As a medical professional, you've likely shouldered a mountain of student debt to earn your white coat. For years, IDR and PSLF provided relief. But with the One Big Beautiful Bill Act (OBBBA), signed July 4, 2025, the landscape has changed. New federal borrowing caps, fewer repayment options, and the gradual erosion of some forgiveness perks have more borrowers considering privately refinancing their student loans. Especially now, since the SAVE interest freeze ended on August 1 and interest rates are trending downward.

If you're a doctor, dentist, or high earner with mortgage-sized student loans who's wondering about refinancing, this guide breaks it all down.

Privately Refinancing Eliminates Federal Protections

If you already have a private loan and you're looking to refinance it again, it makes sense to do so anytime you can lower the interest rate. However, if you're converting federal loans to private loans, you have to consider the federal protections that will go away. Once a federal loan is refinanced into a private loan, you can never convert it back to federal. Here are the key federal protections.

- Deferment or forbearance: Federal loans offer deferment and forbearance options, although interest often accrues and OBBBA cut discretionary forbearance from three years to nine months. Private lenders rarely provide the same flexibility.

- Income-driven repayment plans and standard repayment program: Federal loans offer IDR plans, which can keep payments affordable during training. By contrast, private refinancing locks borrowers into fixed repayment terms that may be far costlier once training ends.

- Death and disability discharge: Federal loans are discharged if the borrower dies or becomes permanently disabled—protections that many private lenders don’t match. Read the fine print before refinancing, or else your family could be on the hook for your loans.

- Public Service Loan Forgiveness and IDR forgiveness: Federal forgiveness programs like PSLF can save physicians hundreds of thousands of dollars, but once you refinance, those options are gone. Be certain you're making the right choice before refinancing.

More information here:

Beyond PSLF: The Top Student Loan Repayment Alternatives for Doctors

Nervous About the Government Taking Away PSLF? Start a PSLF Side Fund

Who Should Refinance Student Loans Now?

There are a couple of common scenarios I see for those who should consider refinancing their student loans now.

Private Practice Physicians

If you’re in a private practice or private group, you usually have no shot at PSLF. If you work in pharma or for an insurance company, those are also privately held organizations, and you won't qualify there either. There are two exceptions to the rule. First is an MD/DO/DPM working in California and Texas. There was a rule change a few years ago that granted PSLF eligibility for doctors contracted to work at nonprofits (i.e., Kaiser, Sutter, even locums).

The other segment that could put off refinancing is those considering the dreaded IDR forgiveness. IDR forgiveness might appeal to those who

- Work part-time (or less) or

- Work at an organization that doesn't qualify for PSLF.

They also need to have student loans that are 2x, 3x, or 4x their income. I don't like this program at all since it is at least a 20-year commitment, the forgiven balance is taxable, and it's subject to change. I've chatted with quite a few doctors who were pursuing an IDR plan called PAYE that reached forgiveness in 20 years and then found out they would be forced into IBR with a higher monthly payment and five additional years of payments. Yikes. Needless to say, there are very few white coat investors who should look into IDR forgiveness.

Most working in private practice/groups will save money by refinancing their loans from the federal government to private.

Physicians with Smaller Balances

Those who owe less than $100,000 can usually pay it off quickly, and they won't benefit much from forgiveness programs. There are a few exceptions, such as those who train for eight-plus years (cardiology, CT surgery, or peds surgery) or who have an income less than $200,000. Otherwise, with a loan balance that low, you'll be better off refinancing and paying it off in less than five years. Most can pay it off in a year or two and not necessarily have to live like a resident.

Physicians with Aggressive Repayment Goals

Some doctors I work with just want the debt gone as quickly as possible. I encounter scenarios where the doctor would save a lot of money by doing a forgiveness program, but they decide against it. Usually, it has to do with them not trusting the government or feeling guilty for pursuing a forgiveness program. Rather than paying your loans at 7%-9%, refinancing to a lower rate may save you thousands in interest.

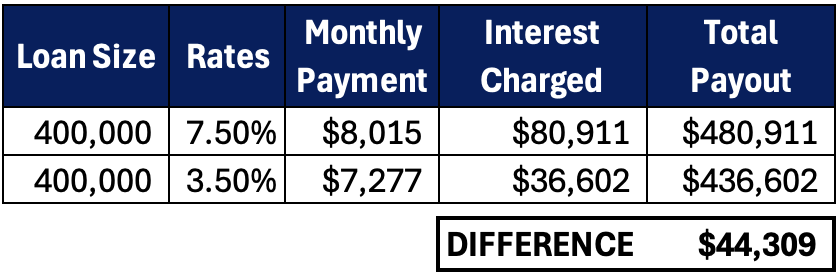

Here's an example of a doctor who refinances $400,000 at a 7.5% federal rate to a 3.5% private rate over a five-year term.

