By Eric Rosenberg, WCI Contributor

By Eric Rosenberg, WCI ContributorTax-loss harvesting is an investment strategy in which you sell investments when they’re down in value and rebuy similar investments to maintain the same portfolio makeup. Doing so allows you to lock in tax losses without dramatically changing your investments. In the long run, this can add up to significant tax savings.

Here’s a closer look at tax-loss harvesting with Fidelity to help you capture tax benefits from the ups and downs of the stock market.

What Is Tax-Loss Harvesting?

Tax-loss harvesting, sometimes called TLH, is the process of selling shares of an asset at a loss, typically paired with the simultaneous or subsequent purchase of a similar but non-identical asset. The process only works in a taxable account, like a regular brokerage or robo-advisor account. Making a similar trade in an IRA or another tax-advantaged retirement account will not give you a tax benefit.

As we’re more into index funds than single stocks at The White Coat Investor, much of our experience with tax-loss harvesting is by swapping one fund with a similar fund that is not substantially the same. You can harvest losses with individual stocks, but the difficulty is finding another stock that you can expect to perform similarly. The point of TLH is that you're taking a paper loss without actually altering your asset allocation significantly.

The wise investor swaps the losing investment for one that is highly correlated with it. The net effect is that your portfolio doesn't change substantially, but you still get to claim the losses on your taxes. As an example: A typical exchange might be to swap the Vanguard Total Stock Market Fund (VTSAX) for the Vanguard 500 Index Fund (VFIAX). These two funds have a correlation of 0.99, but hardly anybody would argue they are substantially identical. The first holds thousands more stocks than the second, they have different CUSIP numbers, and they follow different indices.

You can also tax-loss harvest with ETFs or between mutual funds and ETFs. You may miss out on time in the market if you're waiting for the proceeds of the sale to hit your settlement fund before you can use it to buy a TLH partner. This may be inconsequential or beneficial if the market drops while you wait.

More information here:

Tax Loss-Harvesting with Vanguard

Why Tax-Loss Harvest?

When you take a loss in the markets, those losses will first be used to offset any capital gains you may have incurred that year. Once any gains are used up, your tax losses can offset up to another $3,000 per year of ordinary income.

That $3,000 less in taxable income every year can be significant for high-income professionals. If you’re at the top of the tax brackets, you could have a total marginal tax rate of as much as 35%-50%. That means an additional $3,000 deduction can be worth $1,000-$1,500 annually. Additional losses can carry over to future years. If you save up $3,000 per year in deductions over many years, you can capture a major tax benefit if the markets drop significantly.

It is true that when you tax-loss harvest, you lower your cost basis in the investments you own. This could set you up to recapture some of the taxes by paying more capital gains taxes later. However, it's well worth saving on ordinary income taxes now to pay possibly capital gains taxes later. Nearly everyone will pay a lower capital gains rate later than income tax rate now. At worst, you're deferring the tax.

If you have charitable aspirations, you can donate funds with the lowest cost basis (and most potential gains) to charity. I do this by donating to and from a donor-advised fund. Check out our full post on the Fidelity donor-advised fund offering to learn more about how that works.

Finally, if you die with assets in a taxable brokerage account, the cost basis is reset to the current value when inherited, thanks to the step up in basis at death. Those potential capital gains taxes disappear for your heirs.

Avoid a Wash Sale

If you’re tax-loss harvesting, take care to avoid a wash sale. Doing so can negate the benefits of your TLH strategy. For example, if you sell an asset for a loss, some or all of that loss will be ineligible to be reported as a loss if you have a purchase of the same or a “substantially identical” asset 30 days before or after your TLH sale.

For example, let’s consider a tax-loss harvesting transaction in which we sell the Fidelity Enhanced Large Cap Core ETF (FELC). If you replace it with the Fidelity Large Cap Core Index Fund (FLCEX) within 30 days—a mutual fund that’s effectively the same—it would be a wash sale, and you would lose the tax loss benefit.

The prevailing opinion from quality sources, including Bogleheads, is that funds tracking different indices are not substantially identical, even if there is significant overlap.

So, if you wanted to sell Fidelity's Total Market Index Fund (FSKAX) and buy the No-Fee ZERO Total Stock Market Fund (FZROX), you could do so. The former tracks the Dow Jones US Total Stock Market Index, while the latter tracks a new proprietary index from Fidelity. The same would happen if you wanted to sell the Fidelity Total International Index Fund (FTIHX) and buy the No-Fee ZERO International Index Fund (FZILX).

