By Dr. John R. Dayton, FACEP, FAAEM, Guest Writer

By Dr. John R. Dayton, FACEP, FAAEM, Guest WriterWhat Is Angel Investing?

Angel Investing is a process used by early-stage companies, or startups, to obtain funding and mentorship. The young company has usually bootstrapped as far as it is able, and needs an influx of money to grow. Instead of opting for a business loan, they approach angel investors to reach their next stage of growth.

During a startup’s lifecycle, you can see that a new company will need to go through several rounds of fundraising before it can announce an Initial Public Offering, or IPO. Angel investing offers an initial, “high-risk high-reward” opportunity to own a part of the company long before the general public is able to buy shares. Deals are usually structured so that the startup either sells shares of its stock to raise money or borrows money and converts the debt to equity at a later date.

Because angel investing is high-risk, you could lose all your money. At the same time, every angel investor wants to follow the example of Andy Bechtolsheim, who was the first to invest in a company started by two Ph.D. drop-outs named Sergey Brin and Larry Page (Google), or be like one of the 20 angel investors who bet on a young Jeff Bezos when he was selling books on the internet from his basement.

Who Is an Accredited Investor?

‘Accredited Investor’ is a legal term used to describe an individual with income exceeding $200K/yr, for the last 2 years, or with a net worth of $1,000,000, not including their home. Most full-time physicians meet these criteria. Because the SEC considers angel investing to be high-risk, it limits this type of investing to those who are able to financially tolerate high-risk investments. In addition to angel investing, accredited investors are also able to invest in hedge funds, venture capital funds, and real estate syndications.

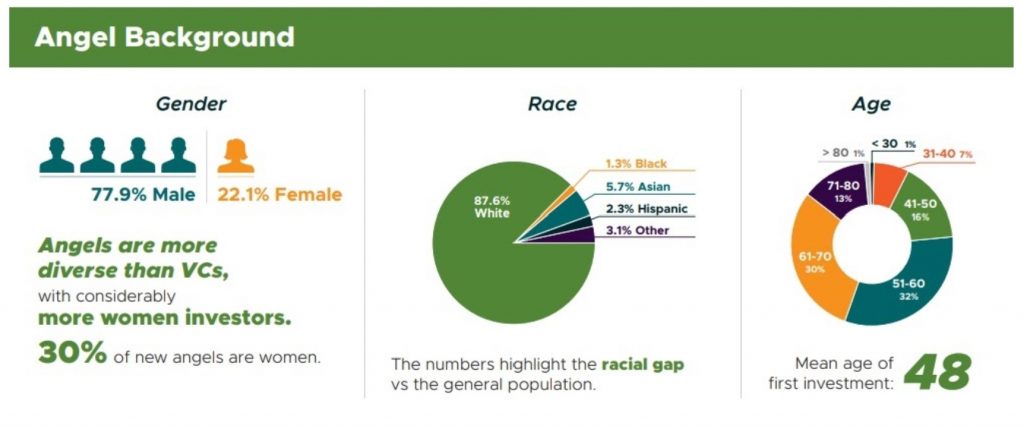

The American Angel conducted a study of angel investors in 2017 and made these interesting discoveries:

- The average check size is $25K, but ranged from just a few thousand to $100K.

- Women wrote 22% of checks and supported women entrepreneurs with 51% of their investments. They represent thirty percent of new angel investors.

- The mean age for a first angel investment is 48.

Image: The American Angel study

Why Physicians?

Historically, investments in health care have provided good returns, and physicians have a strong background in this field. The graph below, from Cambridge Associates, summarizes the rate of return for different types of healthcare investments. The time spent with medical devices, EHRs, and other healthcare tools gives physicians a distinct advantage when predicting what future products would be accepted and adopted by their colleagues in the healthcare industry.

Most angel investment groups are composed of several individuals who bring advanced knowledge of their particular industry to the group. Because many new companies work to address needs in healthcare, physicians become valuable members of their angel groups.

My angel investment group includes three physicians. Over the last year, we’ve seen deals related to medical devices, pharmaceutical safety, digital health, wearables, and medical billing. One of our recent exits came from a medical device that gave investors a 2X, or 200%, return on their investment.

In addition to money, new companies also need advisors and have other needs that physician investors are able to meet. Dr. Alren Meyers, Founder of the Society of Physician Entrepreneurs, describes these needs as the “M’s” at the 2019 InnovatorMD Global Summit:

-

- Money – investments

- Maturity – wisdom from an experienced physician

- Monitoring of Environment – subject matter experts with knowledge of trending topics, needs, and competing solutions

- Manpower – assistance with market research, product evaluations, and related projects

-

- Marketing – advice for reaching their target audience of healthcare users

What Are the Pros and Cons of Angel Investing?

