No matter how old-school you think you are, no matter how much you want to see movies and listen to music created by real-life human beings, no matter how much you want to use spreadsheets to figure out whether you’re on the road to retirement, no matter how much you want to make friends and get emotional support from something that actually has a heartbeat, I’ve come to this conclusion over the past couple of years: AI is inevitable, and it’s going to seep into your life.

I started my journalism career in newspapers, which had already weathered the storms brought in by radio and TV earlier in the 20th century. Then, journalism turned to blogs and the internet. Then, we pivoted to video. Then, search engine optimization became the wave of the future. The journalism business could survive most of that.

Now, it’s all about AI, and no matter how much you or I might not be excited about the present and future revolution that machine learning will rain down upon us, it all seems so inescapable. And many industries, including journalism, seem ill-prepared for the fallout.

An AI bubble might eventually explode and cause havoc in the financial world. Those eerie Boston Dynamics robot dogs might rise up to destroy all of us. And the AI slop that has invaded our Facebook stories and Instagram reels might cause our brains to rot.

But AI, even when it’s complimenting The White Coat Investor or talking about its own limitations when doling out financial advice, isn’t going anywhere.

And many people are now making the easier choice when it comes to financial planning. They’re asking ChatGPT, Gemini, or Claude for a plan they can follow to build wealth, pay less in taxes, or spend in retirement. Whether that’s a good idea is questionable. Even ChatGPT had this to say when I asked it last June whether people could trust chatbots for good financial advice: “You’ve hit the heart of a huge, ongoing debate—can people trust chatbots like ChatGPT for financial advice? The honest answer is: not completely—and not yet. But it’s possible in a limited, smart, and clearly understood way.”

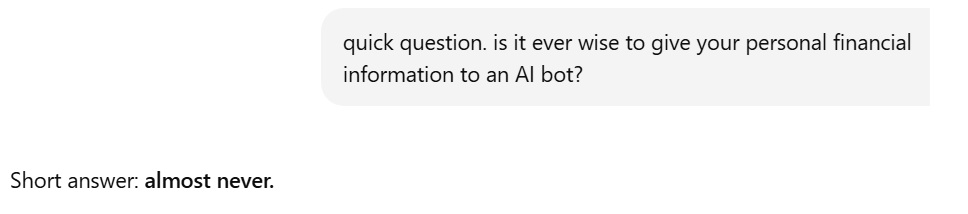

To get a specific plan formulated by AI, you’ll likely need to input your own data onto the internet. For those who feel squeamish about doing so because you’re concerned about data breaches, identity fraud, and government eavesdropping, here’s a question: is that a good idea?

Sharing Financial Info with AI

Should you give up your financial info to get specific advice from an LLM? The answer is probably not.

“Any time you're sharing your own personal, non-public information with a non-financial services provider that, frankly, isn't as regulated as closely—where information sharing practices aren't as governed as they are with a financial institution—there certainly is concern,” Chris Powell, head of deposits at Citizens Bank, told Money.com.

While AI might be OK for more general financial advice, that doesn’t mean oversharing your personal and sensitive information is the smart move—or even all that helpful.

As somebody in IT whom I know and trust told me:

“I think it's probably not a good idea to trust any advice you get from those tools. That's probably the real issue. That may be a bigger issue than sharing . . . It's probably fine to share general information, but are you really expecting different general advice than you already know? I think those asking this question may really be asking for permission to not follow the truths they already know . . . trying to find a shortcut to wealth, etc.”

Also consider that Gemini and ChatGPT store your conversation history and that some of those conversations are reviewed by Google and OpenAI employees for “quality improvement,” meaning there’s a remote chance that your information could be used in nefarious ways by a bad actor.

“At the moment, it is best not to put any confidential financial information into an LLM tool,” Alastair Paterson, CEO and co-founder of Harmonic Security, told Money.com.

I even asked ChatGPT about it.

Even more worrisome, it was reported last summer that Google began indexing ChatGPT conversations, meaning those bits of info you’re providing to the LLM could have turned up in somebody else’s Google search. OpenAI quickly turned off that capability, but that doesn’t mean something similar couldn’t happen in the future.

After all, how many people’s private thoughts and photos have been hacked for all the world to see?

But People's Info Is Out There Anyway, Right?

In the past several months on the WCI Facebook group, one user said they utilized LLMs for running Monte Carlo scenarios on their retirement portfolio (although that person also talked about AI’s “tendency to make things up”), and somebody suggested using ChatGPT for help with contract negotiations. But other than that, the WCI Facebook group members, who theoretically would be more financially literate than most other people, are more interested in sourcing their information and seeking advice from humans.

Which was a pleasant surprise.

