By Dr. Charles Patterson, WCI Columnist

By Dr. Charles Patterson, WCI ColumnistFor the last several years, the good folks over at the Thrift Savings Plan (TSP) have been hard at work giving their program a facelift. Among other things, this overhaul means quicker access and ease of use. With the facelift has come a tummy-tuck: a fancy-dancy new TSP mobile app to accompany it. Today, I will be reviewing these changes and showing you how to use them.

The beloved TSP—ostensibly the 401(k) plan for service members and federal employees—is a legacy system built on a proud tradition of slow change and cumbersome interfaces. Putting on my critic hat, you should know two things about the wearer: 1) I enjoy personal finance and running numbers, and 2) I don’t mesh well with technology. To the latter point, I can barely spell “PC” and wouldn’t care to try. Until several months ago, I was content with my iPhone 3 (It broke, as all gadgets do, and I had to get a fancy-dancy new one at an exorbitant cost).

Until about the same time, I didn’t fully understand what an app was, let alone where the App Store was located (next to the Apple store, perhaps?). I believe true innovation to be rare, with claims of it too often made by turtleneck-donning charlatans. If a computer told me a probable diagnosis but my exam suggested otherwise, I would invite the computer to kindly leave. Technology saves lives, they say. Humbug, says I.

It is through this lens that I will be examining this new TSP technology. I am sure that this is going to go well.

The New TSP Webpage Is Inviting

Simply put, the new TSP webpage has a fin-techie new look. Its subtle color palette and soft fonts allay concerns that your financial journey is complicated. It is enticing and reminiscent of the platforms found with any of the other big firms. I dare say it is even more user-friendly. This is both good and bad, and as such, it can be construed as a “complisult.”

I suspect that this format is more familiar to younger folks. This is a good thing, as financial literacy and ownership of one’s financial health are to be embraced and encouraged. But there is a caustic lining: with ease of use comes ease of change, and this evolution runs the risk of making it too easy to change one’s portfolio.

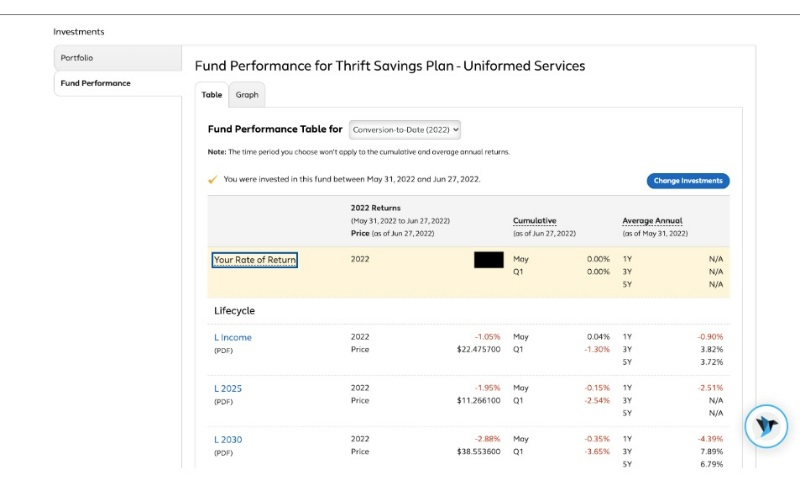

The New TSP Webpage Is Easy to Access and Navigate

As many fellow elder public servants may recall, accessing the TSP used to be a fraught misadventure. Should you forget your password, you could make an online request for it, but it might take two weeks to receive it in the mail. The same goes for the PIN number and username. It's no exaggeration to say that if you forgot your password or had your account locked, it may take a month to gain access again. Not so with the new webpage: a two-factor, SMS-confirmation login makes access simple, just shy of enjoyable. Within milliseconds, you are logged in and can see everything from current balance to fund performance. It is quite nifty that way.

In the bottom right corner of each page is a hummingbird icon that, when clicked, launches an instant chat feature called “AVA.” Within this chat function, you can receive live help, something that is also new to the TSP. Full disclosure: I have not used the help chat function, but this seems to be a tool that mirrors other large firms' web pages (Vanguard, Schwab, Fidelity, etc).

If you are looking to make a change to your portfolio, it has never been easier. I am unconvinced that this is a good thing.

More information here:

What You Need to Know About the Thrift Savings Plan (TSP)

The New TSP Webpage Offers New Functionality

From the main login page, one has the option to view the portfolio, change settings, see account activity, view statements, and review beneficiaries. Also on the login page—and disturbingly on nearly every single other page—is the option to change the portfolio. More on why that is hazardous later.

In the meantime, one feature that is particularly interesting is the automatic balance, otherwise known as the reallocation. With the click of a button, one can rebalance the portfolio to the allocation that one wishes. No more Excel spreadsheets, no more math. Changing contributions manually has never been easier, with the full bevy of excellent TSP lifecycle funds, securities, and indices available from which to tinker. It is easy to tinker, too easy.

Perhaps the largest change in this evolution is the introduction of the “Mutual Fund Window.” While the standard funds from which to choose are still available, investors now have the option to direct their savings to 5,000 different mutual funds through an inter-fund transfer.