This doc would save $44,309 in interest over five years compared to staying federal.

Who Should Think Twice Before Refinancing Student Loans?

Postponing refinancing is not a bad idea for these two groups.

Physicians in Training

While in training, it is almost always better to keep your loans federal. Payments can be affordable—$200-$400 per month in an IDR plan. Plus, you may be uncertain about the job you'll be taking after you graduate from training. If you'd prefer to pay more than the required IDR payment, you can do so to help curb the interest. Those who have already signed an offer with a private practice or have a spouse or partner who can help support them with the payments can consider refinancing while in training. Just be absolutely certain you won't regret passing up PSLF.

Physicians Uncertain in Career Paths

If you have any uncertainty about whether you'll stay at your private group or private practice, you could hold off on refinancing your student loans. Keeping PSLF eligibility could become a valuable option. According to a 2023 survey from MGMA and Jackson Search Group, physicians who completed residency or fellowship in the six years prior were spending less than two years on average in their first job before leaving. Moreover, I've met with several docs who thought they were dyed-in-the-wool private practice doctors and ended up going back to hospital employment after a year. The bottom line is to keep your loans federal and forgiveness as an option until you're certain you'll be out of public service for good.

More information here:

The Case for Ending PSLF — And What You Should Do

Repayment Assistance Plan (RAP) Helps Early-Career Physicians

The OBBBA shook up repayment plans for federal student loans. The Repayment Assistance Plan (RAP) was created as the newest iteration of IDR plans. RAP opens on July 1, 2026, and it's an option for any federal borrower. It's the only IDR plan for those who borrow or consolidate a federal loan on July 1, 2026, or later.

The RAP plan has an interest subsidy component that mirrors IDR predecessors such as SAVE and REPAYE. Payments in RAP start at a minimum of $10 per month for an Adjusted Gross Income (AGI) under $10,000, and it scales upward in 1% increments per $10,000 bracket (e.g., 1% of AGI for $10,000-$19,999, rising to 10% for $100,000 or more). An interest subsidy is applied if your monthly payment in RAP is not enough to cover the monthly interest. And it pays $50 toward the principal balance of the loan. Here's an example of a resident physician.

Dr. Patel owes $343,000 at a 7% interest rate. Her interest is $2,000 per month, and her payment in RAP is $400 per month. Each month, she makes her required $400 payment, and $1,600 in unpaid interest is waived. With the interest benefit, it keeps her loan balance from growing, and $50 is applied to the principal each month. Her equivalent interest rate after the interest subsidy is applied is 1.40% ($400 * 12 / $343,000). That means her rate while in RAP during that year in training is 1.40%. It's unlikely she could refinance her loan to a lower interest rate than that.

Low subsidized rates would occur during training and even into the first year or two of practice due to the delay with IDR recertification. However, once you certify income with a full year's attending salary or even the half trainee/half attending year, you should look into refinancing your student loans to a lower rate as the subsidy is likely phased out. You only move forward with the refinance if you've ruled out any chance at pursuing PSLF.

Interest rates have been trending downward lately (and the Fed cut rates by 25 basis points earlier this month), and they may continue in that direction next year after current Federal Reserve Chair Jerome Powell's term expires in May 2026. With the SAVE interest freeze over, now is a great time to consider refinancing your student loans to a lower interest rate. Before you refinance, run the numbers and be certain PSLF isn’t a better fit. If you want help comparing, schedule a consultation with StudentLoanAdvice.com. If you're ready to refinance now, get a quote instantly with one of WCI's vetted resources.

Variable 5.04%-9.05% APR

† Bonus includes cash rebates and value of free course. Borrowers who refinance more than $60,000 in student loans using the WCI links will be enrolled in The White Coat Investor’s flagship course, Fire Your Financial Advisor: ATTENDING for free ($799 value). Borrowers will still receive the amazing cash rebates that WCI has negotiated with each lender. Offer valid for loan applications submitted from May 1, 2021 through April 30, 2026. Free course must be claimed within 90 days of loan disbursement. To claim free course enrollment, visit https://www.whitecoatinvestor.com/RefiBonus.

What do you think? Have you refinanced your loans lately? Are you considering refinancing your loans now? Why or why not?