By Eric Rosenberg, WCI Contributor

By Eric Rosenberg, WCI ContributorStagflation is an economic term for a combination of stagnant economic growth and inflation. To economists, stagnation is one of the worst-case scenarios.

A low level of inflation is normal and arguably desirable when an economy experiences sustained growth. During stagflation, governments and central banks have fewer available tools to fix the problem, as the methods used to combat inflation can slow down an economy and the methods used to improve economic growth can lead to inflation.

Here’s a closer look at what stagflation is, why it happens, and how you can prepare your personal finances to navigate stagflation with a focus on long-term success.

What Is Stagflation?

Stagflation is a combination of the words stagnation and inflation, kind of like when Brad Pitt and Angelina Jolie were called Brangelina, but for the economy.

Because they don’t cover stagflation in medical school, here’s a breakdown of what the terms mean:

Stagnation

Stagnation means an economy is in a prolonged period of very little or no growth, or even negative growth. In a healthy economy, you’ll see consistent growth every calendar quarter. We typically measure this with Gross Domestic Product (GDP). However, you can consider other economic indicators, such as unemployment rates and stock market trends, to get a fuller picture of economic activity.

Stagnation becomes a recession when an economy experiences two consecutive quarters of negative GDP growth. Most economic leaders aim for a 2%-3% target annualized growth rate. Consistent growth over 3%-4% increases inflation risk, while growth below 2% can lead to unemployment and other challenges.

Inflation

Inflation is an economic measure of how the value of a currency changes over time. Central banks like the United States Federal Reserve, European Central Bank, and Bank of England typically aim for a 2% annual inflation rate.

Very high inflation can be caused when interest rates are too low, governments are “printing money,” excessive government spending or stimulus are issued, or major events are causing supply chain or global trade disruptions. High interest rates mean households have less spending power and a likelihood of less investment and hiring by businesses.

More information here:

You Can’t Hedge Against Inflation in the Short Term

How to Build an Investment Portfolio for Long-Term Success

Is Stagflation Worse Than a Recession?

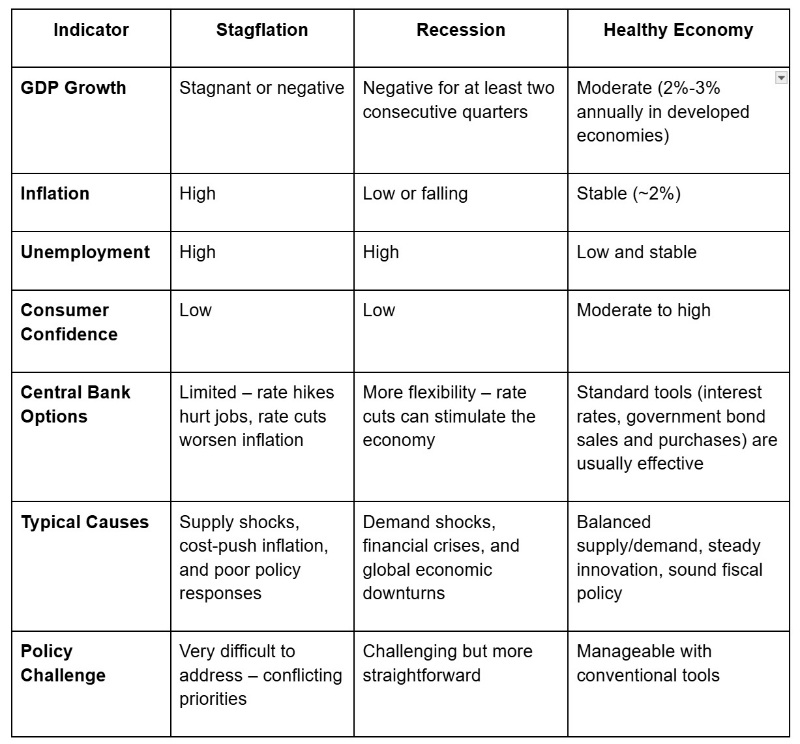

Stagflation is arguably worse than a recession. During a recession, government and Federal Reserve leaders have several options to boost the economy, including lowering interest rates and implementing new programs to stimulate spending.

With stagflation, those methods used to improve the economy can also cause more inflation, which has the potential to make the situation even worse.

History of Stagflation

The United States isn’t immune to stagflation. The most recent noteworthy event started in 1973 when an oil embargo caused a significant spike in oil prices, leading to higher transportation and production costs and inflation rates of over 13% by 1980.

A sharp increase in interest rates solved the inflation problem but caused a deep recession. Eventually, prices stabilized and the economy recovered, but it took about a decade to fully work through the fallout.

