By Dr. Jim Dahle, WCI Founder

By Dr. Jim Dahle, WCI FounderAs the taxable-to-tax-protected ratio has grown for our investments, I pay more and more attention to tax-efficiency issues in my taxable account. So, when I received my 16-page “Tax Information Package” from Vanguard in 2023, I pored over the details. Actually, we get six of these—one for each UTMA, one for our joint brokerage account that we now just use for short-term cash needs (money market funds), and the big one for the trust taxable investing account.

That last one is the one we're talking about today since that's where the vast majority of our investments now sit. We've worked hard and saved a lot, and we've been fortunate, so it's a large account with large amounts of dividends coming out of it every year. To avoid the appearance of humble-bragging, I'll use percentages today rather than the actual dollar amounts and black out the dollar amounts on any forms I share. Also keep in mind that these documents are from 2023 and refer to investments in 2022.

Vanguard Tax Information Package

The first page of this package is where most of the interesting stuff lies. It looks like this.

We invest very tax-efficiently, and the statement reflects that. The upper left section reflects information about dividends. The lower section talks about capital gains (or in our case, large capital losses in 2022 from aggressive tax-loss harvesting). The upper right section (and all of page 2) has nothing but zeros on it. Our selected investments only distributed $4.92 in unwanted capital gains (from the Vanguard Municipal MMF of all places). However, despite investing as tax-efficiently as I can, I am frustrated every year to see a significant percentage of my dividends being classed as non-qualified dividends that get taxed at ordinary income rates.

I decided to dive into that a bit to figure out why.

Dividends

Vanguard pays dividends instead of interest from all of its funds (this is why there is nothing on page 2 of my package). The stock funds pay dividends, the bond funds pay dividends, and the money market funds pay dividends. But these dividends are not all the same. The first division is between tax-exempt (line 12 above) and taxable (line 1 above) dividends. In our case, 10% of our dividends were tax-exempt, and 90% were taxable. The tax-exempt ones come from our main nominal bond holdings, Vanguard municipal bond funds held in this account, and interest from the Vanguard municipal MMF. These dividends are taxable at the state level but not the federal level.

The next division is between qualified and non-qualified dividends. In our case, 76% of our dividends are qualified, and 14% are non-qualified. I find that 14% incredibly frustrating, given that I haven't mistakenly turned any qualified dividends into non-qualified dividends in 2022 doing frenetic tax-loss harvesting and I haven't mistakenly held a fund for less than 61 days around an ex-div date.

Let's dive into the reason why so many of those dividends are not qualified.

More information here:

Why Getting a Dividend Should Not Be Exciting

How to Pay No Taxes on Capital Gains and Dividends

REIT Dividends

REIT dividends—or at least the taxable portion of them (some portion of its income is depreciation passed through to you in the form of “return of principal” distributions)—are also known as Section 199A dividends through at least 2025. They are non-qualified. In our case, that accounts for 3% of the dividends. While we do have to pay taxes on these dividends at our ordinary marginal tax rate (37% + 4.85% + 3.8% = 45.65%), we do get a deduction worth 20% of that amount, lowering the effective tax rate on them from 45.65% to 36.52%—it's still significantly more than our qualified dividend rate (20% + 4.85% + 3.8% = 28.65%).

Where do all these REIT dividends come from if our publicly traded REIT fund holding is only located in tax-protected accounts? It turns out that at Vanguard many other funds besides the Real Estate Index Fund (VGSLX/VNQ) hold REITs as a very small holding, but they make up a disproportionately large percentage of the distributions. At any rate, the REIT issue explains more than 20% of these non-qualified dividends we get from this account. What about the other 80%?

Dividends and Distributions

For that, I turn to pages 6-9 of the package, labeled “Detail for Dividends and Distributions.” Here is a list of every distribution made by the mutual funds I owned in this account during 2022. Each distribution is carefully labeled by its type. In this account, we received dividends from each of the following funds:

- Vanguard Municipal MMF (VMSXX): 0.2% of dividends (and that pesky $4.92 distributed capital gain)

