President Donald Trump signed the much-anticipated and discussed One Big Beautiful Bill Act (OBBBA) into law on July 4, 2025. As President Barack Obama famously said, “Elections have consequences,” and when American voters sweep one party into control of the House, the Senate, and the White House, society-changing legislation usually results. Examples include the Patient Protection and Affordable Care Act (PPACA) in 2009 and the Tax Cuts and Jobs Act (TCJA) in 2017.

Your feelings on the legislation are likely highly flavored by your political views, but the truth is that most people are affected both positively and negatively by such extensive legislative change. In this post, we'll outline the ways in which a typical white coat investor will be affected. Jim wrote the majority of the post, but Andrew Paulson, of StudentLoanAdvice.com fame who knows more about managing physician student loans than anybody in the country, wrote the student loan section.

A Caveat

As we write this post, this law has just been passed. Not every detail of how it will be implemented is known, and it is such a large piece of legislation that there might be errors in this post. If you see one, mention it in the comments, and we'll get it fixed ASAP. If there is something important we omitted that will affect WCIer families, mention that too, and we'll get it added.

Too Long, Didn't Read (TL, DR) Version

The tax cuts, both new and extended, are generally going to be good for the finances of white coat investors. Since taxes are mostly paid by high earners, any cut in taxes generally benefits high earners the most. The changes to healthcare will be mostly bad, as they will decrease the incomes of physicians, particularly those who own their own practices with a large Medicaid payor mix and especially emergency physicians, obstetricians, and others to whom EMTALA frequently applies. Just like the PPACA was good news for these docs, this law is bad news.

The student loan changes are close to disastrous for indebted white coat investors, with much less generous IDR programs and less debt that will be eligible for PSLF. There is precious little good news there for WCIers. While many current borrowers will be grandfathered into the changes, student loan refinancing is going to have a much bigger role in student loan management in the future than it has in the last four years.

The OBBBA, along with executive policy changes, is pretty terrible for many immigrants, including lots of students, residents, and physicians. The new law boosts military spending, but this won't have much of an effect on most WCIers. Base Allowance for Housing (BAH) will go up, and there will be more funding for military healthcare, so perhaps there will be a bit of a raise for military docs. There will be significant additional spending in rural areas, on transportation, and for border security. The budget deficit (and thus the federal debt) will be increased significantly, but discussion of that issue is beyond the scope of this article (although it may be discussed in a later post).

Whether the legislation is overall good or bad for the country is a matter of personal opinion, and it will be highly related to your political persuasion. Politics begins when reasonable people can disagree on a given subject. Bear that in mind when making comments on this post.

More information here:

Staying the Course Despite the Trump Tariffs

The Case for Ending PSLF — And What You Should Do

Tax Changes

Perhaps the greatest motivation for this bill was to extend (and often make permanent) the tax cuts implemented in the TCJA, many of which were scheduled to expire at the end of 2025. These include:

- New tax brackets with a top bracket of 37% are now permanent (the corporate rate of 21% was already permanent).

- Section 199A (Qualified Business Income-QBI) Deduction is now permanent (at 20% of QBI) for sole proprietorships, partnerships, and S Corps. High-earning doctors and other specified service businesses are still excluded. There is a new limitation on how itemized deductions affect the 199A deduction, but it's relatively minor.

- Higher estate tax exemption limits were extended and actually increased to $15 million per spouse and still indexed to inflation

- SALT deduction limitations were extended, but they are now less limited—at least until 2030, when it reverts to $10,000 per year for everyone. Now the state and local tax deduction (mostly state/local income but also property) can be as high as $40,000 (and increases by 1% a year through 2029), but it starts phasing out at a MAGI of $500,000 (single and MFJ, but not MFS, which is half that amount) and is mostly down to $10,000 by a MAGI of $600,000.

- Bonus depreciation extended. If you use your NetJets subscription (or other eligible business expense) only for business until the end of the year you buy it, you can basically expense the whole thing that first year. This is now permanent.

- Changes to some international income taxes. There are lots of these, but we think few will affect any WCIers at all. But if you pay tax on international income, it's worth looking at these.

- Opportunity Zone renewal and enhancement. Remember those funds some investors with large capital gains used to invest in real estate in supposedly downtrodden areas in order to reduce taxes? They're back. There might be more rural benefits this time.

