By TJ Porter, WCI Contributor

By TJ Porter, WCI ContributorPreparing and filing your tax return each year can be a major hassle, but it’s one of those things you have to do. Each April, you have to decide whether you want to handle your own tax return, pay someone to do it for you, or figure out the best tax software for you to use.

If you’re old-school and familiar with the tax code, you could always go through the process of filling out paper tax forms with a pen, but for most people, that quickly becomes much too complicated. Tax software makes the process much easier and intuitive. These programs guide you through preparing your taxes by asking you the essential questions that will give the software all the information it needs to prepare the forms. Each program works slightly differently, making each ideal for different types of filers.

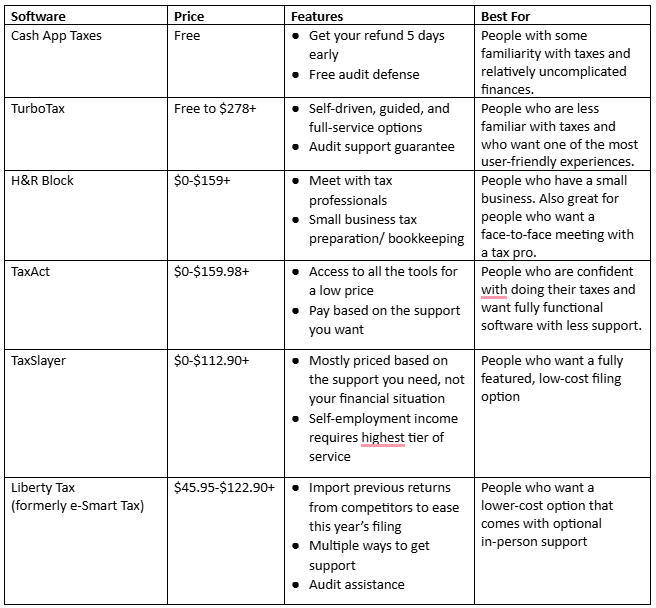

Here's a chart that can help break it down for you and help you determine which tax software would be best for you to use in 2025.

Best Tax Software for Simple Returns: Cash App Taxes

Formerly Credit Karma Tax, Cash App Taxes is relatively unique in that it is 100% free to use, no matter your financial situation or what your filing needs are. Where other programs charge for things like filing as a small business or filling out certain forms, Cash App Taxes is free for anyone.

The drawback of this free service is that the software doesn’t provide as much of a helping hand as other programs. It would help if you have some familiarity with doing your taxes before you try to use Cash App Taxes.

The service also doesn’t support more complex situations, including multiple state filings, part-year state filings, non-resident state filings, foreign earned income, Married Filing Separately in community-property states, and sick leave for certain self-employed individuals.

More information here:

The 1 (Weird) Tax Trick the IRS Hates

Tax Avoidance vs. Tax Evasion — What’s the Difference?

Best Tax Software for Easy Filing: TurboTax

TurboTax is one of the best-known tax preparation programs out there. It offers multiple versions of its service, including a self-driven program, an option to get guidance from tax experts, or the option to have someone handle all of the tax preparation for you.

The program has one of the best user experiences in the world of tax preparation. The software is easy to use and asks simple, clear questions to get the information it needs. However, you pay for this convenience. TurboTax charges for anything beyond the most basic service and adds additional fees if you want to file certain forms and for each state in which you file.

Also be aware that TurboTax has been criticized for its lobbying efforts to, in the words of ProPublica, wage “a sophisticated, sometimes covert war to prevent the government” from making “tax filing simple and free for most citizens.”

Best Tax Software for Small Business: H&R Block

H&R Block is another big name in the tax preparation industry. Taxpayers can choose to prepare their taxes on their own online or work with a tax professional virtually or in person. This makes it a great choice for people who want to sit down with someone and talk over their taxes.