- Vanguard Federal MMF (VMFXX): 0.6% of dividends

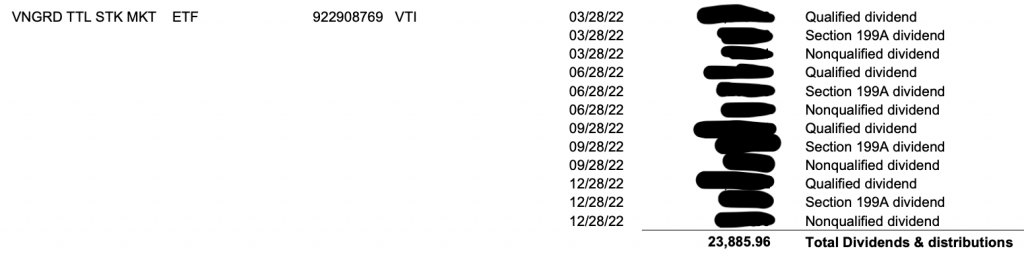

- Vanguard Total Stock Market Index ETF (VTI): 12.6% of dividends

- iShares Total Stock Market ETF (ITOT): 14.3% of dividends

- Vanguard Total International Stock Market ETF (VXUS): 8.4% of dividends

- iShares Total International Stock Market ETF (IXUS): 28.8% of dividends

- Vanguard Small Cap Value ETF (VBR): 8.3% of dividends

- Vanguard S&P 600 Small Value ETF (VIOV): 6.7% of dividends

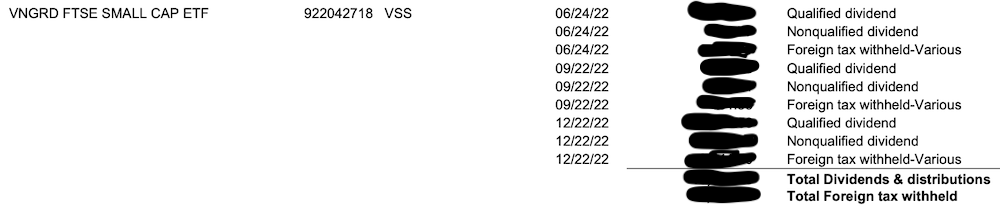

- Vanguard FTSE Small Cap International ETF (VSS): 9.9% of dividends

- Vanguard Intermediate Tax Exempt Fund (VWIUX): 7.7% of dividends

- Vanguard Municipal Tax Exempt Bond Index Fund (VTEAX): 2.3% of dividends

Why do some of these look like duplicate holdings? They're simply tax-loss harvesting partners. I'm fine holding either one long-term, and we flush out highly appreciated shares with charitable giving periodically. But as you tax-loss harvest over the years, you tend to own two holdings for each asset class in your taxable account.

Due to our asset allocation and asset location plan, most of this account is invested in Total Stock Market (VTI/ITOT) and Total International Stock Market (VXUS/IXUS), so that's where most (almost 2/3) of the dividends come from.

More information here:

Digging Further

I'm still trying to figure out where the non-qualified dividends came from. The details for the money market funds and bond funds are not particularly interesting. Aside from that $5 capital gains distribution (but who's bitter?), 100% of the Municipal MMF and the Municipal Bond Fund distributions are tax-exempt interest. The Federal MMF is 100% non-qualified dividends, as expected, but that still only accounts for 0.6% of that 14% in non-qualified dividends. If REIT dividends account for 3% and MMFs only account for 0.6%, we've still got 10.4% missing. If we compare the remaining funds, we can calculate the percentage of their distributions that are non-qualified. For example, let's start with VTI.

You can see that VTI pays a quarterly distribution with a big qualified dividend and a small non-qualified dividend. Interestingly, the 199A dividends are LARGER than the non-qualified dividends, which surprised me. But if you do the math, you see that what they are labeling “non-qualified dividend” is really the non-qualified dividends that are not 199A dividends. Note that that is NOT what it did on page 1. Line 1 (Total ordinary dividends) includes Line 5 (Section 199A dividends). At any rate, counting the lines labeled Section 199A dividends and non-qualified dividends, you can see that 6.2% of VTI distributions were not qualified dividends. Of that 6.2%, 4.5% was Section 199A dividends. If you do this exercise for the remaining funds, you'll see the following (and learn a few interesting tidbits of information):

- VTI: 6.2% (4.5% Section 199A)

- ITOT: 7.1% (2.2% Section 199A)

- VXUS: 26.3%

- IXUS: 10.3%

- VBR: 23.2% (13.1% Section 199A)

- VIOV: 34.5% (15.6% Section 199A)

- VSS: 36.7%

What do you learn from this exercise? I learned a few things.

#1 After-Tax Returns Can Be Very Different from Pre-Tax Returns

Vanguard has a lot of experience running index funds. It's very good at it. If you just look at the 2022 pre-tax returns and compare Vanguard index ETFs to iShares index ETFs, they look very similar.

- VTI: -19.51%

- ITOT: -19.47%

- VXUS: -16.09%

- IXUS: -16.45%

Slight advantage to iShares with the Total Stock Market (TSM) Index and a somewhat larger advantage for Vanguard with Total International Stock Market (TISM). But if you look at the tax-efficiency, you may see a different story. ITOT had a higher percentage of non-qualified dividends than VTI, and a MUCH lower percentage of those (less than half) qualified as 199A dividends.

