By Dr. Jim Dahle, WCI Founder

By Dr. Jim Dahle, WCI FounderA lot of people are surprised to learn that Katie and I have a six-figure Health Savings Account (HSA). We're kind of surprised too, but I guess we shouldn't be. Anyone who did what we did (which wasn't particularly difficult or complex) would be in the same position.

What Is a Health Savings Acccount (HSA)?

HSAs were introduced in the Medicare Prescription Drug, Improvement, and Modernization Act which took effect in 2004 during the George W. Bush administration. HSAs allow those whose only health insurance plan is a federally designated High Deductible Health Plan (HDHP) to open an additional tax-free savings/investment account to help pay that high deductible. It is a triple tax-free account: 1) contributions are tax-deductible, 2) it grows without any tax drag, and 3) as long as the money is spent on some type of healthcare, it comes out of the account tax-free, too.

Unlike a Flexible Savings Account (FSA), it is NOT a use-it-or-lose-it account. If there is money still in the HSA at the end of the year, it can be rolled over to the next year, even if you're no longer using an HDHP. The contribution amounts go up each year with inflation (in 2024, you can contribute $4,150 as a single person and $8,300 as a family). Employers sometimes provide them, and some will even withhold money from your paycheck to go into your HSA (it's also payroll tax-free when done that way), but the best ones are at institutions like Lively and Fidelity. You can roll the money into your favored HSA periodically if using an employer-provided HSA.

More information here:

Which Is the Best HSA? Lively vs. Fidelity Review

The Best Way to Track Your HSA Receipts

What Our HSA Looks Like

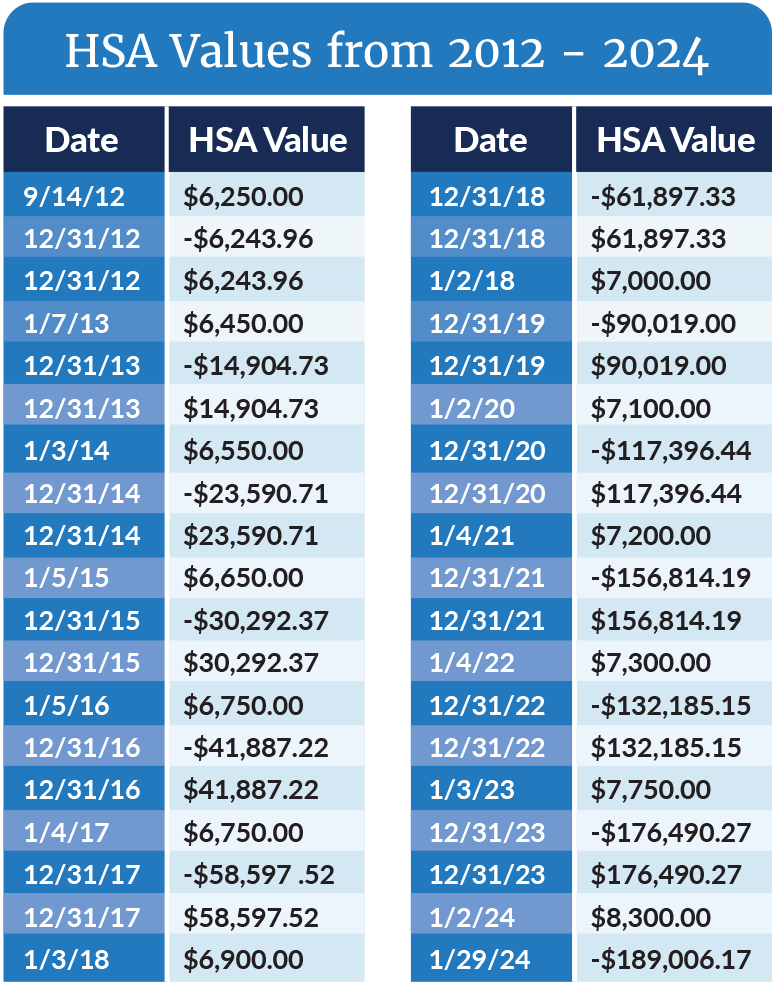

I updated our XIRR spreadsheet (at least the HSA section) for this post, and this is what it shows.

Annualized return: 11.78%

The positive numbers you see mostly in the first week of January are our annual contributions. The numbers on 12/31 of each year are simply the end-of-year value. The bottom number is the amount the HSA was worth on the day I wrote this post in January 2024: $189,006.

We keep it pretty simple in this HSA, investing the whole thing into a total stock market index fund. That was the Vanguard Total Stock Market ETF (VTI) for a while. Then, new contributions went into the Fidelity Zero Index Fund (FZROX) for a while. Now, they're going into VTI again. I haven't bothered consolidating those two holdings, so I actually have both in the account for no good reason other than my own laziness.