The company also offers useful small business services that may appeal to physicians with their own practice. H&R Block can help with things like bookkeeping and payroll, which will make it even easier to deal with filing your taxes at the end of the year.

Of course, small business services and in-person services come at an additional cost, so be ready to pay the price for the assistance.

Best Tax Software for Low Cost: TaxSlayer

TaxSlayer takes a different pricing route than many of its competitors. Where other tax websites base their pricing on the complexity of your financial situation and the forms you need to file, TaxSlayer prices are based on the level of support that you desire. The one exception is small business owners and the self-employed, who must pay additional fees.

If you’re confident when it comes to doing your taxes, you can save some money by using TaxSlayer.

More information here:

Best Tax Software for Self-Employed: Liberty Tax (formerly eSmart Tax)

Liberty Tax offers another low-cost filing option. One thing that makes the tax software appealing is that it makes it easy to import information from other tax preparers. Importing last year’s taxes can make it easier to do this year’s taxes, really speeding up the process.

The service offers one of the lowest prices for filing the forms required by the self-employed, and you can always reach out to one of Liberty Tax’s advisors if you need a hand with filling out the forms. It also offers multiple avenues for support, including email, live chat, social media, and the option to meet with a professional at more than 2,500 offices across the US.

Best Tax Software for People in States with No Income Tax: FreeTaxUSA

FreeTaxUSA has a simple premise. It lets you file your federal income tax return for free. Whether you have a basic situation or a complicated one involving real estate, investments, and self-employment, there’s no charge for filing federal returns.

The company does charge $14.99 for state income tax returns, but if you live somewhere with no state income tax, then you can truly file for free. Beyond charging for state tax returns, the site makes money by charging for other services—including unlimited amended returns, audit assistance, priority support, and printed or bound copies of your taxes.

FreeTaxUSA makes it easy to import data from your previous tax returns, even if you used different software. That makes it easier to try it out even if you’ve relied on other tax preparation software in the past.

More information here:

Unhappy with Your Tax Audit Results? How to Appeal and Litigate an IRS Tax Audit

3 Big Tax Deductions for Doctors

Should You Be Doing Your Own Taxes?

Doing your own taxes can be appealing if you like to be hands-on with your finances, but the reality is that taxes for high earners, such as physicians, can get very complicated very quickly.

Whether it’s a good idea to handle your own tax return depends on two main factors: whether you believe there’s some value in doing your own taxes and whether your situation is simple enough that you can manage the prep yourself.

Some people find the process of doing their taxes to be valuable, giving them a chance to go through their finances and get a clear view of their entire financial situation. Other people feel like they have enough of a handle on things that this isn’t important.

Similarly, some people have a relatively simple return: income from one employer in a single state, with basic investments and maybe owning a home. Others—such as physicians who own their practice, work in many states, have investment properties, or own unusual investments or assets—are likely to benefit from hiring a pro.

If you need help with tax preparation or you’re looking for tips on the best tax strategies, hire a WCI-vetted professional to help you figure it out.

Which Tax Software Is Right for You?

Choosing the right tax software is all about figuring out the one that aligns with your financial situation and level of experience with taxes. If you’re entirely unfamiliar with preparing your own taxes or have a very complex situation, some programs will do the entire process for you, which can be a lifesaver. More experienced filers might prefer a more self-driven program that comes at a lower price.

In the end, choosing which tax software is best depends on your goals. If you just want to get your taxes done in the easiest way possible, paying a bit more for a streamlined experience is worth it. If you want to save some money and take the opportunity to review your entire financial situation, a more self-driven tax program will be a better fit.

The White Coat Investor is filled with posts like this, whether it’s increasing your financial literacy, showing you the best strategies on your path to financial success, or discussing the topic of mental wellness. To discover just how much The White Coat Investor can help you in your financial journey, start here to read some of our most popular posts and to see everything else WCI has to offer. And make sure to sign up for our newsletters to keep up with our newest content.