Here are a few other examples of extreme stagflation from around the world:

- United Kingdom Winter of Discontent (1978-1979): The UK experienced soaring inflation, stagnant growth, and labor strikes due to wage controls and energy shortages. Economic discontent led to the fall of the Labour government and ushered in Thatcher-era reforms.

- Japan’s Lost Decade (1990s): While not textbook stagflation, Japan endured stagnant growth and low inflation or deflation, along with rising unemployment and debt, following the collapse of its asset bubble.

- Brazil Hyperinflation Era (1980s-early 1990s): Brazil faced chronic inflation above 1,000%, combined with slow economic growth and rising poverty. A mix of poor fiscal policy and external debt shocks produced a prolonged stagflationary environment.

- Turkey Currency Crisis (2018): Sharp declines in the Turkish lira caused import prices and inflation to surge while GDP growth fell and unemployment climbed. A lack of central bank independence worsened investor confidence and led to additional economic instability.

- Argentina Economic Crisis (2018-2020): Argentina saw inflation over 50% annually, while the economy contracted and unemployment rose. Currency depreciation, external debt, and political uncertainty contributed to a textbook stagflation scenario.

Knowing what caused past episodes of stagflation can help governments and central bankers make the best decisions to avoid this painful mix of economic conditions.

What Causes Stagflation?

Stagflation is often tied to poor economic policies from elected officials and central banks. These scenarios sometimes precede stagflation:

- Supply shocks: Sudden disruptions (like oil embargoes or war) that raise production costs.

- Rising input costs: Increases in wages, energy, or raw materials that drive up prices. Tariffs also increase costs across the economy, which can trigger inflation and stagflation.

- Poor economic policy: Loose monetary policy combined with high government spending.

- Overregulation: Burdensome rules that stifle productivity and business growth.

- Currency devaluation: A weaker currency raises import prices, fueling inflation.

- Declining productivity: Slower output per worker leads to stagnation.

- Expectations of inflation: When people expect prices to keep rising, it can become self-fulfilling.

Of course, economies are complex, and other factors could trigger stagflation. A major natural disaster, pandemic, wars, and other large-scale events can lead to stagflation.

How to Know If We’re Experiencing Stagflation

Stagflation is rare, but it’s a serious economic problem that can affect a vast number of households. These two concurrent problems mean we’re experiencing stagflation:

- Slow or no economic growth

- High inflation

At the same time, we usually see rising unemployment. When costs are increasing alongside unemployment, families can wind up in a crisis where they can’t afford basic living expenses, and finding a new or better job can be extremely difficult.

More information here:

Staying the Course Despite the Trump Tariffs

How to Prepare for Stagflation

If you think stagflation is on the horizon, it’s wise to shore up your finances to ensure you can weather the storm. Remember, even doctors may see their income decline during stagflation.

Start by increasing your emergency fund to at least six months of expenses, which protects you if your income drops unexpectedly. The more you can save, the better. Patients are likely to tighten up their spending during stagflation, which can lead to fewer medical appointments and far fewer elective procedures.

Next, try to pay off any significant debts if you can. Focus on high-interest debts first, such as credit cards, and then move on to lower-interest debts, such as auto loans. Lowering your monthly minimum required payments can help you manage a tough economic period.

These are back-to-basics personal finance strategies. While high-income earners are in the best position to make it through stagflation with the least difficulty, it’s still wise to prepare your finances for higher costs and lower income just in case.

How to Invest During Stagflation

During stagflation, there’s a very good chance that stock prices will decline. Like any other stagnant economy or recession, company profits can fall, dragging down the entire market. But that doesn’t mean you shouldn’t invest.

As the old saying goes, time in the market beats timing the market. If you sell, you may be lucky enough to miss big market drops, but you will also miss out on the recovery. Volatile markets during economic uncertainty sometimes produce days with very high returns.

Investing is a long-term endeavor. If you stick with your investment strategy, you should see positive results as the economy recovers and transitions to more favorable conditions.

The Bottom Line on Stagflation

Stagflation might be an economist’s nightmare, but it doesn’t have to be yours. While you can’t control inflation, interest rates, or economic policy, you can control how you respond.

The best way to navigate stagflation is the same way you’d approach any financial challenge: by staying focused, flexible, and proactive. Build a strong cash foundation, reduce unnecessary risks, and maintain your long-term investment strategy. As a high-earning professional, you’re already ahead of the curve. A little planning now can help ensure you stay financially healthy, no matter what the economy throws your way.

The White Coat Investor is filled with posts like this, whether it’s increasing your financial literacy, showing you the best strategies on your path to financial success, or discussing the topic of mental wellness. To discover just how much The White Coat Investor can help you in your financial journey, start here to read some of our most popular posts and to see everything else WCI has to offer. And make sure to sign up for our newsletters to keep up with our newest content.