These changes are mostly good for WCIers compared to pre-TCJA laws, although it would have been nice to see the discriminatory-feeling, specified service business limitations go away.

There were plenty of new tax changes as well.

- Increased ($15,750 and $31,500 MFJ) standard deduction for 2025.

- Bonus deduction for the elderly. It's increased from $1,600 ($2,000 single/deceased spouse) to $7,600 ($8,000 single/deceased spouse) through 2028. This only applies to those with less than $75,000 of income, and it has been billed as “eliminating the tax on Social Security,” although it does no such thing directly. It is just an offsetting age and income-based deduction.

- Child tax credit increased to $2,200 (still $1,700 refundable). It still starts phasing out at a MAGI of $200,000 ($400,000 MFJ).

- Tax-free tips and overtime. It's temporary (through 2028) and phases out at higher incomes (MAGI of $150,000/$300,000), but up to $25,000 in tips and $12,500 in overtime pay get an above-the-line deduction now. I'm not sure most cash tips get reported anyway, but wouldn't it be cool if resident salary structures could be changed so that half of their income is due to working overtime?

- Auto loan interest deduction means up to $10,000 in auto loan interest on newly purchased cars can be deducted through 2028. It's only temporary, and it's limited to cars “whose final assembly was in the USA.” This makes buying brand new cars on credit slightly less stupid.

- Charitable donation deduction for non-itemizers is $1,000 ($2,000 MFJ) per year. This popular previous deduction is back starting in 2026 and permanent.

- 0.5% Floor on itemized charitable deductions, which means that the first 0.5% of your taxable income donated to charity is no longer deductible. The combination of the two changes means that Congress has decided to incentivize small gifts and disincentivize large gifts, but the changes are pretty slight. QCDs (the best way to give after RMD age) are unaffected.

- Trump accounts mean that when you have a new baby, you get a $1,000 credit into a Trump account, and $5,000 more can be contributed. It can apparently be used for school, small business expenses, or a first home. There's no tax deduction for contributions, but taxation will apparently be similar to IRAs. Details are still a little tough to sort out, there will be a post all about these soon. We're not sure the complexity is worth it, but “baby bond accounts” have had bipartisan support for years. If it gets more people saving and investing from birth, we think it's overall a good thing.

- University endowment tax is an increase in excise tax (0%-8% of value) on large (at least related to the number of students) endowments, and it will feel a bit confiscatory to many universities, their professors (including docs), and their donors. Like the prior excise tax established by the TCJA, it applies to net investment income, not assets. It makes us wonder what other types of “unapproved” nonprofit institutions could be targeted next. Churches, perhaps?

- Itemized Deduction Limitation somewhat similar to the “Pease” limitation of the past. Basically if you make a lot, your itemized deductions are only good for a 35% deduction instead of a 37% deduction.

- K-12 529 qualified withdrawals increased to $20,000 per year, up from $10,000.

Few of these will have much effect on the tax burdens of WCIers, but you may see a little bit of benefit or harm depending on your situation.

Healthcare Changes

You might have been feeling pretty good after reading the tax section above. This section will be more depressing.

- Medicaid/CHIP Community Engagement requirement says that if you're 19+ and without a “hardship event,” you'll have to spend 80+ hours a month working, in school, or doing community service, or you'll lose your Medicaid and your children's CHIP. Parents/guardians living with dependent kids can be exempted . . . if their state agrees to do so.

- Certain non-citizens can no longer enroll in Medicaid, CHIP, or Medicare, and they can't get premium subsidies or ACA plans. Undocumented immigrants have never been eligible, but these changes affect many “legal” immigrants, too. That might include a lot of your patients.

- Medicaid/CHIP Eligibility determinations will now have to occur every six months.

- Eliminate Medicaid payments to entities providing family planning, reproductive health, or abortion services.

- Increased cost-sharing means it'll be $35 co-pays for lots of non-primary care or mental health visits. This may reduce the percentage of “four-fers” in the ED.

- Medicaid payments are now capped at Medicare limits. That'll be 110% of Medicare limits for “non-ACA expansion” states (many “red” states). We didn't know Medicaid ever paid more than Medicare, but apparently, it can in some states. Some “Medicaid Direct Payment Programs” can be grandfathered in to higher rates, delaying this cap for three more years.

