By Dr. Jim Dahle, WCI Founder

By Dr. Jim Dahle, WCI Founder2023 was generally a good year to be an investor. However, the delay in relative performance between public and private real estate definitely showed up as expected. While our private real estate investments smashed publicly traded REITs in 2022, I was not surprised to see the opposite in 2023 as the effects of the rapid rise in interest rates caught up to private real estate.

Note that any links to investments that you see in this article go to companies that sponsor The White Coat Investor. While we're proud to introduce you to these companies, you have to remember that hearing about them here is just an introduction, not a recommendation to invest. There is no guarantee that a company that advertises at WCI will always provide a good return or even return all of your capital. I'll tell you what I invest in, but if your only criteria to invest is to invest in the same stuff I do, that might mean you'll be losing money right alongside me.

Our Portfolio

As a reminder, our portfolio (asset allocation) is 60% stocks, 20% bonds, and 20% real estate, broken down as follows:

60% Stocks:

- 25% Total US Stock Market

- 15% Small Value Stocks

- 15% Total International Stock Market

- 5% International Small/Small Value Stocks (more on this in a moment)

20% Bonds:

- 10% Nominal bonds

- 10% Inflation-protected bonds

20% Real Estate

- 5% Publicly traded REITs

- 10% Private equity real estate

- 5% Private debt real estate

Note that this is just our retirement portfolio and does not include UTMAs, 529s, our kids' Roth IRAs, HSA, cash reserves, small businesses, etc. The asset allocation (but not overall retirement account performance) also ignores a small cash balance plan (which returned 16.35% in 2023 and will shortly be closed and rolled into my 401(k)).

2023 Portfolio Changes

As discussed in multiple posts that ran in 2023, we've changed our approach with both small value stocks and international small/small value stocks. Unfortunately, both of these asset classes are mostly in a taxable account in our portfolio, so changing in the most tax-efficient way will be a gradual process requiring several years.

On the US side, we're changing from:

- Vanguard Small Value Index Fund/ETF (VBR) and its tax-loss harvesting partner

- Vanguard S&P 600 Small Value Index Fund/ETF (VIOV)

to

- Avantis US Small Cap Value ETF (AVUV) and its tax-loss harvesting partner

- DFA Dimensional US Small Cap Value ETF (DFSV)

At the end of 2023, due to tax-loss harvesting changes and appreciated shares that have not yet been used for our charitable giving, this asset class sits as follows:

- VBR: 0%

- VIOV: 42%

- AVUV: 28%

- DFSV: 30%

On the international side, we feel like good options for international small value are finally available to us. While we're not thrilled to lose emerging market stocks from this asset class, we think it's worth that loss and the slightly higher fees to invest in international small value stocks instead of just international small stocks as we have been doing for many years. We're changing from:

- Vanguard FTSE All-World Ex-US Small-Cap Index ETF (VSS) and its tax-loss harvesting partner

- Schwab International Small Cap Equity ETF (SCHC)

to

- Avantis International Small Cap Value ETF (AVDV) and its tax-loss harvesting partner

- DFA Dimensional International Small Cap Value ETF (DISV)

This transition is ongoing, and the asset class sits as follows in our portfolio as of the end of 2023:

- VSS: 91%

- SCHC: 0%

- AVDV: 9%

- DISV: 0%

More information here:

5 Questions to Consider Before Changing Your Investment Portfolio

150 Portfolios Better Than Yours

2023 Portfolio Performance

As mentioned above, 2023 was a great year to be a stock investor and not a bad year as a bond investor either. Our actual returns (as verified by XIRR) in each of these asset classes for 2023 were as follows:

Stocks

- US stocks (VTI and its TLHing partner ITOT): 26.01%

- Older small value funds (VBR and VIOV): 4.77%

- New small value funds (AVUV and DFSV): 23.82%

- International stocks (VXUS and IXUS): 15.92%

- Older international small funds (VSS and SCHC): 15.31%

- New international small value funds (AVDV and DISV): 6.49%

Note that the numbers above may appear skewed to the casual observer, but this is because we were moving money from the older funds to the newer ones during the year. The above are my actual dollar-weighted returns. The time-weighted returns for these funds in 2023 were as follows:

- VBR: 16.01%

- AVUV: 22.83%

- VSS: 15.56%

- AVDV: 16.78%

Nominal Bonds

- TSP G Fund: 4.22%

- Intermediate Tax-Exempt Bonds (VWITX and VTEAX): 7.03%

Inflation-Indexed Bonds

- Schwab TIPS ETF (SCHP): 7.39%

- Individual TIPS: 3.71%

- I Bonds: 6.04%

Real Estate

- Publicly traded real estate (VNQ): 10.74%

- Private debt real estate overall: 9.10%

- Private equity real estate overall: 8.00%

Overall Retirement Portfolio Return: 14.82%

Debt Real Estate Individual Performance Report

We have three holdings in this space with a six-figure amount in each of them.

DLP Lending Fund

I own this one in my self-directed 401(k)—which is good, because, like all debt funds, it is terribly tax-inefficient. It had another great year with a return of 11.31%. Not quite the 11.74% it made last year but certainly nothing to complain about. It offers an 8% preferred return and targets a 9%-10% return. The most recent loan tape I saw shows over $1 billion of loans in the fund.

Learn more about the DLP Lending Fund!

Arixa Enhanced Income Fund

We switched in the first quarter from Arixa's non-leveraged fund to their leveraged one, increased our investment, and moved it into Katie's self-directed 401(k). Prior to selling, we made 2.64% in the first fund, and after buying, we made 6.49% in the new fund (7.24% if you look at it all together). Arixa's returns have never been the highest. It was a lot easier to get excited about making 6% or 8% when cash was only paying 1% than now when it is paying 5%+.

Unnamed Debt Fund

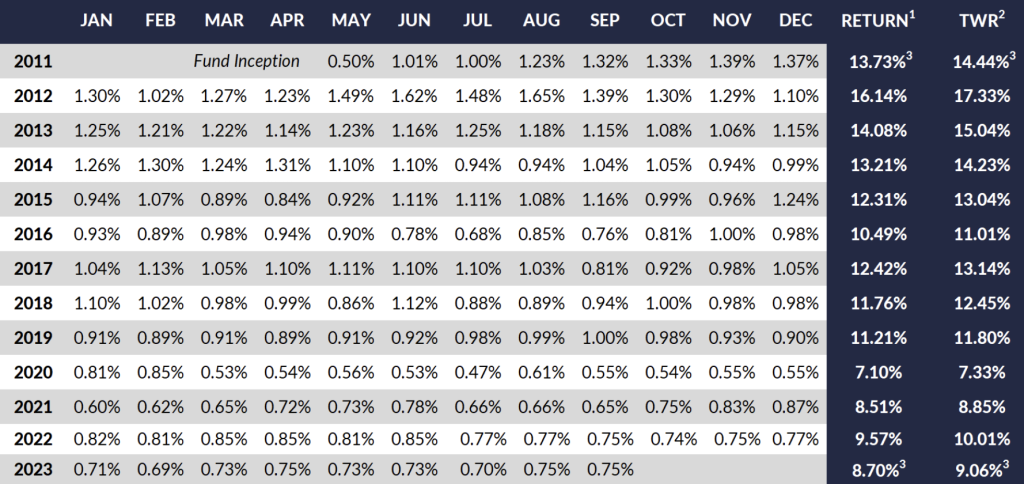

I'm going skiing with these guys in January, and I plan to check in again with them to see if they'd like to advertise with us. Last time I asked, they didn't even want me to tell you who they were. But they had another good year with returns of 9.18%. I like their monthly reports because they always give an extensive discussion of the non-performing loans (currently two out of the 73) and include a chart of monthly returns since inception that looks like this:

Unfortunately, this one is owned in a taxable account so the tax man takes a pretty good bite of that return.

