A doctor who doesn't retire as a multi-millionaire has failed (at least in a financial sense.) There, I said it. Hot take. Tweet it out. Maybe it'll make some people feel badly, but I no longer care. Because I think those physicians who are not en route to multi-millionairehood need to be shocked out of their complacency, and maybe this “hot take” will help do it.

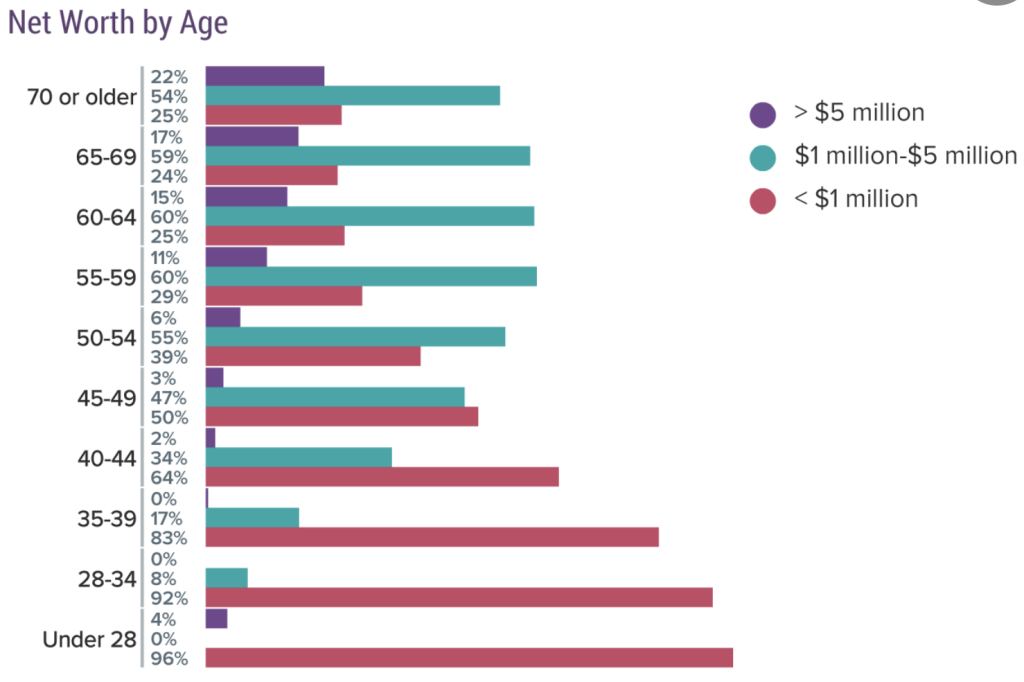

One of the most terrible statistics out there is revealed by a chart comparing physician net worths at various ages. Unfortunately, Medscape apparently stopped collecting (or at least publishing) “age” with this data a few years ago. The last survey that did was in 2019, and it looked like this.

One-quarter of doctors in their 60s are not even millionaires. The chart from the prior year was even more stunning, as it showed 11%-12% of doctors in their 60s didn't even have a net worth over $500,000, and only 48% of doctors over 65 were multi-millionaires. This is appalling. Net worth is the measurement of wealth—everything you own minus everything you owe. We're not talking about just your retirement nest egg. We're talking about everything—your bank account, your investments, your retirement accounts, your home equity, your cars, clothes, jewelry, everything. Less than half a million dollars after 30+ years of physician paychecks.

Hopefully, given recent investment returns and home appreciation, these numbers look better today than they did back in 2019. But they need to look dramatically better for me to feel any reassurance. I mean, bad things happen to people, right? Maybe a doctor had multiple divorces, splitting wealth and income in half every time. Or they were disabled early but never could obtain disability insurance due to medical issues. Or they were scammed out of some huge sum of money.

But that's not happening to half of doctors, sorry. The reason doctors aren't building wealth is because they aren't doing steps 2 and 3 of this incredibly complex formula of wealth building:

- Make a lot of money

- Don't spend a lot of money

- Take the difference between what you make and what you spend and invest it in some reasonable way

Yup, it's that simple.