To help avoid making an accidental wash sale, you may want to turn off automated investments and dividend automatic reinvestment. It's also good practice to avoid holding substantially identical funds in any IRAs in which you or your spouse periodically invest or reinvest dividends.

More information here:

Tax-Loss Harvesting Pairs and Partners

Steps to Tax-Loss Harvesting with Fidelity

#1 Identify Losing Positions

First, click the “Positions” tab on the Fidelity website to see what you own in a taxable account. Then, click on the fund name and “Purchase History/Lots” to see the individual lots.

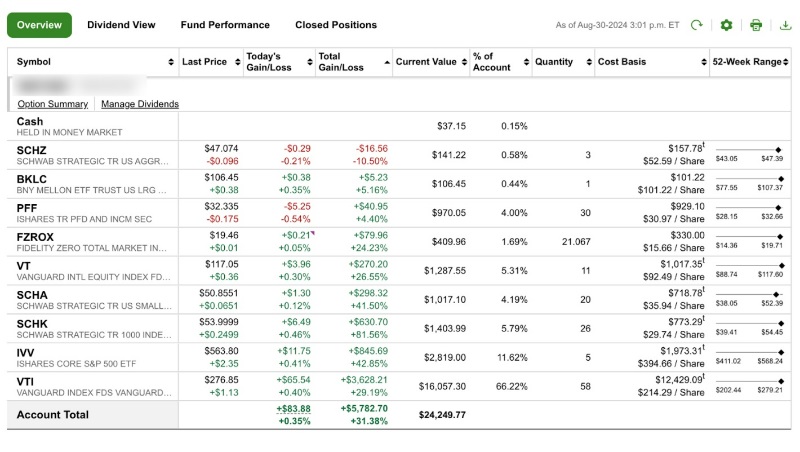

Here’s a look under the hood of my own Fidelity account. While I’ve done very well here and there are no good examples for tax-loss harvesting, you can sort by the Total Gain/Loss column to find prospective losses to capture. Here, my one down investment is in SCHZ.

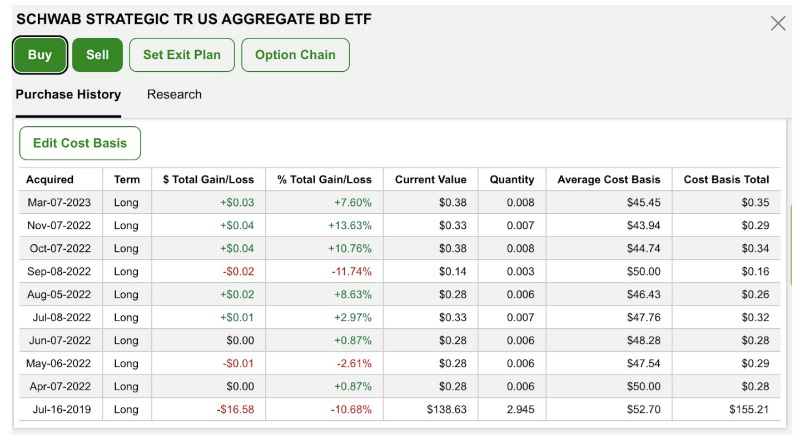

Expanding the details, I can see that most losses came from a single purchase made in 2019. I only bought $155 of the ETF, as I was packing a small amount of cash in the mostly inactive account. But imagine if that investment had another zero or two on the end. In that case, the loss would be worth $165 or $1,656.

Clicking on a stock or fund allows you to view your purchase history by lots, which is helpful if you’ve used dividend reinvestment or bought the security more than once.