Overall, I'm pleased with the returns of this particular asset class, just like I've always been. When equity deals go bad, the debt investors often make out just fine. Projected returns are, of course, lower, but if you're like me, you can reach all of your financial goals just fine with a return of 9.36%, which is what my long-term return in this asset class has been. My worst year was 6.7%, and my best year was 15.8%. Yes, it's riskier than investing in Treasuries, but I think the extra 4%-5% of return is more than adequate compensation for that risk.

More information here:

Comparing Private Real Estate Lending Funds

Equity Real Estate Individual Performance Report

Want more excitement in your investing life? The 2023 private equity real estate market was one place to get it. Interest rates have never risen as quickly as they did in 2022-2023, and it caught a lot of syndication operators and fund managers with their pants down. Warren Buffett likes to say that you don't know who's skinny-dipping until the tide goes out. Well, it turns out there were quite a few in this space, and I'm sure some more will be revealed in 2024.

While some of our investments did great and many did fine, there were a few that struggled and at least one disaster. In 2022, publicly traded REITs lost 26%. They got almost 11% of it back in 2023. Since private equity real estate is not marked to market nearly as often, there is often a delay in their performance compared to public real estate. Thus, our private real estate investments in 2022 spanked our public real estate investments +9% to -23%. In 2023, public real estate won, 11% to 8%. Still, it's hard to complain about 8% in a market like today.

A big focus we have had the last couple of years is to attempt to both simplify and diversify our equity real estate investments. We're simplifying by trying to reduce the number of K-1s we receive and the number of states in which we file. I really don't want to file in more than the 12 states we had to in 2022. So, we're trying to invest more in each investment rather than acquiring new investments, and I'm deliberating getting rid of the smaller investments whenever possible. We're trying to diversify by avoiding individual properties and by buying funds. Naturally, the round trip on many of these investments is 5-10 years, so it takes time to make these changes.

Let's go through our individual investments.

Practice Office Building

I was managing this syndication until this year. We have a five-figure amount invested, and it had a great year. I also got paid an additional share for being the manager for the last three or four years, so my total return on it was 30% in 2023 with a long-term return of 10.84%. As part of our portfolio simplification and diversification, we're in the process of being bought out of this one, but we're financing the buyout ourselves due to cash flow. I just don't need five-figure real estate investments in my portfolio, much less ones where I have to go to meetings.

Origin Fund III

We've been in this one for a long time, and it's been educational. The managers expect to wrap it up in 2024. It still owns a couple of properties, but it has sold the rest (well, aside from one where they mailed in the keys to the lender). In 2023, Origin internally marked down the value of the remaining two properties, accounting for a lousy 2023 return of -39.31%. However, the long-term XIRR so far is 11.21%. Not awesome and certainly below pro forma but hardly a disaster.

Learn more about Origin Investments!

Houston Apartment Building

You want a disaster? Here you go. This has been a disaster in my portfolio for many years. Fraud was involved, and although the platform that featured this investment formed a new partnership to try to recapitalize it, the company finally felt comfortable in 2023 projecting that the most probable outcome for the original equity investors like me is a total loss of capital. I had already written this one down to $0 in value on my spreadsheet, so my return for 2023 was 0%. After six years, this value-add project has finally finished the renovations, and it got the occupancy rates up to 90% or so. But it just took so long that it ended up eating all of the equity investors' capital in operating costs to do so. It'll likely get sold and finalized in 2024. I count my blessings that I only invested $20,000 here.

Fort Worth Apartment Building from 37th Parallel

Another one of my few remaining individual syndications, I invested six figures in this one. It continues to plod along below the original pro forma. Nothing bad has really happened; it just hasn't been awesome. Occupancy is not quite as good as we'd hoped, and it's not quite as easy to raise rents as we'd hoped. Expenses are a little higher than we'd hoped. It ran into some cash-flow problems in 2023 but continued to make distributions. I think the original pro forma called for something like 6% in distributions each year. On average, they've been less than 3%, and the latest are only 1.46%. Still, I think we're only about halfway through the 10-year hold period, so I think there's still plenty of time for this one to generate a solid return. It probably won't be what was projected, though. They don't mark it to market so I really don't know what our return is so far. I still use the original purchase price as its value, and I am only counting the income as the return.

