By Dr. Jim Dahle, WCI Founder

By Dr. Jim Dahle, WCI FounderI tell new attending physicians (and their equivalents in other professions) to live like a resident for 2-5 years after they finish their training. The meaning of those four words is that if you can carve out a massive difference between your newfound high income and your lifestyle, you can build wealth rapidly. You can max out retirement accounts, pay off student loans, save up a down payment on a dream house, build an emergency fund, upgrade that beater, and pay off your consumer debt all at the same time.

Within 2-5 years, your net worth may swing from negative $200,000 to positive $500,000. At that point, you can mostly grow into your income (still saving 20% of gross for retirement) and have a financially awesome life. The easiest time to “live like a resident” is right after you have HAD to live like a resident. You're already used to living on $50,000-$60,000 (the average American household income). It's really not that hard to do it for a little while longer.

However, the truth is that almost no white coat investors live exactly like a resident. Most inflate their lifestyle a little. A little lifestyle creep is probably OK. Heck, give yourself a 50% raise. What you're trying to avoid, however, is a lifestyle explosion. If your spending quadruples when you leave residency, you blew a golden wealth-building opportunity. And it's really hard to go back. I've met a few who have done it, but they're pretty rare.

What Does a Lifestyle Explosion Look Like?

Some of you have probably wondered over the years whether Katie and I COULD spend more money or WOULD spend more money if we had it. I confess that, at times, I had my doubts, too. She's naturally frugal, and I'm downright cheap. Over the last few years, we have pushed each other to deliberately spend on everything that we thought could possibly make us any happier. Our “budget process” over the years has gone from a very strict budget (20 years ago, we might have only had $20 to spend on ourselves in a given month) to basically just cash flow tracking.

We know what we spend, but we do not put any sort of limits on that spending. If we spend more in a given month, we just save/invest/give less that month. As you might expect, that sort of mindset has led to a relative lifestyle explosion that I thought people might find interesting to see. [AUTHOR'S NOTE: If not, forgive the personal nature of this post and skip over to the next blog post on the site. This one is not for you. As with everything at WCI, take what you find useful and leave the rest.]

One result of this increased spending is that I understand a whole lot better how hard it is for you spenders to spend less. It really is not all that difficult to spend hundreds of thousands of dollars in a year. Housing-wise, we live in a moderately expensive part of the country, but property taxes are still pretty low. We don't have any payments. No car payments. No mortgage payments. No student loan payments. We don't have daycare or private school costs. Our health insurance costs are paid for by WCI (20% comes out of our paychecks, I suppose, but we didn't count that). And yet we now spend so much—it's certainly the majority of a typical full-time emergency physician income.

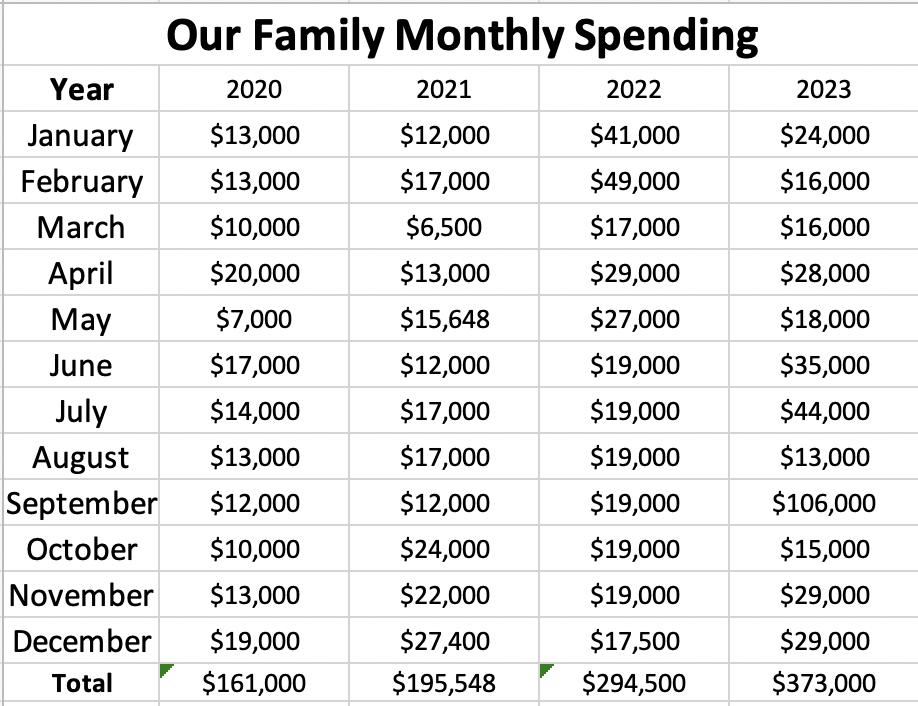

Now, without further ado, here is the evidence of our lifestyle explosion in the last few years.