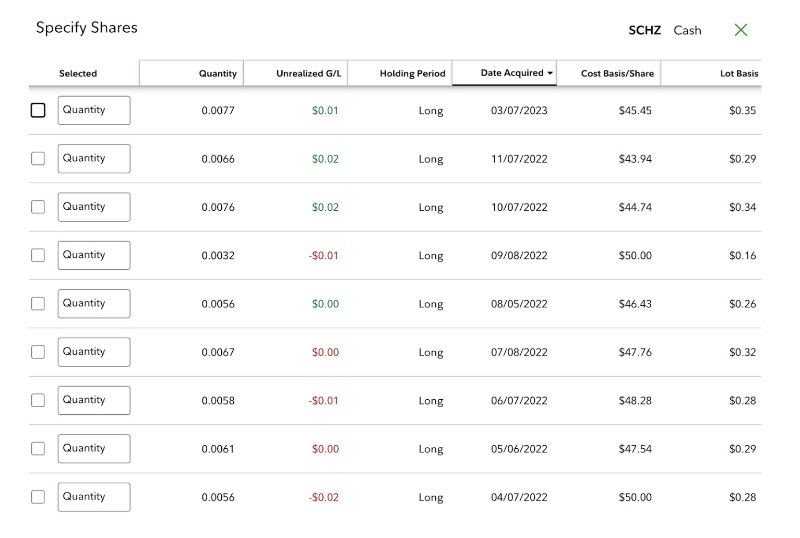

If I sold my entire stake, I would get the $16.56 in tax losses, offsetting up to that value of capital gains this year. If I wanted only to sell the first 2.945 shares, I could enter a sale for that number of shares following the FIFO (first in, first out) option in the trade screen or the “Sell Specific” dropdown option in the sale type menu on the order screen.

The Sell Specific option allows you to pick specific purchases to sell, which is helpful for tax-loss harvesting.

#2 Exchange One Fund for Another

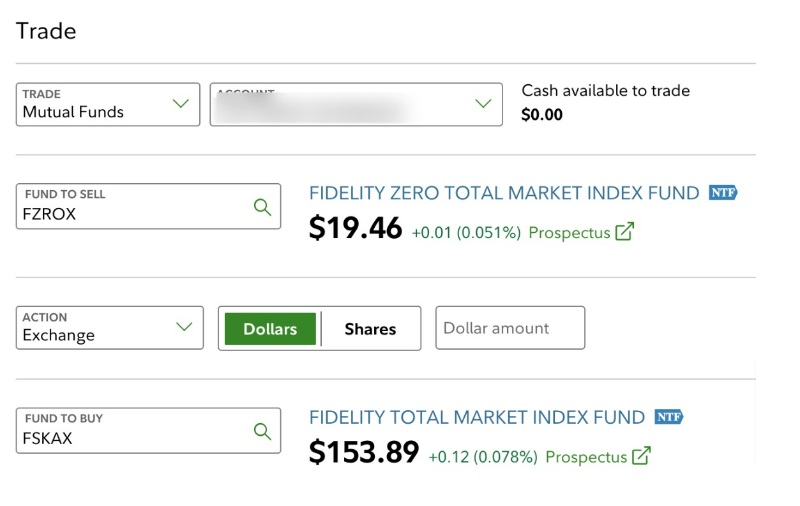

Let’s say you've decided to exchange shares of FZROX into another total stock market fund from Fidelity, FSKAX. While these funds will behave similarly, they are not identical, and they each follow a different index.

To exchange one mutual fund for another without sitting out of the market for any time, you can choose to exchange one mutual fund for another when selling.

You can sell a specific number of shares or sell by dollar amount.

Note that Fidelity mutual funds are not intended for frequent trading, and selling a fund purchased within 30 days is considered a “roundtrip transaction.” More than four of these in the same account will result in a hold on your ability to trade. More information is available in Fidelity's Excessive Trading Policy.

Turning off the automatic dividend reinvestment will limit the number of roundtrip transactions possible, which is another reason to make that change if you intend to follow a tax-loss harvesting strategy.

Automated Tax-Loss Harvesting

Managed accounts are Fidelity’s version of robo-advising. However, Fidelity Go doesn’t include automated tax-loss harvesting. You should check out our robo-advisor reviews to learn more if you're looking for that.

With automated tax-loss harvesting, your brokerage looks for tax-loss harvesting opportunities and makes automatic trades to capture the market's ups and downs.

More information here:

Is Tax-Loss Harvesting Worth It?

9 Reasons NOT to Tax-Loss Harvest

Your Turn for Tax-Loss Harvesting

While it may look complicated, entering a manual tax-loss harvesting transaction is simple. If you find a similar fund but different enough to avoid a wash sale, you can enter the tax-loss harvesting trade in less than a minute.

While it’s easier in accounts with many holdings, it’s also possible with simple accounts holding only a few funds. Even if the market is soaring to all-time highs, it feels inevitable that you’ll see opportunities for harvesting additional tax losses in the future.

The White Coat Investor is filled with posts like this, whether it’s increasing your financial literacy, showing you the best strategies on your path to financial success, or discussing the topic of mental wellness. To discover just how much The White Coat Investor can help you in your financial journey, start here to read some of our most popular posts and to see everything else WCI has to offer. And make sure to sign up for our newsletters to keep up with our newest content.