My wife recently started her pediatrics residency, and she was faced with decisions about a 401(k).

- How much to contribute?

- Where to allocate the capital?

We looked at the options and determined it made sense to max out the employer match provided by her hospital, but the options for allocation were fairly underwhelming. They consisted largely of generic S&P-type ETFs—which are OK but lack diversification—and various bond funds, which help reduce volatility but also lower the total returns of the portfolio. It may seem like total market ETFs are diversified as they contain so many holdings, but the vast majority of those holdings are highly correlated with one another.

We wanted to get more diversification while maximizing total returns, and we determined that REITs were the answer.

What Are REITs?

A REIT is a real estate investment trust which is a special tax designation for companies that have at least 75% of their assets in real estate or cash and derive at least 75% of revenues from real estate. To maintain REIT status, a company additionally must pay out at least 90% of its taxable income as dividends to shareholders.

The advantage to jumping through these hoops? No corporate tax.

Tax Advantages of a REIT

Most companies, such as those in the S&P, get taxed at the corporate level, and then shareholders are taxed on their capital gains and/or dividends.

Thus, for investors, most stocks are hit with double taxation. This also hits ETF and mutual fund investors who are subject to both layers of taxation in addition to whatever fees the ETF charges.

REITs avoid the first layer of taxation in that REITs do not pay corporate tax. One layer of taxation is generally going to be a significant overall advantage to double taxation. For example, in the first quarter of 2023, Microsoft paid $4.37 billion in taxes on its corporate income. If Microsoft was a REIT, it would not have had to pay this, and that $4.37 billion would have accrued to shareholder value instead of going to the government. Microsoft, of course, cannot get the REIT tax advantage because that designation is reserved for companies that generate most of their revenues from real estate.

Instead of paying corporate tax, REITs are treated as pass-through entities, such that they pass their taxable earnings to shareholders in the form of dividends and then the shareholders are taxed on their dividends/capital gains. REIT dividends can be classified as capital gains, return of capital, or 199A dividends—each has distinct advantages and disadvantages. The wise investor can hold the right REITs in the right account types to maximize their after-tax returns.

More information here:

10 Tax Advantages of Real Estate – How Many Can You Name?

What Counts as Real Estate in the Eyes of the IRS?

Some forms of real estate are obvious:

- Houses

- Commercial real estate, like shopping centers or apartments

- Office towers

These are just the tip of the iceberg. Far more things count as real estate than colloquial knowledge anticipates.

To count as real estate, a property has to be stationary and passive in its function. Passivity of function is a key distinction—for example, cell towers themselves are real estate, but the equipment attached to them is not considered real estate to the IRS. Similarly, the land or rooftops underneath solar panels—and even the brackets and hardware to which the panels are affixed—count as REIT-valid real estate, but the panels themselves serve an active function (energy production) and are not REIT-qualifying.

REITs can thereby own the physical structural assets while leasing out those assets to the operator that takes care of the active functions. It maximizes the tax efficiency of the supply chain.

Publicly traded REITs are broad reaching in 20 distinctly different economic sectors, as pictured below.

2nd Market Capital

Those sectors include:

- Hotels

- Farmland

- Energy infrastructure

- Data centers

- Advertising

- Industrial logistics

- Office

- Casino

- Corrections

- Self-Storage

- Malls

- Manufactured housing

- Apartments

- Ground lease

- Open-air shopping centers

- Triple net lease

- Timberland

- Educational facilities

- Single-family housing

- Medical properties (hospitals, clinics, senior living (ALFs/ILF))

Each property type has a distinctly different set of revenue drivers. Some of these sectors are counter-cyclical or defensive in nature while others tend to thrive with broader economic GDP growth. In analyzing each sector, there are some that I like more than others from a business model perspective.

