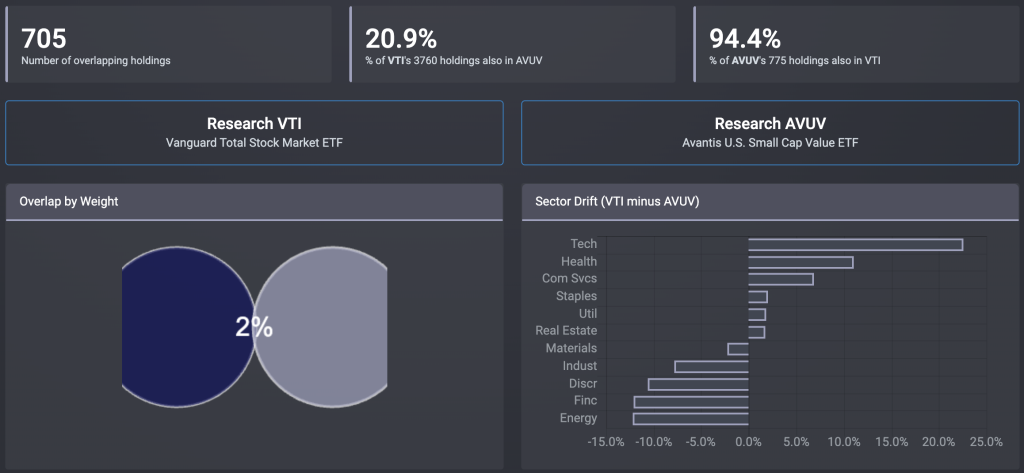

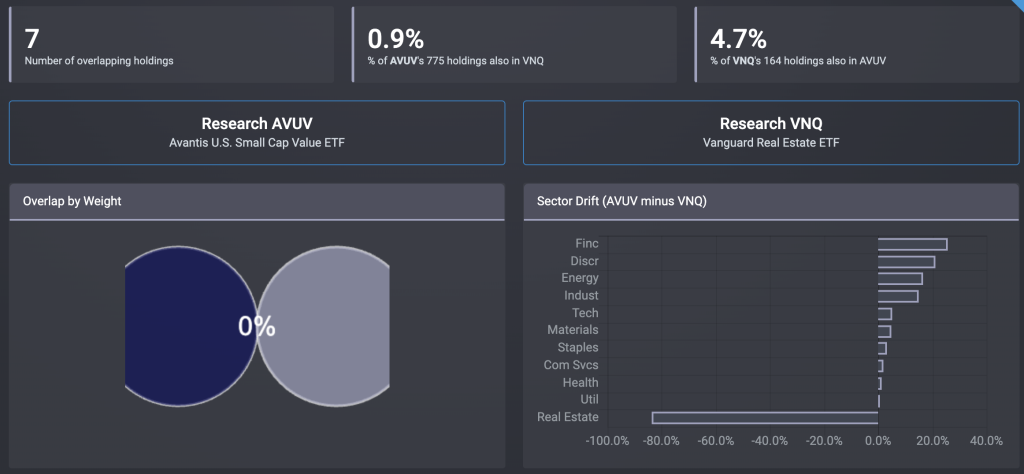

Imagine you're wondering whether there is any value to adding a third fund to your portfolio, such as one that invests in REITs like VNQ. What is the overlap between VTI and VNQ and between AVUV and VNQ?