However, it wasn't the same thing on the international side. In fact, the percentage of non-qualified dividends for VXUS was over twice as high as for IXUS.

[EDITOR'S NOTE: The numbers for 2023 were 41.1% and 26.7% respectively so the trend in favor of iShares persisted for at least a couple of years.]

#2 International Funds Don't Get 199A Dividends

Notice that none of the international funds paid any dividends that qualified for 199A treatment. Vanguard has a foreign REIT fund, and I presume TISM and VSS own some REITs. But apparently those REITS don't get 199A treatment.

#3 Total Market Funds Are Much More Tax-Efficient

Compare the TSM and TISM funds to the SV and IS funds. It's 3%-12% non-qualified dividends vs. 23%-36% non-qualified dividends. When you are forced to invest in taxable, put your total market funds in there first.

#4 REITS Account for Much of the Non-Qualified Dividends in Domestic Funds

A big chunk of the non-qualified dividends are 199A dividends from REITs. It's over half with VTI and VBR, almost half with VIOV, and about 30% with ITOT.

I still don't know why these dividends are not 100% qualified. There are two possible explanations I could come up with for why even a very tax-efficient VTI is still sending out 1.7% (and VSS sends out 36.7%) of its dividends as non-qualified, non-Section 199A dividends. The first is that the stocks themselves are paying non-qualified dividends for some reason. This is probably part of the explanation, particularly with the international funds. If the US does not have a tax treaty with the country in which you are investing, those dividends might not be qualified. Many foreign companies don't trade on US stock exchanges, or they are considered “passive” companies. Their dividends aren't qualified either. Dividends on REITs and Master Limited Partnerships (MLPs) are also not qualified. Neither are dividends paid on employee stock options nor special one-time dividends.

The second is that the funds are not holding shares for more than 60 days around ex-div dates. Technically, the shares have to be held for at least 60 days in the 121-day period around the ex-div date. Funds do have to buy and sell from time to time so they're probably never going to have 100% qualified dividends for this reason, but you wouldn't think that would cause 36.7% of dividends to be non-qualified in a fund with a turnover of only 17% per year.

I think the more significant explanation is the first, especially for international funds.

International or Domestic in Taxable First

A question related to this topic that often comes up is whether to move international stocks (such as TISM) or US stocks (such as TSM) into taxable first. There are several factors to consider that argue one way or the other.

#1 Qualified Dividends

The first is what we have been discussing, the percentage of the dividend that is qualified. As you can see, that doesn't argue clearly one way or the other. With the Vanguard ETFs, VXUS has a higher qualified-to-non-qualified ratio than VTI. On the other hand, ITOT had the higher ratio with the iShares ETFs in 2022.

#2 199A Treatment

The US stocks benefit from 199A treatment on some of those non-qualified dividends. That argues in favor of TSM first.

#3 Higher Yield

International stocks have a higher overall dividend yield. They are generally smaller and more valuey than US stocks and sell at a lower Price/Earnings (P/E) ratio. Dividends are forced taxation, so a stock that pays lower dividends is actually more tax-efficient. This argues for TSM to go into taxable first.

#4 Foreign Tax Credit

The final factor is one of the most important. When you own foreign stocks in a tax-protected account, you still pay foreign taxes on their dividends indirectly via the fund. But you don't get any credit on your taxes for it. This reduces your after-tax return. When you own foreign stocks (such as TISM) in a taxable account, you get a credit on your taxes for a lot of the taxes the fund paid on your behalf. This is known as the foreign tax credit and is claimed on IRS Form 1040, Schedule 3, Line 1 and sometimes on IRS Form 1116. You can also see your foreign tax credit on your Tax Information Package.

As you can see, this is reported in detail right along with the dividends. In the case of my three international funds, the foreign tax credit was equal to the following percentage of the dividend:

- VXUS: 7.9%

- IXUS: 15.6%

- VSS: 15.5%

Again, I can't explain why VXUS and IXUS are so different in this regard. However, I think the proper way to think about this is to realize that most white coat investors pay 18.8%-23.8% on their dividends. Getting a credit back for only 8%-16% of what you paid isn't so awesome.

So, does the foreign tax credit overcome the fact that TSM pays a lower dividend yield and more of it gets special (qualified dividend or 199A) treatment? I don't think so. While some have tried to quantify this and argue one way or the other, I think that once you've gotten to the point where you worry about this sort of thing with your portfolio, you've won the game and should figure out how to spend and give better instead of invest better.

Whether you put TSM or TISM into taxable first, the other one is surely going to be your second choice for an asset class to move in there so it isn't an issue most investors have to worry about for long.

What do you think? What have you done to improve your ratio of qualified to non-qualified dividends? What else do you do to invest tax-efficiently?