- State provider tax limitations. Apparently, something like 17% of state Medicaid expenditures are paid for by a “provider tax” on those providing the care. Limiting those taxes seems fair to me. Provider tax is really just a loophole states use to get more money from the Feds for Medicaid. Minimizing it or eliminating it for all states sounds like a good way to reduce fraud, waste, and abuse to me.

- Temporary doc fix with the 2.5% Medicare fee schedule increase for 2026. It's still not indexed to inflation; it's just a one-time “fix.” Just like all the other ones.

- Exemption of orphan drugs from Medicare negotiation. Drugs that are used to treat rare diseases can still be so expensive that your Medicare patients won't be able to afford them.

- Rural Health Transformation Program is the first good news for healthcare with $50 billion being set aside to help rural hospitals and providers.

- Biden-era healthcare rules delayed until 2034. These include such rules as minimum staffing in LTC facilities.

- Direct Primary Care (DPC) payments are now an eligible HSA expense. It's bonkers that they weren't before.

- Telehealth can also be paid for even before an HDHP deductible is met.

Overall, these changes might help some docs a little, but the decreased eligibility for Medicaid and CHIP will probably outweigh all of those changes. Estimates are that 10-17 million of the 72 million people on Medicaid will lose it. That will increase the number of “self-pay” patients by about 50%

Student Loan Changes

The OBBBA alters student loan repayment for all borrowers, with a more significant impact on current and future medical students.

Lower Borrowing Caps for Higher Education

Starting July 1, 2026, the OBBBA is introducing lower federal loan limits that will significantly impact medical and professional students. The Graduate Plus loan program created in 2006, will be discontinued as well.

New federal borrowing caps:

- $100,000 for graduate school ($20,500 per year)

- $200,000 for professional school ($50,000 per year)

- $65,000 (per child) for parent plus loans ($20,000 per year)

Please note: students still in school who borrowed before July 1, 2026, will have three additional years of borrowing under the older standard, allowing borrowing up to the cost of attendance.

Lower federal loan caps will force many students to rely on private loans to finance their education. Private student loans have less favorable terms and stricter underwriting requirements, and they commonly require a co-signer to receive them. This shift could disproportionately impact first-generation or low-income students, potentially limiting access to medical education.

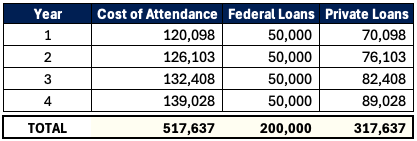

There's a DO program in our home state of Utah called Rocky Vista University. For the 2025-2026 academic year, the cost of attendance (COA) is $120,098. A medical student can only borrow up to $50,000 per year federally in the future. The overall $200,000 loan doesn't quite cover half of this student's education over four years. Assuming the COA increases 5% per year, this student borrows $517,637 in student loans overall with $317,637 of that with private loans

That's a steep debt mountain to climb, regardless of specialty. And we aren't even factoring in interest growth while the student is in school, which could be nearly $100,000. This reliance on private loans that are ineligible for federal programs like Income Driven Repayment (IDR) or Public Service Loan Forgiveness (PSLF)—and often at higher interest rates (like 11%)—may dramatically increase costs for students. Schools may face pressure to curb tuition increases, but for now, students must plan strategically to manage this new reality.

PSLF Could Become Less Common

Over 1 million public servants have had their loans discharged through the Public Service Loan Forgiveness Program (PSLF). PSLF has become a lifeline for doctors and other public servants who work in nonprofits or academia. While earlier OBBBA drafts excluded medical residencies from PSLF eligibility, the final bill restored this key provision. However, with new federal loan caps now lowered for medical and professional school, PSLF becomes less attractive for future borrowers as they'll have less federal debt eligible for forgiveness.

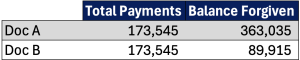

Here's an example of two psychiatrists pursuing PSLF:

Doc A = $400,000 at 7%

Doc B = $200,000 at 7% (new federal limit)

Both earn $65,000 during their four-year residencies and $350,000 as attendings. They are in the newly proposed Repayment Assistance Plan (RAP = 10% of adjusted gross income).

Doc A benefits significantly from the original PSLF with more than $360,000 forgiven. Doc B would also benefit, but it would result in far less forgiven since they had a lower federal balance. Doc B may find private refinancing combined with higher-paying private practice jobs more appealing than PSLF-eligible employers. PSLF will still work out for those in lower-earning specialities or extended training periods (5+ years). But it's going to be far less of a factor for future doctors.