Pros

David Rose, who wrote Angel Investing and founded Gust, a platform for early-stage investors, notes that angel investments have historically good returns when compared with other asset classes. He used this graph when describing those returns in answer to a question on Quora.

Physicians, with their unique knowledge and skill set, have an advantage when evaluating health care innovations.

Investing is also becoming recognized as a solution to physician burnout. Physicians increasingly feel like they are becoming cogs in a wheel. Angel investing becomes a way to move that locus of control from external to internal, re-claim their role in medicine, influence the future of healthcare delivery, and benefit financially from their involvement.

Finally, angel investing is also a great way to network. Angel investors tend to be leaders in their professions and companies that pitch businesses are led by rising entrepreneurs. Physicians that don’t have a business background are also able to learn how other industry leaders evaluate companies and investment opportunities.

Cons

Regarding the cons, there are three main ideas to keep in mind:

#1 Risk

Angel investing is risky! It is so risky that the SEC only allows individuals who can afford to lose money to participate.

#2 Illiquidity

Investments are not liquid. Some investments are tied up for several years. Investments in “zombie companies” may stay financially solvent, but not grow rapidly enough for another round of funding or a potential exit for angel investors.

#3 Loss of Equity

As companies grow, there is a risk that you can lose your initial equity as companies raise future rounds of funding or become involved in mergers and acquisitions. This risk can be mitigated by proper legal work during the initial investment but is always a risk.

Pro Tips

If you decide to become an angel investor, here are some tips to help guide your investments:

- Stick to what you know. Focus on investments related to healthcare and your other areas of expertise.

- Learn from other angels about trends and opportunities related to their areas of expertise. What are their industries’ pain points and emerging opportunities?

- Use a portfolio strategy by making several investments. This spreads the risk and allows for the high-performing startups to make up for losses with other companies. While a majority of investments won’t pan out (<1X), the ones that work out can have high (5-10X), and sometimes very high (>30X), rates of return. This is shown in the graph below which shows results of angel investments during studies tracked by the Angel Resource Institute from 2016 (red), 2009 (orange), and 2007 (blue).

How Can I Get Involved as an Angel Investor?

- Find an angel investment group in your area. There are groups like the Angel Capital Association that have regional directories of angel investment groups.

- Check out angel investment groups focused on physicians including AngelMD, Global Health Impact Fund, and Life Science Angels

- Look into other physician entrepreneur groups like the Society of Physician Entrepreneurs and InnovatorMD, and events like Leverage & Growth Summit for Physicians.

[FOUNDER'S NOTE BY DR. JIM DAHLE: I think that last chart is the most important part of this article. If you read it carefully, you will see that 53%-69% of angel investments lose money. This is the main reason I think this asset class should be avoided. Lots of people like to dip a toe into investments, trying one or two out before really committing to the asset class. Well, what is the likely outcome of doing that with angel investing? Losing money. And not just a negative return. I'm talking about losing your entire investment most of the time. And if you didn't lose money, the truth is you probably just got lucky.

I also think the idea that physicians can pick winning health care companies is a fallacy. Certainly, it hasn't been the case in publicly traded companies, so I'm not sure why it would be any better in small start-ups. Like some other types of investments such as direct real estate investing, you either need to do it right or not do it at all. David Rose gave a good discussion here about how to do it right:

- IF you are an Accredited Investor, and

- IF you are prepared to invest at least $50K to $100K per year, and

- IF you make sure to reserve quite a bit for follow-on financings, and

- IF you develop a strong deal flow of good companies, either through an angel group or your own contacts, and

- IF you invest consistently so that you have at least 20 companies (ideally more) in your portfolio, and

- IF you are professional in both your due diligence investigation and your deal term negotiation (including specifically with regard to valuations), and

- IF you go in with the knowledge that you are going to be in it for at least a decade, holding completely illiquid assets, and

- IF you can help add value to your portfolio companies above and beyond simply money (such as board service, contacts, fundraising, etc.)

- Then (and only then) will the odds be in your favor for you to join the relatively rarified band of successful, professional angel investors who show average IRRs over their investing years of over 25% per year.

In short, successful angel investors did not become wealthy from angel investing. They were already wealthy. And they're not doing this passively, they're doing it as a serious side pursuit. I have no idea how a busy doctor can have time to add value to 20+ companies, but if that's you, go for it. My best investments are small start-ups that I can add value to. But I think it is a pretty easy argument to make that angel investments should not be any significant part of the portfolios of most physicians.]

What do you think? Should an accredited doctor consider angel investing? Why or why not?