How Much Doctors Should Retire On

So, how much should a doctor have when they retire? In 2023, the average physician earned $363,000. The average physician is out of training by their early 30s. Let's say an average career is 30 years. If you start saving 20% of $363,000 ($72,600) for retirement that first year out of residency and earn 5% real (after-inflation) on it, you should, after 30 years, have

=FV(5%,30,-72600) = $4.8 million

in your nest egg. Plus, the value of your house and all your stuff. It should probably be $6 million or so, right? You get to spend 80% of a physician's income ($290,400 per year or $8.7 million total), and at the end, you still have $6 million of it left. That's how it is supposed to work. That's what financial success looks like. Even if you don't start saving anything for retirement for the first five years, you should still end up with a nest egg of

=FV(5%,25,-72600) = $3.5 million.

That's well into multi-millionaire status. And these are all real numbers. I mean, if you're starting today, the nominal amount you end up with in your nest egg is going to be much more. It's going to be eight figures at least. So yeah, if you end up with six figures, you really blew it.

How does that usually happen? It happens because doctors live hand to mouth. I know it's hard for the average American and even a medical student or resident to imagine that a doctor can spend their entire $400,000 income—or even a $200,000 income. But I assure you that it happens all the time. It's not even that hard. It actually does take a little discipline to save, no matter your income. You have to tell “Present You” that “Future You” is going to need some of that money.

More information here:

Real Life Examples of How WCIers Live, Worry, and Withdraw Money in Retirement

How Much Money Physicians Actually Need to Retire

The Possibilities of Compound Interest

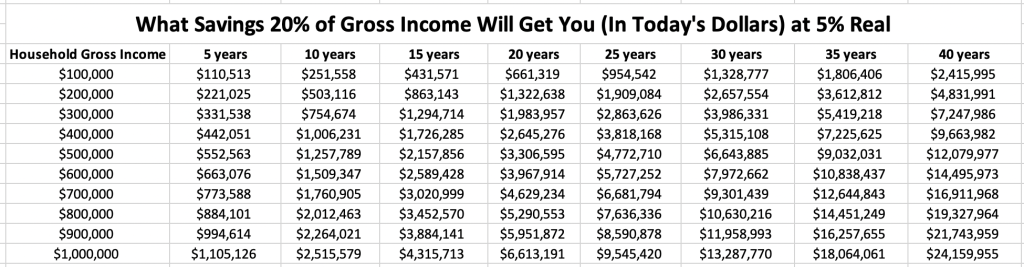

Albert Einstein supposedly said that compound interest is the eighth wonder of the world. It can certainly work some magic over the years. Look up your household income and expected career length on this chart and compare how you're doing.

At most physician household incomes, multi-millionairehood (in today's dollars) should be reached within 10-30 years. If you're not on track to do that, it's time to make some changes so you can. Here are some possible adjustments you need to make.

#1 Negotiate a better salary, change jobs, or make your practice more efficient: Income matters, and it's easier to build wealth on a higher income.

#2 Get a written spending plan: Know where your money actually goes, ensure that money is spent in accordance with your values, and put 20% of your gross income toward retirement.

#3 Make your money work as hard as you do: Are you taking advantage of available tax-protected accounts like 401(k)s, 457(b)s, Backdoor Roth IRAs, and HSAs? Are your investments intelligent (low-cost, broadly diversified index funds or well-managed real estate)? Are you taking on an adequate amount of risk, or is it all in cash or bonds? Are you getting hosed by lousy advice or ridiculous fees?

You can do this. Hundreds of thousands of doctors before you have done it, and they're no smarter or harder working than you are. The combination of a little financial literacy and a little financial discipline goes a long way when combined with a physician's income.

What do you think? Are you ahead or behind where that chart says you should be? Will you retire as a multi-millionaire? Why or why not?