As a bit of background, the Federal Retirement Thrift Investment Board (FRTIB) has been looking at the question of opening outside funds to government employees for more than a decade. Legislation that first permitted the TSP to open the Mutual Fund Window was passed in 2009 (Thrift Savings Plan Enhancement Act of 2009, Public Law 111-31, Division B, Title I, sec. 104 codified at 5 U.S.C. 8438(b)(5)(A) in case you are interested). The FRTIB director, in conjunction with the Employee Thrift Advisory Council (ETAC) then directed a 6-year-long study on the implications of such a change.

Happily, in July 2015, the Board considered the results of the study and voted unanimously to adopt the window. Administrivia, cogs and wheels, Rube Goldberg complexes, magic, and seven (yes, seven) years later, we arrive at the execution of the decision. That’s correct: it has taken this governmental organization 13 years to open a Mutual Fund Window. If that doesn’t inspire confidence in bureaucracy, I don’t know what will.

The decision may be somewhat null, as the Mutual Fund Window offers more choices but seemingly fails to convincingly prove superior over existing TSP funds. Details on the 5,000 available mutual funds are forthcoming, but the parameters of the Window may make it a non-starter. To even opt in to the Mutual Fund Window, one must consider several rules and fees:

- The initial investment must be at least $10,000

- The initial investment cannot exceed 25% of one’s account balance

- One must have an account balance of at least $40,000 to participate

- There is a $55 annual administrative fee and a $95 annual maintenance fee in addition to fees associated with the selected funds

- Each trade costs $28.75

From the start, then, this Window would only be useful to those who have served for quite some time: it would take at least two years of service (assuming one maximizes their TSP contribution) to even be eligible to use it. For the average enlisted person contributing 10% of their income to the TSP, it would take over a decade to reach Window eligibility (and if there’s anything we’ve learned about the TSP and a decade, it's that rules actually can change in that timeframe).

At a minimum, one will be spending $178.75 for the first trade (1.8% if the minimum of $10,000 is used). Thus, the $178.75 question becomes: “Is it worth it?” To some, it might depend on the fund being used. But this would imply that the change would result in a higher return than can be achieved with a low-cost Lifecycle Fund or the classic C, S, and I Funds. I am unconvinced that such a change would be so beneficial—particularly in the long-term—and especially with the associated fees. In the words of Charles Barkley: “I could be wrong, but I don’t think so.”

The TSP touts a new suite of services designed to increase efficiency in withdrawals, distributions, and account queries. These include the aforementioned AVA, a new Secure Participant Mailbox, and the ThriftLine phone service. Loans and Legal Processing (conservatorship, guardianship, Power of Attorney) have changed only minimally. In all, the TSP appears contemporary, tuned, and detailed.

More information here:

Patterson: 5 Questions to Consider Before Changing Your Investment Portfolio

The TSP Mobile App Is Fancy Without the Hassle of Functionality

In June 2022, the TSP launched their app called “TSP,” and it is available in the App Store (not next to the Apple store). With the new app, one gets the fancy new font that we have come to enjoy with the webpage, all from the comfort of your phone.

And here’s the utility: imagine for a moment that you are in a standard social situation—you're in an elevator, boarding a plane, scrubbing in for the OR—and to your horror, you’ve exhausted your social media, news, and even medical literature review. Do you make eye contact and start a conversation with an acquaintance or friend? God, no! Here enters the TSP app: one more useless distraction that feigns important engagement to save you from a human experience.

Transaction capability is exceptionally limited—most significant account changes and questions will require you to log onto the TSP webpage. The only real function seems to be the ability to see one’s account balance and allocation in real time.

Things Were Better Back When They Were Tough

Grumble, grumble, harrumph! The new face of the TSP is fancy[dancy] with new functionality of arguable utility. For the long-term investor, these changes are of little value given their lack of applicability and the increased risk of inordinate change. More dangerously, for the young investor on the path to financial literacy, the risk of inordinate portfolio change is even greater, given the ease of access.

With a written financial plan in place, changes to a portfolio should be few and far between. Furthermore, it's likely that the high cost of inter-fund transfers will dissuade most folks from using the Mutual Fund Window, a portal that is equally incapable of efficiently executing frequent trading. In the good old days, you couldn’t even access your portfolio to change it. Now, if you have a tempting, terrible thought, all that separates you from an inane misstep is a few clicks. Bring back the snail mail passwords, I say!

All old man-ing aside, one function not included in the above review is the educational value of the webpage. Without question, the interface is more user-friendly, and the resources are more robust. In turn, this leads to greater engagement, and on the whole, that is a very good thing. I am a fan of any instrument which facilitates financial literacy, particularly in young adults. For this reason alone, I would give the TSP refresh my endorsement.

Success in personal finance need not be complicated. Time, attention, and habitual saving are the main ingredients of the recipe. All else is flavor. It may be fun to have more functionality, but that increased functionality is one more thing to break—there’s a reason tractors don’t come with adaptive cruise control.

You probably wouldn’t drain a skin abscess with a DaVinci robotic surgery system. The upgraded TSP features some shiny, but unnecessary, new services that long-term investors won’t ever use. What is nice to see is the attention that was paid in creating the digital interface and the promise of increased, efficient service. After all, it's not the DaVinci that conducts the procedure—it's the team wielding it.

Have you used the new TSP website and app? What do you think? Do you have any tips and tricks to make the experience even better? Is it now too easy to change your allocation?

[The views expressed in this article are those of the author and do not reflect any official position of the Department of Defense or the US government. These writings are not authorized, approved, or endorsed by any of the above entities.]