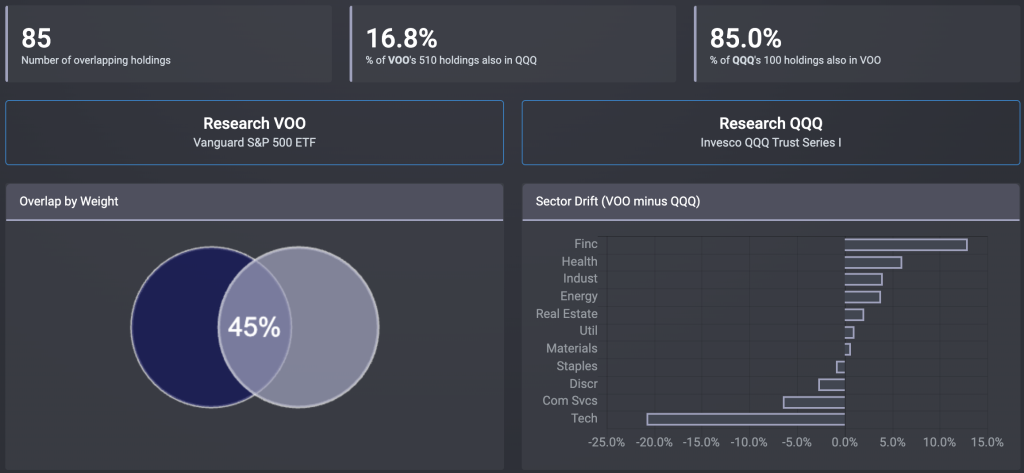

Real diversification or false diversification? I'd say real. But what if you wanted to add QQQ (an index fund that invests in stocks traded on the NASDAQ exchange) to an S&P 500 (VOO) portfolio? What would that look like?

There's an awful lot of overlap there.

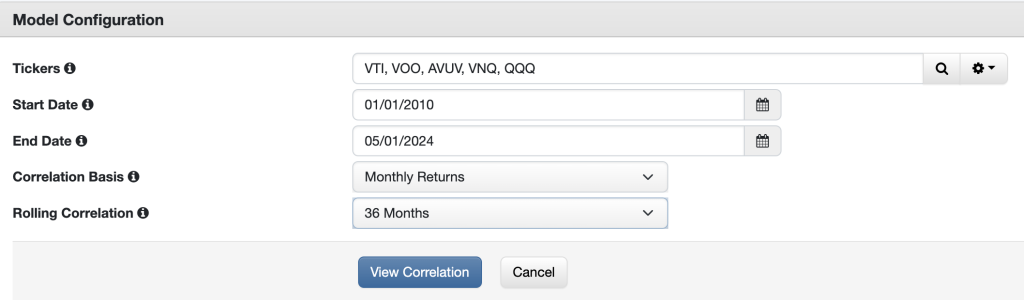

Another thing you can look at is the correlation between mutual funds. Correlation varies by time period and length of time period, but it can be useful to look at. Portfolio Visualizer has a great tool for this. Let's put all the funds we've mentioned so far into it and see what it says. If you put this in:

You get this output:

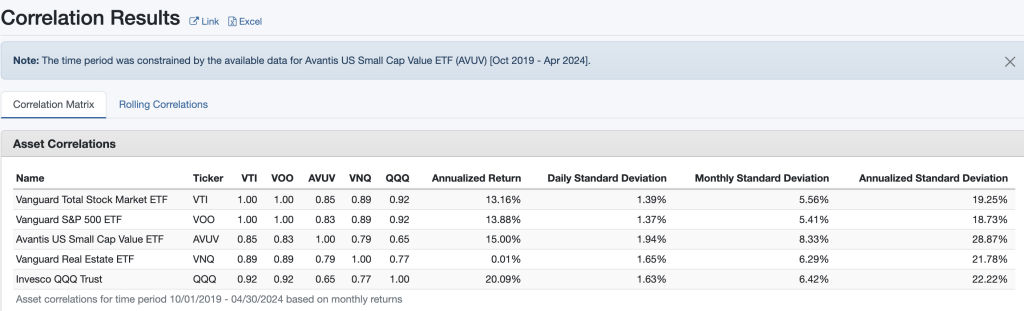

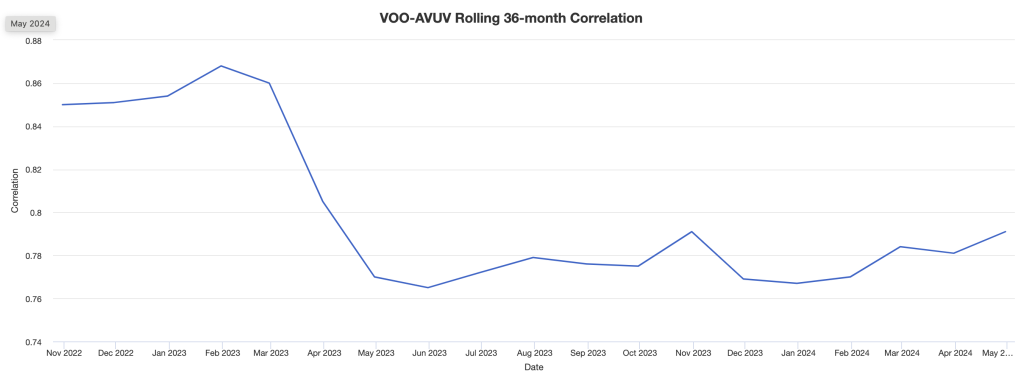

As you can see, the performance of VTI and VOO is nearly identical with a correlation of 1.00. However, it is interesting to see that the correlations with these other US stock ETFs are pretty darn high too, ranging from 0.85-0.92. Of course, correlation varies over time, as you can see if you click over to the rolling correlations tab.

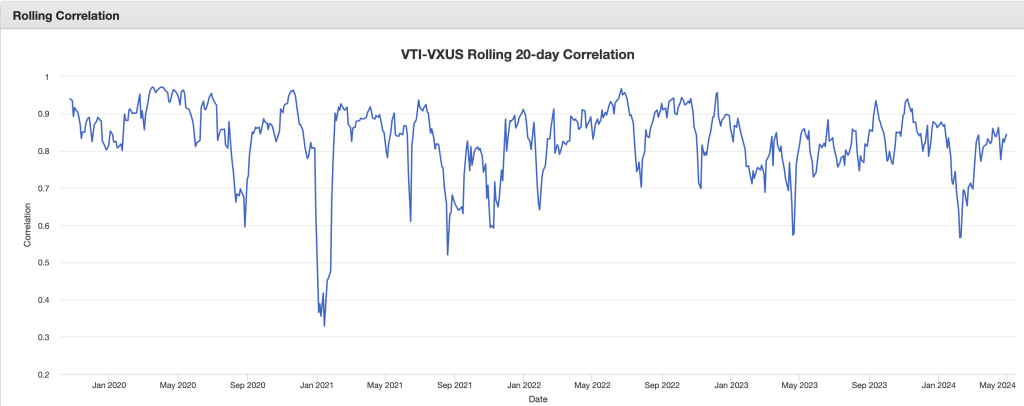

Thirty-six-month correlations as measured over about a year and a half varied from 0.87 to 0.77 between these two funds. It gets even more interesting if you shorten the time periods. Let's look at the daily correlation over 20-day rolling periods for VTI (US stocks) and VXUS (international stocks):

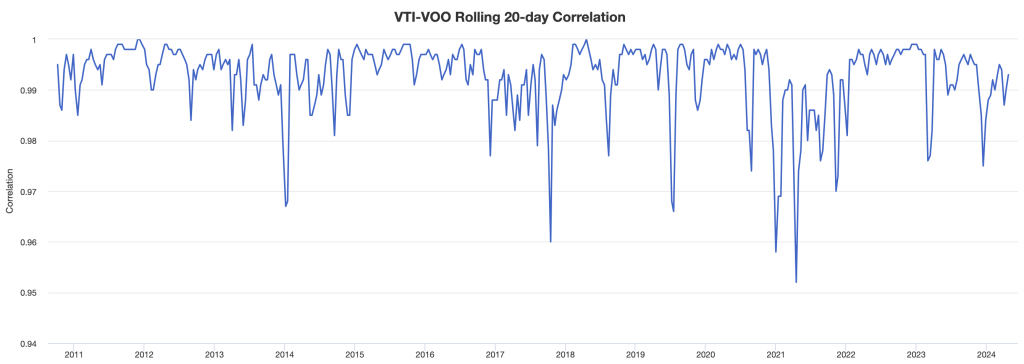

It's often highly correlated, but periodically, the correlation drops dramatically (as low as 0.35) for a few days, providing real diversification. You don't see that with VTI and VOO.

Yes, the graph still looks spikey, but if you look at the scale on the Y-axis, you see that the spikes are only going to 0.95. There's no diversification there.

Diversification is good, but additional cost and complexity without benefit are obviously bad. That's false diversification. Learn to recognize it.

What do you think? What's the worst example of a falsely diversified portfolio that you've seen?