Learn more about 37th Parallel!

Origin Income Plus Fund

A six-figure investment for us, this evergreen fund owns equity (and now a lot of preferred equity) and even a little debt. We've owned it for almost four years now. We made 4.4% on it in 2023, and our XIRR over the last four years is 8.4%. It's much less risky than the Origin Fund III and is much more focused on income. The income it pays is substantial (about 6%) and very regular. Plus, you get some appreciation on the equity investments (obviously not this year). I like that Origin actually tries to figure out what its properties are worth so you have a pretty good idea where you stand. I think we'll probably end up investing a little more into this fund in 2024.

Learn more about the Origin Income Plus Fund!

37th Parallel Fund I

On average, 37th Parallel does a lot better on their properties than the one I own in Fort Worth. This fund is a collection of a bunch of them. Still, like with most equity real estate, 2023 doesn't seem to have been a great year. It's not in trouble or anything but the income is definitely lower than the year before as expenses are up more than revenue. We've been in this one with a six-figure investment for four years (I think it runs 8-10), and the average income has only been 2.75% a year—definitely less than the original pro forma. In 2023, it was only 1.21%. Still, compared to the disasters in my portfolio, I'm perfectly happy with this one, and I'll reserve judgment on overall performance until it's gone round trip. I didn't buy it because I needed the income; I just wanted solid long-term performance. This fund is not evergreen, but 37th Parallel is currently raising money for Fund II. The company has never lost investor capital over the course of a deal so I don't see why it'd start now.

Learn more about the 37th Parallel Fund II!

Alpha Investing Fund I

This is another non-evergreen fund from a company that used to advertise here. It's been good about communication so you know what's going on, but it's clear that there have been some challenges in 2023 with several of its properties and it's reduced some return of capital and income payments to ensure it has the cash flow to get through. This is a six-figure investment for us, and it still has at least a couple more years to run. My XIRR calculation shows a return of 6.14% (4.72% in 2023), but the investments aren't marked to market regularly.

MLG Fund IV

We're now about three years into this six-figure investment with blog sponsor MLG. While I don't want to say MLG is immune to what's been going on in the markets, I certainly can't complain about the returns. In 2023, it returned 42.59% and 18.89% per year since we started investing. This is one of the larger investments in our portfolio and is certainly a bright star so far. One of the things investors love about MLG is its long, long track record and broad diversification.

This fund owns about 10,000 doors across about 40 investments, mostly multi-family. It's got some floating rate debt in the portfolio, but most of it has been protected so far by previously purchased rate caps. Despite having the same challenges as other multi-family fund managers and syndicators, MLG seems to be weathering the storm a lot better so far. I certainly don't expect 2024 to look like 2023, though. MLG also has a nice feature in that it offers two versions of its funds—one with a K-1 passing through depreciation that will eventually require multi-state returns and the other with a 1099 for those who wish to avoid that hassle or are investing within retirement accounts. The funds aren't evergreen, though, so they're currently raising money for Fund VI.

Learn more about MLG Fund VI!

Unnamed Fund

This equity fund, a six-figure investment for us and managed by the same folks as the unnamed debt fund above, never did end up calling all of its capital. It just didn't find deals good enough to include in the fund. After an investor-approved extension, it still has a few months to call some of it, but I don't think it will. In fact, it's already returned a fair amount of capital.

But it's been marking down the value of the properties it owns as it goes, and 2023 wasn't exactly a banner year for multi-family investments. Our return was -4.52% in 2023 with a multi-year XIRR return of -2.26% per year over the last three years. My only real problem here is that I never got as much invested as I had hoped, but I'd rather see that than have a fund manager buying lousy properties just because they have (my) money in their pocket. The thing I like best about this fund is that I have had a chance to see how the managers would handle the catastrophic event of its debt fund becoming an equity fund in a major real estate downturn, and I like what I see. This fund still has many years to run.