I lean toward REITs that deal directly with their tenants to avoid middlemen taking a bite out of the revenue stream. Hotels are a great example of the weaker business model, as a significant portion of room rates goes to paying the brands (Marriott or Hilton) and the online travel agencies (Expedia or the equivalent). The hotel owner takes all the capital risk while the intermediaries get the lion’s share of the profits. Hotels can do well in a booming travel economy, but over the course of business cycles, hotels, as an asset class, will underperform.

On the other end of the spectrum, we can look to farmland as an example of a REIT sector with a very clean REIT business model. The farmer directly pays the REIT to rent a piece of land for a year. Farmers have a tendency to stay on the same piece of land for decades, which gives the REIT a reliable tenant and evades leasing costs. There are minimal transactional frictions—just a clean stream of cashflows.

Beyond the property types, there are three different structures of REITs.

4 Main Types of REITs

- Equity REITs – Those that directly own income-producing real estate

- Mortgage REITs – Those that collect interest income by financing real estate

- Non-traded Public REITs – Can be either equity or mortgage in style but are not listed on a public stock exchange. They are still public and they have to file documents, but the shares are placed by brokers (often for substantial commissions) rather than exchange-traded.

- Private REITs – Require accredited investor status and use fee structures similar to but generally less than those of hedge funds. These can also be equity or mortgage in style.

Publicly traded equity REITs tend to be the better area, as mortgage REITs struggle in certain interest rate environments and non-traded REITs often have high fees.

More information here:

401(k) vs. Real Estate: Where Should You Invest?

Why Invest in REITs Alongside a 401(k)?

As my wife’s 401(k) consists primarily of S&P-style ETFs, we chose to supplement it with a separate portfolio (in our case a Roth IRA) of REITs. The differing drivers and market behavior of REITs should help reduce the overall volatility of our finances.

In periods in which the S&P-style 401(k) is performing poorly, the REIT portfolio might be doing well and vice versa. Allow me to go a bit deeper into this diversification

Beyond the aforementioned tax advantages, three aspects of REITs make them gainful investments.

- Transparency: Most REIT revenues come in the form of contractual income from tenants. This provides greater visibility into future earnings than most other investment sectors.

- Dividend income: REITs have higher dividend yields on average than the broader market.

- Diversification: REITs have a low correlation with other asset classes, making the inclusion of REITs in a portfolio volatility-reducing.

This third point gets back to the opener of this post, achieving greater diversification than an S&P-style ETF without sacrificing returns.

Bonds in the classic 60/40 stock/bond portfolio do indeed mitigate volatility, but hundreds of years of stock market history show compelling evidence that, over the long run, bonds have lower total returns. Thus, the 60/40 portfolio underperforms the 100/0 portfolio.

REITs, over the long run, provide a total return that is right in line with the S&P, so by adding REITs into a portfolio, one can achieve a greater degree of diversification without lowering total return. Any ratio of REITs in a portfolio provides diversification benefits over just the S&P 500. A common allocation would be 20% in REITs, but the entire portfolio for my wife and I is closer to 20/80 with the 80% being the REITs. It is not a precise science. Qualitatively, variety is a good thing as long as one achieves variety through investments that are, in themselves, high quality.

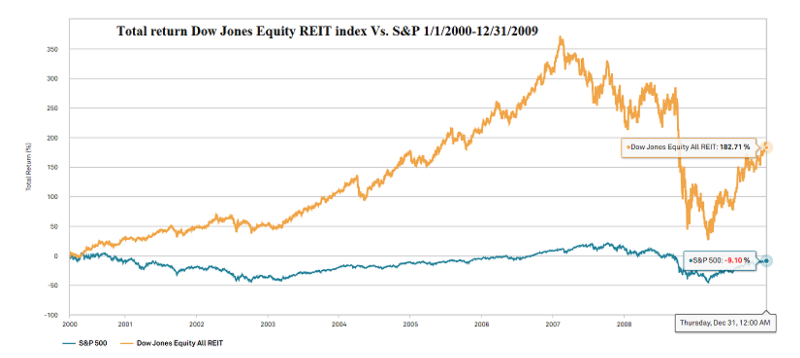

Allow me to demonstrate the diversifying aspect with a look at historical returns. Around the turn of the century, the S&P 500 went through what has been called “the lost decade” in which the total return of the S&P 500 was basically 0% from January 1, 2000, through December 31, 2009. During that same decade, REITs returned 182.7%.

