If you run your own practice, you likely have a few employees working for you. Whether they’re other physicians, a receptionist who helps handle paperwork and makes appointments, or people doing other work, you want to make sure you can hire and retain good talent. Offering good compensation and benefits is one way to manage that. A profit-sharing 401(k) plan is a type of retirement account that lets you support your employees on their path toward retirement while also providing them an incentive to work hard and help your practice succeed.

What Is 401(k) Profit-Sharing?

A 401(k) is a type of employer-sponsored retirement account. People can contribute money to their 401(k) and receive tax benefits for doing so. Money in the account generally can’t be touched until retirement. A profit-sharing 401(k) is a special type of 401(k) in which the employer also makes contributions to the account on the employees’ behalf, with those contributions varying based on the profit the employer makes.

For example, you might promise to dedicate 5% of your practice’s profits to profit-sharing each year. If your profit is $100,000, you’ll add $5,000 across your employees’ 401(k)s. If the profit is $500,000, you’d split $25,000 across the accounts. Remember, you’re also an employee of your practice, so you also get to receive profit-sharing in the form of these tax-advantaged savings.

Benefits of Profit-Sharing for Employers

There are a number of good reasons to consider profit-sharing as an employer. One is that it can help you attract employees to your practice. Helping people save for retirement is a form of compensation, which can help make your practice stand out. It also helps with retention. The fact that the contributions are based on the practice’s profit also gives your employees an incentive to perform. The harder/better they work, the more money your practice makes, which means more money in their 401(k)s.

You also get to participate in the profit-sharing plan, which means you get all of the perks of a 401(k), too—including easier estate planning, protection for your retirement account, and tax-advantaged investing.

More information here:

The Criteria to Evaluate Before Running Your Own Practice Retirement Plan

Medical Practice Group Retirement Plans: The Good, the Bad, and the Ugly

Costs and Downsides of a Profit-Sharing 401(k)

Profit-sharing 401(k)s aren’t perfect for every situation. For one, offering a 401(k) of any kind adds complexity to running your business. You’ll have to spend time finding a company to work with to provide the 401(k) and pay various ongoing management fees. Some employees may also not find the idea of a profit-sharing 401(k) appealing. They could prefer simply getting a higher salary or a more predictable 401(k) matching program.

There’s also the fact that contributions to 401(k)s are limited. Employees can contribute $23,500 to the account, and employers can add additional funds up to $70,000 [2025 — visit our annual numbers page to get the most up-to-date figures].

How to Know If You Should Offer a Profit-Sharing 401(k)

Deciding whether to offer profit-sharing 401(k)s can be difficult for many physicians. The answer relies on a few factors, including how many employees you have and whether you’ll be participating too.

If you will participate, you need to consider things like where you live, the amount of insurance you carry, your personal risk profile, your level of assets, and your own personal fear of litigation. The estate planning benefit can be quantified as the expense and hassle of using a will and trust to determine where your assets go at death, instead of just naming beneficiaries as you would in a 401(k)/profit-sharing plan.

The expenses of the 401(k)/profit-sharing plan are relatively easy to figure out by bringing in an experienced advisor who can give you a quote for the initial and ongoing 401(k) expenses. If they are really good, they can keep your investment expenses no higher than they would be in a taxable account by using low-cost, passive funds in the plan.

The personal tax benefits of the plan are relatively easy to calculate, although some guesswork is required. The tax-protected growth factor is simply the difference between investing in a taxable account vs. investing in a Roth IRA. The tax rate arbitrage, of course, depends on future, unknowable tax rates. But if you're making contributions at a marginal rate of 33% and withdrawing the money at an effective rate of 18%, the benefit of this arbitrage can easily exceed the benefit of the tax-protected growth.

The value to the employees is perhaps the most difficult number to quantify. Each employee is different. The less they save, the less they're paid, and the less they think about retirement, the lower this benefit will be. It is quite possible that your expenses will be higher than the value your employees see in the benefit.

Try to figure out how much running the plan will cost, and then compare it to the expected benefit to decide if offering a 401(k) makes sense.