DLP Housing Fund

Another major investment in our real estate portfolio, it's hard not to like DLP. This year's return was “only” 12.57%. It definitely prefers staying positive, but you wouldn't even know there were headwinds this year in the multi-family space if all you were looking at was the DLP funds. Our XIRR over the 2.5 years we've been in this fund is 13.83%. Not bad given its target of 10%-12% returns.

Learn more about the DLP Housing Fund!

Single-Family Home REIT

This is the disaster of the year when it comes to my real estate portfolio and that of many other white coat investors. Overleveraged, floating rate debt, a call option offered (and used) by a preferred equity provider, and cash flow challenges from trying to grow too fast all added up to badness. The fund stopped taking new investments at the beginning of the year, and by the end of the first quarter, everyone knew trouble was brewing. It was hard to project how bad it was going to be, but by the end of the year, it became clear that equity investors like me were probably going to lose 75%-100% of their investment.

While we appreciate the transparency, we all wish the managers had just not taken as much risk as they did. I like the idea of a diversified investment in single-family homes, but it turns out this wasn't the one to choose. Thankfully, I only invested the minimum $25,000 in this one. Investments like this one really teach the importance of diversification—not only between properties but between managers.

Wellings Income Fund

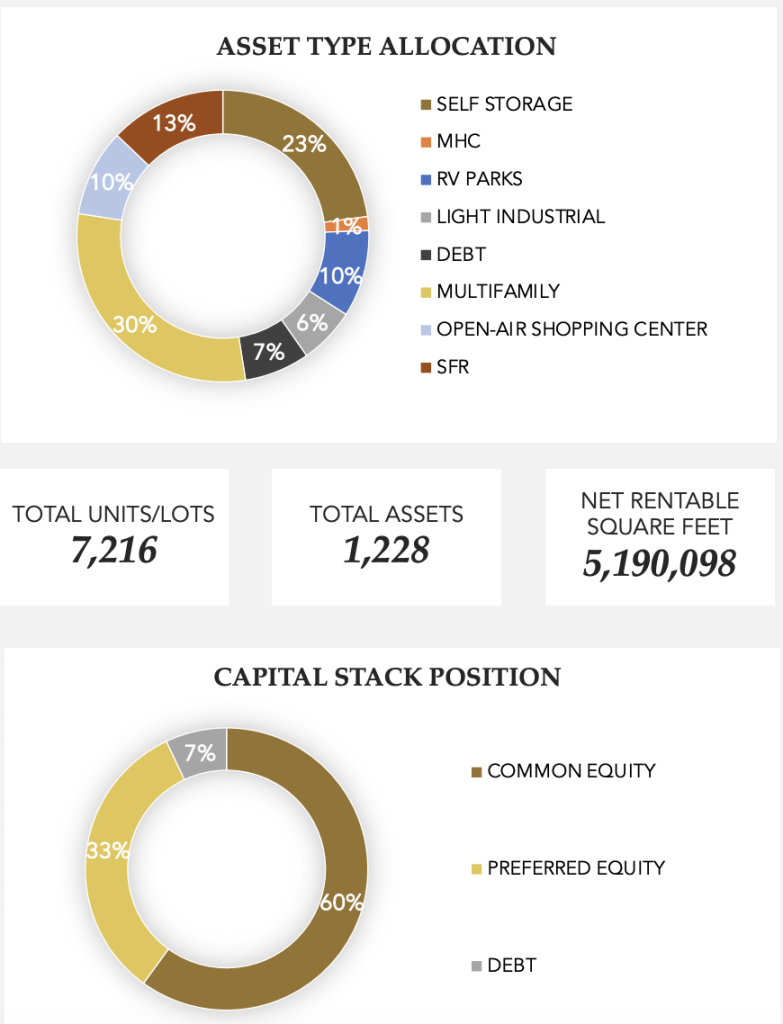

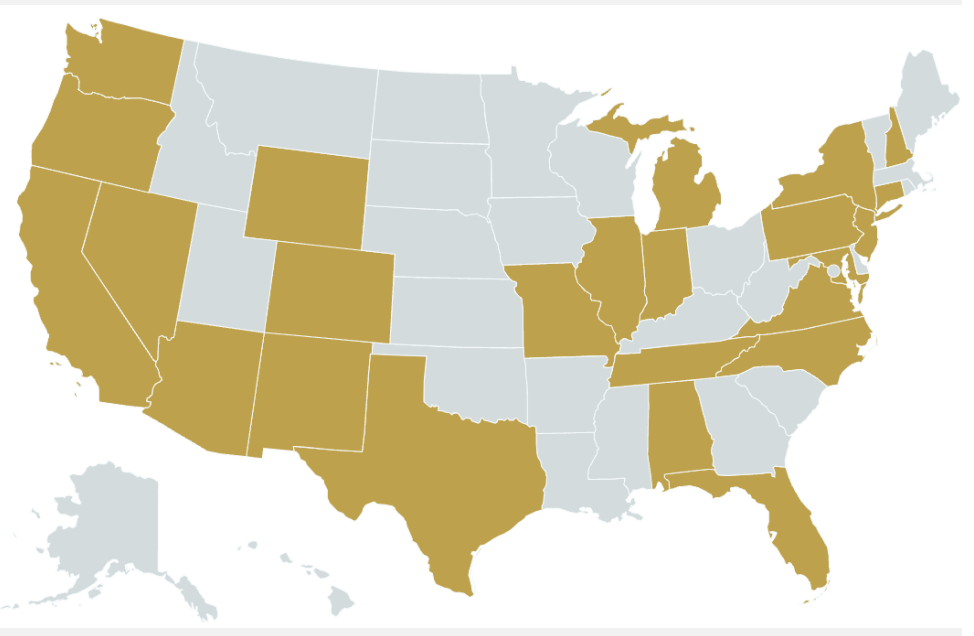

This investment is a little bit unique. A lot of white coat investors really don't feel comfortable doing due diligence on properties and managers. That's where Wellings comes in. While it costs you an extra layer of fees (Wellings is technically a Registered Investment Advisor; it doesn't operate any of the properties in the fund), the due diligence done seems to be about as good as it gets. After watching this investment for a year and a half, Katie and I recently quadrupled the amount we have invested here. We figure if we are going to get a multi-state K-1, we might as well make more off the investment than the tax returns are costing us. Due diligence and diversification are the principles at play with this income-focused fund. Check out this diversification:

That's 1,200 properties in eight asset classes from 10 different operators in 24 states. Wellings is definitely trying to be a one-stop shop for real estate. I'd still diversify between managers, but you're getting a lot of diversification here for an entry price of just $50,000. Although it's still raising money for this fund, the income payout increased in December. For most of 2023, it was 4%, and it was just increased to 5%. The properties are not marked to market in this 10-year hold fund, so the income is the only return I can report.

Learn more about the Wellings Income Fund!

Reliant Fund IV

This was our only new equity real estate investment of 2023. It is a major holding for us, and, along with the additional investment in the Wellings fund, it will help us diversify our mostly multi-family portfolio. This one invests solely in self-storage units: nine properties in four states so far. It started making distributions toward the end of 2023, but the distributions only added up to 1.33% of the investment. That should grow over time. We may be bringing them on as a sponsor eventually, so you'll likely get to hear more about them.

It's always so hard to report an overall return for private equity real estate investments because so many of them are not regularly marked to market. That has the effect of hiding the volatility and risk that is actually there, although much of that volatility is dampened by the multi-year nature of these investments. It also has the effect of hiding the returns you are actually getting. While my calculated return for 2023 was 7.89% and my long-term XIRR return is only 8.33%, I expect the actual returns achieved over the long run to be double digits, perhaps 10%-15%.

2023 was a good year for most investors, including us. Our retirement portfolio is 32% larger than it was a year ago. Some of that is new contributions since we're still earning, investing, and accumulating. But a lot of it was also our money doing its share of the heavy lifting. “Just Keep Buying” is good advice indeed.

If you are interested in private real estate investing opportunities, start your due diligence with those who support The White Coat Investor site:

What do you think? How did your investments do in 2023? What were the highlights and disappointments? Most importantly, what did you learn?