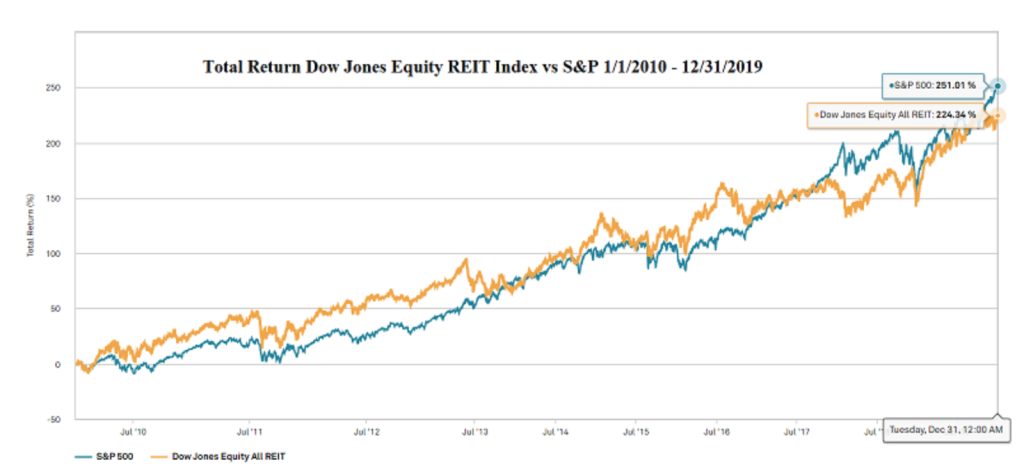

(You can click on the charts below to enlarge them.)

Thus, having a mixed portfolio would have mitigated the S&P’s weak period.

In the following decade—January 1, 2010, through December 31, 2019—the S&P 500 came surging back, delivering a 251% return that beat the REIT return of 224% in that same decade.

The verdict is still out as to what the next decade will bring, but I really like the diversifying benefits of REITs in my investment portfolio and believe an allocation to REITs is a great supplement to the standard 401(k).

[FOUNDER'S NOTE FROM DR. JIM DAHLE: Like the author, I am also a fan of diversifying into real estate. As long-term readers know, my portfolio is composed of 60% stocks, 20% bonds, and 20% real estate. Of that 20% in real estate, 1/4 of it is invested in publicly traded REITs, and many of our private investments have also adopted a REIT structure. In this post, the author talks about “diversifying a 401(k) by using REITs.” That's a bit of confusing terminology, as a 401(k) is an account and a REIT is an investment. In reality, he means diversifying a stock-heavy portfolio (S&P 500 style ETF) with REITs. This diversification is available without purchasing individual REITs. Individual publicly traded REITs (and private ones, for that matter) have the same problem that individual stocks have: uncompensated risk. To avoid this, my preferred investment for publicly traded equity REITs is the Vanguard Real Estate Index Fund (VGSLX) or ETF (VNQ). While I think a reasonable allocation to real estate ranges from 0%-80% of a portfolio, putting 80% of a portfolio into publicly traded REITs is well beyond what I would feel comfortable with or recommend. Those who I think will be OK with 80% of their portfolio in real estate are generally investing most of that directly into properties and real estate businesses they are heavily involved with. I think passive investors should have a much lower allocation to real estate. Perhaps no more than 40-50%.]

If you are interested in private real estate investing opportunities, start your due diligence with those who support The White Coat Investor site:

What do you think? Do you believe that REITs can supplement your 401(k)? If not, what would you rather have in your retirement accounts?

Disclosure: This discussion is general in nature and for informational purposes only; it is not a substitute for professional advice. None of the information offered should be construed as constituting a specific recommendation, or as investment or tax advice.