By Dr. Jim Dahle, WCI Founder

By Dr. Jim Dahle, WCI FounderI wrote the post, Best Health Savings Accounts (HSAs) for those, like myself, using an HSA as another retirement investing account. I was looking for the lowest possible fees and the best possible investments. I ranked and reviewed the twelve best HSAs. Lively came out on top, but not by much. At that time, I was with the second choice on my list, HSA Bank, and the difference in my case was only about $35 a year. That wasn't quite enough money for me to overcome my inertia and switch.

I Moved My Health Savings Account to Fidelity

Then, a new development came on scene. Mutual fund giant Fidelity came out with an HSA. Even better, their HSA charges NO ANNUAL FEES AT ALL.

That was enough of a difference for me to get off my butt and actually make some changes. Even more motivating than lower fees was the opportunity to eliminate two financial accounts from my life. When I was at HSA Bank, I had an HSA Bank account and a TD Ameritrade account. By switching to Fidelity, I eliminated both of those two accounts from my life. I already had a Fidelity account (for the Fidelity 2% back card). Simplification is great.

I was worried I'd have to liquidate my account and move it over as cash. It doesn't make sense to move in order to save $75 a year in fees if you're out of the market for a few days and your HSA misses a $1,000 run up in the market. It turned out that was not an issue. I could just transfer my securities (100% VTI) in kind from TD Ameritrade to Fidelity. No big deal. There was a little bit of cash at TD Ameritrade and a little at HSA Bank and that came over as well. I combined the cash with my 2019 contribution ($7,000 for our family) and invested it into a similar Fidelity Index Fund. Not only does that mean I didn't pay any commissions, but I don't even pay an expense ratio since I went with Fidelity's fancy new Zero TSM Fund.

How to Open a Health Savings Account at Fidelity

I attempted to do the entire rollover online but was stymied. However, a quick call to Fidelity got me a very friendly and competent representative who took care of it so fast I considered moving all my money from Vanguard to Fidelity. I took a few screenshots of the process you may enjoy seeing.

No big deal, right. Just hit next.

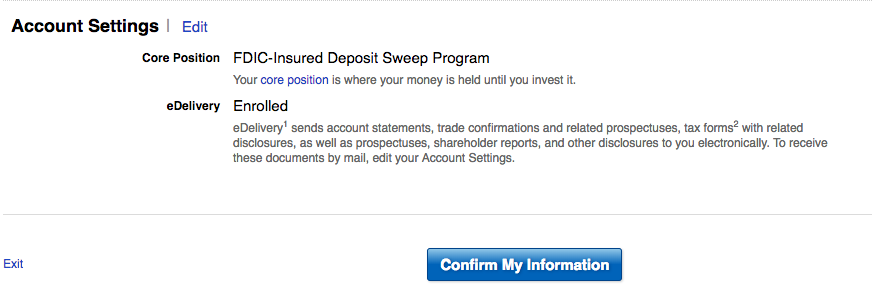

Then you just have to choose your sweep account. No big deal. There's obviously only one button to hit.

There's all the fine print if you want to read it.

See how easy this is? Click click click click.

Now all you have to do is transfer money from your bank (mine was already linked since I already had a Fidelity account) and buy an investment.

So I put my 2019 contribution in. Now there were a few more screens in there somewhere, but they were no more complicated than these. I just left them out because they showed my account numbers. It really was super easy to do this online, especially if you already have a Fidelity account. The rollover was a little trickier and I had to call customer service, but it happened very quickly and flawlessly. Now when I go into my HSA account, I can see my investments.

I log into Fidelity, click on the HSA account, and this is what I see:

Easy peasy. I have yet to pay any fee or commission whatsoever to Fidelity and I don't have to do a thing with it until next January when I contribute again. Could I simplify things a little by paying $4.95 to sell VTI and buy FZROX with it? I suppose I could but….inertia. Maybe one of these days I'll get around to it. The funds really are nearly identical.