One of our goals was to learn how to spend more money. Mission accomplished! And it's not quite as bad as it looks. Some of this is just inflation. Using CPI-U, $161,000 in January 2020 is the equivalent of $192,000 by the end of 2023. There is also a bit of an anomaly in September 2023. That truck I ordered way back in December 2021 finally arrived. A Super Duty truck can cost over $90,000 now. If you subtract that out, 2023 is actually a step down from 2022. But look at what is not in there that we actually did pay for:

- Income and payroll taxes

- Charitable contributions (aside from small amounts, < $20,000 per year)

- Health insurance

- Savings/Investing

- That big home renovation in 2019-2020

Plus, the expenses that many doctors have that we don't:

- Mortgage

- Student loan payments

- Car payments

- Private school

- Childcare costs

- College costs (Yeah, we had one kid in college during this time period, but the little bit we contributed came out of her 529.)

This is just spending—on things and experiences and insurance and utilities and subscriptions and groceries and eating out and kids' activities and traveling and gasoline and car repairs and boat expenses and all that stuff. For many people, the vast majority of their income goes toward things that are NOT included in these numbers.

If we had lived anything like this right out of residency, we would have never built any wealth at all. I'd be asking if I could have your shifts (and a loan) because we'd be in debt up to our eyeballs. There might be a time to YOLO and live it up, but that time is almost surely not in the first five years out of residency. We were living in a little townhome back then with a drug dealer two doors down, driving a $1,850 1997 Mazda 6 with 4/40 air conditioning (me, not the drug dealer. His car was much nicer.) Our household income that first year out of training was $120,000 ($186,000 in today's dollars). We couldn't live like this on that even if we had wanted.

How can we live like this now? Well, we earn a lot more. While this spending level is no longer covered by my 0.4 FTE all-day-shifts clinical income, it is more than covered by the combination of my clinical income and the investment income from our taxable investing account. Thus, like it always has been, the profit of WCI still goes entirely toward taxes, charitable giving, and savings. OK, and one really big home renovation.

Lessons to Be Learned

There are a few lessons that I've learned and that maybe you can learn, too, from our lifestyle explosion.

#1 It's Not That Hard to Spend More Money

If you're a cheapskate like me and worried that you'll always be a cheap/frugal/thrifty person who cannot enjoy his or her wealth, let me reassure you that, with just a little bit of effort, you can spend more money. With only a very reasonable amount of care, you can probably spend it mostly on things that actually make you at least a little bit happier. So, if that's your problem, rededicate yourself to it. I know you can do it.

If you're really struggling, put some additional incentives in place. Make a spending budget. You HAVE to spend it all or you lose the money. Maybe it has to go to your favorite charity or your least favorite political party if you don't spend it.

More information here:

The Lifestyle of Doctors Worth About $50 Million and How They Made So Much Money

How Much This FI Physician Family Actually Spends in a Year

#2 If You Don't Budget, You Will Spend More

Take away the constraints on your spending, and you will spend more money. If reaching your financial goals involves spending less money, put some constraints on your spending. What happens naturally is exactly what happens to most doctors when they leave residency. They rapidly grow into their entire income.

#3 Variable Spending Is Just That

In our (almost) monthly money meetings, I showed that chart above to Katie to get her thoughts on it. Her response? We could spend A LOT less if the situation called for it. That's true. Most of that is variable spending. We've eliminated just about every fixed expense from our lives that we can. We're done saving for retirement and college (additional savings is all about legacy now). All of our vehicles and toys are paid off. We don't have any debts. We didn't buy a second home. The biggest chunk of our spending these days is on travel. We've got “status” on Delta Airlines for a reason. Thank goodness we don't live at a Spirit Airlines hub.

But look at the month-to-month variation in our spending. Throw out the truck month, and it's $7,000-$44,000. Even if you only look at 2023 and throw out the two highest and two lowest months, it still ranges from $16,000-$35,000. Your spending plan needs to account for that kind of volatility. That means you cannot let those fixed expenses become too large of a percentage of your income.

#4 It's OK to Spend

Money is not the end. It's not the goal. It's a tool. It's there to be used. So use it. Sure, use some of it to do good for other people. (We still give away far more than we spend.) But use some of it to do good for you. If that's hard for you, have your spouse or employee sign the check at the restaurant or pay for the vacation. I actually have more fun when I don't know what something costs.

More information here:

#5 Inflation Is Real

I can't believe what we spend on food. In college, my grocery bill was $100 a month. Now we spend $100 just on breakfast stuff. And it doesn't even last the whole month. You used to get a fast food combo meal for $5 a person. Now, a milkshake costs more than that, and I'm swiping my card for $80 when all five of us are there. And forget about a real restaurant. A steak dinner starts at $30, and it can easily be over $100 a plate. If your financial plan does not include inflation, it's going to fail. You (and your financial plan) must assume that your nominal spending will increase over time, even without changing your lifestyle.

More information here:

WCI Travel Club: Meaningful Trips to Half Dome, Thailand, and Alaska

WCI Travel Club: Magical Trips to Peru, Portugal, and Disney World

#6 The Good Life Is Out There

In the original White Coat Investor book, published in 2014 just after we became millionaires, I defined The Good Life as

“. . . a life free from financial worries, a career where you make a real contribution to society, a few luxuries along the way, the ability to help others financially throughout your life, and a comfortable retirement at a time of your choosing.”

I think we've achieved that, and you can, too.

What do you think? Have you ever had a lifestyle explosion? What did it look like? Did you ever think you'd spend what you spend now? Why or why not? What are you doing now to avoid a lifestyle explosion?