In other forums, though, the idea of using ChatGPT to build a portfolio using personal information is a more acceptable practice. And I can see the point. Why pay a financial advisor thousands of dollars per year when you can just ask your friendly AI bot for some help? As one person on the Bogleheads forum wrote last year,

“I hired a fee-only financial planner to discuss retirement planning. I expect to pay him about $7,000 by the time we are done. Out of curiosity, I submitted a detailed description of our finances to ChatGPT (free version) and asked for a Roth conversion plan and suggested asset allocation for each account. The result was remarkably similar to the advice received from the planner, and very consistent with Boglehead philosophy. The planner is still working on a Roth conversion strategy, and the Chat summary said we don't have a good opportunity for conversions because we don't have a year with low taxes . . . I enjoy talking to the planner, and he has helped me feel more confident about asset allocations and other decisions, but I'll be running most questions through ChatGPT first now.”

Plus, isn’t most of our personal info sitting out there on the internet, ready to be stolen or sold, anyway? And haven’t credit reporting agencies that have plenty of your info been hacked and leaked? Same with password managers, right? And don’t budget apps that you know and love already utilize built-in AI assistants?

And getting back to my original question: isn’t AI just inevitable anyway?

Sure, but why give thieves or bad actors even more of a chance to pry into your bank and retirement accounts by telling that info to Claude and Gemini?

“I don't think there's much value in sharing your financial information with ChatGPT/Claude/Gemini,” my trusted IT friend said. “There is definitely risk in sharing anything with those tools, so the risk/reward ratio doesn't make sense to do it.”

If you are tempted to make use of chatbots for financial help, here’s what you shouldn’t input into the conversation:

- Your bank/investment account numbers

- Your Social Security number

- Any logins or passwords

- Your full name, address, and birthday

- Tax returns or pay stubs

- Any of your crypto passwords and keys

- The names of old pets, the street address where you grew up, your mother’s maiden name, and the name of your elementary school

I’m not going to be putting my personal info into the LLMs anytime soon. But what do I know? I’ll always consider myself a newspaper guy, because that’s where I started my career and what I loved. But I haven’t physically picked up a newspaper in years.

Technology advances, things change, and the stuff we swore we would never do has just become too easy not to—and if AI takes over the world and destroys the way of life we've always known, it's not like any of this will matter anyway.

More information here:

Artificial Intelligence: Toy, Tool, or Takeover for Doctors?

What Is the Worst Financial Advice You Ever Got?

Money Song of the Week

Your parents give you life, and then they pass their values onto you. If you, in turn, eventually have children of your own, you probably will do the same for them. As a parent, you hope they take all the good aspects of how you live your life and ignore the stuff of which you’re not proud. You hope they can become better than you.

While today’s Money Song of the Week isn’t about money or finances, it’s still important nonetheless. Here’s what a WCIer wrote in the comments section of a podcast show notes post from 2025:

“I can relate to feeling that my family couldn’t afford to pay for competitive sports when I was young. When my daughters had the opportunity to participate in competitive sports, at first I was hesitant to spend the money, but my husband convinced me of the value of it. He grew up playing competitive hockey, and he shared how it challenged him, taught him to persevere, and develop confidence in difficult situations. I can already see the positive influence a competitive activity is having for our daughters, and while I’m so thankful we can afford to provide this for them, I also feel the challenge to teach them humble gratitude, and compassion for others who can’t participate.

Part of why I’ve been thinking about this lately, is I recently heard the song Unsung Hero by For King + Country, and it inspired me to focus on, ‘What values do I want to pass to our children?’ It’s a work in progress, and I’ve realized part of what I want pass on is to be an example of finding my true purpose in humbly serving others . . . Along with this, I’m learning how to view our financial resources as part of how we can serve others.”

I took a listen to For King + Country’s 2022 tune Unsung Hero, and yeah, you’d have to admit that it would be one of the grandest accomplishments of your life if one (or more) of your kids wrote a song about you with a chorus like this.

“You're strong like your father, even when you are scared/When I was in trouble, you nevеr left me therе/And you love like your mother, like there's nothing to lose/You're an unsung hero, so I'll sing this song for you.”

As Luke and Joel Smallbone, who make up the Christian pop duo, told Billboard, the song honors the decision their parents made to immigrate from Australia to the US with their six children after their father David’s music business lost hundreds of thousands of dollars. After landing in Nashville, the family “cleaned houses, raked leaves, mowed lawns, and did whatever odd jobs they could find” to survive in a new land.

As Luke Smallbone told Cross Rhythms, “I think what Mom and Dad really proved to us is that struggle is guaranteed in this world. And what are you going to do with it? I think that's the thing that when we look back, years and years, you start to see someone with a hope and a dream. And we all have hopes and we all have dreams. But sometimes you don't really hear about the struggle because when the hopes and the dreams fail, you don't talk about it anymore. You move on to something, a new dream, a new hope, in hopes that it's successful.”

More information here:

Every Money Song of the Week Ever Published

Facebook Video of the Week

As we say a tearful farewell to actor James Van Der Beek, who died from cancer this week at the age of 48, here's one of his amazing messages from March 2025. It's not money-related, but hopefully, it will warm your heart.

Have you ever given your personal info to AI? Would you ever? If not, what is your concern? Do you trust AI for anything?