How We Built a 6-Figure HSA

How did we do this? Some of the lessons you can learn from what we did are HSA-specific, but most are not. They're simply good investing practices applied to a single account over a long time period.

#1 Start Early

We started using our HSA as soon as we became eligible to do so. See that first contribution? September 14, 2012. That was the month after I made partner and was no longer on the pre-partner health plan (which wasn't an HDHP). We didn't waste any time.

#2 Use a High Deductible Health Plan

We are fortunate that our family is healthy. When given the choice between a standard plan and a high deductible, the right answer for us is the high deductible plan. If you are going to use a high deductible health plan, you might as well use the HSA. So, we have been using an HDHP from 2012 until the present.

#3 Max Out the HSA

If you look carefully through the list of our contributions, it's basically a list of the annual HSA family contribution limits. We maxed it out every year from 2012-2024.

#4 Invest in the HSA Early

If you look at the dates of our contributions, you will see that an HSA, being our only triple tax-free account, is my favorite investing account. That's the first money we save each year. The money goes in just as soon as it can so it can start compounding tax-free just as soon as possible. Since 2013, the latest date in the year that we made a contribution was the 7th of January, and most years it was even earlier.

#5 Don't Spend from the HSA

You know what else helps you to have a big investing account? Not taking any money out of it. We probably should be taking out money for our occasional health expenses, but there's a bit of inertia there keeping us from doing it. We tell ourselves that we're doing the “save receipts now and take the money out later for a sailboat” thing, but we're not even that good at saving receipts. Mostly, we just pay for what healthcare expenses we have with our cash flow.

#6 Invest the Money

A lot of people don't realize you can actually invest the money in your HSA. Their money sits in a savings account at a crappy HSA provider paying less than 0.5% a year. As you can see from our record above, our account is worth $189,000. But we've only put $91,000 into it. Guess where the other half came from?

We invest the money, and we invest it aggressively. Knowing we have plenty of cash flow to pay our deductibles and other healthcare expenses, we don't bother keeping any of our HSA in cash, and that has really paid off in our returns over the years. Plus, let's be honest, US stocks were the place to have your money for the last decade, and out of sheer dumb luck and laziness, that's how we invested this entire account.

#7 Keep Fees Low

We've always done all we could to minimize our fees and other expenses. There's no churning and additional commissions in the account, the expense ratios are dirt cheap (0.03% and 0%), and we aren't paying any fees at all. For a few years, this account was at HSA Bank/TD Ameritrade. It's currently at Fidelity. I don't think any companies make much money off HSAs, and we've taken advantage of that fact to invest basically for free.

More information here:

25 Things You Must Do Before You Retire (and Here’s a Checklist to Help)

What We Plan to Do with the HSA

Our HSA is already six figures, and we're still in our 40s. If we keep doing what we've been doing, it's only going to get bigger. I guess theoretically it could even become a seven-figure HSA at some point. What are we going to do with that money?

#1 Pay for All Our Healthcare Expenses

We're eventually going to start using it for healthcare expenses. I was planning to start doing that two or three years ago (and even wrote a blog post about it). But we never actually got around to it (or published the blog post). Maybe this year. But the point is that the best thing to do with an HSA is to pay for healthcare. I'm sure we'll get to it eventually in between making content for you, seeing patients, coaching kids, and going on trips. Everyone says that retirees are likely to spend tons of money (I've seen estimates in the low- to mid-six figures) on healthcare. If that's true for us, well, we'll have the money.

#2 Leave It to Charity

In our case, however, most of it is probably going to charity, just like our tax-deferred accounts. We can live the rest of our lives off our taxable account. Inheritances will come from that taxable account and our tax-free (Roth accounts). But the worst kind of account to inherit is an HSA. It's 100% taxable to the heir at ordinary income tax rates in the year you die. But it's a great account for charity, which doesn't have to pay those taxes. So, that's where most of ours will likely go.

#3 Stealth IRA

There's also the option to take the money out and spend it ourselves on something besides healthcare. If we can find receipts for prior healthcare expenses, the money can come out tax-free. But after age 65, it can come out penalty-free (but not tax-free) and be used on anything. I guess that's always an option for an overfunded HSA, but I don't think it's an option we'll use.

HSAs are great investing accounts. Ours has done particularly well. Yours can, too. But then you'll have to figure out what you're going to do with it, just like we have.

If you need extra help with planning for retirement or have questions about the best way to save your money in tax-protected accounts, hire a WCI-vetted professional to help you figure it out.

What do you think? Do you have a big HSA? What do you plan to do with it?