How to Structure Profit-Sharing at Year End

If you choose to offer a profit-sharing 401(k), one of the most important considerations is precisely how you’ll do the profit-sharing. You need to be careful when making this decision because of what is called non-discrimination testing. In other words, an employer cannot overly benefit highly compensated employees or be too top-heavy.

One of the most common methods for structuring profit-sharing is the “comp-to-comp” method. To use this method, find the sum of all of your employees’ annual pay. Then, divide each person's pay by that number to find what percentage of your company’s wage bill each person is earning. Then, give them that percentage of the profit-sharing pool.

This method is also considered a safe harbor method, meaning you don’t have to worry about non-discrimination testing.

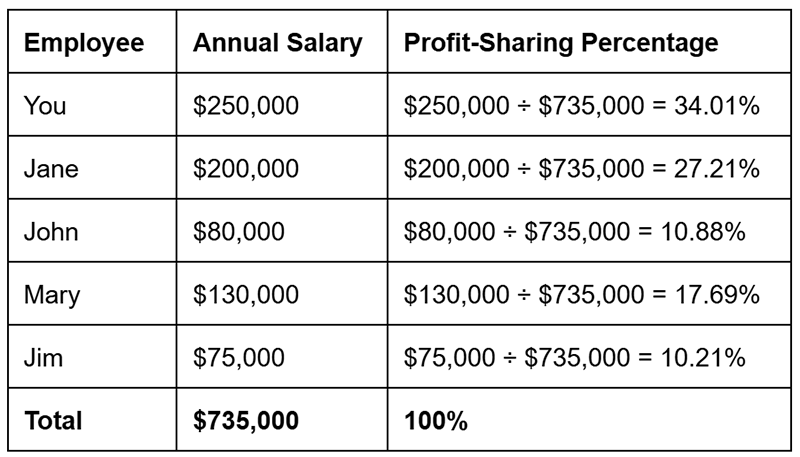

For example, imagine you have a practice with five employees. The table below shows their annual pay and the percentage of the profit-sharing pool they get.

Since Jane’s salary is equal to 27.21% of the practice’s total wage bill, she gets 27.21% of the money available for profit-sharing. Jim’s pay is 10.21% of the total wage bill, so he gets 10.21% of the profit-sharing pool, and so on.

Other non-safe harbor methods of structuring your profit-sharing include:

The Age-Weighted Method: This can be a great way to go if the business/practice owner is much older than all the employees. The logic behind this method is that contributions need to be comparable at retirement age.

So, if you're 60, the retirement age in the plan is 65, and the employees are 25, then a small lump sum at 25 that is allowed to grow for 40 years is equal to a much larger lump sum at 60 that can only grow for five years—especially when discounted at the maximum allowed 8.5%. A really young employee may only get a profit-sharing contribution of 3%-4% of salary, while the older owner can get a 20% contribution.

Beware, however, of hiring older staff with this method, even if they are not paid well. The profit-sharing contribution could be much higher than 20%!

The New Comparability Method: This method is gaining more popularity all the time among those who wish to minimize the size of the required contributions for employees. With this one, you split employees into different groups, such as Doctors/Owners and All Other Employees.

It turns out you can profit-share just 5% of the salary of the “All Other Employees” group, while profit-sharing 20% of your own salary.

Obviously, this is going to save a whole lot of cash compared to the Uniform Percentage of Pay Method, since it cuts your required profit-sharing contributions by 75%.

Non-Discrimination Testing

If you wind up using a non-safe harbor method, you’ll have to do non-discrimination testing to see how much each employee is allowed to contribute to their 401(k).

A highly compensated employee (HCE) is defined as one who owns 5% or more of the business or who earned more than $160,000 from the employer that year. The government uses a few tests to check for non-discrimination.

