By Eric Rosenberg, WCI Contributor

By Eric Rosenberg, WCI ContributorIf you’re looking to track your finances and plan for the future, you may be interested in Boldin and Empower. Both offer the ability to track your finances with a focus on the future, but each offers a unique experience tailored to different preferences and needs. Here’s a closer look at Boldin vs. Empower to understand the best financial tracking and planning app for your financial goals.

[EDITOR'S NOTE: Full disclosure: The White Coat Investor has a financial relationship with Boldin and an affiliate relationship with Empower. (Remember how affiliate links work: if you invest after going through our links, WCI gets paid, but it doesn't cost you any more to go through that link.) However, the writer of this post had free reign to rate and write about Boldin and Empower how he saw fit.]

Boldin vs. Empower: Company Backgrounds

Boldin

Formerly known as NewRetirement, Boldin is a unique software solution to track your finances in one place and to get ideas and advice for how to improve your finances for the future. The company’s mission is to “help anyone get confident and achieve financial independence so they can make the most of their money and time.”

According to Boldin data at the time of this writing, it has helped 200,000 individuals build financial plans and has managed more than $200 million in assets. Through the Boldin API (a tool allowing users to tap into Boldin features on other websites), more than 5 million people use Boldin calculators and tools.

Empower

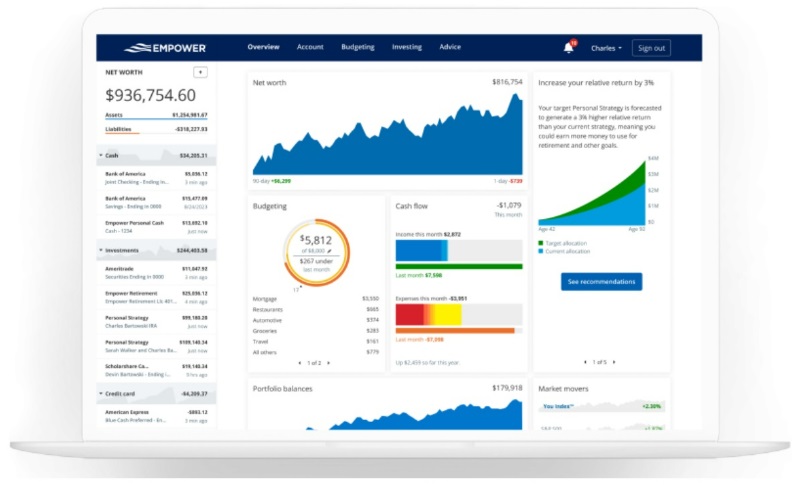

Formerly known as Personal Capital, Empower is a financial app and investment advisor. The free personal finance app offers the ability to track all of your financial accounts with a focus on investments. The investment service is a paid offering but isn’t required to use the free investment software.

Empower claims $1.4 trillion in assets under management, as of this writing. More than 18 million people use Empower products and services.

More information here:

Boldin Review: An Online Retirement Calculator on Steroids

Features and Services

Boldin

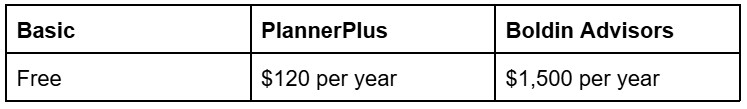

Boldin offers three tiers of its software and service combo. The free version includes basic software features in a self-service tool. It includes simple retirement planning as well as financial account tracking.

With the second tier, you get all software features—including more financial planning features, net worth monitoring, digital financial coaching, more insights, and comparisons between multiple financial scenarios. At this tier, you also get access to group online financial education classes.

The top tier is a major step up in price and includes access to a Certified Financial Planner (CFP) and more comprehensive financial planning.

Empower

Empower offers free investment tracking software that helps you view all financial accounts in one place with helpful insights to improve your investments. Tools offer a deep dive into your asset allocation, investment fees, and just about anything else you might want to know about your current portfolio.

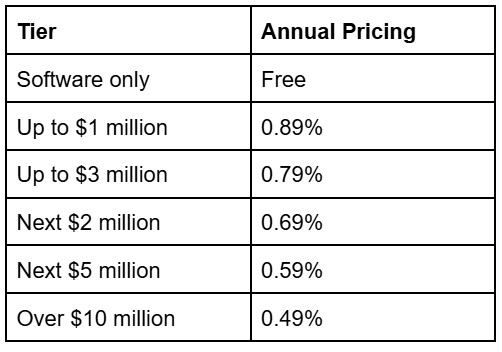

You can upgrade to the wealth management service if you have at least $100,000 in investable assets (cash and brokerage accounts). Pricing decreases as your portfolio with Empower increases in size. Human advisors help you manage budgets, investments, and taxes with a technology-enabled platform.

User Experience and Interface

Boldin

The main dashboard helps you organize your finances in one place with a focus on retirement. It compares your current outlook with your retirement plan to help you understand if you’re on track for your goals.

With paid tiers, it turns that data into actionable insights to help you make the best financial decisions. You’ll receive detailed comparisons and plans that help you make investment decisions and compare financial decisions. It’s an action-oriented platform that’s intuitive and interesting. Think of it as a turbo-charged financial calculator.

Empower

The Empower personal finance dashboard is intuitive, with sections focused on cash flow, net worth, and investments put front and center. You can navigate through your holdings, balances, and asset allocation, among other portfolio details. You can view your cash flow, bills, and budget on the budgeting side.

The retirement fee analyzer and investment checkup are two standout tools, offering valuable insights that can help you improve your long-term investment outlook.

More information here:

Cost and Pricing Structure

Boldin

Boldin offers three pricing tiers:

For the free and PlannerPlus tiers, Boldin is an excellent value for high-income professionals. The Advisors tier is worthwhile for households that don’t want a traditional financial advisor but are looking for extra help managing their money.

Empower

For Empower, the software is free. If you upgrade to a paid financial advisor, pricing is based on the size of your portfolio under management:

The Bottom Line

Boldin offers a robust range of services, from basic financial tracking to advanced planning with CFPs. It caters to those seeking detailed, interactive financial planning and education. Modeling scenarios and changing assumptions are its strengths. It is also very useful for tweaking your plan slightly or just updating it every year. Boldin is well worth your time and certainly worth your money.

Conversely, Empower, known for investment tracking and wealth management, is ideal for those with significant investable assets, offering tools like a retirement fee analyzer and an investment checkup. It's certainly a good option to track your cash flow and portfolio, particularly if you wish to view your investments across all of your accounts to better understand your overall portfolio makeup.

Both Boldin and Empower present unique strengths tailored to different financial needs. Boldin excels in action-oriented financial planning, while Empower is a standout in investment analysis and wealth management. To identify the best platform for your financial journey, consider exploring both options, focusing on how each aligns with your specific financial goals and strategies.

Have you had experiences with either Boldin or Empower? What did you like? What didn't you like? Are there other options out there?