The Lively Response

Right after I moved my account, Lively decided to match Fidelity by eliminating their already rock bottom fees in order to compete. By now my inertia had kicked in again and I really didn't want to switch again just to go to Lively. Seriously, if they had made that change the week before I might have a Lively HSA. The downside of Lively for me is that I would still have that TD Ameritrade account to worry about and I would just be exchanging an HSA Bank account for a Lively account. But the fees would be almost the same. I would pay Lively nothing and I would pay TD Ameritrade $6.95 once a year to buy $7K of VTI. Super cheap.

Fidelity vs. Lively Health Savings Account Review

As far as I know, no other HSA providers have eliminated their fees. So today we're going to go head to head comparing Lively to Fidelity. I will try to be as unbiased as I can be in my review, but that is going to be a little tricky for two reasons. First, I have a Fidelity account and second I am an affiliate partner with Lively. If you sign up for a Lively account through the links on this page, I make $10. Don't worry, it doesn't cost you any extra. We'll compare them in a handful of ways and you can draw your own conclusions.

HSA Fees

This one is almost a straight up draw. They both charge $0 for the typical fees. However, Fidelity has one fee Lively doesn't–a $25 account closing fee. Most HSAs have this, but Lively doesn't.

Advantage Lively.

Investment Options

Both Fidelity and TD Ameritrade (linked to your Lively HSA) are full-service brokerage options. You can buy anything. TD Ameritrade charges slightly more ($6.95/trade) than Fidelity ($4.95/trade) but both have a robust offering of commission-free ETFs. Fidelity has over 500 ETFs on their list (including all the iShares and Fidelity ones you are likely interested in). TD Ameritrade has over 300 ETFs on their list including many iShares and SPDR ETFs. Fidelity also has its very low-cost index funds available commission free. Both brokerages will charge you a small commission to buy Vanguard ETFs.

The edge here has to go to Fidelity, but let's be honest, the edge is very small and could easily be outweighed by other factors.

Cash Options

Sometimes you don't want all of your HSA money invested. You want it sitting in cash waiting for you to spend it. At Fidelity, the usual place for cash is your CORE FDIC Insured account. Now I suppose you could buy a money market fund at either brokerage as well. Fidelity offers its Prime MMF for no commission. TD Ameritrade made it very difficult to figure out what their best-paying no transaction fee MMF was, but at a minimum, you could pay a commission and buy a Fidelity or Vanguard Prime MMF.

The edge here again goes to Fidelity, although again, it is very small.

Convenience

This one is probably in the eye of the beholder. In my case, I already had a Fidelity account, so Fidelity is more convenient. If your employer uses Lively or if you already have a TD Ameritrade account, you may find Lively more convenient. Both are good companies with good customer service.

We'll call this one a draw.

HSA Features

Now that we've looked at the fees and the investing features, you can see that there is very little difference between these two stalwarts. So let's take a look at the HSA features. While these don't matter all that much to me right now, eventually I may actually start using HSA money for, you know, health care expenses or something.

Both companies offer debit cards. They both have useful websites. They both allow you to upload and store receipts from health care purchases. Fidelity offers online bill pay (Lively doesn't). Fidelity offers check writing (Lively doesn't.) Fidelity has an app (Lively doesn't.) Fidelity gets rated higher by HSA experts. Lively gets rated higher by actual HSA users.

However, at Fidelity, you can tell that HSAs are just one thing they do. It feels like a brokerage or a mutual fund company. At Lively, it's all HSA all the time. The company is clearly built from the ground up to do one thing and one thing only–HSAs. And it does a darn good job of it.

The edge here goes to Lively, although if you really want check writing or online bill pay capability, that might be enough to sway you to Fidelity.

Which Is the Best HSA, Fidelity, or Lively?

Overall, the differences between these two HSA juggernauts are slight. They are both head and shoulders over all of the other HSAs currently being offered. I don't think you can really go wrong with either one of them. If you do decide to open an HSA at Lively, I appreciate you going through the links on this page to help support this website.

Open a Lively HSA Today!

What do you think of my review? Which HSA provider do you use and why? Which one do you think is best? What do you like and dislike about the Fidelity and Lively HSAs?

[This updated post originally published in 2019.]