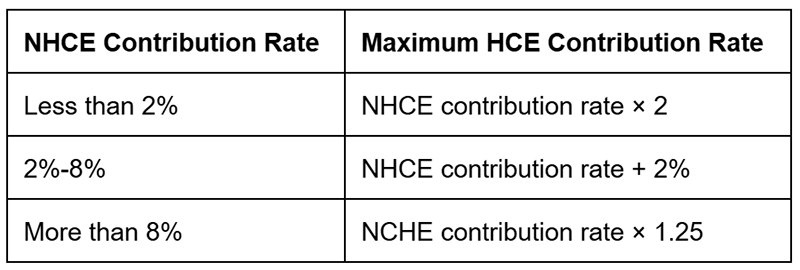

Actual Deferral Percentage (ADP): The amount that HCEs can contribute is directly proportional to the amount that the average non-highly compensated employee (NHCE) contributed as a percentage of their salary, using this formula:

If the average NHCE contributed 7% of their salary, HCEs could contribute 9%. If NHCEs contributed 12% of their salaries, HCEs could contribute 15%.

Actual Contribution Percentage (ACP): This is the same as the ADP test, but it includes money contributed by the employer when calculating the contribution rate, not just the amount contributed by the employee.

Top-Heavy Test: If HCEs hold 60% of the plan’s total assets, the employer must make minimum contributions to each non-HCE’s account equal to 3% of their pay.

More information here:

401(k) vs. Taxable Accounts

Is setting up a profit-sharing 401(k) plan worth all the effort? The answer is yes, especially if you want to save money on taxes.

To start, we’ll look at the savings from a normal 401(k)

Let's assume you have four employees whose combined salaries are $230,000, and you're going to use the 3% safe harbor mandatory contribution. That might cost you $2,000 in administrative costs. Your employer contributions are going to run 3% * $230,000 = $6,900, for a total of $8,900 per year after costs.

In exchange, you get to defer $23,500 per year. For the purposes of this example, we’ll assume you continue this plan for 30 years, never changing the cost or amount you defer. We’ll also make these assumptions:

- Your marginal tax rate is 33%

- You can withdraw contributions at 17% in retirement

- You earn 8% returns each year

- You can invest in a taxable account but pay 20% in dividend/long-term capital gains taxes

Over 30 years, you’ll have contributed $705,000. At 8% return, your portfolio would grow to $2.66 million. At 17% tax on withdrawals, you’d be able to get $2.21 million out of the account.

In a taxable account, you’d only contribute $472,350 because of the 33% marginal tax rate. At 8% returns, that would grow to $1.78 million, of which $1.31 million is gains. After paying 20% capital gains taxes on those gains, you’d get $1.52 million out of the account.

With a total cost of $8,900 pre-tax ($5,963 post-tax) for running the plan each year, you’d pay $178,890 in post-tax management fees over 30 years. That still leaves using a 401(k) as a winner by more than half a million dollars.

Now, let’s run the numbers again for a profit-sharing 401(k). This would let you max out both the employer and employee portions of the 401(k) contributions, deferring $70,000 per year.

After 30 years, you’d have saved $2.1 million, and your portfolio would have grown to $7.93 million. After 17% tax, you’d be able to take out more than $6.5 million. Even if you double the administrative costs and the amount you contribute on behalf of your employees, it’s easy to see that profit-sharing 401(k)s offer massively better opportunities for tax-advantaged savings.

Profit-Sharing 401(k) Checklist

Running a retirement plan is complicated, and using profit-sharing only makes it more so. Use this checklist when putting one together.

- Compare multiple retirement plan providers and financial institutions to select one for your account.

- Determine the best way to determine profit-sharing amounts.

- Decide on the amount of profit to dedicate to profit-sharing each year.

- Consider non-discrimination testing and whether to set up a safe harbor plan.

- Hire a recordkeeper or make sure you understand the reporting and documentation requirements.

- Adopt a written plan document.

- Inform your employees of the plan and provide any essential information to them.

The White Coat Investor is filled with posts like this, whether it’s increasing your financial literacy, showing you the best strategies on your path to financial success, or discussing the topic of mental wellness. To discover just how much The White Coat Investor can help you in your financial journey, start here to read some of our most popular posts and to see everything else WCI has to offer. And make sure to sign up for our newsletters to keep up with our newest content.