Repayment Plan Overhaul

OBBBA simplifies federal loan repayment options for new borrowers (loans on or after July 1, 2026) to two plans. Existing repayment options such as Income Based Repayment (IBR), Pay As You Earn (PAYE), Saving on a Valuable Education (SAVE), and Income-Contingent Repayment (ICR) will be eliminated for new borrowers. Existing borrowers must transition to one of three plans by July 1, 2028: Standard Repayment, Repayment Assistance Plan (RAP), or modified Income Based Repayment (IBR).

New Borrower (Post-July 1, 2026) Repayment Options

- Standard Repayment or

- Repayment Assistance Plan (RAP)

The new standard repayment plan term and payments are based on your loan balance.

- 10-year payoff for balances of $1-$24,999

- 15-year payoff for balances of $25,000-$49,999

- 20-year payoff for balances of $50,000-$99,999

- 25-year payoff for balances of $100,000 or greater

Standard repayment would not qualify for the PSLF program.

The Repayment Assistance Plan (RAP) is an income-based repayment plan similar to previous programs. However, RAP bases payments on Adjusted Gross Income (AGI) rather than discretionary income. Dual-earning couples can exclude spousal income by filing taxes as Married Filing Separately. Some of the previous bill texts had discussed INCLUDING spousal income regardless of tax filing (so it's nice to see this wasn't included in the final bill). RAP deducts $50 per monthly payment per child (two children = $100 monthly deduction).

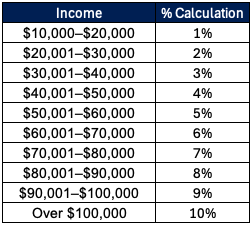

Here's how they calculate your payment based on AGI.

A noteworthy difference with RAP vs. previous IDR plans is the payment cliff. Here's an example.

- AGI: $99,999 * 9% / 12 = $750 monthly payment

- AGI: $100,000 * 10% / 12 = $833 monthly payment

Making $1 extra in this case would bump up your payments $83 per month and $1,000 for the year!

RAP qualifies for PSLF and has an IDR forgiveness track over 30 years of payments. That's 5-10 years longer in repayment than other IDR plans. The minimum payment is $10 per month, so there won't be any more months of zero dollar payments. Similar to the previous Revised Pay As You Earn (REPAYE) and Saving on a Valuable Education (SAVE) is the interest subsidy with RAP. If your monthly payment does not cover the monthly accrued interest, the government would waive 100% of the unpaid interest. This prevents your loan from growing higher when you move into repayment. In addition, the government will provide up to a $50 monthly subsidy to ensure your principal balance decreases by at least that amount monthly.

Existing Borrowers (Pre-July 1, 2026) Repayment Options

Existing borrowers will need to move into one of these three repayment plans by July 1, 2028.

- Standard Repayment,

- Repayment Assistance Plan (RAP) or

- Modified Income Based Repayment (IBR)

The modified Income Based Repayment (IBR) plan is quite similar to what IBR was previously. The modified IBR has two versions.

- Pre-2014: Loan originating prior to July 1, 2014 (15% of discretionary income), 25-year IDR forgiveness

- Post-2014: Loan originating on July 1, 2014, to June 30, 2026 (10% of discretionary income), 20-year IDR forgiveness

The only change to the IBR plan is that it drops the partial financial hardship requirement to enroll in it. It'll be easier to switch into now.

Selecting the optimal repayment plan amidst all this change can be tricky for your student loan strategy. Run the numbers or get professional advice now to ensure you're on the right track.

More Noteworthy Student Loan Updates

- Stricter deferment and forbearance rules: Forbearance is now limited to no more than nine months during any 24-month period. It also eliminates economic hardship and unemployment deferments.

- Increased reliance on private loans: With lower federal borrowing caps, more borrowers will require private student loans to finance their education. You'll need to shop around to find the best rate.

- Parent Plus Loan challenges: Parent Plus Loan borrowers need to consolidate their loans and enroll in the ICR plan by June 30, 2026, to be eligible for IDR plans.

The One Big Beautiful Bill Act affects many aspects of the lives of most Americans. We'll continue to explore its implications on the personal finance and investments of white coat investors in future posts.

What do you think? What did we miss that is important in your financial life? Try to minimize your political commentary in the comment section below, or you may find your comment being edited or even deleted.